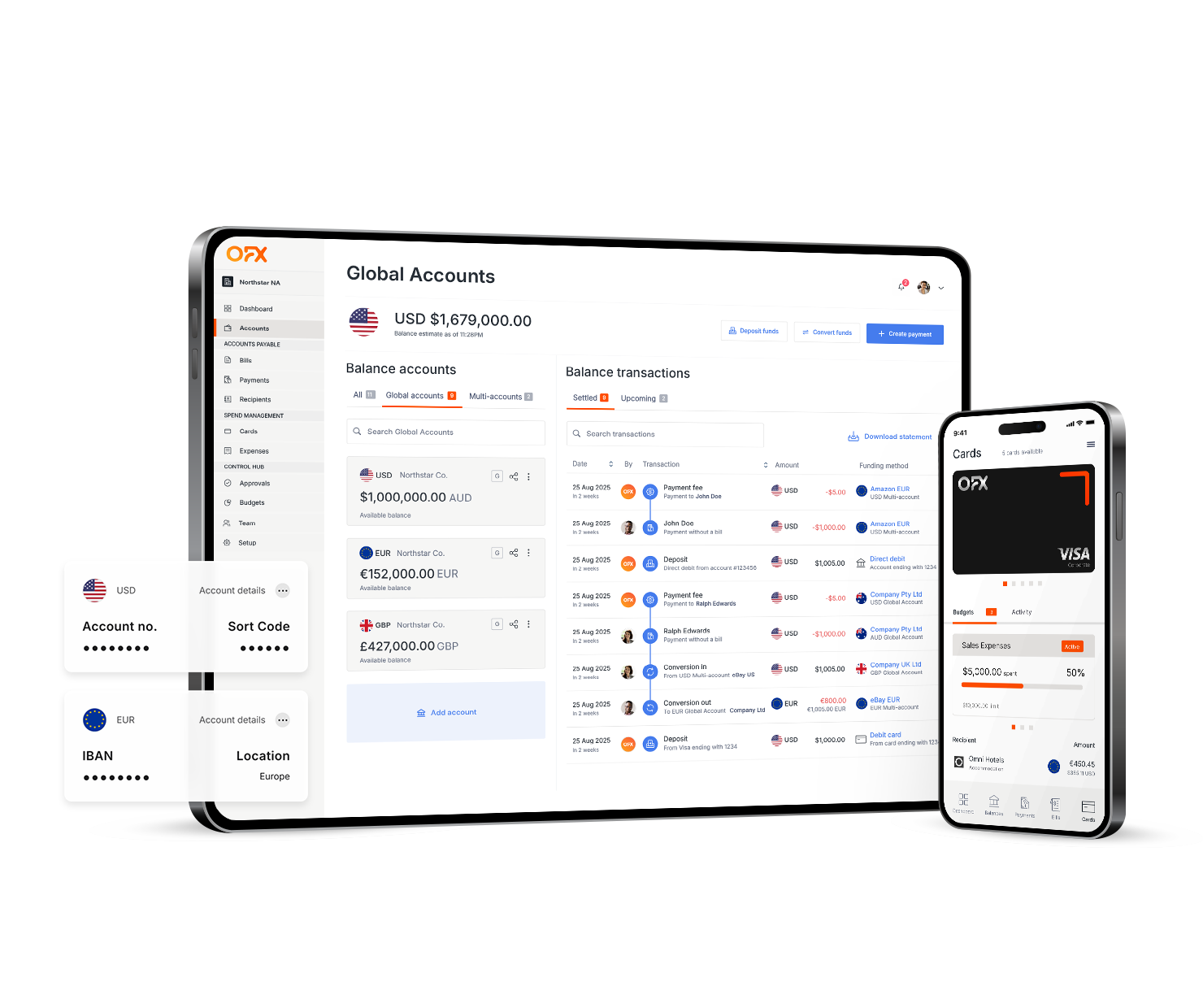

Limit Orders

Secure the exchange rate you want — automatically with a Limit Order.

