Your guide to using business credit and debit cards strategically

For SMBs, and that’s around 99% of all businesses globally 1, maintaining healthy working capital is crucial. Unfortunately, 60% of small and medium size businesses fail because of cash flow challenges 2. While it might not seem like a big decision, how you choose to pay for everyday expenses plays a bigger role than you might think.

Choosing the right corporate card – debit, credit or prepaid – starts with understanding how each type can impact your bottom line. In this guide, we’ll break down credit cards vs debit cards for business and what corporate cards are. We’ll walk through the key differences, benefits and trade-offs, so you can choose the right tools to manage spend and keep your business moving forward.

Jump to:

• Credit cards vs debit cards for business: What’s the difference?

• Credit cards: Features and uses

• Debit cards: Features and uses

• Risks and considerations: credit vs debit

• Comparing business credit cards vs business debit cards

• Is a credit card or debit card better as a corporate card?

• What about a prepaid card?

• Corporate cards and spend management solutions

• Spend smarter with OFX Corporate Cards

• Best practices for managing credit and debit cards for business

• Complete visibility on your business spend

• FAQs: Business credit, debit, and corporate cards FAQs

Credit cards vs debit cards for business. What’s the difference?

What is a business debit card, and how does it compare to a credit card for business use? The short answer: credit cards let you borrow against a credit limit, while corporate debit cards draw directly from your existing business funds. Both can help streamline expenses, but the right choice depends on your company’s needs, risk appetite and goals.

When managing money across teams, tools and borders, choosing between a business credit card and a corporate debit card isn’t just about convenience at checkout. It’s about how you handle cash flow, control spending, and make the most of the rewards you earn as you spend.

Business credit cards are popular for rewards and flexibility. However, they require careful management to avoid debt or interest charges. Corporate debit cards, particularly when paired with a multi-currency business account, offer simplicity and tighter spend control.

Credit cards: Features and uses

A business credit card allows you to borrow funds up to a set limit for business-related spending. Typically, you’ll receive a monthly statement and can choose to pay it off in full or carry a balance with interest. Credit cards are commonly used for larger purchases, managing short-term cash flow, or covering travel expenses and subscriptions.

Key features often include:

- Access to a revolving credit line

- Rewards programs (points, cashback, airline miles)

- Purchase protection and extended warranties

- The ability to build business credit

- Credit cards can be helpful when your business needs flexibility or if you’re looking to benefit from loyalty or rewards schemes tied to spend.

Debit cards: Features and uses

A business debit card is linked directly to your company’s account and draws funds from your available balance at the time of purchase. It’s ideal for day-to-day business spending, like office supplies, software subscriptions, or fuel, without the risk of accumulating debt.

Key features often include:

- Spend is limited to your available funds

- No interest or debt accrual

- Lower risk of overspending

- Instant transaction tracking

- Debit cards are especially useful when you want real-time control over cash flow and spending.

Risks and considerations: credit card vs debit card

Credit card risks:

- Interest charges on unpaid balances

- Risk of debt accumulation

- Overuse due to available credit

- More complex reconciliation

Debit card risks:

- Limited fraud protection compared to credit (varies by provider)

- Less helpful for establishing credit history

- Insufficient funds can result in declined transactions

- May lack the rewards perks associated with credit

Comparing business credit cards vs business debit cards

| Feature | Business credit card | Business debit card |

| Spending flexibility | Borrow up to a credit limit; repay later. | Spend only what’s available in your account |

| Interest charges | Interest applies if balance isn’t paid in full. Grace periods may apply. | No interest charges. Funds are directly debited from your account. |

| Credit building | Helps build your business’ credit profile with timely repayments. | Does not impact credit history as there’s no credit involved. |

| Rewards and perks | Often offers rewards like cashback, travel points or insurance benefits. | Reward schemes such as earn cashback and reward points |

| Approval process | Requires credit assessment and may need a personal guarantee. | Easier approval. All you need is a business transaction account. |

| Spend control | Flexible however at risk of spending beyond means. Requires being strict with setting individual card limits and monitoring actively. | Strong control. Reduces risk of overspending as purchases can’t exceed the account balance. Set card spend limits, budgets, control categories and vendors. |

| Fraud protection | Enhanced fraud protection, and may include purchase insurance. | Basic fraud protection. It depends on the bank or provider’s policies. |

| Fees | May include annual fees and interest charges if the balance is carried. | Generally lower fees. Some may have monthly account fees. |

| International use | Suitable for international purchases. May offer multi-currency options. | Suitable for international purchases. Some charge foreign transaction fees. |

| Reconciliation | May require manual reconciliation. Some integrate with accounting software. | Easier reconciliation. Transactions are directly linked to your business transaction account. |

Is a credit card or debit card better as a corporate card?

It depends on your business goals. A credit card might suit you if you need flexibility, want to build business credit, or regularly make larger purchases. A debit card is better if you want to keep spending grounded in your available funds, improve financial discipline, and reduce the risk of accumulating debt.

At OFX, our corporate cards offer the best of both worlds: spend control, visibility, multi-currency functionality without the interest fees while earning cashback on everyday business spend.

