Votes and volatility

If you’re following the news, or even if you’re not – it’s hard not to notice the upcoming US election.

October 2020

There’s a lot of noise out there. From the speculation on the presidential candidates, the various federal and state responses to COVID-19 and ongoing civil unrest. All of these factors have the potential to impact the US dollar, the world’s most widely-traded currency.

But do you need to pay attention? If you or your business move money globally, yes, as events in the US have an outsized impact on global markets. Here, our OFXperts explain what we could see in the currency markets in the lead up to the election and beyond.

What’s driving the US dollar now?

In a US election year, there are clues that currency market participants might look at to determine potential impacts. What are the candidates’ proposed policies that could impact global trade and therefore the currency markets? Are there any big changes to tax proposed which could be advantageous or a barrier to corporate America? They might also consider the trend of the US dollar strengthening due to uncertainty in the lead up to an election.

However, it’s no surprise that in 2020 there is so much more at play for the US dollar than just election speculation. The United States has struggled to contain COVID-19, recently hitting devastating milestones of over 7 million cases and 200,000 deaths. There has also been simmering social unrest across the country and a rise in unemployment. The fall in job figures was the steepest since 20081, this has left many unemployed without a safety net, as a second round of unemployment benefits are held up by bipartisan disputes in congress.

The recent rush by Republicans to nominate Amy Coney Barrett as candidate for the Supreme Court has only added to this environment of uncertainty and bipartisanship. This seat could not only be critical in determining the next president in the event there is a contest of election results (more on that later), but also in shaping the fabric of American culture in the decades ahead.

Despite these challenges, the US stock markets achieved record highs over the summer, with the S&P 500 reaching 3,431.28 on August 24. Yet, this strength in equities stands in stark contrast to other economic data which does not paint such a rosy outlook for the US economy.

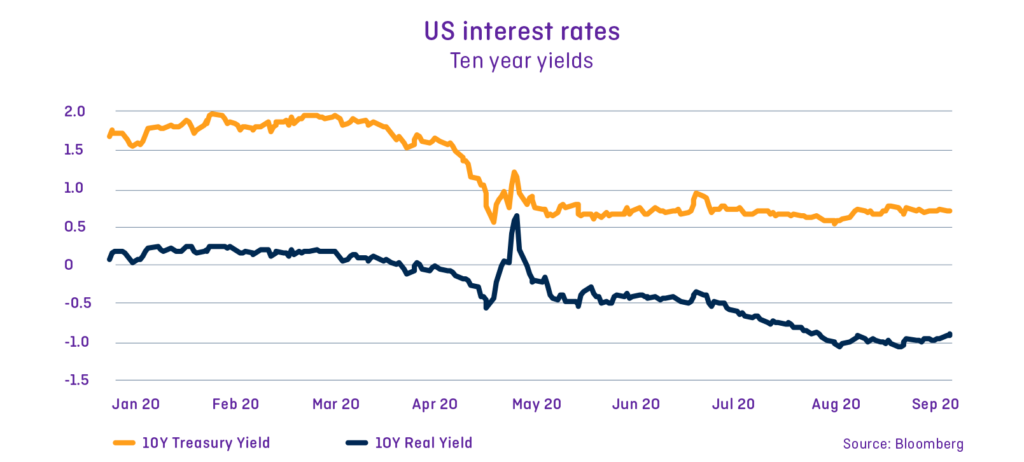

In a bid to help its economy recover from so many blows, the US Federal Reserve announced aggressive monetary policy, keeping low interest rates on hold and aiming for an average inflation rate of 2%. This will effectively keep interest rates lower for longer, reducing yields on the US dollar compared to other major currencies.

The 10 year Treasury, a classical thermometer of risk, touched historical lows back in March. It has been on an uptrend since June but it’s still far away from pre-COVID levels. In the medium term, low levels of interest rates could put downward pressure on the USD.

So, what does this all mean if you’re buying or selling USD? There is no simple answer, but a combination of factors point to limited growth and weakness for the currency in the medium to long term.

Countdown to the election

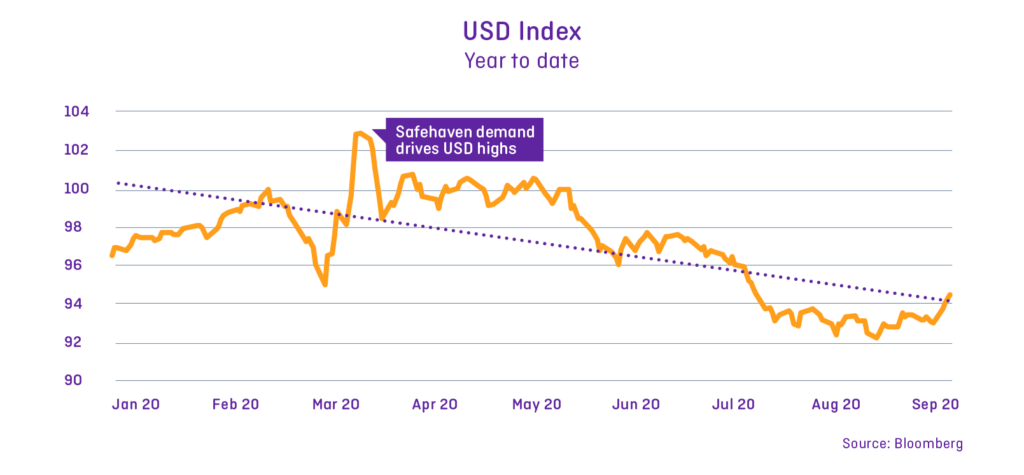

The uncertainty in a lead up to an election has historically created a stronger US dollar due to safe-haven demand and weaker equity markets, but as we’ve said, 2020 has been a year like no other, so things are not necessarily behaving as you’d expect.

