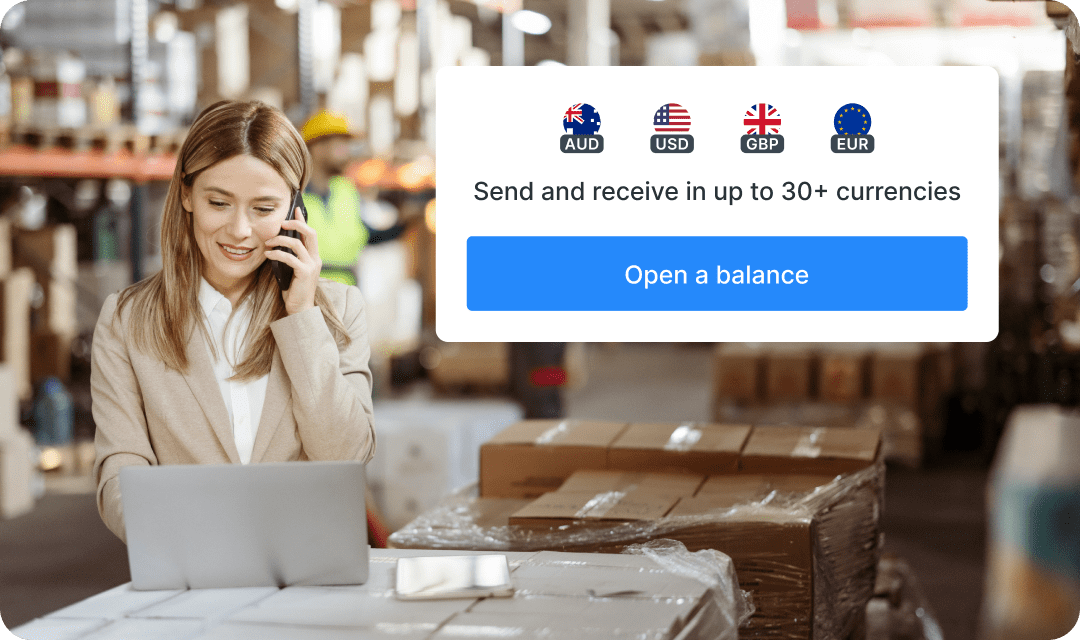

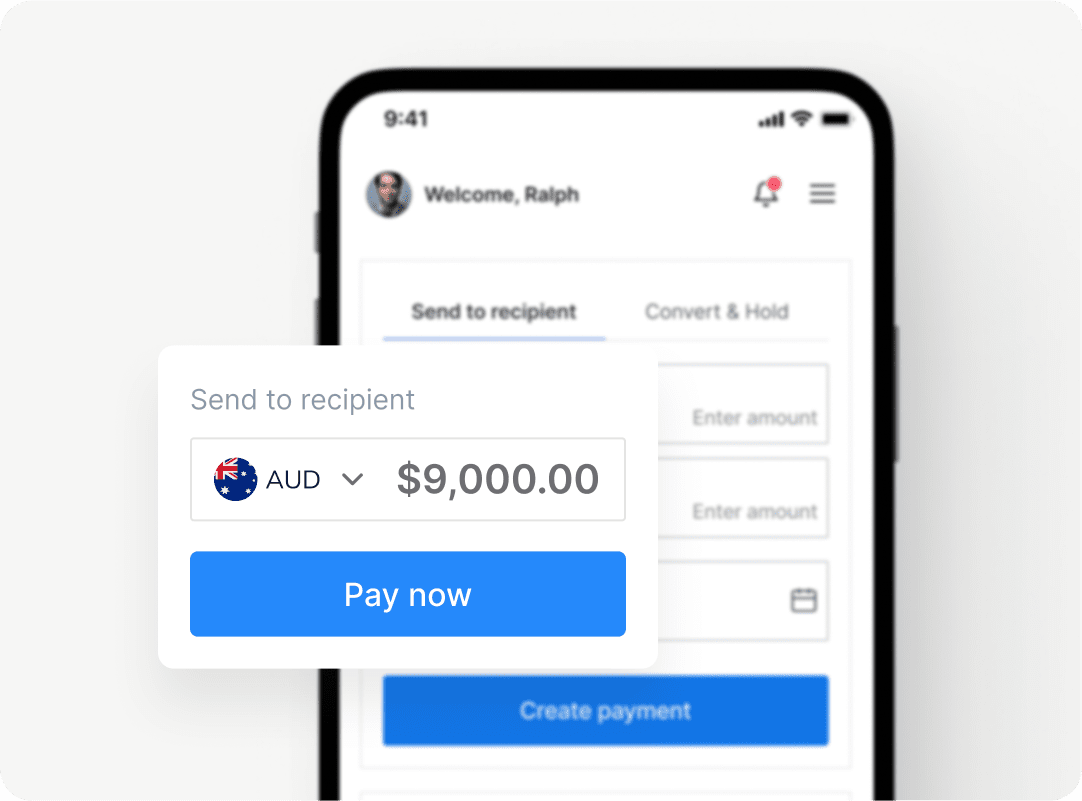

Quick and easy access to 30+ currencies

Expand your business globally while managing finances as if you were in your home market. Hold, pay and receive money in over 30+ currencies. and access local bank details for GBP, EUR, USD, and CAD.

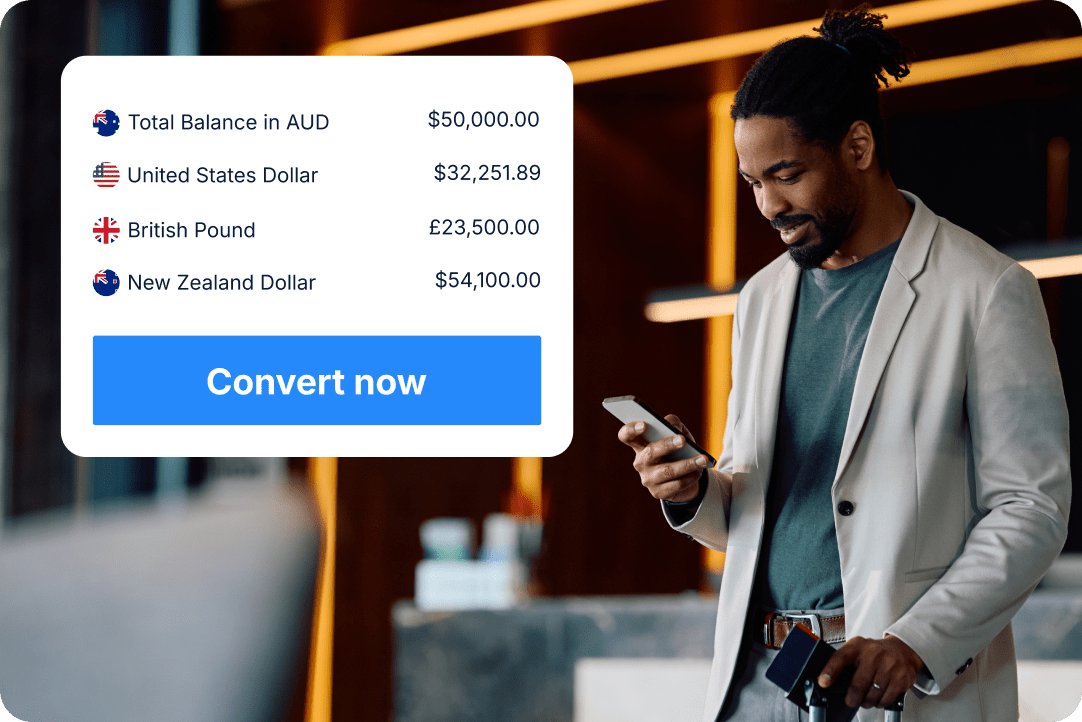

Keep multiple currencies in your Global Business Account and convert them when exchange rates work in your favour, like AUD to USD, giving you more control over your transactions.

Manage multiple currencies from one powerful platform

Win back the minutes in your day by managing all your multi-currency transactions in one place, giving you clear oversight of your spending and balances, no more juggling different platforms.

Skip long bank queues and bypass the hassle and expense of opening a business bank account, even if you don’t have a physical office in that country.