What about a prepaid card?

Prepaid cards can be a handy option for some types of business spending. They’re loaded with a set amount of funds, allowing employees to spend only what’s available and offering control without the risk of overspending or interest charges.

Here’s what you should know:

- You can top up the card as needed, giving flexibility without access to your full account balance.

- Spend is limited to the funds available on the card. Once it’s gone, that’s it.

- Prepaid cards often have limited acceptance and may not work everywhere, including on platforms like Google Ads or some ATMs.

- Many are based on gift card models, meaning they can only be used in select places.

- Some providers charge load fees, inactivity fees or hidden costs, so it pays to read the fine print.

- When paired with the right provider, prepaid cards can function similarly to standard corporate cards, with visibility and control through a mobile or desktop app.

While prepaid cards can offer a simple way to manage small or one-off expenses, they may not provide the flexibility or oversight required for growing businesses.

For greater control and international functionality, many companies opt for corporate debit cards linked to their primary business account, such as the OFX Global Business Account.

Corporate cards and spend management solutions

Managing business expenses is about creating a smarter, more connected way to handle spending across your organization. When your team has access to tools that simplify spending, integrate seamlessly with your financial systems and scale with your growth, you get more control, better visibility, and fewer roadblocks.

That’s why our corporate cards are designed to work in sync with the broader OFX ecosystem, including multi-currency accounts, global payments, and accounting software integrations. Everything connects, so you can manage spending across teams, platforms and borders with less admin and more control.

With our Multi-currency Account, you can hold, pay, and receive in 30+ currencies. When your OFX Corporate Card is used for international purchases, funds can be drawn directly from your available balances, helping you avoid unnecessary conversions or delays.

FX Solutions make it easy to pay overseas vendors or transfer funds across borders, all at competitive exchange rates. With automated feeds into popular accounting platforms, reconciliation becomes faster and reporting more accurate. From custom spend controls to real-time visibility, OFX Corporate Cards give you the spend management flexibility to support your team, while keeping your finance team in the driver’s seat. It’s a smarter way for a modern business to manage money.

Spend smarter with OFX Corporate Cards

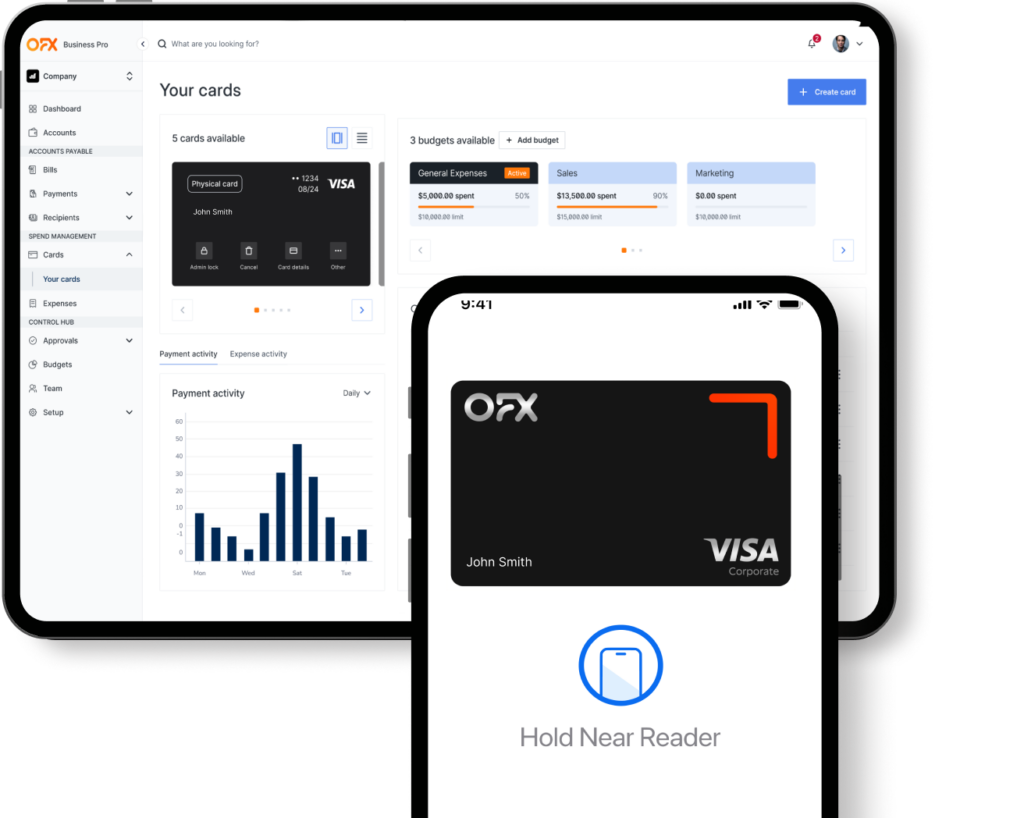

OFX smart corporate cards put you in control of business spend. You can set team or individual limits, monitor transactions in real time, and keep an eye on cash flow, all from one intuitive dashboard.

