Business FX solutions

Foreign exchange solutions you can bank on

Whether you’re paying overseas suppliers or managing regular offshore expenses, global payments have never been easier. Get great rates fast with secure transactions. Backed by a global network and supported by currency specialists in offices worldwide.

Competitive FX rates are just the beginning.

Manage currency risk with smart FX tools designed to give you control, clarity, and peace of mind.

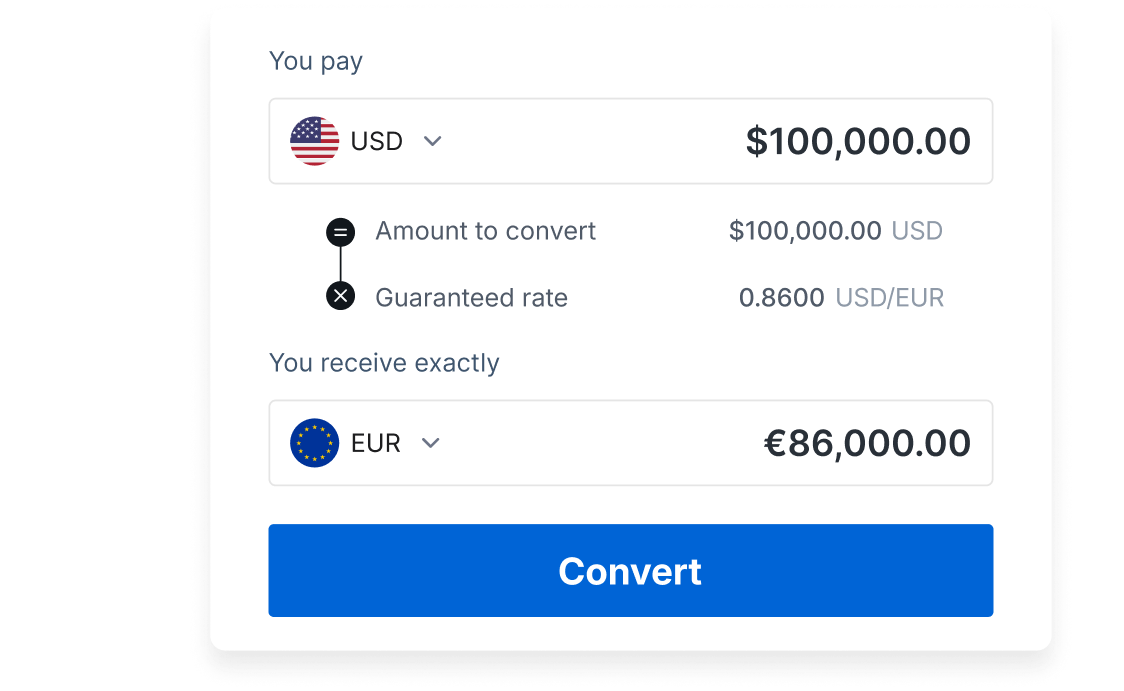

Spot Transfers

Instant currency conversions. Instant payments.

When timing is critical, move money quickly and securely in 30+ currencies — so your funds are where they need to be, when they need to be there.

