Accounting Firms and Advisors

All your clients. One platform. One login

Get the oversight, automation and control you need to deliver a winning advantage for your clients. Our fully integrated Accounts Payable, Corporate Cards and Spend/Expense Management can streamline your services, giving you more time back to focus on your clients and growing your business.

Supporting your clients just got a whole lot easier.

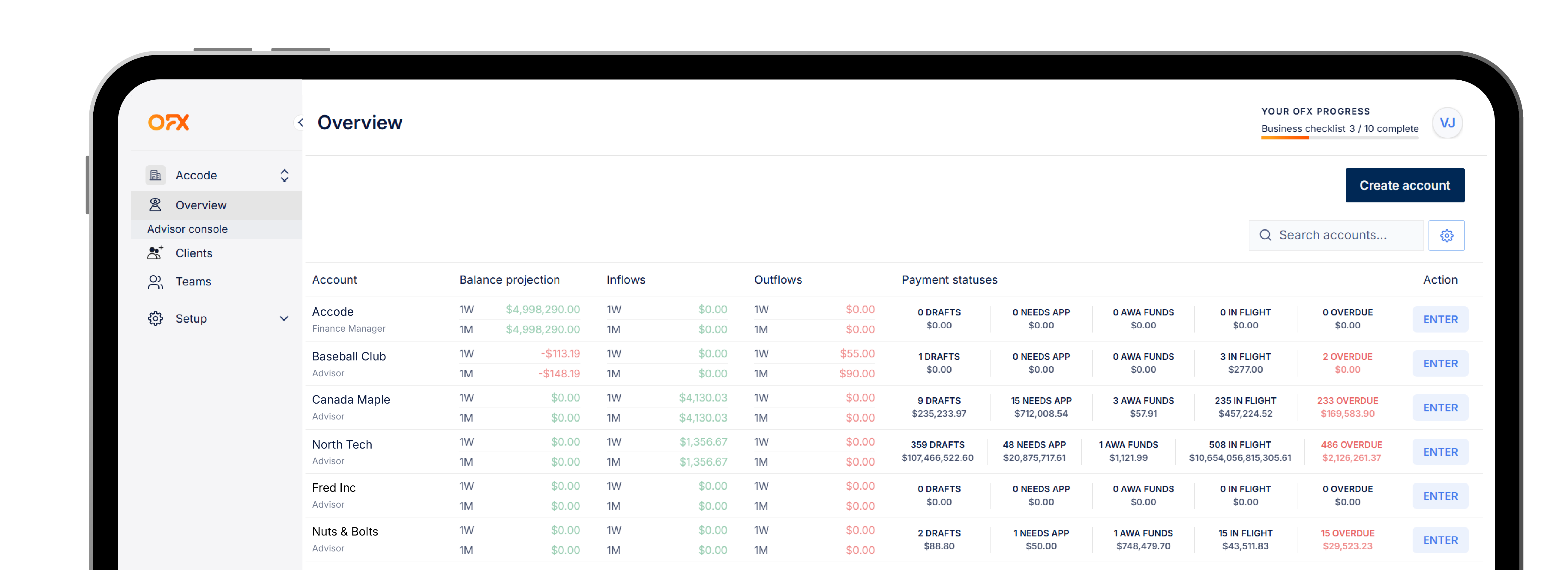

The OFX Advisor Console is custom-built to provide outsourced accountants and advisors with a clear overview of all your clients’ expenses and cashflow. Easily add and manage your clients, track their on-boarding, add users internally and externally, and simply switch between client accounts all in one platform.

With automated workflows, segregated duties and spend management controls across AR and AP you can better manage every client securely and efficiently.

Need technical support? Get 24/7 real-human help for your team and your clients.

Security that lets you sleep at night

We use robust security measures, like Multi-Factor Authentication (MFA), to protect your data and to ensure a secure online experience.

You and your clients can focus on what really matters, your business. We are registered with the Financial Crimes Enforcement Network (FinCEN), stock-listed on the ASX and ISO 27001 certified.

Sync and simplify

Integrations make it easy to connect the OFX platform to your clients accounting software. With a range from two-way automated sync or via a manual push, we have a solution for every technical level.

A simpler way to take control and offer strategic advisory.

Save yourself (and your clients) time, money and stress with an integrated platform that syncs and automates time-consuming processes.

Robust controls

Configurable approval workflows to suit you and your clients. Assign to different teams with ease.

Advisory services

Make it your own with flexible billing. Bundle the OFX services together and profit from an extended advisory service opportunity.