Built-in fraud protection and automated reconciliation help you stay secure and reduce admin. With unlimited company cards, it’s easy to separate spending by vendor, subscription, or employee and spot opportunities to save.

Our corporate card gives your business more flexibility and control over everyday spending. Unlike typical credit cards, the OFX Corporate Card draws from available funds in your OFX Global Business Account which helps you stay on budget while avoiding debt. You can issue physical or virtual cards, tailor permissions by role, and decide exactly how and where funds are used. It’s a smarter, more flexible way to manage expenses, locally and across borders.

Earn cashback rewards

It gets even better! With OFX Corporate Cards you’ll get instant cashback rewards. Earn 1% unlimited cashback on everyday spend. So while your team stays productive, your bottom line benefits as well.

Best practices for managing corporate cards for business

Managing business expenses gets easier when you have the right systems in place. If you’re using business credit cards, debit cards or a combination of both, a few smart habits can help you stay in control, reduce risk, and keep your financial processes running smoothly.

Best practices for managing business credit and debit cards

- Set cardholder permissions: Limit spend categories, vendors and amounts

- Review transactions regularly: Spot issues before they escalate

- Define a clear policy: Make sure employees understand what’s covered

- Use accounting integrations: Sync cards with your finance software

- Monitor spend in real time: Use dashboards or apps for instant insights

- Educate your team: Offer guidance on using cards responsibly

Best practices for managing business expenses with corporate cards

- Use employee cards to empower your team without losing control

- Issue virtual cards for one-off or online payments to reduce risk

- Apply spend limits and controls to each cardholder

- Integrate cards with your expense management system

- Automate receipt capture and categorisation to reduce admin time

- Track spend by team, project, or location for budget clarity

Complete visibility on your business spend

With your OFX Global Business Account and OFX Corporate Cards, you can see exactly how and where the money is being spent across your business. From managing team expenses to vendor payments or recurring subscriptions, every transaction is tracked in real time.

OFX offers corporate VISA cards that come with a range of handy features, including:

- Multi-currency support: Hold and spend in 30+ currencies

- No international transaction fees: when you spend from your held balances

- Virtual and physical cards: Use online or in-store

- Company and employee cards: Tailored to how you operate

- Customisable spend controls: Set limits and categories

- Real-time visibility and reporting: Track and manage spending easily

- Cashback rewards: Earn 1% unlimited cashback on everyday spend.

You can assign individual cards, set spending limits, and categorize expenses, which gives you a clear picture of cash flow and helps you make more informed decisions. Plus, with built-in reporting and reconciliation tools, it’s easier to stay on top of budgets, reduce manual admin, and keep your finances on track.

Ready to simplify your business spending? Learn more about OFX Corporate Cards

Get started for free with a 60-day trial.

You have nothing to lose, and so much time and money to save. Your all-in-one control platform is ready. Get started today.

FAQs: Business credit, debit, and corporate cards

What’s the difference between a business credit card, a debit card, and a corporate card?

A business credit card gives you access to a revolving line of credit that you repay over time. A business debit card draws funds directly from your business account, meaning you can only spend what’s available. A corporate card is often part of a wider program designed for teams and offers spend controls, real-time visibility, and system integrations. It may be a credit or debit card, depending on the provider.

Which is better for business: credit or debit?

That depends on your priorities. Credit cards can help manage cash flow gaps, offer rewards, and build credit history, but they can also carry interest charges if not managed carefully. Debit cards help you stick to budget, avoid debt, and simplify reconciliation. For many businesses, using both strategically makes sense.

What is a corporate card used for?

Corporate cards are issued by a business to its employees for work-related expenses. This could include travel, meals, digital subscriptions, equipment or vendor payments. Corporate cards reduce the need for reimbursements and give finance teams greater oversight and control over spend.

Are corporate cards linked to employee credit scores?

No. Most corporate cards (including OFX Corporate Cards) are linked to the company’s account and do not impact the employee’s personal credit. This makes them ideal for businesses that want to issue cards without affecting individual staff.

Can I issue multiple cards to my team?

Yes. With OFX, you can issue unlimited corporate cards, both virtual and physical. You can assign them by team, role, or purpose such as travel, subscriptions, or project spend.

Are corporate and business cards secure?

Modern cards include fraud detection, encryption, and real-time alerts. With OFX, you also get the ability to lock or cancel cards instantly, set limits, and restrict usage to certain merchants or regions, minimizing risk while staying in control.

When does a credit card make sense?

Business credit cards can be useful for covering large or unexpected costs, earning rewards, or smoothing out short-term cash flow. Just be sure to factor in repayment terms, interest rates, and potential fees.

What’s the difference between a company card and an employee card?

Company cards are typically assigned to shared business expenses (like software, advertising or tools), while employee cards are allocated to individuals for travel or operational spending. OFX offers both types, with flexible limits and tracking by person, team or project.

Can these cards integrate with our accounting system?

Yes. OFX cards are designed to integrate with Xero and Quickbooks accounting software, making it easier to categories spend, reconcile quickly, and gain better visibility over your finances.

References

1) https://www.oecd.org/en/topics/smes-and-entrepreneurship.html