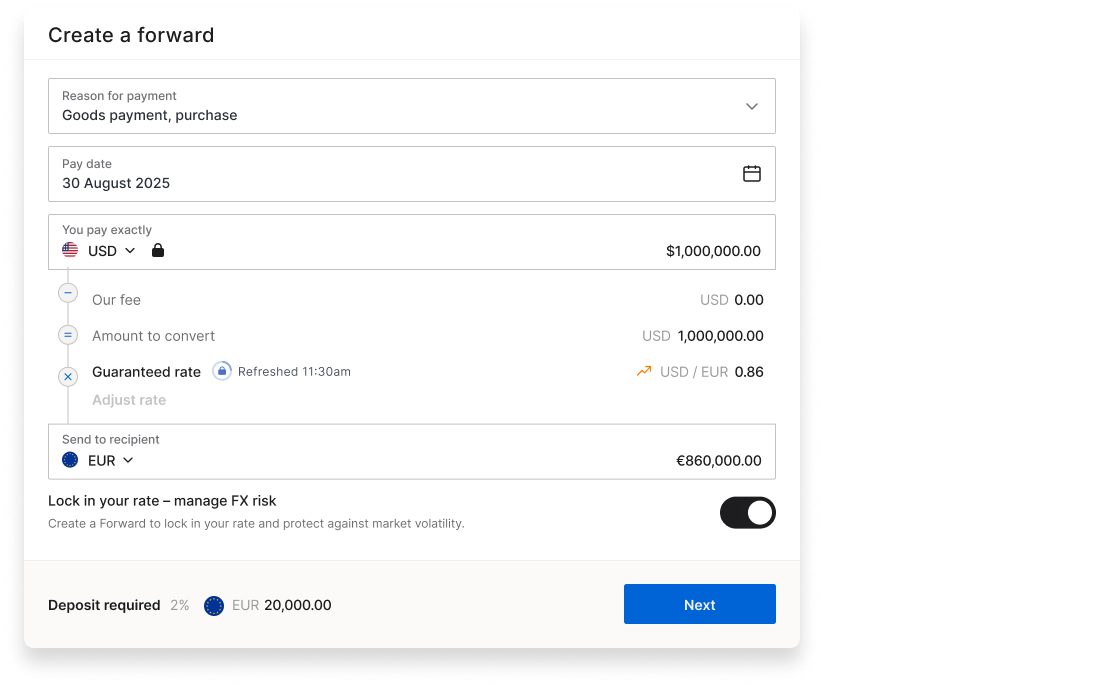

Forward Contracts

Lock in today’s exchange rate for future use.

If you like the rate you see today, secure it for up to 12 months. Shield your margins from market swings and plan with confidence.

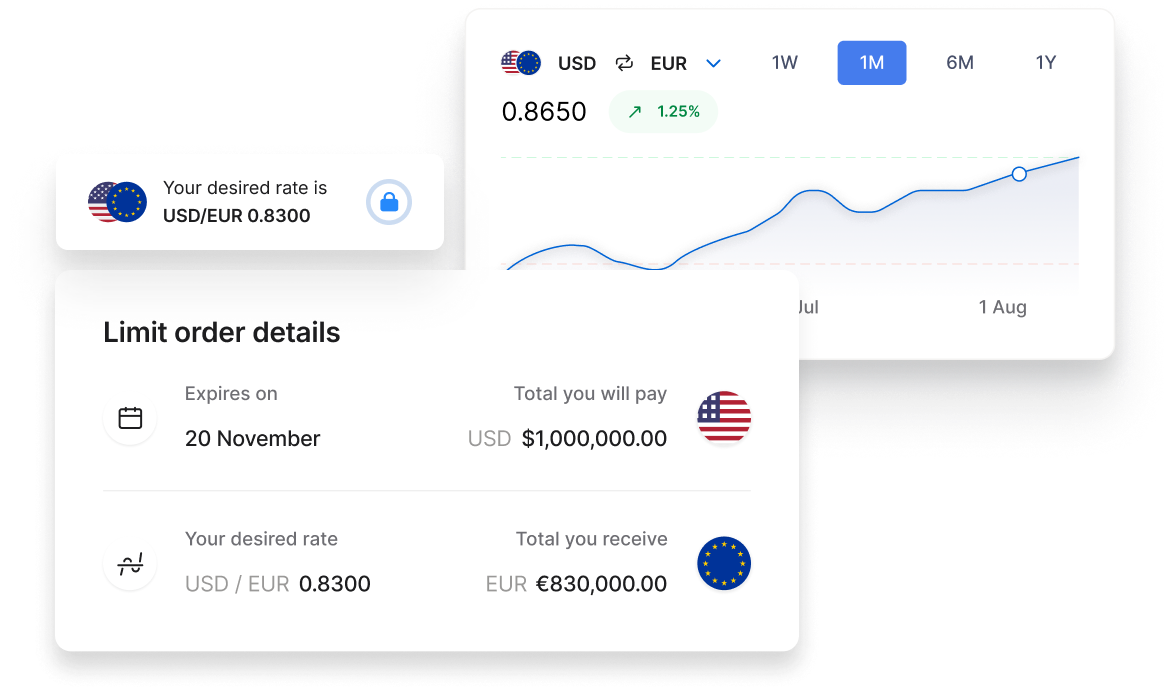

Limit Orders

Automated currency exchange at your target rate.

Have time to wait for a better rate? Set your target rate and how much. We’ll do the rest.

Not just a financial tool, a trusted partner.

Currency swings can hit without warning. That’s why you have 24/7 access to experienced FX specialists, plus smart tools to lock in rates, limit losses, and protect your profits. Day or night.

Your trusted partner for global payments.

Pay suppliers and employees around the world — without the high costs, delays, and complexity of traditional banks.

