Our Global Currency Account can make running your international or eCommerce business easier

Open accounts for up to 7 of these foreign currencies

Account number BSB | Account number Institution number Transit number | IBAN SWIFT/BIC | Account number Sort code | Account number Bank code Branch code | Account Number Routing Number (ABA) SWIFT/BIC | Account number SWIFT/BIC |

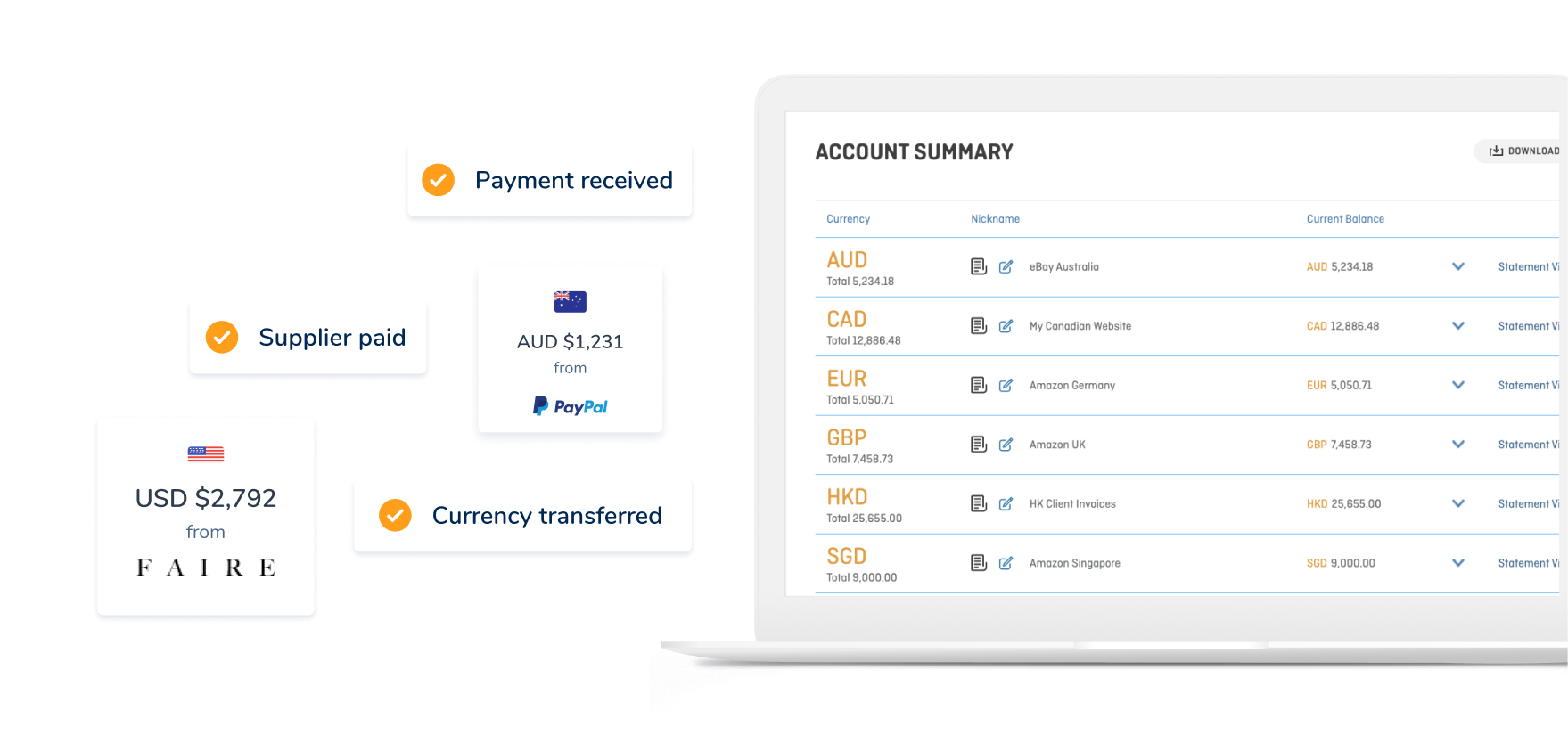

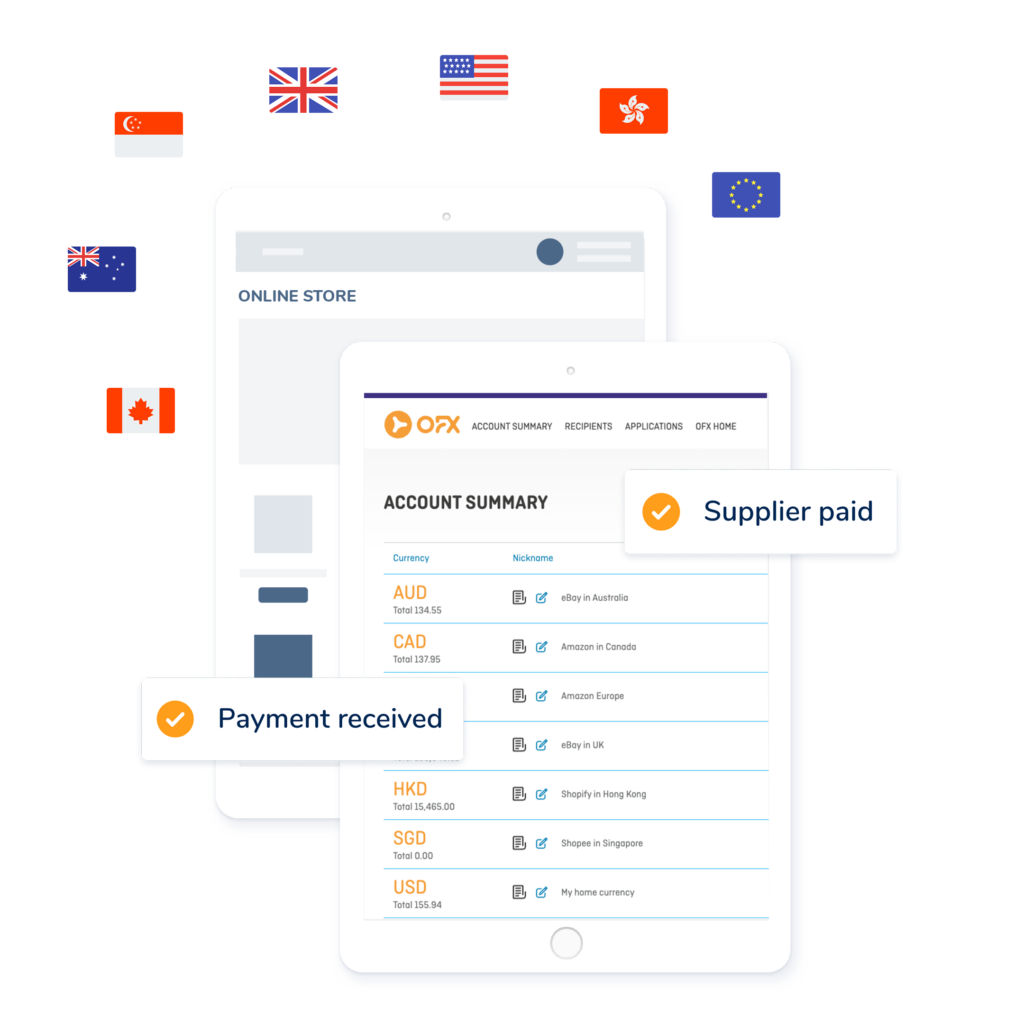

Manage multiple currencies, from one dashboard

Exclusively for our eCommerce and business clients, the OFX Global Currency Account allows you to have up to 7 foreign currency accounts, so you can pay invoices, receive payments, and easily reconcile transfers in your selected currencies such as euros, dollars or yen.

Our solution helps you tap into different business markets and get paid.

No need to set up a business bank account. This can be difficult, expensive and time-consuming if you don’t have a “brick and mortar” business in that country.

What’s the cost?

There are no set up costs, account-keeping fees or monthly fees.

The benefits of our Global Currency Account

No need for overseas bank accounts

With a ”virtual” account in your name, you don’t need overseas business bank accounts.

Manage up to 7 currencies

Make and receive fast and secure payments in up to 7 different currencies.

Hold funds and convert when you want

Wait for a better rate before converting a payment. Like EUR to AUD

Connect your Global Currency Account with Xero

Your transfers automatically post to Xero so you can easily reconcile payments.

Simple to connect to marketplaces

Connecting to marketplaces is a simple and straightforward process.

No set up fees. No monthly fees

There are no set up costs, account-keeping fees or monthly fees.

*Occasionally third-party intermediary banks may deduct a fee from your transfer before paying your recipient. This fee may vary, and OFX receives no portion of it.

Ready to make your first transfer? Create your free account

OFX is participating in Amazon’s Payment Services Provider Program

Amazon’s Payment Service Provider Program is part of its continued efforts to be the safest and most trusted store in the world for customers and sellers.

