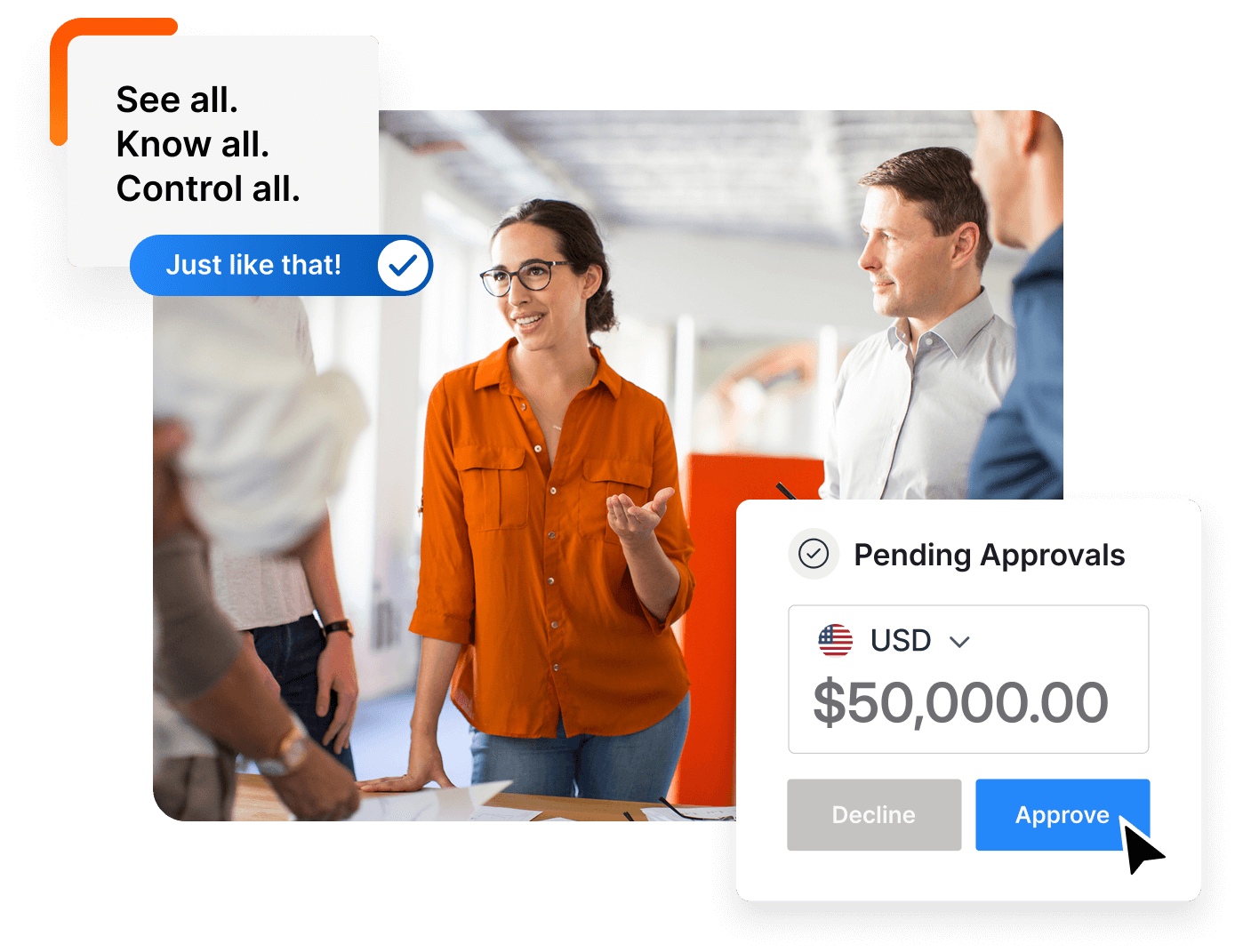

One account that does it all.

Your Global Business Account gives you airtight expense control. Hold multiple currencies in one account, pay suppliers abroad, and collect from customers overseas – without juggling multiple bank accounts.

