1-Minute Summary:

If you’re launching a new global business in the US or expanding internationally, you’ll need a reliable business account for managing international payments, currencies, and cash flow. That usually means deciding between a traditional international bank account and a modern fintech alternative.

- Traditional banks in the US provide international business bank accounts with branch-based services, SWIFT transfers, and credit facilities. While these accounts are comprehensive, they can be slower and more costly, especially for international wire transfers.

- Fintech providers like an OFX Global Business Account offer digital-first international business accounts that emphasize speed, lower transfer fees, and a range of handy integrated finance tools.

Your choice will depend on what matters most for your business: in-person banking services and access to credit, or a faster, flexible alternative built specifically for modern cross-border operations.

This guide compares some of the most popular options from both categories so you can pick an account that’s well-suited to your business needs.

Jump to:

• Why international accounts matter for US businesses

• International business bank account vs fintech alternatives

• Top international business bank accounts & fintech alternatives

• Comparing international business accounts: key takeaways

• Features to look for in an international business account

• How to open an international business account in Five Steps

• Why businesses are choosing OFX over a traditional banks

• Best international bank FAQs

Why international accounts matter for US businesses

If you run a business in the US, chances are you’ve already come up against the limits of a traditional bank when sending and receiving overseas payments.

Most big banks rely almost entirely on the SWIFT network to move money internationally. That means every transaction can come with wire transfer fees, extra charges, and a waiting period that often stretches across several business days.

If you’re paying suppliers abroad or receiving funds from global clients, using a traditional bank works, but it’s not always the most efficient or cost-effective way to keep your money moving.

This is where fintech platforms like OFX take a different approach. Instead of routing everything through SWIFT, they give you local details and account numbers in the markets where you operate. That might be euros in Europe, pounds in the UK, or dollars in Canada.

Suddenly, you can pay staff, settle invoices, or collect revenue as if you were based there yourself. The result is lower transaction fees, faster delivery of funds, and a far simpler process.

For businesses managing payroll across remote teams, billing international customers, or making frequent overseas payments, the savings in both time and cost can add up quickly. This can make a noticeable difference to cash flow and your business’s bottom line.

