Currency Strategy

When to consider an FX Forward Contract?

Trade rules change, headlines break, the market wobbles. Whether you’re paying an overseas supplier next month, forecasting imports, or budgeting client revenue, fluctuating FX rates can impact profit margins.

Forward Contracts let you lock in great FX rates today, for up to 12 months. You know exactly what you’ll be paying, no matter how currencies fluctuate over the next year*.

No complicated contracts, no financial jargon, just simple tools that help you to clear the currency noise and get back to business.

Exchange rates can swing.

Forward Contracts mean certainty.

Payments in foreign currencies can put you at the mercy of global fluctuations. Lock in a great rate today and avoid unexpected overspending in the future.

Lock in today’s rate.

Set transfers anytime, from two days to 12 months, with the FX rate guaranteed.*

Limit currency risk.

Protect your business from currency fluctuations and unexpected spikes.

Forecast your costs.

Plan and forecast costs with certainty, and fix your FX costs for the year ahead.

Plan with confidence.

Make and receive payments at predictable rates.

*Forward Contracts are subject to advanced payments during the duration of your contract. For full details on advanced payments and deposit calls, please reference our Terms and Conditions. If you book a Forward Contract, it may mean losing out if the market rate improves because you’re contracted to settle at the agreed rate.

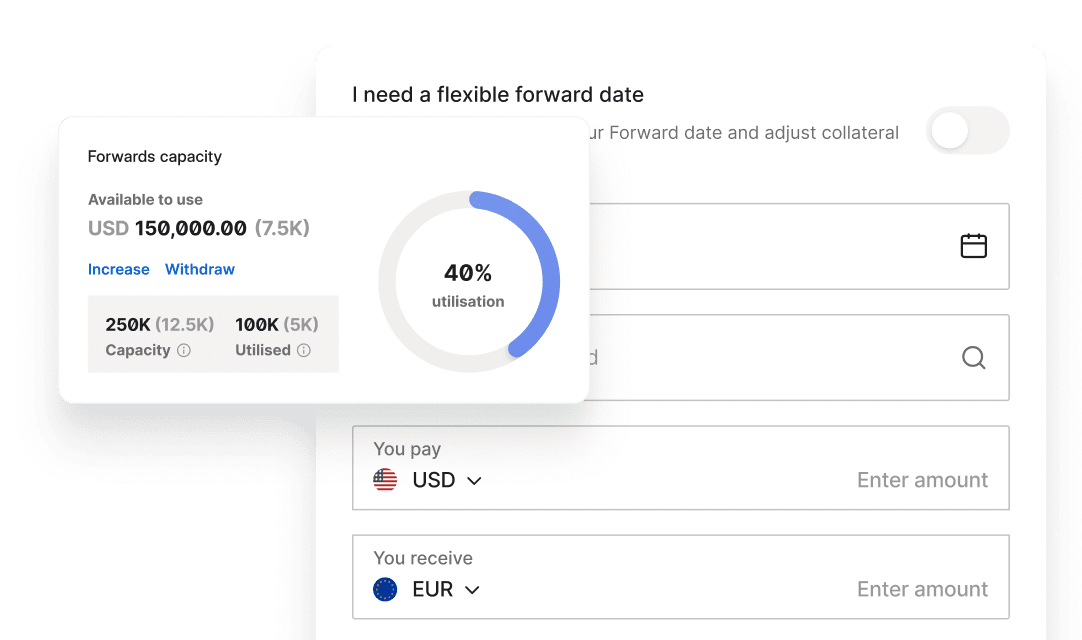

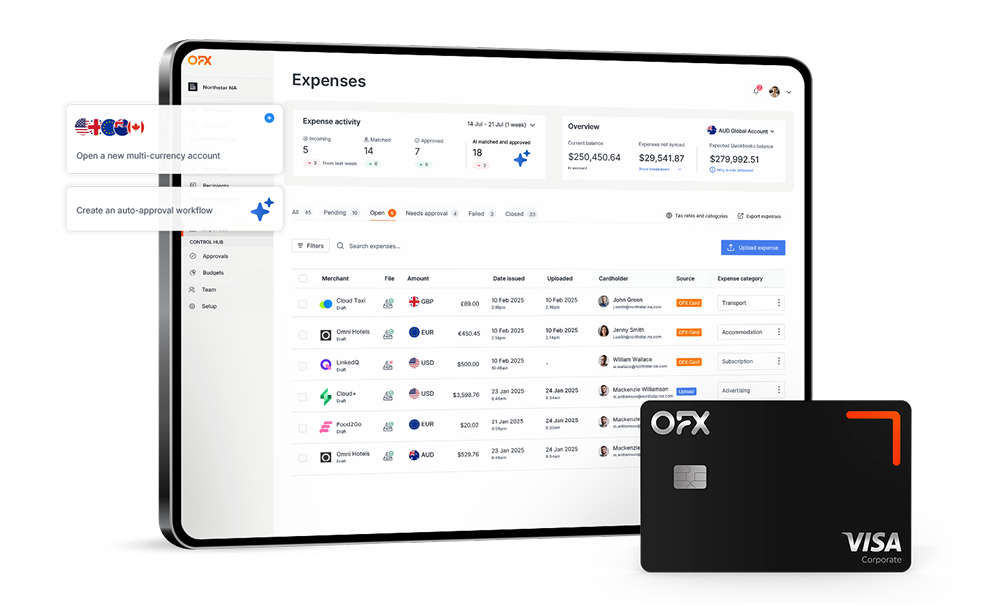

Forwards without friction.

OFX Forward Contracts integrate directly into your Accounts Payable workflow. When it’s time to pay an invoice, draw down directly from the platform. No more calling. No more manual back and forth.

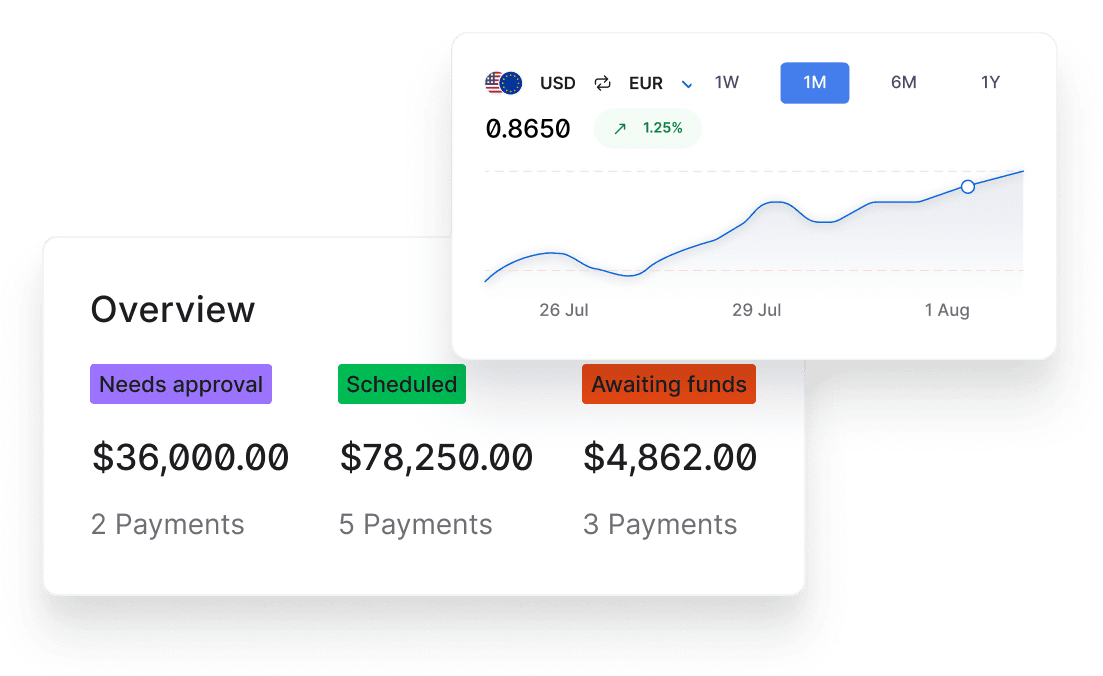

Forward Contracts and payments. Side by side.