Simple end-to-end financial automation.

A simplified approach to your business payments and finances. Track your bills, expenses, payments, cards and currencies – everything you need in one place.

Free up your finance team by distributing expense management tasks to employees via smart AI receipt capture and expense coding automation.

Helping you simplify your global business needs.

Multi entity. Multi market. One login.

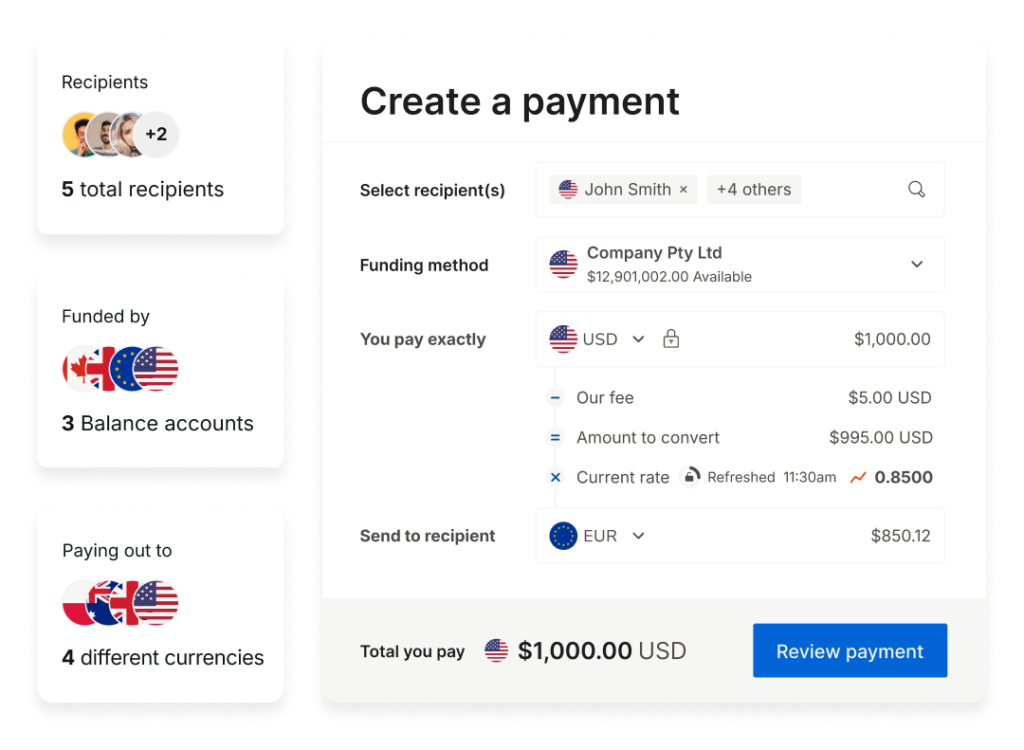

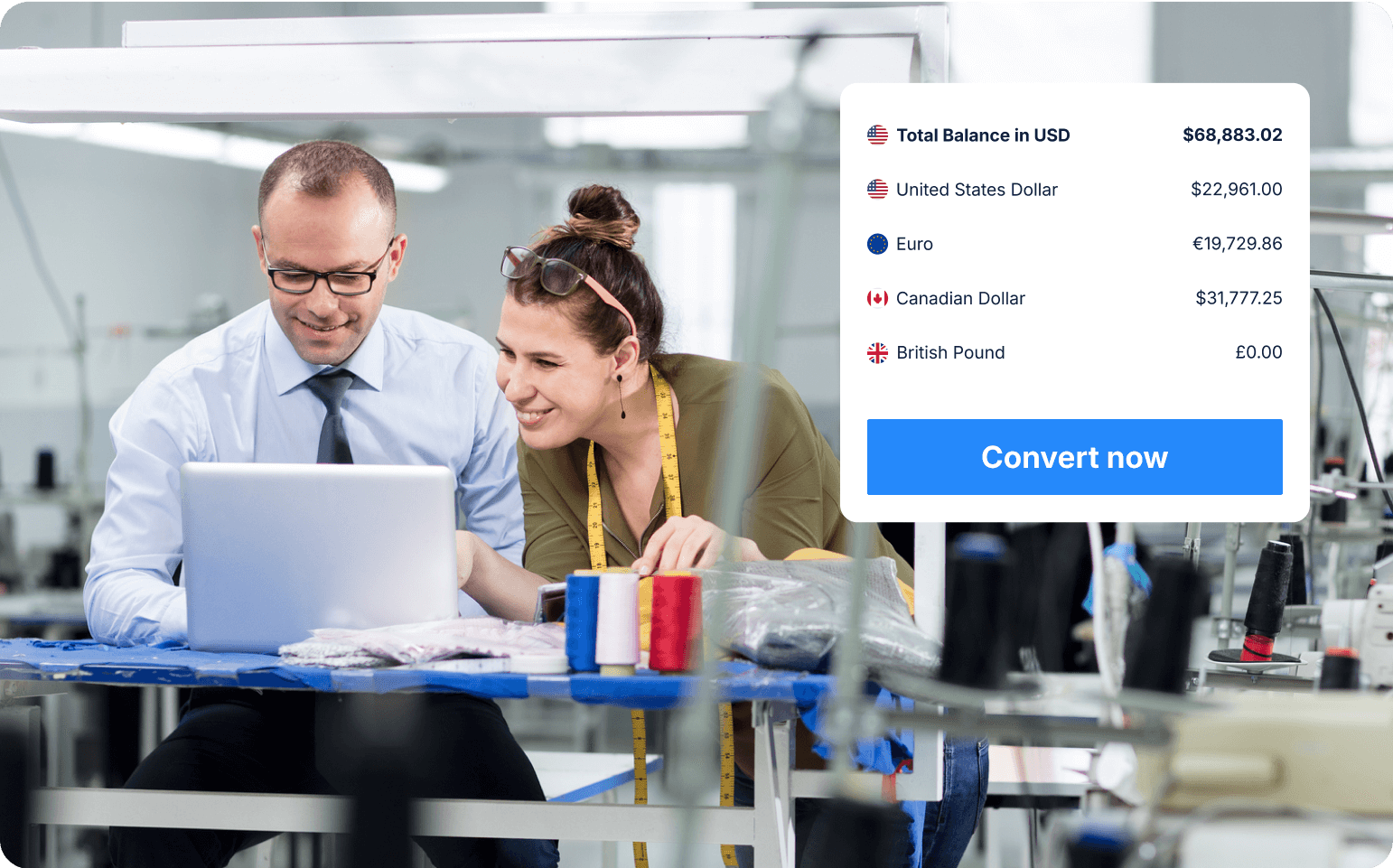

Chances are, you have some countries and currencies that really matter. An Australian customer. A Euro Supplier. Pre-convert USD when the rates are in your favor. Make fast transfers between your currency accounts at great FX rates.

Paid like a local. Paid faster.

A brilliant way to reduce FX fees. Get paid in foreign currency and hold it. Then, when a foreign expense comes up, pay like a local with your holdings.

30+ currencies at your fingertips. None of the bank fees.

Skip the hassle and expense of opening a business bank account. Your multi-currency account sets up in minutes, with lower fees and better rates.