Integrated features

Managing your clients’ expenses with easy AP automation and simplified workflows.

User permissions

Set rules to segregate duties, payment approvals to enable your client to work securely.

Reduce manual tasks

Reclaim your time by eliminating manual data entry and physical approvals. Don’t hate it. Automate it.

Clear oversight

View client data, revise payments and process invoices to get the full picture of all linked cash flows.

Ready to get started?

See the big picture.

Onboard new clients, gain real-time visibility over cash positions, payment activity, and upcoming transactions across all client accounts, all from a single login.

Consolidate all company spend.

Whether you’re managing your client’s employee expenses, supplier invoices, or international transfers, full oversight is vital.

Centralize all your client’s expenditures for complete visibility and control.

Control Hub lets you track all spending in one place, issue employee cards with custom limits, and automate manual, repetitive tasks.

The result? Smooth, fast financial control, without the hurdles and headaches slowing you down.

Why accounting firms choose OFX.

Built with client security in mind.

We use robust security measures to protect your client’s data, and ensure a secure online experience. We’re registered with the Financial Crimes Enforcement Network (FinCEN), and ISO 27001 compliant.

Ready to transform your services with the OFX Advisor Console?

Plans to suit accountants

Flexible, transparent pricing designed for consulting accountants. Scalable plans that maximize efficiency, profitability, and control.

Finance solutions for Accountants FAQs

How does using OFX benefit accountants?

OFX helps you save time, reduce errors, and deliver more value to your clients. With integrations to Xero and QuickBooks, transactions, bills, and payments sync automatically, removing manual entry and data mismatches. Manage multiple clients from one dashboard, streamline approvals with flexible workflows, and set permissions to reduce fraud risks.

Can I manage all of my clients with a single log in to OFX?

You can gain clear oversight, meaning you can view client data, revise payments, and process invoices with ease, offering a complete picture of all linked cashflows in one place.

This can include the below based on your permissions with each client:

- Payments and transfers: View, initiate, and track client payments in real time, including cross-border transfers.

- Expense management: Set budgets, monitor spending, and enforce rules across client accounts without switching platforms.

- Approval workflows: Configure and oversee layered approval chains to ensure compliance with each client’s policies.

- Integrations: Sync client transactions, bills, and expenses directly with Xero or QuickBooks, keeping accounting records accurate and up to date.

- User permissions: Assign roles and access levels across multiple client accounts, reducing risk while maintaining flexibility.

- Cashflow visibility: Monitor balances and upcoming obligations across clients, helping you provide timely insights and advice.

By managing these features centrally, you can streamline workload, reduce time spent on administrative tasks, and deliver more efficient, scalable services to every client.

How flexible are the approval workflows and user permissions in OFX?

OFX offers robust controls with configurable approval workflows. You can assign permissions by team or role, ensuring a secure, delegation-friendly setup that aligns with each client’s structure.

OFX gives you control over how approvals and access are set up across different clients or business units. Approval workflows are highly configurable. You can create single or multi-level approval chains based on payment size, transaction type, or client policy. This ensures every payment is reviewed by the right people before it goes out, reducing the risk of errors or fraud.

User permissions are equally flexible. You can assign roles such as viewer, preparer, approver, administrator or custom, tailoring access to match each team member’s responsibilities. For example, junior staff can prepare payments without the ability to release them, while senior accountants or CFOs retain final sign-off.

This layered approach not only strengthens internal controls but also saves time by reducing bottlenecks. By balancing oversight with efficiency, you can delegate work confidently, maintain compliance, and keep financial operations moving smoothly.

How does OFX reduce manual tasks for accountants?

The platform eliminates repetitive data entry and physical approvals, automating workflows. This means time better spent on higher-value advisory work for your clients. For example, processing hundreds of payments individually takes time, increases transaction fees, and makes reconciliation a headache. By combining multiple bills for the same vendor into a bulk payment, you can create batch payments that sync up in real-time with their AP solution.

What are the integration options to sync my clients’ accounting data?

OFX provides real-time integrations with QuickBooks and Xero. You can choose a real-time, two-way sync or opt for a manual push of data, giving you flexibility based on your clients’ needs.

How does OFX help me scale my accounting firm?

OFX helps your firm grow by streamlining client management and freeing up time for higher-value work. In partnership with your accounting solution, you can oversee payments, approvals, and expense controls for all your clients.

Trust earned daily.

Take control. Free your time. Save money.