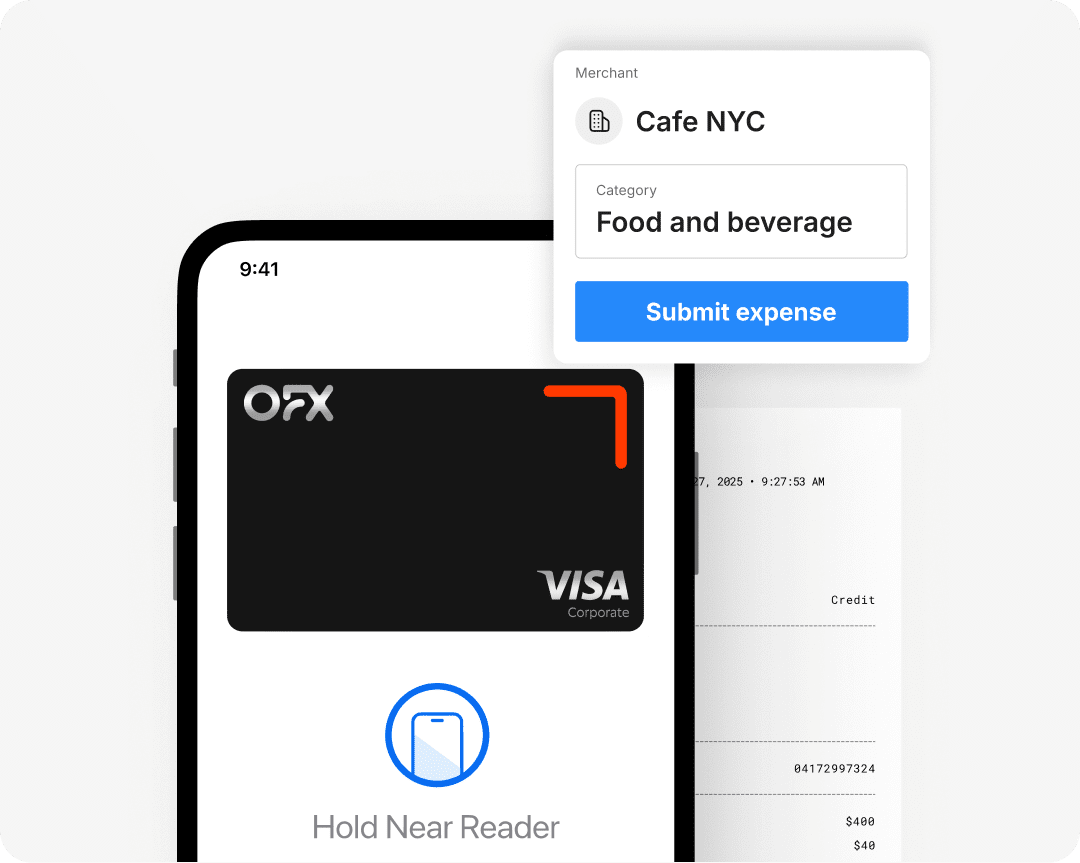

Seamless spend management with multi-currency corporate cards

Monitor and approve spend before it happens with smart OFX Corporate Cards. Pay securely online or in person in over 30 currencies, with $0 FX fees when using held account balances.

Stay in control of recurring expenses with virtual cards by setting individual spending limits for added flexibility and oversight, helping businesses thrive.