Limit Orders work overtime, so you don’t miss out on market movements in different time zones. Eliminate the stress of having to watch the markets 24/7.

What is a Limit Order?

A Limit Order is an FX tool to help you move money at your ideal exchange rate. No more round-the-clock monitoring. Limit Orders automatically track the exchange rate you want to target and secure that rate, even outside of business hours.

Great for moving money if you don’t need to convert it immediately. It can be used as part of a currency plan to help achieve a target rate and stay in budget, or in conjunction with other tools to help protect against currency risk.

*Lock in your ideal great rate with OFX Limit Order for up to 6 months. If the rate hits, your target rate will be secured. No manual action required.

*Limit Orders lock in your target rate, however the market rate may continue to move above or below your target rate. Limit Orders do not guarantee that your desired rate will be reached.

Set it and forget it. Smarter FX Limit Orders.

If you don’t need to exchange the currency right away, consider an OFX Limit Order. Tell us how much you want to purchase and your ideal rate. If your target customer rate is achieved, we’ll automatically buy the currency for you and notify you.

Once we have received your funds, we’ll transfer the purchased currency to your nominated recipient.

Ready to create your first Limit Order? Open your FREE account today.

The benefits of a Limit Order with OFX.

Great rates

Set a target rate for your transfer and, if it’s reached, we’ll help get your money moving.

Secure

We’re ISO/IEC 27001:2022 certified globally and regulated by over 50 regulators worldwide.

Trusted

We’ve been a trusted innovator in the global money movement for over 25 years.

24/7 support

Real human service and support when you need us. Call or email us anytime.

Have a question? Need some help?

We provide 24/7 client service and support. Email us or call us anytime. We are here to help.

Create your Global Business Account today

Start using Limit Orders today with your 60-day free trial.

The one thing we canʼt automate? You, clicking the free trial button. You have nothing to lose and so much time and money to gain.

FAQs on Limit Orders

How does a Limit Order work?

A Limit Order allows you to automatically convert currency once a specific target exchange rate is met, giving you control over your FX transactions without needing to monitor the market constantly. You set your desired rate, and when the market reaches it, OFX processes and confirms the exchange.

Are there any downsides to Limit Orders?

Your transfer will be completed at the target rate; however, the exchange rate could continue to move above or below your target rate, meaning that you could have achieved a better rate of exchange.

The market may never reach your desired rate, meaning it could have been better to transfer earlier to meet your time and budget goals.