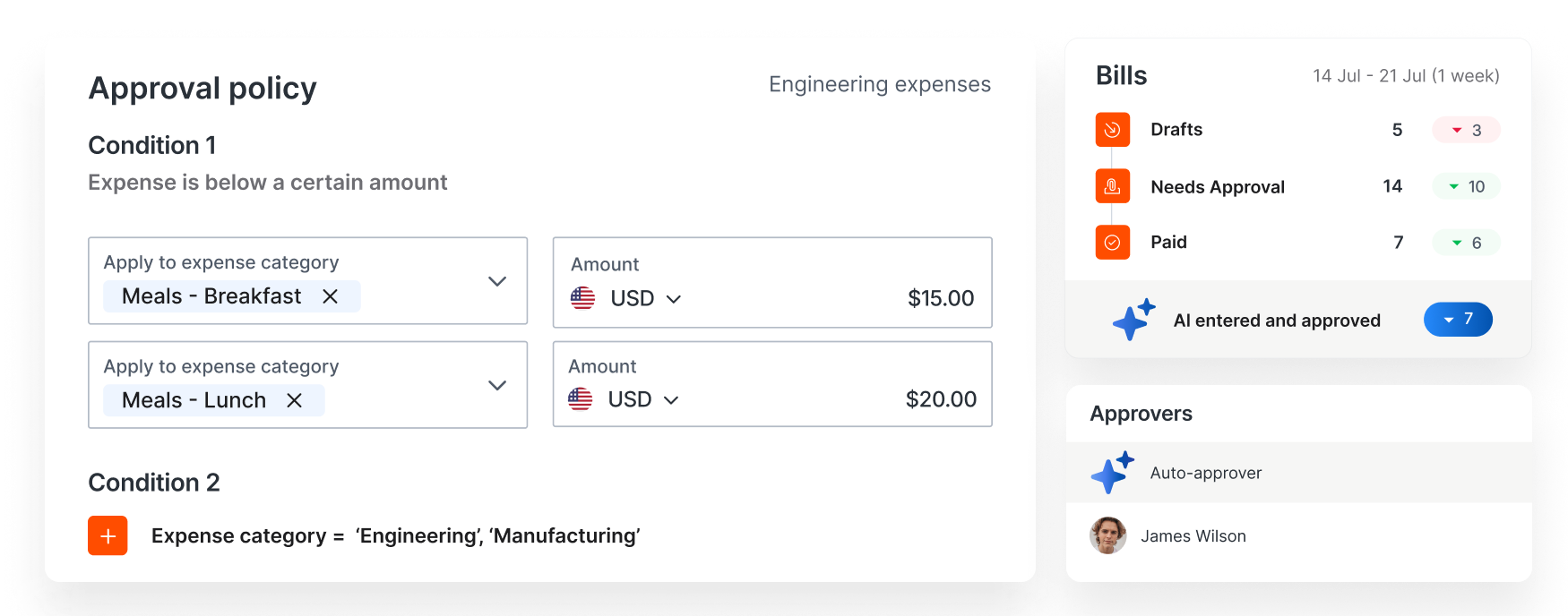

Stay in control of every payment. Track, approve, and spend with confidence.

With centralized approvals, spend limits, and real-time tracking, every transaction is authorized, compliant, and accounted for.

