A matter of Truss: UK backtracks as pound plummets

By the OFX team | 5 October 2022 | 5 minute read

Key points in this article

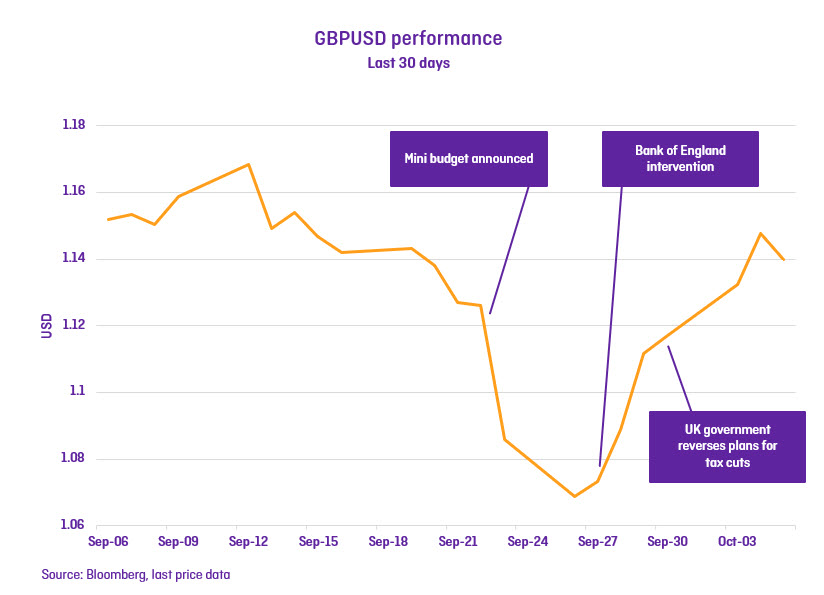

- Financial markets spooked as the UK government announces its mini budget

- The pound drops to record lows against the US dollar

- The Bank of England intervenes to prevent crisis in UK financial markets

- Uncertainty around government and economy will continue to weigh on the pound

Incoming governments — especially those coming in during a crisis — have one job, settling nerves and demonstrating a steady hand. Their first order of business should be no surprises.

So when Britain’s new prime minister, Liz Truss, and her Chancellor Kwasi Kwarteng launched a mini-budget that fell considerably outside current economic orthodoxy, by slashing taxes for the country’s richest citizens and adding £45 billion to the national debt over the next five years to pay for it1, they shocked pretty much everybody.

So why the shock?

Their plan to drag the British economy out of the doldrums sent exactly the wrong message.

The cash-splashing mini-budget appeared counteractive to the Bank of England’s attempts to slow rampant inflation by raising interest rates. That shook the faith of markets, with raised concerns that unsustainable debt levels and that a lack of coordination between the British Treasury and its central bank would lead to financial instability. Investors sold off British gilts (government bonds), causing bond yields to rapidly rise. (Bond prices and yields move in opposite directions)

[The Bank of England’s intervention] was significant and highlighted how Truss, Kwarteng and the Conservative Party had misread how the fiscal loosening would be received by the markets

The pound plummeted on the news, crashing to a record low of $1.03 against the US dollar, while the steep rise in yields sent the financial system into panic in the following ways;

- Pension funds, highly reliant on gilts as part of their portfolio, saw prices of some gilts halve as interest rates went up, and were forced into selling gilts themselves, putting further downward pressure on gilt prices and upward pressure on interest rates2

- Mortgage lenders scrambled to reprice loans as interest rates rose sharply higher, and by the end of the week there were 40% fewer products available than before the mini-budget, according to one broker.3 That raised the potential for a wealth-destroying drop in house prices

- In a rare public pronouncement on a G7 country, the International Monetary Fund urged PM Truss to reverse course4

- U.S. bond giant PIMCO said it would have less confidence in sterling than it did before the announcement5

By Wednesday, the Bank of England (BoE) was forced to intervene in UK financial markets. “Such a move was significant and highlighted how Truss, Kwarteng and the Conservative Party had misread how the fiscal loosening would be received by the markets,” said Jake Trask, Senior Corporate Client Manager at OFX.

The pound reacted quickly to the BoE’s interventionist move of buying around 65 billion pounds of long-dated government bonds to see off the “dysfunction” in the market, pushing currency back up to $1.0877 against the US dollar.