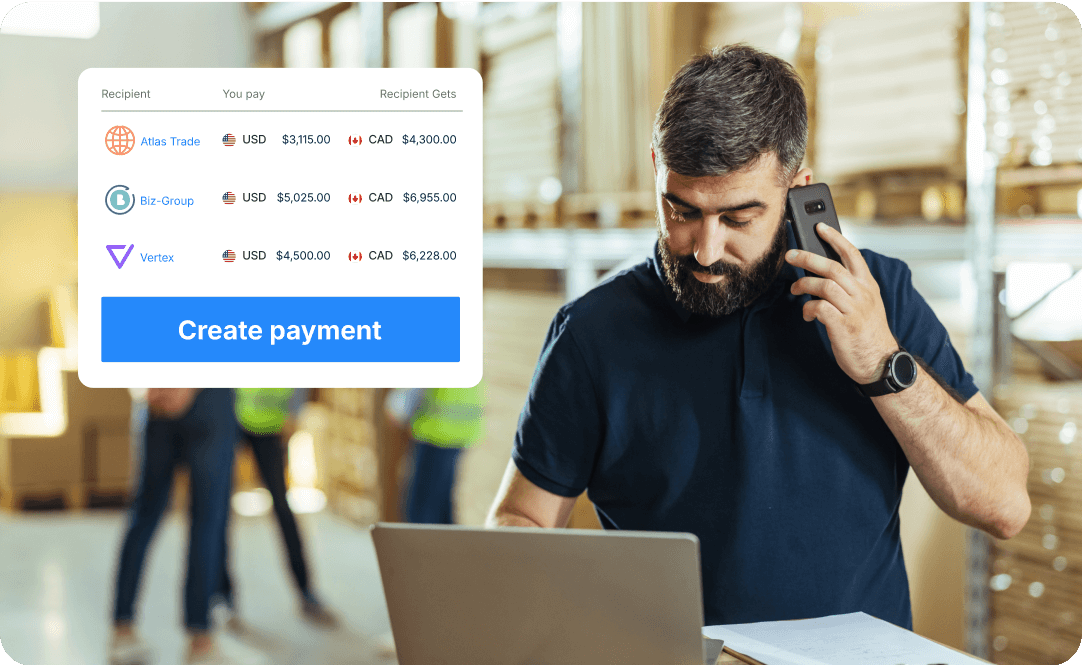

Manage payments in 30+ currencies from one platform

Import and export goods frequently and need a seamless and reliable payment solution for international transactions?

Pay and receive funds from clients locally or internationally. Hold currencies and convert when the rates are in your favor, like from USD to EUR.

Eliminate manual admin work.

Boost your team’s productivity with automatic invoice extraction tools, custom workflows and payment processes. Reclaim your time and gain real-time visibility of your cashflow.