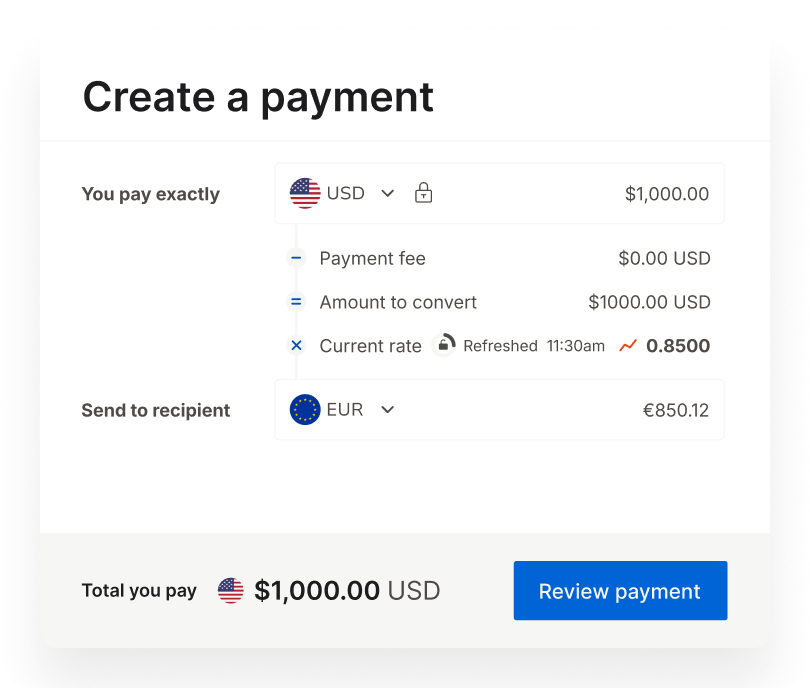

Better exchange rates. Every time.

Access competitive exchange rates on every transaction. Say goodbye to hidden fees.

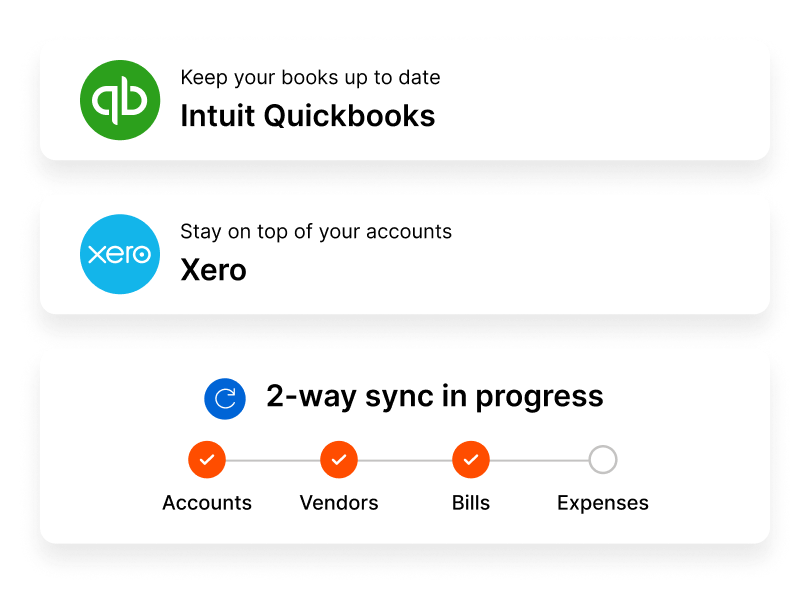

Bookkeeping made effortless.

Transactions sync seamlessly to QuickBooks Online or Xero. Even your foreign currency transactions effortlessly flow in. All perfectly updated. All on its own.

Create your Global Business Account today

The free trial lasts 60 days.

The savings last forever.

You have nothing to lose, and so much time and money to save. Your all-in-one control platform is ready. Start your free trial today.

Clients love us. Here’s why.

FX Solutions FAQs

How can I make international payments or receive foreign currencies for my business?

You can make international payments or receive foreign currencies through a virtual global business transaction account.

