International money transfers.

Bank-beating exchange rates

Send money to 170+ countries

24/7 support via phone and email

International money transfer

Live rates as at Feb 3, 2026, 11:13 PM (CUT)

1 Australian dollar = 0.701670 US dollar

Inverse rate 1.425171

New to OFX? Get a rate too good to ignore.

Take advantage of a great introductory rate across these 7 currencies on your first personal transfer when booked online. Then keep the savings going with our bank-beating rates across 50+ currencies when you transfer again. T&Cs apply.

Terms and Conditions: The introductory rate is (i) available to new personal customers of OzForex who have registered from 1 April 2021 and have not dealt; (ii) for the first spot transfer only if that transfer is self-booked by the customer in our online platform; and (iii) in sell and buy currencies of AUD, USD, SGD, GBP, NZD, EUR, CAD. Offer not available (i) to customers on pre-arranged fixed rates; (ii) to customers referred by OFX partners; or (iii) in conjunction with any other offers. OFX reserves the right to withdraw the offer at any time. All transactions are governed by OFX Terms and Conditions which includes information in relation to Margin which is how we make our money.

How to send money internationally from Australia.

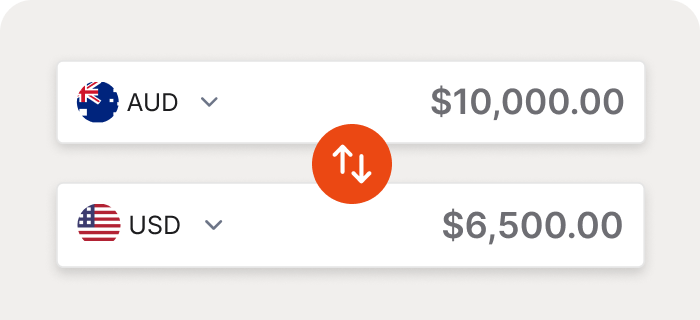

Enter amount to send in AUD.

Enter the amount you want to send in Australian dollars and select your destination currency.

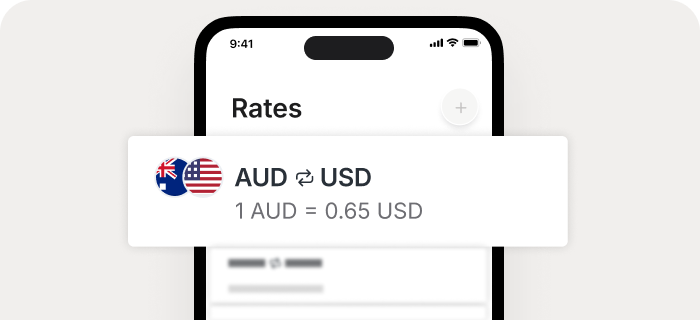

Check the rates.

Get competitive rates when you transfer, with customised rates offered for larger transactions or regular international payments.

Send your payment.

Enter your recipient’s details and hit ‘Transfer Now’. You can keep track of your transfer online or via the OFX app.

Secure platform

How OFX keeps you, and your money secure.

Your money matters, so does your peace of mind. That’s why we protect your account with multiple security measures, including early detection of unusual activity.

With over 25 years of experience, OFX is trusted for secure global transfers. We hold an Australian Financial Services Licence (AFSL), are regulated by ASIC and AUSTRAC, and have security teams operating worldwide.

Identity and data protection.

Your account is kept secure through the use of passwords, multi-factor authentication (MFA), security questions, and automatic time-outs.

Fraud prevention.

Our multifaceted fraud prevention system helps detect and mitigate risks posed by phishing, malware, and fraudulent apps.

Robust security framework.

Committed to the highest international standards, our security framework is robust, with ongoing efforts to enhance our security controls.

Keep more of your money

Save on the rates banks charge with OFX.

Unlock bank-beating rates for global money transfers with OFX. We make moving money easy and help you access real savings.