While early in the pandemic the US dollar was preferred, the currency faced broad-based weakness in July and August. In the period between June 30 and September 1 the DXY index, which measures the strength of the US dollar against a basket of currencies it trades with, dropped 6.2% and hit its lowest level in nearly 2.5 years.

The USD benefitted from safe-haven demand, but hit nearly 2.5 year lows in July and August.

More recently, however, volatility is picking up following a correction in US equities, which is driving demand for the US dollar again. “The only reason for the US dollar to go higher in the short-term is that market participants don’t like uncertainty, which can boost the US dollar as a safe haven,” said Isaac Figueroa, Treasury Dealer, OFX North America. “This will probably also push the stock market lower because market participants are waiting to find out whether Biden or Trump will win the election.”

As news, polling and results start to build a picture of a probable winner, the currency and stock markets will react in real time. Three presidential debates (September 29, October 15, October 22) could trigger short-term volatility, especially if any there is any unexpected commentary from either candidate.

Election day

The election will be held on Tuesday November 3 and typically brings a highly volatile day of trading with the USD trading within a wide range and at double or triple the usual volatility.

After the shock of the 2016 result, there will be increased scepticism of pre-election polls and market participants will be less sensitive to early signs that the result will go either way. When you also consider that this year the number of votes submitted by mail is expected to be much higher than usual it’s easy to see how the process could be even further drawn out, and a race right until the very finish.

Then what? Mr Figueroa explains that volatility could continue in the short term. “The US dollar might bounce or fall in the first 3-6 months, but then, it might be poised to continue its current downward trend,” he said.

And what if the result is contested?

Recent rhetoric around mail-in voting fraudulence and the peaceful transference of power have drawn speculation that the results of the election might be contested by the losing party. The last disputed election was in 2000 and was escalated to the Supreme Court. Polarisation in the US bipartisan system is very high and this is unlikely to improve before the election. “This means it might be a while before we get official results and either side might even contest those results, which could impact volatility” said Sebastian Schinkel, Head of Treasury, OFX.

WHAT TO WATCH

I. A Democrat win

If Democrat Joe Biden wins the election, Mr Figueroa said the US could expect foreign policy to soften and more social spending which could weaken the US dollar.

II. A Republican second term

If Republican incumbent Donald Trump wins a second term in office, the US dollar might weaken in the long term but strengthen in the short term due to uncertainty. This is down to the harsher foreign policy that is likely to exist, said Mr Figueroa. This could raise global tensions “which would affect other G10 countries and probably give temporary strength to the US dollar”.

III. Who controls congress?

However, no matter who wins, market sentiment is also impacted by which party controls which house – the Senate and the House of Representatives – and can create conflict on reforms when it comes to enacting the wishes of the President.

Mr Figueroa added “No matter who wins, a divided congress would infer more weakness in the US dollar, due to lower growth expectations.” In the short-term, uncertainty around who controls congress will drive the dollar higher but in the long term, weakness could prevail due to US economy fundamentals.

How does this impact my currency exchange?

The US dollar is effectively the world’s reserve currency. For example, many business deals in China and the Middle East, are conducted in US dollars rather than local currencies. So, while the ongoing challenges in the US and the election affect the US dollar value directly, by default that means the other currency pairs are impacted because of the pervasive nature of the US dollar’s value.

If you need to buy or sell US dollars before November, to make the most of your transfer you could take advantage of volatility, using it to your advantage to buy low and sell high.

If you need to buy or sell any of the commodity currencies – the Canadian dollar, Australian dollar and the New Zealand dollar – remember that they are heavily affected by the performance of the US dollar. When equity markets rise and the US dollar falls, investors are generally willing to take on more risk. This makes commodity currencies more attractive.

While the outcome of the election is significant in the short term, over time the wider issues such as any ongoing economic fallout from the COVID-19 pandemic, Brexit and any future re-escalation of the US-China trade war will have a greater impact on anyone moving money between any of the G10 currencies or the US dollar.

Volatility is a sure thing

Making predictions on currency movements is very difficult even when the global economy is relatively stable and operating according to its usual fundamentals. These are truly exceptional circumstances, the various internal pressure both in US politics, economics and employment levels continue to be difficult to predict, not least as we are still in the throes of the pandemic. This year, looking back at previous elections will not be enough for analysts to determine what could happen in the currency market leading up to, and after, the US election.

The race to the White House looks like it will be a fought until the very finish. The political landscape continues to evolve and currency volatility is almost certain. In the short term, Mr Schinkel believes there will be two factors at play, “I think the market will be focusing on potential policy outcomes and uncertainty around results which could generate USD demand”.

“The US dollar might gain some strength in the short-term, given the uncertainty that this US election brings. However, it does not change the fundamentals of a weak US dollar in the long-term.”

______

Download the OFX Currency Outlook

Learn more in the latest edition of the OFX Currency Outlook. It’s been produced to help you navigate market movements today, and to understand what to watch out for in the coming months.