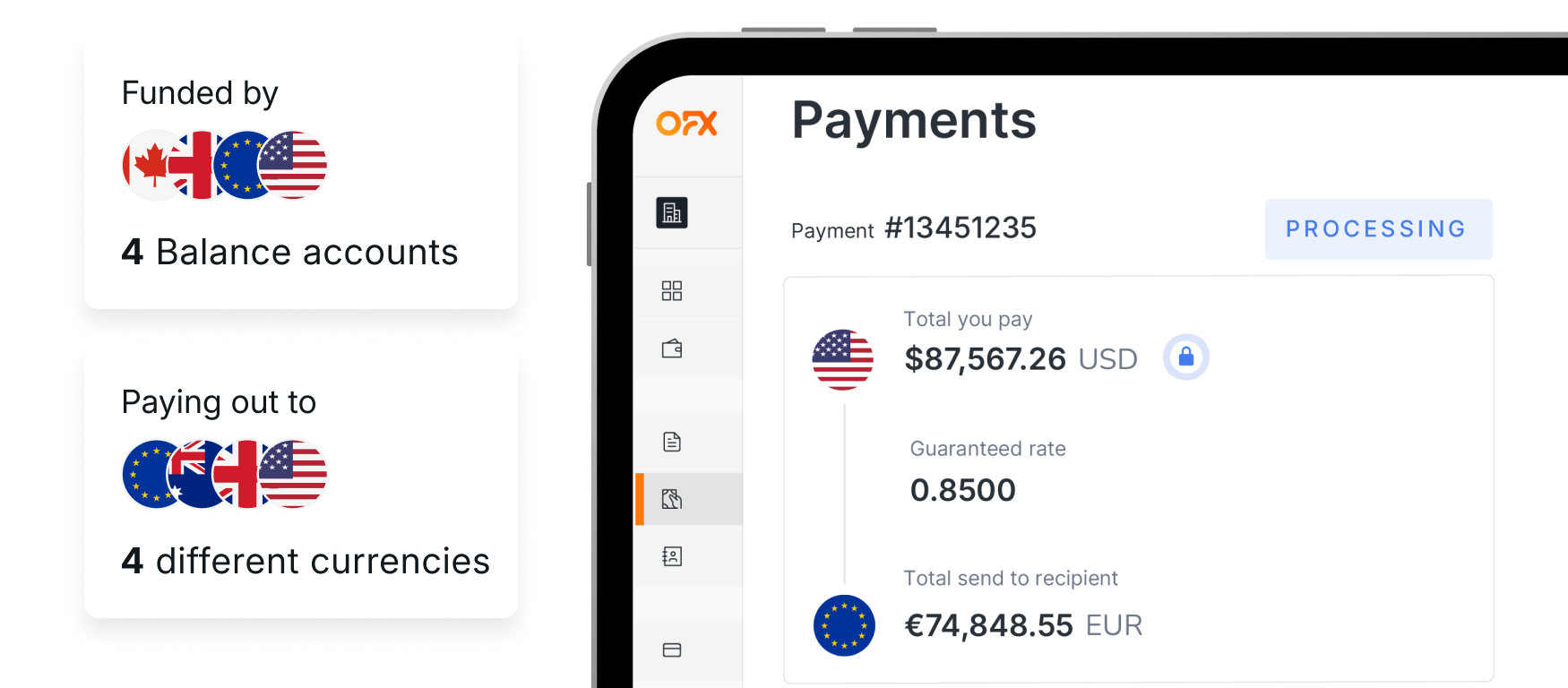

With the OFX Global Business Account, you have the ability to create and manage multiple currency accounts, where your customers can pay into any of these currency accounts.

Four of these currency accounts (USD, EUR, CAD, and GBP) also allow you to hold local account details, so you can pay and receive like a local.

How do businesses use OFX’s foreign exchange solutions?

Businesses can use OFX to make international payments, receive foreign currencies, and convert funds when the exchange rates are in their favor. This helps them manage global transactions efficiently and save on costs associated with currency conversion.

By leveraging global money management platforms like OFX, businesses can better handle cross-border financial transactions to enhance their competitiveness.

How can my business benefit from OFX?

We help businesses make secure, fast international payments and more.

With OFX, you can:

- Open multi-currency accounts to grow with your business.

- Receive and make payments in up to 30+ currencies or from 170+ countries.

- Our team of specialists are also available 24/7 to help you navigate the complexities of foreign exchange.

How many currencies can I manage with the OFX Global Business Account?

With the OFX Global Business Account, you can create multi-currency accounts in 30+ currencies. Your customers can also pay into any of these accounts. Four of these accounts (USD, EUR, CAD, and GBP) also allow you to hold local account details for your convenience. Here is a full list of our supported currencies.

Is a Forward Contract right for me?

Forward Contracts are designed to benefit businesses of all sizes, especially those exposed to foreign exchange (FX) risks.

If your business deals with cross-border transactions, even on a smaller scale, fluctuating exchange rates can significantly impact your profit margins and financial planning. A Forward Contract allows you to lock in an exchange rate for future payments, providing certainty and stability. Setting up a Forward Contract is simpler than you might think, often requiring an initial deposit and basic documentation such as purchase orders or invoices.

By using a Forward Contract, you can help protect your bottom line from FX volatility, accurately budget your costs and revenues, and gain peace of mind knowing your financial risks are minimized. Some clients use a Forward Contract for a portion of their FX transfers, as a way to partially hedge against volatility and ensure they can take advantage of Spot rates as well.

Remember, if you book a Forward Contract, it may mean losing out if the market rate improves because you’re contracted to settle at the agreed rate.

Can everyone set up a Forward Contract?

All Forward Contracts are subject to approval by OFX. To set up your first Forward Contract, you’ll need to answer a few questions on the platform. Our specialist team will then review your application and set up the contract if approved.

Trust earned daily

Great FX rates are just the start. Your 60-day free trial is ready.