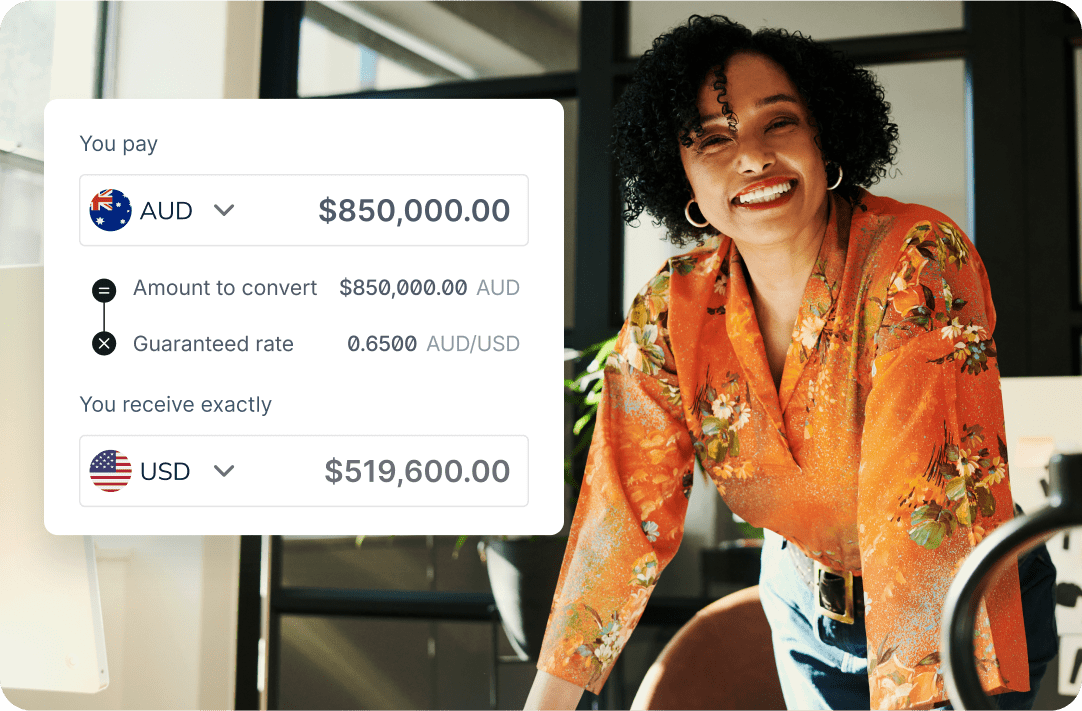

Save money on international payments

Are you losing money on international transaction fees? Convert your international revenue to your home currency and save your hard-earned profits.

With access to local bank details in AUD, USD, CAD, GBP and EUR, get paid or receive funds in the markets you operate with no international transaction fees and competitive rates.

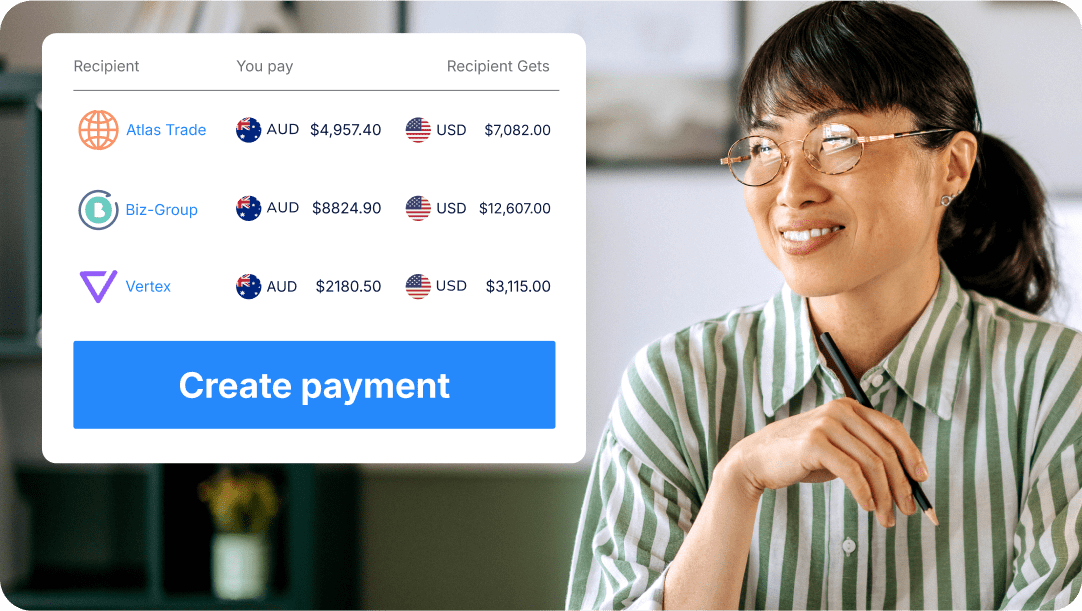

Save time by paying bills and invoices directly from your currency accounts

Streamline your payments by settling local and international bills and invoices directly from your Global Business Account. Save time on currency conversions and reduce FX costs with our competitive rates.

Convert funds when the rates are in your favor and hold them until you’re ready to pay, giving you greater control over your finances.

