Swift codes

Whatever the reason for your international money transfer, we understand how important it is to you.

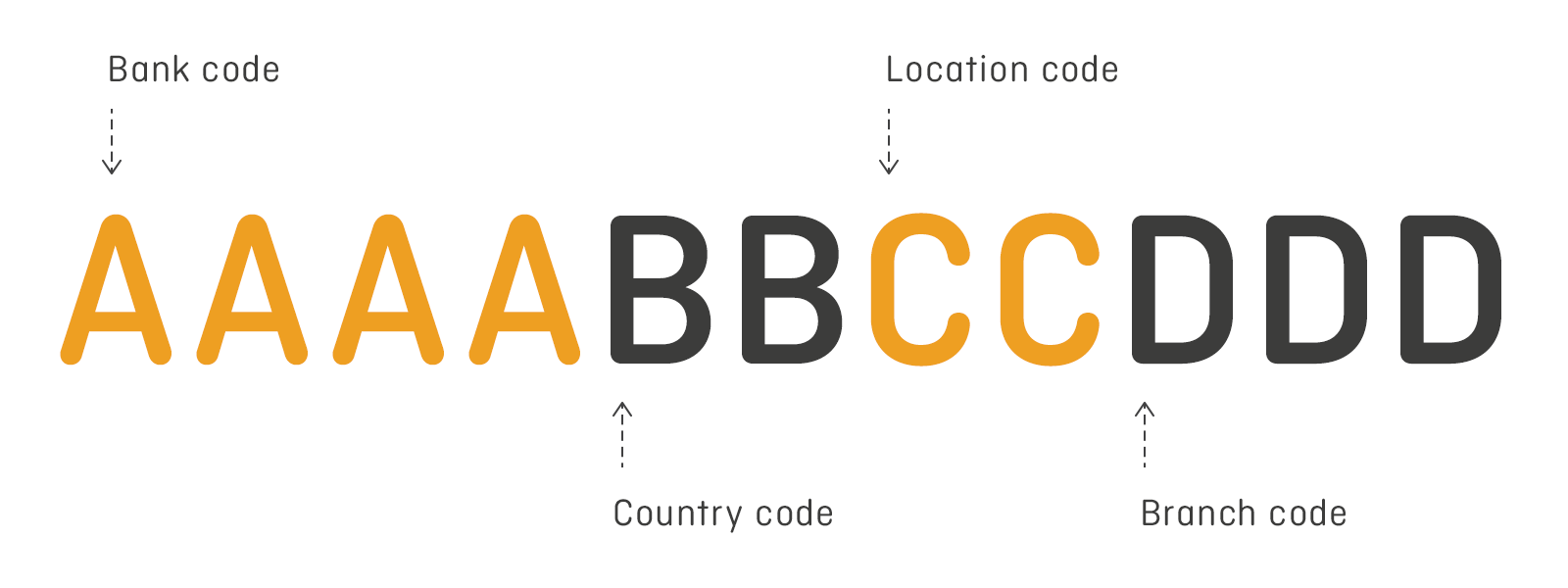

What do the letters and numbers mean in the swift code?

A SWIFT code (sometimes known as a SWIFT Number) are 8 to 11 characters long and made of both letters and numbers. You can typically find them on a bank statement or on your bank’s website. The SWIFT code is a format of your BIC (Bank Identification Code), and the two terms are used interchangeably. SWIFTs or BICs are unique identification codes for the particular bank that holds your account.

- Bank code (A-Z): 4 letters identifying the bank

- Country Code (A-Z): 2 Letters representing the country where the bank is located

- Location Code (0-9, A-Z): 2 characters usually comprising of letters or numbers, representing the bank’s head office

- Branch code (0-9, A-Z): 3 digits or letters to identify a unique branch of the bank. ‘XXX’ is typically used to represent the head office

Swift codes for banks

Always check with your bank or recipient directly to make sure you are paying to the right bank account.