But on Thursday, after a series of BBC interviews where the new PM said she would stick with the policy, the pound’s slide continued — a further sign of how unpopular the plans were with investors.6

Politically, things were beginning to look disastrous for the weeks-old government as it headed into its 4-day Conservative Party conference, with a poll showing support for the Tories had dropped to its lowest level since Tony Blair swept to power in 2001. The poll also showed that 72% of voters were opposed to the tax changes that would primarily benefit the richest people in the country.7

By the Monday morning of the Conservative conference, Truss and Kwarteng had read the tea-leaves and put the tax plan on ice, which helped push the pound back up to its pre mini-budget level. Faith in the government, however, is still weak. A new policy to save £4 billion a year by not indexing welfare benefits to inflation has opened a further schism in the Conservative Party, with some cabinet MPs openly questioning whether Truss has a future as leader.8

While higher interest rates are generally appreciative for currencies, there is less of a benefit if that economy is in recession.

Economic pressures remain

The pound has been one of the weakest performing currencies in the developed world, and it is a reflection of the economic challenges the country faces.

The country has not yet entered a recession yet, according to the latest figures from the Office of National Statistics. It showed the economy had grown by 0.2% in the April to June quarter, but the worrying news is that the ONS downgraded its estimate for growth going forward.9

That made the UK the slowest of the G7 economies to recover from COVID-19, and as the Bank of England attempts to battle rising inflation, particularly due to energy costs driven by the war in Ukraine, that increase in rates will further drain consumers’ wallets.10

“The Bank of England may be forced to raise interest rates higher than previously expected, causing issues such as higher living costs for those having to re-mortgage over the next 12 months or so,” said Jake Trask of OFX. “These costs could possibly exceed the benefit seen by the cap on energy bills.”

While higher interest rates are generally appreciative for currencies, there is less of a benefit if that economy is in recession.

New government on shaky footing

The turmoil facing the Conservative Party does not bode well for the pound. Markets hate uncertainty, and another leadership spill if Truss can’t turn things around, could cause another selloff in the pound. Even if Truss manages to maintain the faith of the party, the prospect of a landslide win for Labour would mean a new economic direction and a reversal of some of the Tory reforms — not the kind of consistency markets hope for.

Some hope on the horizon

The war in Ukraine appears to be turning, at least on the ground, and that may force Russian President Vladimir Putin to seek an exit from what has been a humiliating and politically damaging campaign. For now, threats from Russia revolve more strongly around nuclear escalation but they may be part of a bluff to save face from defeat.

If a de-escalation in the conflict led to a reopening of energy supply, that would be good news for all economies and take pressure off the UK with its soaring energy bills.

If the war drags on, energy needs will increase and hardships will endure but the UK pound may still perform better than European counterparts across the Channel according to Trask.

“It appears the pound’s drop has stopped for the time being, however, with huge energy supply uncertainty hanging over the UK and Europe as we head into the winter, we could see GBPUSD back under 1.10 before too long. The outlook for GBPEUR is not as bleak, as the Eurozone is more exposed to the energy crisis, so the pound may be able to eke out some gains versus the shared currency.”

References

- https://www.bloomberg.com/opinion/articles/2022-09-26/uk-financial-markets-rebuke-liz-truss-and-her-mini-budget

- https://www.bbc.com/news/business-63065415

- https://www.bbc.com/news/business-63066543

- https://www.reuters.com/world/uk/imf-moodys-censure-uk-policy-bank-england-says-will-act-big-2022-09-28/

- Ibid.,

- https://www.reuters.com/markets/europe/sterling-drops-1-pm-truss-defends-economic-plans-2022-09-29/

- https://news.sky.com/story/labour-surge-to-biggest-poll-lead-over-tories-since-2001-ahead-of-keir-starmers-keynote-speech-12705857

- https://www.theguardian.com/politics/2022/oct/04/kwasi-kwarteng-fiscal-plan-date-thrown-into-confusion

- https://www.reuters.com/markets/europe/uk-economy-grew-q2-revised-data-shows-2022-09-30/

- https://www.reuters.com/markets/europe/uk-house-prices-unchanged-september-versus-august-nationwide-2022-09-30/