Save money when receiving payments from around the world

Paying too much to convert international revenue to your home currency? With our OFX Global Currency Account, you can get paid like a local in up to 7 different currencies, without losing your hard-earned profits on conversion.

It could save you thousands on unnecessary currency conversions.

Easily connect your marketplaces and payment gateways

Connecting your payment gateways or marketplaces is an easy and straightforward process.

Keep track of your connected accounts with nicknames like “Etsy US”, “eBay UK” or “Shopify”. And the best part? You can connect multiple platforms.

Not an online seller? You can simply invoice your customers or suppliers directly to collect funds.

Pay bills and invoices directly from your own currency accounts

Does your business incur costs in the countries you’re selling in? Save time and skip unnecessary currency conversions by using your virtual accounts to pay taxes, fees, vendors or suppliers.

Secure and regulated

In the US, we’re registered as a Money Service Business at the federal level with the Financial Crimes Enforcement Network (“FinCEN”). We’re also licensed as a money transmitter by every state regulatory agency that requires a license (every state except Montana and Wisconsin).

We monitor transactions for suspicious activity with sophisticated technology. Our teams are highly trained and we have a dedicated Financial Investigation department that specialises in the detection and prevention of fraud.

How to connect to your marketplaces

Add the account

Once you’ve registered with OFX, click ‘open a new account’ in your account dashboard

Name the account

Give the new account a name that makes sense to you, such as “Etsy AU” or “Shopify”

Save

Hit save. Copy your new virtual account details.

Start transferring

Manage your funds in the Global Currency Account dashboard.

Ready to make your first transfer? Create your free account

Let us take the hard work out of international business

See how easy managing your international payments could be with OFX.

What our clients say about us

Request a demo of the OFX Global Currency Account

An OFXpert will be in touch to show how you can pay and get paid in the foreign currencies you do business in.

"*" indicates required fields

FAQs

My bank offers a multi-currency account, what’s the difference?

Your bank’s multi-currency accounts may not be issued in the country of the currency e.g. a USD account issued in the US. As most marketplaces and gateways only pay into local accounts, using internationally-held accounts means that you won’t enjoy the cost benefits of getting paid like a local.

Yes. You can use your Global Currency Account with multiple of OFX’s approved marketplaces. Each marketplace must deliver the currency that your local currency account was initially set up to receive. Find more information about the Global Currency Account here or contact an OFXpert.

What are the fees?

The Global Currency Account has $0 receiving fees, $0 setup fees and $0 account fees. We charge a margin on the exchange rate for FX transfers, and for same-currency transfers we charge either a flat fee or a % of the value. Transfers from the Global Currency Account to a recipient bank account may be subject to additional fees depending on currency pair and transfer size. Occasionally, third-party intermediary banks may deduct a fee from your transfer before paying your recipient. This fee may vary, and OFX receives no portion of it.

Which online marketplaces are compatible with the Global Currency account?

Our local currency accounts accept payments from some of the world’s largest online marketplaces like Amazon, eBay, PriceMinister.com, Newegg, Buy.com, Game, Wish.com, Rue du Commerce and Shop.com.

How do I upload my local currency account details to my online marketplaces?

Once you have registered for an OFX account, we will call you and guide you in uploading the local currency account details to the marketplace. Or you can watch this handy OFXpert guide.

How do I set up a Global Currency Account with OFX?

Creating an account can be done in 3 simple steps:

Register: click ‘Register’ in the top right corner and fill in your details. There are no setup fees or monthly account fees.

We’ll call you: After you have registered for an account, we will call you to complete the registration. We will ask you some basic questions including which currencies you want to receive funds from.

Verification & Global Currency Account Opening: To verify your account, we will request some documentation. During the call, we will tell you which documents we require and direct you to our Secure Site to send them directly to the relevant team.

*Please note: OFX accounts are normally approved within 4 business days. Following this, your local currency account details should be delivered within 2 business days.

Can I make payments out of my local currency account directly to my suppliers?

Yes! You can pay your vendors, suppliers, or taxes in multiple currencies at your preferred rate before bringing your profits home. Watch our short OFXpert guide for instructions on how to make local and international payments.

Can I use my local currency account details with more than one marketplace?

Yes. You can use your local currency accounts with multiple marketplaces that have been authorised by us. Each marketplace must deliver the currency that your local currency account was initially set up to receive.

Not sure if our multi-currency solution is right for your business?

Speak with an OFXpert to learn more about the OFX Global Currency Account and how it can help your business, today.