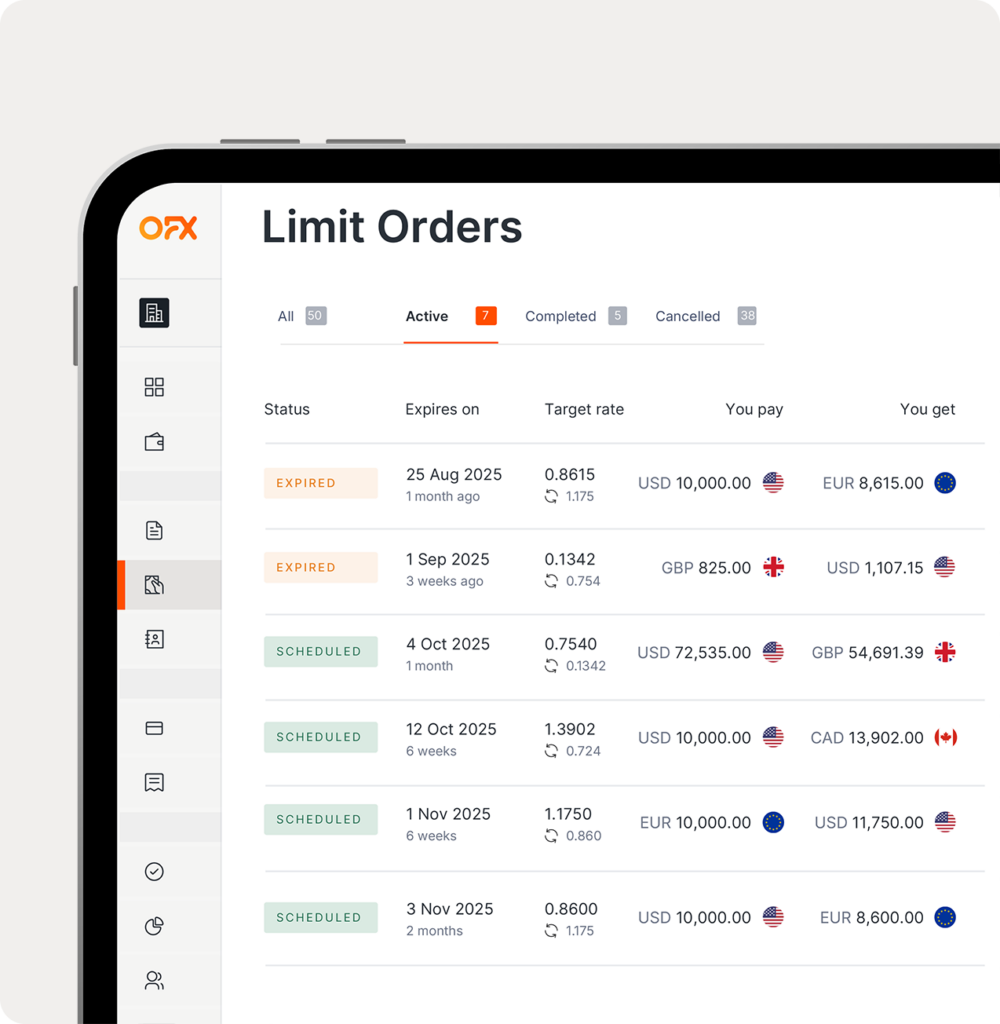

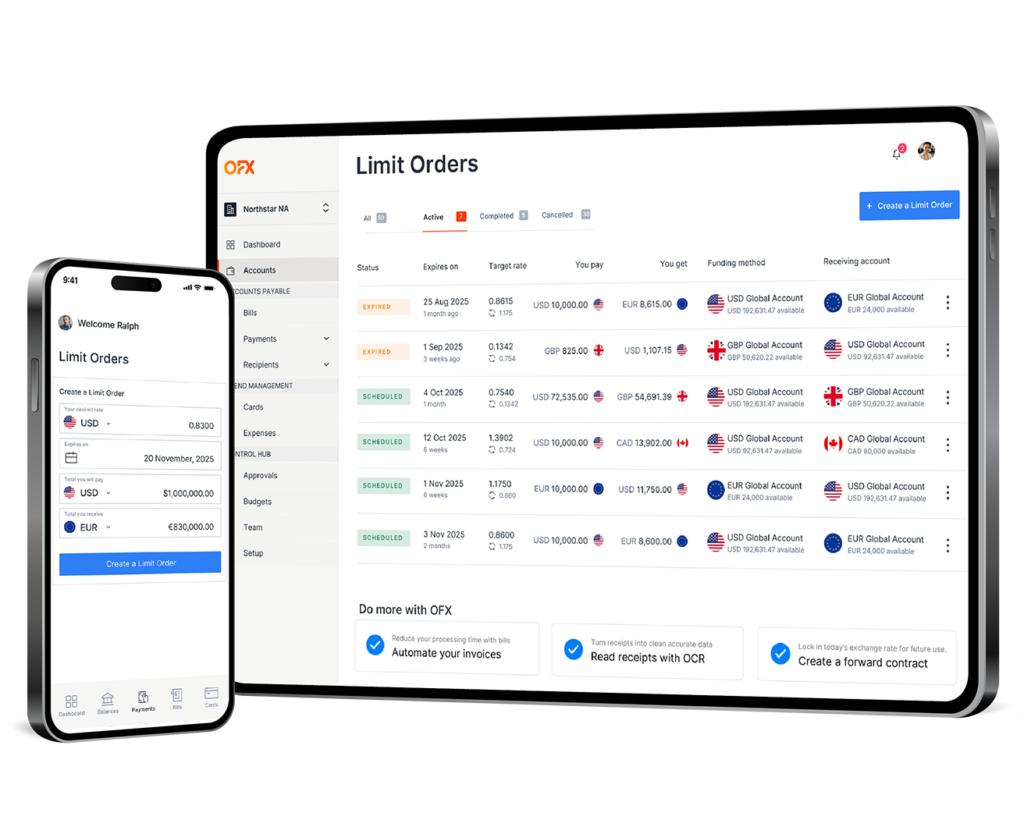

How do you set a Limit Order?