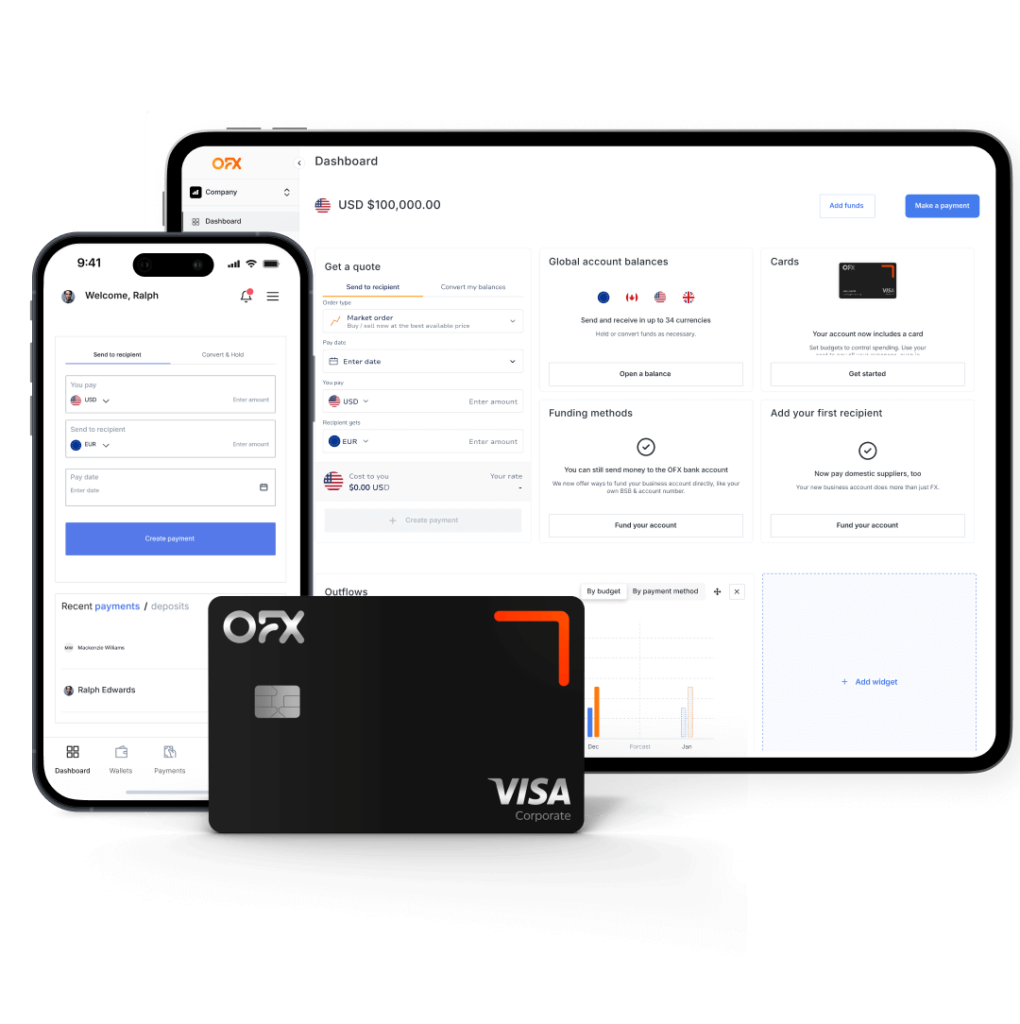

Apple Pay has arrived. An easy, secure, and private way to pay.

Now live: an easy secure and private way to pay. Apple Pay is an easy, secure and private way to use your OFX card on all your Apple devices.

Real people. Real help.

Need technical support? Have a question? We’re on hand 24/7 to support you. Call or email us anytime.

Create your Global Business Account today

The free trial lasts 60 days.

The savings last forever.

The one thing we canʼt automate? You, clicking the free trial button. You have nothing to lose and so much time and money to gain.

Small and medium business solutions FAQs

What makes OFX good for small and medium businesses?

Your business never stops. That’s why OFX financial solutions are designed to simplify financial operations and help your business thrive. With a Global Business Account, manage 30+ currencies, make international payments, and get paid like a local in global markets.

Other benefits include:

- Competitive FX rates and tools like Spot Transfers and Forward Contracts to manage currency risk.

- Corporate Cards and Spend Management solutions control expenses, track spending, and streamline approvals.

- Integration with accounting software such as QuickBooks and Xero for accurate, automated bookkeeping.

- Time-saving AP automation for payments, approvals, and reconciliation, reducing manual work and errors

What are the benefits of using OFX Corporate Cards for small and medium businesses?

OFX Corporate Cards offer several advantages for small and medium businesses. Cards can be issued instantly to employees, with customizable spend limits to control expenses, and supports multi-currency transactions in 30+ currencies.

You also get 5% cashback for your first 90 days up to a spend of $2,500 and 1% thereafter*. All these help you streamline expense management and maintain better control over spending.

Are there different pricing plans?

We offer flexible pricing plans designed to meet the diverse needs of small and medium businesses.

- Standard: Manage and automate payments in 30+ currencies with an OFX Global Business Account and OFX Corporate Cards.

- Full Suite: Everything you get in the Standard plan, plus more. Get access to enhanced automation controls, and advanced tools like approvals and spend management.

- Custom: Designed to scale with your business. If you are a multi-entity or have high transaction volumes, get in touch with us.

Each plan is designed to suit your business needs, providing the tools and support necessary to manage your finances efficiently.

Start with a 60-day free trial to explore the features and determine which plan best suits your needs. For detailed information on each plan and to compare features, visit our pricing plan page.

How can I get started with OFX?

Getting started with OFX is simple.

- Register for a 60-day free trial: Experience the OFX Global Business Account with no commitment.

- Set up your Global Business Account: Start managing multiple currencies and making international payments.

- Add your team and issue cards: Invite team members as users on your account and start issuing OFX Corporate Cards to manage expenses efficiently.

- Integrate your accounting software: Connect with QuickBooks or Xero for real-time, seamless financial data sync.

Trust earned daily.

Streamline your invoicing, billing, and global payment needs.