Thanks to advanced technology, free trade agreements, and globalisation, it’s easier than ever to expand your business operations into overseas markets. Managing your currency exposure may give you the competitive edge you need to protect your profits abroad.

In this guide from global money transfer specialists OFX you will learn:

- How many businesses are growing overseas

- Which countries are considered the best for business

- 5 things to consider before doing business overseas

- How to reduce currency exposure

- The best way to bring your profits home from abroad

How many businesses are growing overseas?

More and more businesses from all over the world are taking the leap into the international marketplace. However, Australian businesses in particular are still reluctant to enter the international market. This comes despite the wealth of opportunity it presents and the accessibility of operating across borders thanks to Australia’s low dollar value and trade agreements around the world.

According to a report from the Export Council of Australia in 2018, Australian SMEs account for around 14% of goods exports. Australia’s overall exports also make up for 21% of its GDP, which is lower than the OECD average of 28%. Meaning that opportunity for greater exporting and other forms of international trade is ripe for businesses in Australia looking to expand overseas.

Further abroad, according to a 2018 DMCC Future of Trade report, the UK ranked number three on the Commodity Trade Index, which evaluates 10 trading hubs based on three factors: commodity endowment, institutions, and location. And in 2016, 47% of businesses in the US stated that they expected their profits from international activity to rise that year, and 87% of companies agreed that expansion overseas is necessary for long-term growth.

Which countries are considered the best for business?

Different markets provide different opportunities for business expansion. Only you can decide which market will be optimal for your unique business proposition. However, some countries are more friendly to foreign businesses than others. These have been named the best countries for business according to Forbes:

- United Kingdom

- Sweden

- Hong Kong

- Netherlands

- New Zealand

- Canada

- Denmark

- Singapore

- Australia

- Switzerland

5 things to consider before doing business overseas:

Local context

Your Unique Selling Proposition (USP) may be more viable in one market than another. Be cautious before entering a market where your competitors are already operating as there may be cultural nuances that affect your ultimate success in a given market. Resist the temptation to follow your competitor into a market without the necessary market research for your brand.

Update your brand proposition

Your brand may need an update. Consider how your brand will translate in an overseas market in both visual and verbal application. Find the best way to communicate your brand story in a totally new market with totally new customers.

Take a trip to your new location

You’ll be due for a business trip. Anytime you’re expanding overseas and especially if you’re selling online, you may want to visit a country before deciding whether or not you will do business there.

Local connections

Consider hiring a guide or translator with connections in your industry, so you can see the competition up close. A guide may help you find new distribution channels or networks to speed up your supply chain and can assist you with understanding typical employee expectations if you’re tapping into the local workforce.

Legal investment

You may need to invest in your legal team. Ensuring your business complies with local laws and regulations is essential for expanding your business abroad. Of course, legal counsel with strong local knowledge will also help you establish contracts with partners and employees.

You’ll need to check in often. In addition to managing your business at home, you will need to be in regular communication with your sales reps, distributors, and colleagues overseas, so budget your time and resources accordingly.

Take your business global

Looking for inspiration on how to take your business global? Check out the key strategies and tips from our Go Global Workshop 2019

How to protect yourself against currency exposure

One of the biggest challenges of doing business abroad is the potential impact of currency fluctuations. Hardly a week goes by without a news report of a major currency move. That’s why it’s essential to protect your payments to overseas staff and suppliers by developing a sound currency strategy.

Hedging

You can use OFX’s Forward Exchange Contract to lock in a preferred exchange rate for up to 12 months, so you can keep your cash flowing as predicted.

Lock in a Limit Order

If your money transfer dates are flexible, use a Limit Order to set your target exchange rate. When the rate is right, you just confirm the transfer, so you can stay on top of the markets even if you’re out playing golf.

Transact fast

Reduce the amount of time between an invoice and a transaction’s settlement. Doing so may help protect your company against extreme currency fluctuations that could hurt your bottom line.

Negotiate all contracts with currencies in mind

Many suppliers prefer to be paid in currencies like USD, EUR, or AUD. Major currencies may be less susceptible to large fluctuations than emerging market currencies, which could benefit your business. That said, if your supplier is converting costs in Indian rupees into dollars, they could potentially overcharge you on the exchange rate unless you have one specified in the contract.

Stay informed

Once you go global, market movements start to matter more. Sign up for OFX’s daily or weekly market commentary to get the news you need.

The best way to bring your profits home from abroad

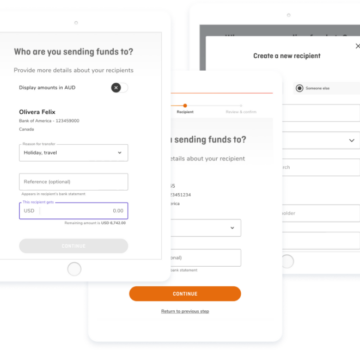

OFX can help you save on your global money transfers. We do this by giving you access to competitive rates, as well as experts who will help you put the right currency strategy in place.

With offices in seven locations around the world, our experts can help you with your currency strategy 24/7. So wherever you are in the world, OFX can be your partner in payments.

Our local network also extends beyond our bank accounts, with offices in seven locations around the world, the customer support team can help you with your currency strategy 24/7. So wherever you are in the world, OFX can be your partner in payments.

Are you ready to expand into the overseas market?

With the right research and guidance from professionals, you can start doing business overseas and take advantage of global buying trends around the world to boost your profits. As with any other business decision, the key will be in your ability to accurately weigh the pros and cons of going abroad, and then determining the best ways to save the most money while maintaining efficient operations at home and abroad.

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. OzForex Limited (trading as OFX) and its affiliated entities make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.