Setting up a Limit Order with OFX is easy. All you need to do is follow these steps:

- Log in to OFX via the online platform or mobile app.

- Navigate to ‘Limit Orders’ and select ‘Create Limit Order’.

- Fill in details such as the currency pair, your desired exchange rate and expiry date.

- Review and confirm.

If the market hits your desired rate, OFX automatically executes the exchange for you. If not, it will remain active until it expires or if you cancel it.

Do I need to have the full funds in my Global Business Account to place a Limit Order?

With OFX, you don’t need the full funds in your account to place a Limit Order. This gives you added flexibility to manage your cashflow. You need to ensure that your account has funds before the Limit Order’s expiry date. Once your target rate has been reached, you’ll have up to 3 business days to fund your account. If your account has insufficient funds after 3 business days of the expiry date, OFX may cancel the Limit Order and you’ll be liable for any losses.

How do I know when my target rate has been reached?

You’ll receive a notification when your target has been reached.

How long does a Limit Order last?

With OFX Limit Orders, you can choose a timeframe from a couple of days, up to 6 months.

Which currencies can you place Limit Orders for?

At OFX, our Limit Orders allow you to set your targeted rates across 10+ currencies on the platform.

What to consider when placing Limit Orders?

When setting up a Limit Order, it’s important to make sure it fits your business needs and cashflow plans. Think about target rate, market conditions, order size, currency pair, timing, cashflow, and risk management.

Limit Orders work best when they’re part of a broader FX strategy. Some businesses also choose to set up rate alerts alongside their Limit Orders, so they can monitor movements and adjust if needed.

When are Limit Orders used?

Limit Orders let you target an exchange rate for up to 6 months. Because OFX is open 24/7, our system will lock in the Limit Order and we will notify you once the target rate has been achieved.

Limit Orders often work best for businesses or individuals that need to move money, but don’t need to convert it immediately. Instead, you can wait for your desired rate. Have a question? Speak to our specialists.

Remember, if you book a Limit Order, it may mean losing out if the market rate continues to move above or below your target rate. There is no guarantee that your desired rate will be reached. Once the order is triggered, the transfer is binding and cannot be cancelled.

How do Limit Orders and Forward Contracts differ?

OFX Limit Orders allow you to set a desired exchange rate. Once the market hits the rate, OFX completes the transfer. However, there is no guarantee your transfer will go through if that specific rate is not reached in the market.

On the other hand, OFX Forward Contracts allow you to fix a future rate. This lets you lock-in the current exchange rate for a transfer up to 12 months in advance. However, if you book a Forward Contract, it may mean losing out if the market rate improves because you’re contracted to settle at the agreed rate.

What does it cost to set up a Limit Order?

Limit Orders with OFX don’t require a deposit or advance payment. There are no additional fees beyond your usual FX transaction charges.

Can I cancel a Limit Order?

Your Limit Order can be cancelled or changed anytime before your target rate is reached. You can cancel or change adjust it by logging in to your OFX account online, or through the OFX Business App. If you need technical support, contact our OFX specialist on the phone.

However, if your desired exchange rate is reached, you cannot cancel your Limit Order as the deal becomes legally binding when the market hits your target rate. If you don’t make payment within 3 business days of the expiry date, OFX may cancel the Limit Order and you’ll be liable for any losses. Remember, if you book a Limit Order, it may mean losing out if the market rate continues to move above your target.

Trust earned daily.

Automate currency conversions at your targeted exchange rate.