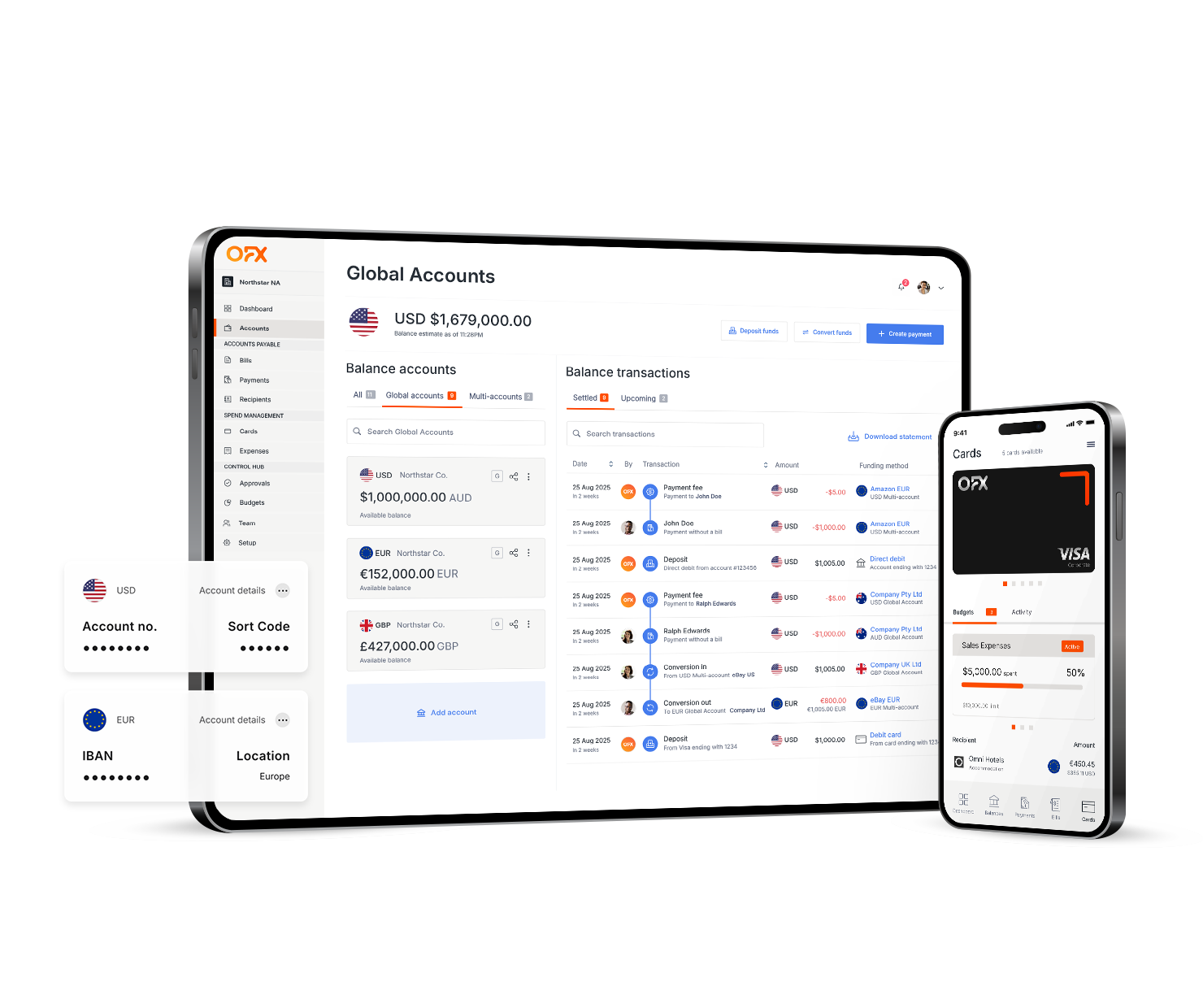

OFX Global Business Account

Receive, hold, convert and send funds across a wide range of currencies, reduce costs and gain greater control over your international payments.

International business bank account vs fintech alternatives: key features

When you’re weighing up where to open an international business account, it helps to understand how fintech providers differ from traditional banks. On the surface, they may appear to offer the same thing: a place to hold multiple currencies and make cross-border payments. However, the structure and features can be very different:

- Traditional banks issue international accounts under a full banking license, which usually means you can hold funds in foreign currencies, move money through SWIFT, and sometimes access extras such as a line of credit. These accounts often double as a business checking account, complete with debit cards, ATM withdrawals, and occasionally interest on deposits.

- Fintech providers like OFX are licensed differently. Their design philosophy is very different. Instead of forcing you into large opening deposits or strict minimum balances, they focus on speed and accessibility. This means you can get up and running quickly while still holding balances in multiple currencies, managing cross-border payments, and issuing both physical and virtual cards for your team. OFX is licensed as a money transmitter by the relevant state regulatory agency in the U.S, and registered as a Money Service Business at the federal level with the Financial Crimes Enforcement Network (“FinCEN”).8,9

- Expense management and automation features are also more likely to be built in with fintechs. For example, OFX combines multi-currency accounts with real-time reporting, batch payments, and corporate cards that let you track spending instantly. These are capabilities you would rarely see bundled together in a traditional international business bank account.

If you want to manage your account in a physical branch or have access to full-service credit facilities, a traditional bank may better meet your needs. If you value convenience, speed, and digital-first integration, fintechs like OFX are hands down the winning option.

Top international business bank accounts & fintech alternatives

Now that you understand the major differences between these two account types, let’s examine how some of the most popular providers compare. Here are some of the leading options available in the US right now.

OFX Global Business Account 1

With OFX, you can open a multi-currency international business account built for cross-border operations. You can hold funds in 30+ currencies, access local accounts in key markets, and transfer funds using competitive FX rates via local rails to over 180 countries.

OFX also gives you corporate cards, batch payments, and expense management tools to control your business finances. If you’re a larger company, you can automate transferring money at scale through APIs. If you’re running a startup or small business, you can apply online and enjoy fast setup with the Standard plan priced at $15 per user/month. With its global reach and 24/7 human phone support, OFX is particularly useful if you’re active in international trade.