See Forward Contracts together with your account balances, bills, and payment statuses in a single dashboard.

This means finance teams can easily track drawdowns, manage remaining balances, and reconcile payments with QuickBooks and Xero.

Whether it is $1K or $3M+, we got you.

When it’s your money, every deal is a big deal. OFX has been helping businesses make Forward Contracts for 25+ years. Our platform makes it fast and easy. Which means you can quickly protect an upcoming payment need.

Clients love us. Here’s why.

Creating a Forward Contract is easy as 1, 2, 3.

Step 1

Access Forwards within your OFX Global Business Account.

Step 2

Apply for eligibility and get activated on the platform.

Step 3

Book and manage Forwards directly whenever you need.

Book a FREE demo

Let’s talk about your business needs.

Book your FREE demo.

See the OFX financial platform in action. Book your personalized demo and learn how to automate everything in a few clicks. Global Payments, Corporate Cards, Spend Management, Currency Solutions and so much more.

Stay a step ahead, with our FREE monthly FX report.

Don’t let currency fluctuations catch you off guard. Get our FREE monthly Currency Outlook, prepared by our team of global currency specialists. Includes our time-saving FX rate cheat sheet.

Forward Contracts FAQs

What is an FX Forward Contract?

An FX Forward Contract is an agreement between two parties (i.e. the client and OFX) to lock in a currency exchange at an agreed FX rate for a future date. By locking in today’s rate, businesses can protect themselves from currency swings and gain certainty over future costs and international transactions to manage budgets with confidence.

Can everyone set up a Forward Contract?

All Forward Contracts are subject to approval by OFX. Conditions vary per market.

What are the benefits of a Forward Contract?

The core benefits of FX Forward Contracts can include:

- Certainty: Forward Contracts provide certainty for future international payments, eliminating the risk of unexpected costs from currency fluctuations.

- Budgeting: By locking in an agreed FX rate, businesses can plan and budget more effectively for overseas costs and profit margins.

- Risk management (otherwise known as hedging): Forward Contracts are a common tool for managing currency risk, protecting profits and financial stability.

Is a Forward Contract right for me?

You might consider a Forward Contract if you’re committed to making an international payment for goods or services in the next few months, like paying suppliers or overseas contractors and employees.

To continue to take advantage of exchange rate movements, some businesses use a Forward Contract for only part of their liability as a way to partially hedge against currency swings.

How is a Forward Contract rate calculated?

The exchange rate you’ll receive takes into account the market rate on the day you book your Forward Contract, a margin charged by OFX, and the central bank interest rates for the currencies you are exchanging.

Do I need to pay upfront when I book a Forward Contract?

You may be asked to pay a deposit when you book a Forward Contract. This is a fixed percentage of the value of the transaction, and is most often 5% for a business account. However, this could be more or less depending on the duration and assessment of the Forward Contract, credit limits, and other factors. Your deposit is held until the maturity date specified in the Forward Contract.

Please note, you must pay the remaining balance of the total amount due which is the difference between the Forward Contract and your deposit, in addition to any applicable fees by the maturity date. For more information, contact us.

Remember, if you book a Forward Contract, it may mean losing out if the market rate improves because you’re contracted to settle at the agreed rate.

Why do I need to make an advance payment?

Your advance payment is held as security for your completion of the contract until the maturity date. The advance payment is calculated as a percentage of the notional mark-to-market exposure of your Forward Contract. Mark-to-market exposure is the difference between your contracted rate and the current rate.

Do I need to wait until my Forward Contract matures to use the currency?

You have the option to drawdown at any point during the contract’s lifetime. When your Forward Contract matures you will need to settle the remaining amount. If you choose to deliver earlier than your agreed maturity date, the exchange rate may differ to your original contract. For more information, contact us.

Remember, if you book a Forward Contract, it may mean losing out if the market rate improves because you’re contracted to settle at the agreed rate.

What if I no longer need the Forward Contract?

You can easily cancel a Forward Contract within your account. At the time of cancellation, you’ll see a summary with the estimated cost to cancel. Alternatively, you can change the date to bring it earlier.

Get the power of Forward Contracts.