Need to talk to someone? Our currency specialists are available on the phone 24/7, day and night. Get real help when you need it, backed by a simple, digital platform.

Transfer amount AUD 20,000 to USD

| Company | $20k AUD to USD = | $ difference |

|---|---|---|

| $12,260 | $400 extra | |

| Westpac | $11,860 | $400 less |

| CBA | $11,886 | $374 less |

| NAB | $12,001 | $259 less |

| ANZ | $12,040 | $220 less |

How do I send my money at a good rate?

Our competitive customer rates are often more favourable than the rates offered by banks. They also come with low or no transfer fees. With the ability to see changing market rates in an instant and make your overseas money transfers quickly, you can secure a great rate when the timing is right.

Our team of dedicated customer service specialists are available to call 24/7 to answer any questions and guide you through the transfer process.

How long does it take to send money internationally?

Generally, no time at all. Since we have a global network of bank accounts, making a transfer with us is not only secure, but also very fast.

As soon as you send us your funds, we’ll transfer them to your recipient. The time it takes for us to transfer the funds to your recipient depends on the country, but in most cases, it takes 1-2 business days.

See our list of standard delivery times for money transfers times to our most popular countries.

Best way to send money internationally with OFX.

Once you’ve locked in your money transfer, the best way to pay is via bank transfer to OFX. Payment methods may vary depending on the currency and destination your sending.

How to make a international money transfer with OFX.

1. Create your OFX account

Start your registration online or via the OFX app. We’ll ask for some personal information including your contact details and nationality.

2. Verify your identity

Verification helps keep our platform safe, so we’ll check your details to ensure everything matches up. We may ask you to upload documents including proof of identity and proof of address.

One of our OFX specialists will call for final verification and to get you ready for your first transfer.

3. Enter your transfer details

Tell us the amount you want to send or the amount that you want the recipient to receive. See your customer rate.

Next, add your recipient and their account details and choose your payment option.

If everything looks correct, press confirm to lock in your transfer.

4. Send funds for your transfer

Depending on the currency you’re sending, you’ll have different payment methods to choose from.

For most currencies you can simply send the funds via bank transfer or BPay.

5. Track your transfer

We will send you email notifications when we receive funds and pay out your transfer to your recipient. You can also opt in for SMS updates or even track your transfer by logging in online or on the app and selecting ‘transfers’ on your home screen.

Helping people and businesses send money from Australia every day.

Relocate to a new country.

No matter where you’re living or working, we help keep your finances connected. Transferring a large amount? Speak to an OFXpert.

Send money home.

With our global network of about 115 bank accounts, you can send money back home quickly, with great rates and minimal or zero fees.

Pay taxes and bills from abroad.

Save time by scheduling regular payments for recurring bills up to 12 months ahead.

Manage FX risk, with dedicated support.

Protect yourself and your business with a risk management strategy. Our currency specialists can help create a tailored strategy.

Pay overseas staff and suppliers seamlessly.

Our mass payment solution allows you to pay 500 people with just one click.

Run your business with one Global Business Account.

Unlock global currencies and markets. Get access to smart AP automation, spend management and corporate cards.

See why clients around the world recommend OFX.

Trust earned daily.

International money transfer FAQs.

How can I send money to a friend?

Whether it’s a gift or a lifeline, OFX can send money directly to your friend’s bank account. They don’t need to sign up; you just need to provide their bank details.

What verification details do I need to provide?

To keep our platform secure, we verify the identity of every customer. You’ll need to provide contact details, and possibly a photo ID and proof of address. Business users may also be asked for a company number and additional documents depending on business type.

Can I send money with a mobile app?

Yes, you can send money internationally using the OFX app available on Android and iOS. Download the app now.

Is there a limit on the amount of money I can send?

OFX does not enforce any limits on how much you can transfer.

Send money with us

Transfer money overseas with great rates.

Our OFXperts could help you save more on overseas money transfers. Register online or speak to an OFXpert.