A corporate multi-currency card that’s integrated with your business

Gain greater control and visibility by managing your domestic and international expenses and approvals all in one place. Issue a virtual card to employees worldwide, or use the card for recurring expenses with our new Visa debit business card.

It’s not just a regular corporate card

Access to 30+ currencies

Save more with our competitive exchange rates. Spend like a local in 5 major currencies without incurring foreign exchange fees by using the held balances in these currency accounts.

More control of your employee expenses

No more card sharing or using personal cards for company spending. Issue a virtual card in real-time to any employee worldwide, ready to use on Apple Pay and Google Pay.

Reduce the risks of overspending

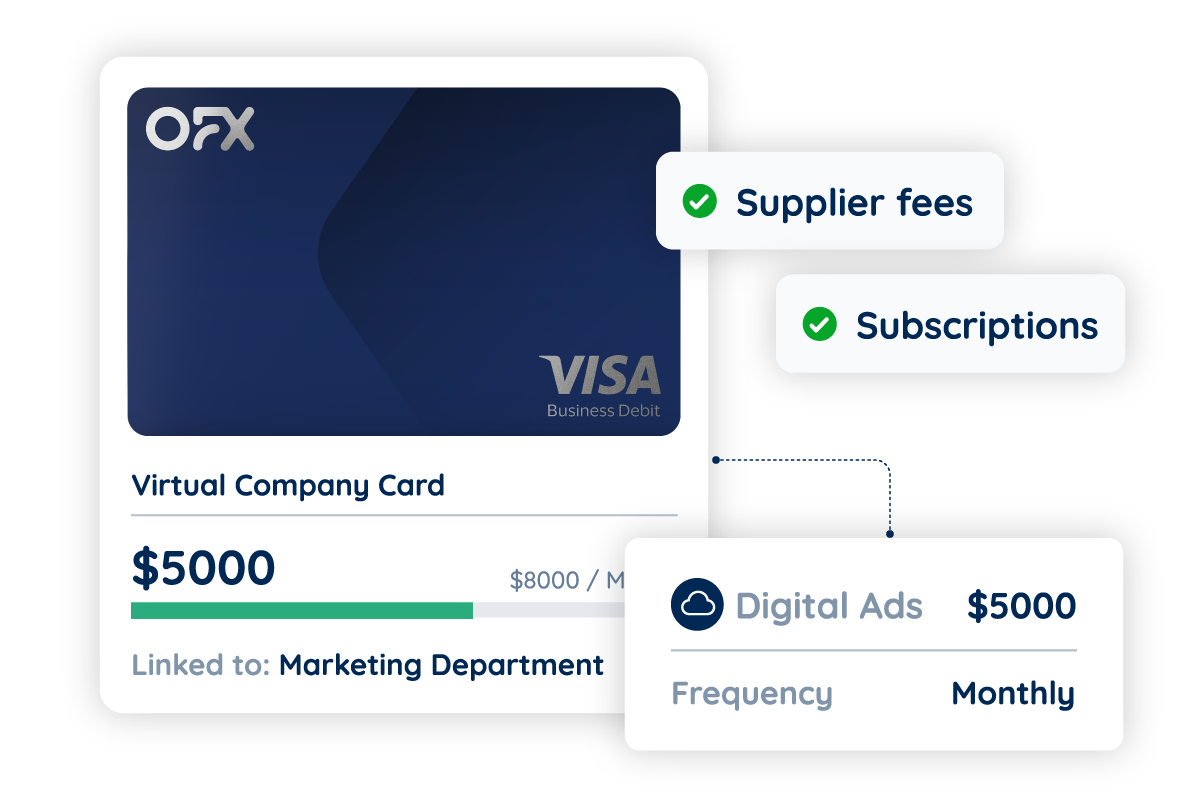

Issue cards to your employees yet still have control and visibility. Set spending limits for teams or projects to prevent employees from going over budget.

Ready to get started? Create your free account now.

Consolidate your business expenses in one place

Get a clear oversight of all your card transactions in a single dashboard. Track, view and organise your employees’ spend, company recurring expenses and subscriptions in our platform for a more streamlined bill and expense management.

A corporate card that supports multiple currencies

Get access to 30+ currencies to make payments simple, whether you’re using your card locally or overseas. The best part? Save money by converting your funds when the rates are in your favour with our competitive FX rates.

Create and assign budgets and spend limits on your corporate cards for more control

Issue a virtual card to your employees anywhere in the world. Prevent overspending by adding team members to share a budget and set individual card limits. They get autonomy, while you get more control and visibility with real-time transaction data.

No more paying twice for the same recurring expenses

Set up a company card for a specific recurring expense. With OFX, you can create unlimited virtual company cards linked to your business account. Great for sharing between teams and to pay for monthly subscriptions, like Google, LinkedIn or Meta ads.

Use the card on your mobile wallet to pay on the go

Unlock your card access in real-time without visiting a bank. Issue virtual cards to any employee globally, and use it with Apple Pay and Google Pay. You can also pause and cancel your cards any time.

Capture and upload receipts at your convenience

Save time on tracking your card expenses with our in-app receipt capture. Document receipts in real-time and automatically reconcile with Xero, so you can focus on what matters most.

How to get started with our Corporate Multi-Currency Card

1. Open a business account

Access multiple currencies, enjoy competitive exchange rates, and issue cards to employees without visiting a bank. Create your free business account here.

2. Create budget

This is the budget created in your account. You can set single-use and/or recurring budgets and give specific team members access to this budget.