Pros: You get a true multi-currency account with 30+ currencies, corporate cards with cash back rewards, batch payments, plus spend management and account payable automation tools. The ability to get through to someone on the phone when it matters sets OFX apart.

Cons: As a fintech, OFX does not provide credit facilities or in-branch banking services.

Wise Business 2

Wise (sometimes referred to as a “Wise account”) is known for fee-free transfers and transparent mid-market rate exchange rates. You can hold funds in multiple currencies, get local bank details, and make global transactions with no minimum deposit required.

Pros: Wise uses the real mid-market exchange rate and charges competitive fees every transfer, offers local account details, and requires no minimum deposit.

Cons: Larger businesses may find Wise limited, as it lacks many of the advanced features that other fintechs offer.

Payoneer 3

With Payoneer, you can open accounts in multiple countries, accept payments from international customers, and move funds into your local bank. It is especially useful if you work with global clients or eCommerce platforms.

Pro: Payoneer is ideal for freelancers and eCommerce businesses, with accounts in multiple countries and easy withdrawals to your local bank.

Con: It charges withdrawal, FX, and transaction fees that can quickly add up for high-volume users

Revolut Business 4

Revolut gives you multi-currency checking accounts, debit cards, and integrated expense tools. With premium plans, unlimited transfers, and support for remote teams, it’s designed for fast-growing companies that need scalable financial products.

Pros: Revolut provides flexible multi-currency checking accounts, debit cards, and expense tools that scale with your business.

Cons: Some advanced features are locked behind higher-tier premium plans, which may be too expensive for smaller companies.

JPMorgan Chase 5

Chase offers enterprise-level international business bank accounts, treasury management, and international wire transfers. As a full-service provider with worldwide banking capabilities, it also delivers investment banking and wealth management alongside traditional business bank accounts.

If you need access to credit, in-person banking services, or a dedicated relationship manager, this may be the right fit. However, you will usually face an opening deposit requirement and higher fees.

Pros: Chase delivers enterprise-level global banking with treasury management, international wire transfers, and investment banking services.

Cons: You’ll likely face higher fees, opening deposit requirements, and slower onboarding compared to more agile fintech alternatives.

Community Federal Savings Bank 6

Community Federal Savings Bank offers business checking accounts with some international features, including cross-border SWIFT payments. It may suit you if you prefer working with a smaller US-based business bank, but it lacks the advanced digital tools that leading fintechs provide.

Pros: This smaller US-based bank may appeal if you prefer personal service and a traditional business checking account.

Cons: It lacks full multi-currency support and the modern digital tools offered by leading fintech providers.

Comparison international business accounts: key takeaways

| Provider | International transfers | Currencies held | Multi-currency cards | Fees |

| OFX Global Business Account 1 | Local rails, fast settlement, low transfer fees | 30+ | ✅ | Low FX margins, Standard plan $15 per user/month, Full Suite $25 per user/month |

| Wise Business 2 | Low-cost transfers; mid-market exchange rates | 40+ | ✅ | 31 USD setup fee for local accounts8, No monthly fees; per-transaction charges and fees |

| Payoneer 3 | Payouts to 190+ countries | ~10 | ✅ | FX and withdrawal fees |

| Revolut Business 4 | Transfers to 30+ countries | 25+ | ✅ | Free or premium plans up to $119 per month |

| JPMorgan Chase 5 | International wire transfers via SWIFT | Not disclosed | ❌ | Variable wire transfer fees |

| Community Federal Savings Bank 6 | International wire transfers via SWIFT | USD only | ❌ | Variable wire transfer fees |

Features to look for in an international business account

Once you’ve compared providers side by side, it helps to step back and think about the features that will make the biggest difference to your daily operations. Modern fintechs like OFX tend to go beyond facilitating simple SWIFT transfers, offering tools that make global finance more efficient.

Some of the most useful, bank-beating features include:

- Local currency accounts to hold USD, EUR, GBP, CAD, and more. This reduces unnecessary currency exchange and makes it easier to pay suppliers or overseas customers in their own currency.

- Multi-currency wallets that let you hold balances in different currencies, with the option to convert only when exchange rates are most favourable.

- Multi-currency corporate cards for you and your team, helping reduce reimbursement delays, control business expenses, and add an extra layer of fraud protection.

