Stocks, shocks, and currencies

How the stock market affects currency markets

September 2020

Reading this content will help you understand:

- How stock market performance impacts market sentiment

- Investor behaviour in response to stock market volatility

- The currencies most impacted by stock markets, and how

Why it is important to watch stock markets if you have foreign exchange needs

Stock markets and currency markets are more closely correlated than they may first appear, so watching what is happening in one may help you to understand what is likely to happen in the other.

For anyone sending money abroad, anticipating which direction currency markets will move can help you get the best available rate. But this isn’t easy, as shocks, volatility and the actions of politicians and central banks can all change the performance of currencies in an instant.

| Dow Jones | US | Dow Jones Industrial Average. Benchmark index in the U.S. for blue-chip stocks. |

| S&P 500 | US | Standard & Poor’s 500. Measures the stock performance of 500 large companies listed on stock exchanges in the United States. |

| NASDAQ | US | Nasdaq Composite Index. Includes almost all stocks listed on the Nasdaq stock market, most are technology and internet-related. This index includes some companies that are not based in the United States. |

| FTSE 100 | GB | Informally the “Footsie”. The 100 companies listed on the London Stock Exchange with the highest market capitalisation. |

| Euro Stoxx 50 | EU | Benchmark index for Eurozone blue-chip stocks. |

| CSI 3000 FTSE China Nikkei Index | China and Japan | When US markets are closed, Asian markets are tracked by investors for market sentiment. |

Stock market indexes around the world are powerful indicators for global and country-specific economies.

Which comes first?

As both stock and currency markets react to each other’s movements, it’s important to understand which is likely to move first. Isaac Figueroa, Treasury Dealer, OFX Canada, said: “Market sentiment is usually related to the stock market first. The stock market is a leading indicator of the economy, so then consumer sentiment follows it.”

Market sentiment is literally how investors and foreign exchange clients ‘feel’ about the markets. For example, a political or economic shock, or a natural disaster, will spook investors and create ‘fear’, leading to them move money away from stock markets and into other assets that are considered safer, such as gold. On the other hand, unexpected good news could lead to a buying frenzy, pushing prices up.

The COVID-19 pandemic has created exactly this kind of shock, which is why we have seen gold prices rise to more than US$2,000 per troy ounce1 . A similar shock came when Britain voted to leave the EU on June 23, 2016. The day after, the UK’s FTSE 100 dropped by 8.7%2 and the pound plummeted too. GBP/USD experienced a huge loss of 8% in a single day, from June 23-24.

Fear breeds fear

Stock markets fall as money is moved out of shares which creates a ripple effect where more investors are scared off. But whether a currency rises or falls depends on the currency itself and its correlated market.

Michael Judge, Head of Australia and New Zealand, OFX, said: “Since the 2008 global financial crisis, there has been a strong correlation between strong US stock markets and positive performance of the Australian dollar, and to a lesser extent the New Zealand dollar.” But the opposite is the case for the US dollar, Swiss franc and Japanese yen. In short, when the US dollar is strong, the US stock market tends to be weaker and vice versa.

This is largely down to the fact that it costs international traders more to buy US goods when the US dollar is strong, so they buy less and stock markets fall.

Nothing is done in isolation

However, nothing in any economy is done in isolation. In fact, various currencies will perform differently depending on the level of both local and global stock market volatility and the economic cycle, said Hamish Muress, Senior Manager, OFX London.

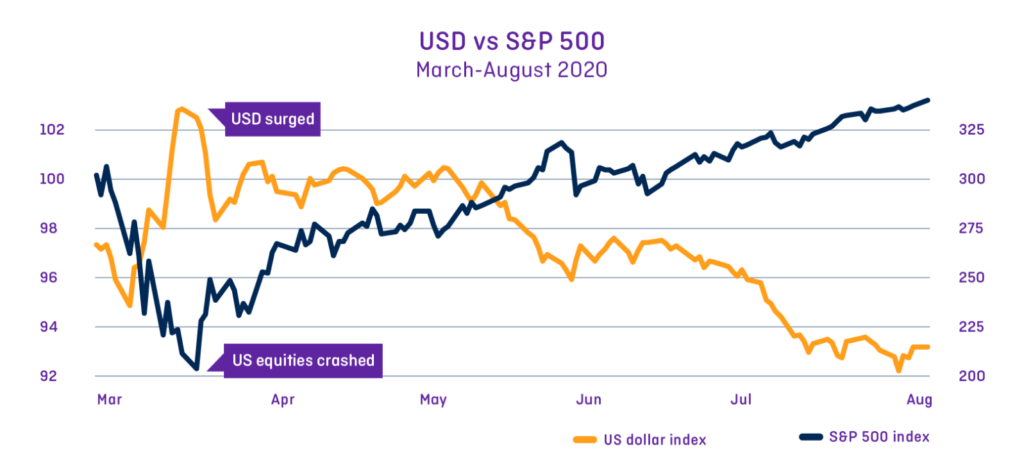

He added: “In times of high uncertainty and high volatility the traditional safe-haven currencies of the US dollar, Japanese yen and Swiss franc have benefited in the face of falling equities, otherwise known as stocks and shares. March 2020 is a great example of this when the US dollar surged while US equities crashed.”

osed after the financial crisis of 2008 before the COVID-19 pandemic hit 12 years later will reinforce this thinking.

