International payments

- We’re open 24/7 and 363 days a year. When your bank is sleeping, we’re not

- Your business gets a dedicated service rep – like a personal forex concierge

- Manage your exposure to currency volatility with OFX products such as forward contracts and limit orders

- Your international payments often arrive within one business day

- Pay suppliers, contractors and staff at great rates

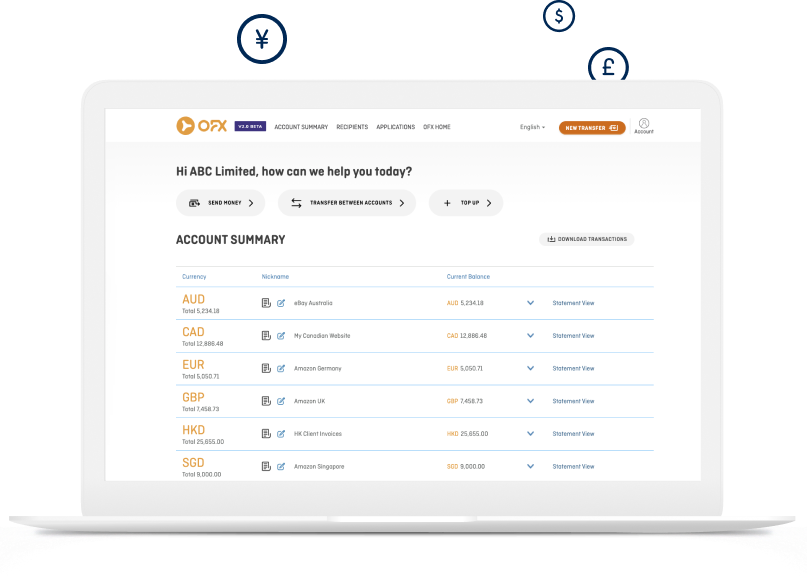

- Use your OFX account to receive payments from clients overseas

We offer bespoke foreign currency strategies

to help you achieve your business objectives

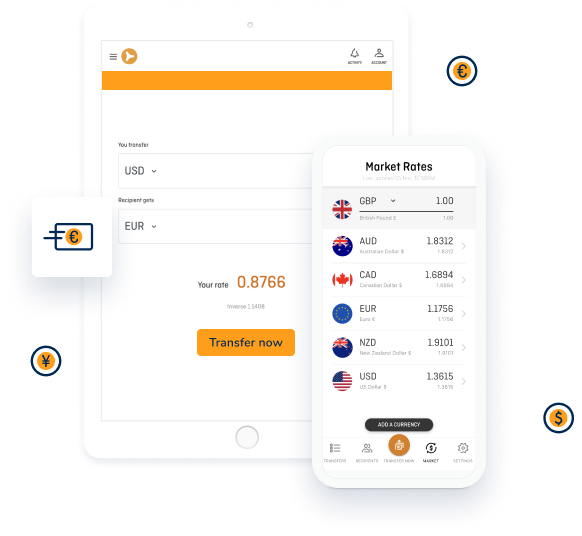

Spot Transfer

Buy now, pay now. Need to transfer on nights, weekends, or holidays? No problem.

Forward Contracts

Secure an exchange rate for up to 12 months.

Automated Regular Payments

Simplify your accounting and choose from fixed or non-fixed rates of exchange.

Limit orders

When the rate is right, we transfer your funds automatically

The best investment for your business costs nothing upfront

It’s a simple 3-step process:

- Register online or over the phone in ~20 mins or less

- Provide the relevant verification documents

- Make your international payment with OFX, and potentially save enough to pay for the annual xmas party. That’s it