Pro-tip: You can also set individual spend limits and controls within each budget for different users and teams.

3. Invite or add a new user to your team

A card must be attached to a user. Invite a new user to your team and assign them a role and permissions.

Note: If you’re on our Business plan, you have free access to one employee card per user (for up to 3 users). To enjoy more cards or users, consider the OFX Business Plus plan.

4. Create your new card

You’re now all set to issue virtual cards for employees, or create unlimited virtual company cards for subscriptions and other recurring expenses. No waiting or going to the banks.

Note: You’ll need money in your OFX Business Account to spend on the card. You can add funds to your account through a rewards credit card, direct debit or bank transfer.

Corporate cards FAQs

What is the OFX Corporate Multi-Currency Card?

It is a borderless, multi-currency Visa debit card that allows you to transact locally and globally for your business. On top of AUD, you can use the card to make purchases in over 30 international currencies, plus shop and pay like a local in USD, GBP, EUR and CAD by using funds held in these currency accounts.

What are the benefits of having a multi-currency card for your business?

A multi-currency card can help your business save on currency conversion fees. It simplifies expense management and reduces time and costs related to tracking and reconciling international payments across different platforms or accounts.

Is the OFX Corporate Multi-Currency Card a debit card, credit card or prepaid card?

Our Corporate Multi-Currency Card is a Visa business debit card. In order to spend on the card, all you need to ensure is that there are sufficient funds in your OFX Business Account to fully cover the transaction.

How does the card work with the OFX Business Account?

Our Corporate Multi-Currency Card is directly linked to the Global Accounts created in your OFX Business Account. Save money by pre-converting your local currency to foreign currency when the rates suit you.

With our card, you get access to:

- a domestic currency (AUD)

- pay like a local in USD, GBP, EUR, CAD with no cross-border transaction fees*

- 30+ currencies

When making a payment, our card automatically draws funds from your relevant Global Account, ensuring a smooth and efficient transaction. This allows you to spend from the specific currency balance of your choice, reducing the need for costly FX conversion.

For insufficient pre-converted foreign currency balances, we’ll automatically convert from your local currency (AUD) at competitive exchange rates.

*This only applies if there are sufficient funds in your USD, GBP, EUR and CAD Global Accounts.

Can I use the card with Apple Pay and Google Pay?

Yes, our card can be used with Apple Pay and Google Pay. Our card can be used as a virtual card on your mobile device. You can also choose to use it for online or in-store payments.

How can I apply for the card?

To receive and use our card, you need to register a business account with us. You can learn more about our pricing plans here.

Do you offer a physical card?

Yes. The physical card is launching before the end of 2024, and will cost AU$10 per card (one-off fee).

How many cards can I assign to my employees?

You can assign one employee card to a user, but the virtual company card can be shared across different users. The number of users you have in your account depends on your OFX pricing plan.

What’s the difference between an employee card and a company card?

At OFX, you can choose to create employee and company cards. The employee card is allocated to individual users. Each user gains access to a mobile app where they can privately view and manage their own spending on the cards. You can set specific spending limits on your employee cards to control expenses and ensure compliance with company policies.

The company card can be shared among team members and allows you to control spending limits to prevent overspending, such as setting a limit on Google Ads expenses. It’s ideal for specific subscriptions or recurring expenses, e.g. Google Ads or SaaS services. You can also create a company card for a specific event.

What is the benefit of setting up a company card?

The benefit of the company card is that if an employee leaves, you don’t have to transfer all the subscriptions from their personal card. If you need to stop a subscription, you can simply cancel the associated card. Another advantage is you could prevent duplicate expenses by assigning cards for specific purposes.

Can I create company cards linked to my OFX Business Account?

Yes. You can set up a card for each subscription and manage your expenses per card, with built-in control limits. If your subscription ends, you can cancel the card anytime to ensure you’re not charged on that fee. If there is a security breach on a particular card, you only need to delete that card. This means easier reconciliation, oversight, and added security.

Unlike the employee card (1 card per user), there are no limits to creating company cards in our platform. You can set up multiple company cards all linked to your OFX Business Account.

How much can I spend per day on my card?

The maximum amount you can spend on your card depends on how much funds you have in your Global Accounts created in your OFX Business Account.

Your cards can be allocated a budget. You can use the card controls and set a spend limit for each card. When it’s time to make payments, your Global Accounts will need to be sufficiently funded. You’ll be notified if there are insufficient funds in your account.

Can I withdraw cash from an ATM with the card?

You can’t withdraw cash from an ATM with our card.

Can I link my card payments to a Xero account?

Yes, you can. Reduce reconciliation bottlenecks by syncing your card expenses with your Xero account. Our in-app receipt capture also allows you to document receipts in real-time to help you track employees’ and other business spend.

Connect to Xero by following the below steps:

- Log into your OFX Business Account.

- Click on “Setup” from the left sidebar menu.

- Click on “Integrations” from the dropdown menu.

- Click toggle to connect to Xero.

- Read the acknowledgement and confirm.

- Follow the on-screen instructions to authorise the integration with Xero.

Can I connect the OFX Business Account to other accounting or Enterprise Resource Planning (ERP) platforms?

Yes. It’s easy to export data from your OFX Business Account as a CSV file and import it into your accounting platform.

We’re working on integrating other accounting packages with our platform, which will be available soon.

Want to learn more?

Gain more control and time with streamlined accounts processes – all from a single platform. Get started for free with a Business plan. Or enjoy more features in our paid Business Plus plan with a 30-day free trial.

Visa is a trademark owned by Visa International Service Association and used under licence.