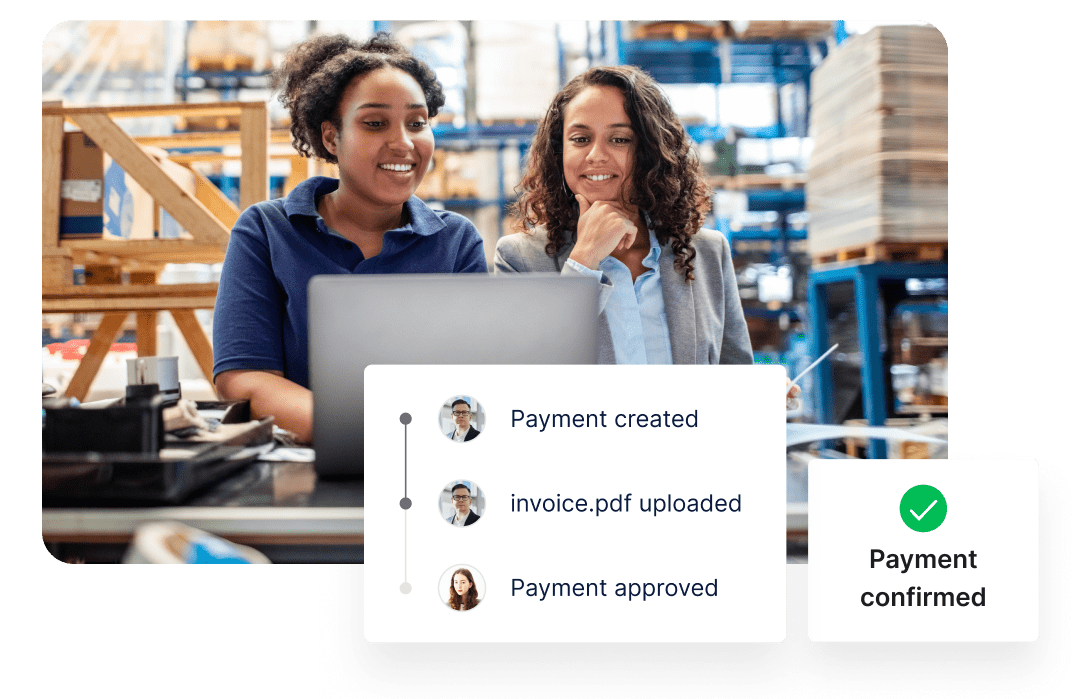

Boost your business with smart automation

Save time on admin tasks and focus on what matters most. With our Accounts Payable Automation tools, you can reduce manual data entry using built-in OCR and AI for seamless invoice data capture.

Effortlessly streamline your payments by bundling transactions, saving time while keeping your accounting records up to date in real time.

How to create your multi-currency business account

- Start your OFX Business registration online

Create your account in minutes. - Identify verification

Get verified with your ID by our team. - Add money

Add money in the currencies you want. - Start making payments

Start spending in 30+ currencies and 180+ countries.

Manage all your currencies in one simple account

Benefits of your

multi-currency accounts

Take control of your international payments with our Global Business Account. Stop overpaying and start optimising your currency needs today.

Open domestic and foreign currency accounts

Hold, pay and convert funds in 30+ currencies when the rates are in your favor

Make instant transfers between your multi-currency accounts with competitive FX rates

Multi-currency corporate cards that can be issued in seconds

Pay your invoices, taxes, bills and receive payments in one dashboard

Xero and QuickBooks integration

Clients love us. Here’s why.

Multi-currency accounts FAQs

Is the OFX Global Business Account a bank account?

The OFX Global Business Account is not a bank account. It is a virtual global business transaction account and a non-cash payment facility. The account enables you to receive, manage, pay and spend in 30+ currencies by opening multiple currency accounts within our platform.

How many currencies can I manage with the OFX Global Business Account?

With the OFX Global Business Account, you can create multi-currency accounts in 30+ currencies. Your customers can also pay into any of these accounts. Five of these accounts (AUD, GBP, EUR, USD, and CAD) also allow you to hold local bank details for your convenience. Here is a full list of our supported currencies

My bank offers a multi-currency account, what’s the difference?

Your bank’s multi-currency accounts may not be issued in the country of the currency, e.g. a USD account issued in the US. Using accounts held in the local country means you can enjoy the benefits of being able to spend and pay like a local in domestic currency with no international transaction fees.

What are the benefits of having multiple currency accounts for my business?

Having multiple currency accounts allows you to save money by converting your local currency to foreign currencies when the exchange rates are beneficial to you. You can hold those currencies in your account and choose when to use it at your convenience.

Plus, having multiple currency accounts allow you to receive payments or get paid in different foreign currencies quickly and seamlessly. The OFX Global Business Account allows you to do all the above in one platform.

What is the benefit of having a multi-currency card for my businesses?

If you spend abroad or buy anything online in a foreign currency with a debit or credit card attached to a bank or financial institution, you could be charged an international transaction fee.

A dedicated corporate multi-currency card could help you save more with lower or no international transaction fees. Our Corporate Multi-Currency Card gives you access to competitive foreign exchange rates, allowing you to spend in 30+ currencies that are directly linked to your OFX Business Account.

This means you can spend overseas or make an online purchase in a foreign currency, without incurring international transaction fees or currency conversion fees. You can also assign our cards to employees and set spending limits for teams or projects, to prevent overspending and going over budget.

Manage all your currencies in one simple account