- Expense management dashboards that provide real-time visibility across departments and currencies, making it easier to monitor spending and stay compliant.

- Payment collection options such as invoices, checkout integrations, and payment links give you flexible ways to receive money from global clients.

- Integrations with accounting software like QuickBooks and Xero to cut down on manual work and speed up reconciliation.

Traditional business bank accounts may offer some of these capabilities, but often with higher monthly fees, slower account opening times, and less flexibility when it comes to automation or integrations.

How to open an international business account in five steps

Opening an international business account is easier than it might sound, especially if you know what to expect. Here’s a 5-step overview:

- Pick your provider carefully

Start by deciding whether a fintech like OFX with 24/7 human phone support makes sense for your business, or if you require in-person support of a traditional bank during banking hours. Think about how often you’ll make international transfers, what currencies you’ll need, and whether you want digital tools that banks normally don’t offer. - Review the costs

Look closely at fees, from FX margins and conversion charges to ATM fees and wire transfer fees. Some traditional providers also have minimum balances or opening deposits, while others, like OFX, keep it simple with no minimum balance requirements. - Check the requirements

Each provider has its own eligibility rules. These usually depend on your business structure, registering as a U.S. business entity, having an Employer Identification Number (EIN), your business postal address, and any relevant business licences. - Gather your documents

You’ll normally need personal ID (like a passport or driver’s licence), proof of business registration, and tax numbers. Having these ready helps to speed up the registration process. - Apply online or in person

Fintechs like OFX let you apply online in minutes, often with verification completed in just a few business days. Banks may require you to visit a branch, particularly if they follow more complex setup protocols.

Finally, watch out for common roadblocks like unexpected ATM withdrawal charges, delays during account opening, or accidentally breaching minimum balance requirements. Checking the PDS and planning ahead can help you sidestep these unwanted pitfalls.

Why businesses are choosing OFX over traditional banks

With OFX, you get speed and cost advantages that most business accounts provided by banks simply cannot match. Our FX markups are typically 0.4–1.5%, compared to 2–3% at banks.

Opening an account is a simple process with immediate access to the platform while you wait for KYC to complete to be approved for full access. Our OFX Global Business Account can usually be verified within a few business days, entirely online.

Once approved, you’ll gain access to multi-currency capabilities, virtual cards and physical corporate cards, and a full suite of batch payment and expense management automations that simplify your day-to-day finances. And you can download the OFX Business App to manage your account from anywhere, 24/7. If you’re ready to find out just how easy and cost-effective international business can be, take our virtual tour and book a free demo with one of our OFX specialists today.

Best international bank account FAQs

What are the top international bank & business accounts in the US in 2025?

Here are some of the top international business accounts in the US:

- OFX Global Business Account

- JPMorgan Chase

- Wise Business

- Payoneer

- Revolut Business

- Community Federal Savings Bank

How do I open an international business account online?

You can apply online with OFX, and the registration form normally takes less than 10 minutes to complete. You can normally get a multi-currency account up and running in 2–3 business days.

What documents will I need?

You’ll generally need government-issued ID, proof of registration, and your business address. Banks may also ask for a minimum deposit.

Can I hold multiple currencies?

Yes, OFX offers multi-currency accounts, making it easier to deal with international customers and pay suppliers in different countries.

How fast are transfers?

With fintechs like OFX, you can often receive money or settle transfers on the same day. Banks rely on SWIFT, which takes longer and adds conversion and wire transfer fees.

Do I need to maintain minimum balances?

Fintechs, including OFX, typically don’t make this requirement. However, banks often require minimum balances to keep your account open.

Are fintech accounts regulated?

Yes, providers like OFX operate under strict Money Transmission Licenses in every state and prioritise keeping your funds safe. FinCEN registration ensures OFX meets federal standards for transparency and compliance.

Open an OFX Global Business Account Make international payment easy

Sources:

- https://www.ofx.com/en-us/business/global-business-account/

- https://wise.com/us/business/

- https://www.payoneer.com/business/

- https://www.revolut.com/en-US/business/

- https://www.jpmorgan.com/international-banking

- https://cfsbank.bank/business-banking/

- https://wise.com/us/pricing/business/receive

- https://www.ofx.com/en-us/legal/

- https://www.ofx.com/en-us/legal/state-licensing/