Guide to paying

off a loan abroad

How to pay off your loan abroad:

- Find a money transfer provider who can deliver better exchange rates than your bank.

- Consider using Forward Contracts to lock in favourable exchange rates for up to one year.

- Set up recurring payments, so you don’t get hit with late fees.

- Assess the value of sending one larger lump sum versus a series of smaller payments.

With the right strategy, you can minimise risk and manage foreign currency fluctuations as you make payments.

How to pay a mortgage abroad

If you need to make recurring payments on a mortgage or loan abroad, use a money transfer service that lets you schedule recurring payments. Keep in mind that banks usually take a margin on the exchange rate of up to 5% in addition to hefty money transfer fees. Using a specialist money transfer provider, like OFX, will help you save money on every payment. Over time the savings really add up.

How to minimise risk when paying off a loan abroad

While an overseas property can be a great investment, there are some risks associated with carrying an overseas mortgage or loan. One of those risks is currency exchange rate fluctuations. Currency fluctuations of as little as 1-2% can take a big cut out of your personal budget when you’re making payments over the long term.

One of the ways to minimise risk associated with long term currency exposure is to consider sending a large sum of money overseas when rates are favourable. Making larger payments may also reduce your interest rate charges, but be advised that as an overseas resident, you may not be able to access credit in that market from abroad. So before choosing a hedging strategy, take into account your personal financial objectives. Check with your bank about the rules that may apply for tapping the equity in your overseas property from abroad later on, in case your circumstances change.

Another way to keep more control over your money is to use a Forward Contract to lock in an exchange rate for a period of 12 months. With a Forward, you know exactly what exchange rate you’ll be using, so you can budget and plan accordingly. You can employ similar strategies for paying off credit cards abroad or making student loan payments from overseas.

Paying off a student loan from overseas

If you’re going overseas and need to make student loan repayments, you may be able to apply for a payment holiday which structures your repayments differently. The new loan structure will depend on:

- How much you owe

- Why you’re going overseas

- How long you’re planning to be abroad

If your creditors only accept payments from a local bank account, it’s best to keep a bank account in that jurisdiction open, so you can continue making regular payments.

You’ll also want to make sure you retain access to your logins to government sites or creditors. Don’t forget to turn off secondary verifications on your local mobile device, if you’re planning on getting a new phone number overseas.

When it comes to converting currencies, using your bank to transfer funds is old-fashioned and expensive. Choose an online service provider who processes money transfers 24/7, so you can move your money in the middle of the night Milan time, if you want to.

What’s the cheapest way to pay off an overseas credit card?

As with mortgages and student loans, it’s best to keep a bank account in the country where you have creditors. This will make it easier to do a bank-to-bank money transfer from abroad. As long as you have an account from which you can make easy payments to your credit card, savings on international transaction fees and exchange rates is a matter of choosing the right money transfer provider.

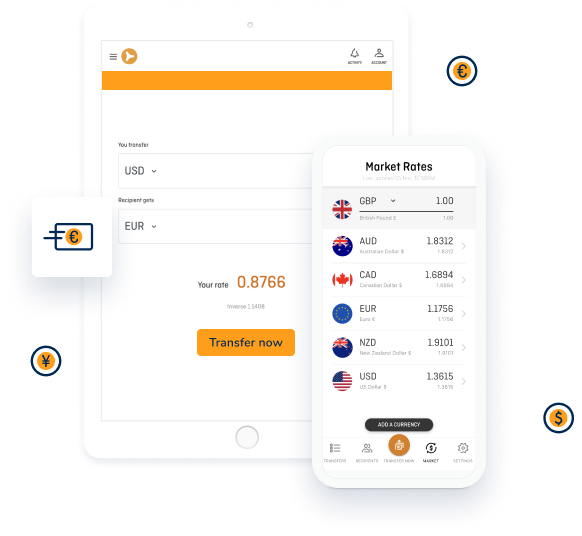

Why use OFX to pay an international mortgage or loan?

- Recurring payments make timely transfers a breeze.

- You save money every time you transfer compared to using your bank.

- You get access to risk management tools, so you can keep control of your money.

- Our 24/7 online platform and phone support means you can move your money on your schedule, not your bank’s.

Ready to make a transfer? Register or login to get started.

With offices around the world, we’re on-hand to answer questions 24/7

Personal Clients

1300 300 424 (Within Australia)

+61 2 8667 8090 (International)

Sydney Office Address

Level 19, 60 Margaret St

Sydney NSW 2000 Australia