Source: S&P 500 index and DXY

When the Dow Jones was falling to its lowest level on March 23, at 18,592, the US dollar strengthened 5.9% against the Australian dollar, from A$1.63 on March 16 to A$1.73 on March 21. That means any Australian company that was looking to buy, say, US$50,000 of goods from the US would have had to pay an additional A$4,780 for the products within a matter of five days. For many companies, especially as they fought to stay open and working during the height of the pandemic, this would potentially have been a cost they couldn’t afford to bear.

Central banks come to the rescue – but primarily for the stock markets

Central banks will intervene to either cut interest rates or employ quantitative easing (simply, injecting money into the economy to stimulate spending), or both. This is designed to increase the appeal of equities for investors and boost the economy, or both.

Mr Muress said: “When rates get slashed by central banks, investing once again in equities becomes cheaper because money is cheaper to borrow.” At the time of writing, the S&P 500 has bounced back and continues to hit new record highs.

Equity markets react to each other

Bear in mind too that the different equity markets will impact each other. “For example, the Asian markets are very sensitive to what is happening in the US and also China,” said Mr Muress.

He added: “However, the typical commodity currencies don’t fare well in times of uncertainty and March was a very good example of this with both the Australian dollar and Canadian dollar tanking against the US dollar. Yet both have now recovered and, in many ways, their recovery mirrors that of the US equity market.”

As mentioned, the US dollar weakness has led to a resurgence in the US stock markets. It has also created a relative strength in the Australian dollar, New Zealand dollar and the euro, which creates a perfect opportunity for anyone buying goods in US dollars to fix their transaction costs for up to a year with the help of one of our OFXperts.

Safe-haven currencies are changing

During times of most uncertainty, the safe-haven currencies come to the fore. The US dollar is the traditional safe haven but that is now being called into question3. While early in the pandemic the US dollar was preferred, it has now weakened. The US dollar index fell over 10% from March 20 to August 18 and reached two-year lows.

Simultaneously, the Japanese yen, the Swiss franc and euro are becoming stronger. Good news if you’re buying other currencies with one of these, but bad news if you’re a US, Australian or UK resident or business that needs to buy goods or services in Japan, Switzerland or the Eurozone. Everything just got a little more expensive for you.

Mr Muress said: “In many ways the euro is beginning to act as a safe-haven currency as well and it might not be long before it is added to this list.”

If the US dollar continued to weaken, even in times of uncertainty, over the longer term, it would be a sea-change in how currencies are impacted by volatility. This would create a major change in currency plays, with less predictability about the performance of the US dollar going forwards.

That said, it is likely we will know more about how the US dollar and the US stock markets will perform after the US Presidential election on November 3, 2020. In fact, there is potential for sentiment across all markets to be affected by the outcome.

For now, investors, business owners, finance directors and individuals who need to move money globally in the coming months should pay closer attention to stock market movements as there is some correlation between the sentiment in stock markets and currencies. But remember, there are many factors that come into play, so it is wise to speak to an expert to get the full picture on events that could influence market moves.

What to watch

With the COVID-19 economic fallout still washing through the system, volatility in equities is something we can expect for a while to come. Governments worldwide continue to make decisions that impact heavily on other countries and on travel companies particularly – such as the UK adding Spain, France, Belgium and Malta among others to its quarantine list4. Ongoing volatility could lead to strengthening of specific currencies depending on their correlated stock market performance.

As central banks continue to step in with measures to boost market performance, sentiment could receive a boost which could help currencies such as the Canadian dollar, Australian and New Zealand dollar.

Also, keep an eye on whether the US dollar really has lost its safe-haven status and wait to see if the euro is added to this list.

1https://www.bbc.co.uk/news/business-53660052

2https://www.reuters.com/article/us-britain-stocks/ftse-ends-june-on-2016-high-idUSKCN0ZG2GC

3https://www.cnbc.com/2020/07/27/dollar-hits-perfect-storm-as-gold-and-stocks-rise.html

4https://www.gov.uk/guidance/coronavirus-covid-19-travel-corridors

Download the OFX Currency Outlook

Learn more in the latest edition of the OFX Currency Outlook. It’s been produced to help you navigate market movements today, and to understand what to watch out for in the coming months.