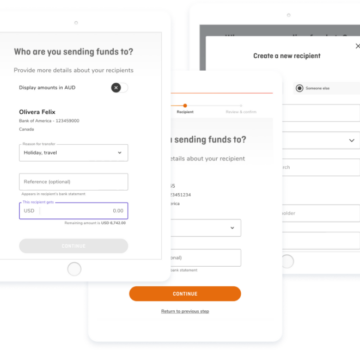

In today’s fast-paced world, finding the right payment method can leave your head spinning. At OFX we make it simple. Let’s dive into the different types of international payment methods. Our experienced OFXperts weigh in on the advantages and disadvantages of the various payment methods available and how to select the right payment channel for you.

Types of international payment methods

In a highly globalized world, transferring money across borders is important to many people and businesses. Finding the right transfer method can save you time and money.

Transferring money in North America

Let’s dive into some of the most common ways OFX helps you send and receive payments in North America:

- Direct Debit*

- With direct debit OFX withdraws funds directly from your linked bank account.

- This is one of the most common ways clients settle their CAD or USD transactions because it is fee-free and seamless.

- This is also known as pre-authorized debit.

*Please note that direct debit is only available in certain regions. Contact your OFXpert for more information.

- Electronic Funds Transfer

- An Electronic Funds Transfer (EFT) is a common payment method used in Canada.

- Any Canadian dollar or US dollar payment made within Canada can be easily sent using EFT.

- Automated Clearing House (ACH)

- ACH payments can also be used for sending USD to bank accounts within the US.

Sending money globally

So we’ve covered payment methods for transferring in North America, but did you know there is a payment option that works almost anywhere in the world:

- Wire Transfer

- The quickest way to transfer money to most places in the world, including North America, is an international wire transfer.

Now that we’ve laid out some of the most common international payment methods for North America, let’s dive a bit deeper into the advantages and disadvantages of each method.

Ready to start transferring with OFX? Register now

Advantages and disadvantages of international payment methods

Each of these payment methods have clear advantages and disadvantages, and it all comes down to how and when you need to move your funds and the costs associated with the transfer. Let’s run through both sides of each international payment method discussed above.

Direct Debit

| Pros | Cons |

| No bank fees | Hold periods may apply# |

| Set and forget; automated payments for regular payments* | Limits may apply |

*If Regular Payments are set up, your direct debit will be stopped upon expiration of the recurring payments. Contact an OFXpert one month before renewal.

#Holding periods for corporate deals apply to first-time transfers while all subsequent transfers have no holding period.

Wire Transfer

| Pros | Cons |

| Transfers are usually completed by your bank to OFX within one business day | Bank charges may be incurred |

| No transfer limits | |

| Transfers are traceable |

Electronic Funds Transfer (EFT) and Automated Clearing House (ACH)

| Pros | Cons |

| Transfers are normally settled within the same business day* | Transfers are not traceable |

| No bank fees for EFT or ACH receiving transfers |

*When sending USD to Canada via EFT funds will usually be transferred the following business day.

We know your needs change and our OFXperts are here to help you identify the right payment method each time. “Understanding the advantages and disadvantages of each type of payment method can be overwhelming. Don’t sweat it, we’re here to help. Our team is well-versed in each payment method and will help you find the right method every time.” North American Consumer Client Team Manager, Richard Srour said.

Now that we’ve run through what each payment method has to offer, let’s discuss selecting the right payment option for you.

It is great to be informed, but don’t feel like you need to know every detail about every payment method. Leave that to us.” – Richard Srour, North American Consumer Client Team Manager

Which payment type is right for me?

Choosing the right payment method for you or your business comes down to five main things:

- How much you want to transfer

- Where do you want your money to go

- What currency you are transferring to and from

- How fast do you need the transfer to move

- How much you are willing to pay in transfer fees

We asked another OFXpert Jacob Scriven, Head of North American Sales, to share what he believes are the most important considerations for choosing a transfer type.

- Amount

The first step in selecting the correct transfer method is knowing the amount you need to trade. This is important because some OFX payment methods have minimum or maximum limits depending on the currency pair you are transferring.

- Location

The second step is to know where you want your money to go. Some payment methods are only accepted in certain regions or countries around the world and can incur more fees depending on where you want your money sent.

- Currency

The third step is knowing what currencies you are transferring to and from. As with the location, some currencies can only be transferred via certain payment methods. Contact your OFXpert to learn more.

- Speed

The fourth step is identifying when you want your payment to arrive. If your transfer is urgent our OFXperts would usually suggest using a wire transfer as it will likely be received within a day.

- Cost

The final step is knowing how much you are comfortable spending on fees for your transfer. Some international payment methods have higher fees than others.

That should give you a place to start, but if you’d like more help identifying which method works best for your needs, contact an OFXpert.

Finding the right payment method for your business can get complicated, at OFX we keep it simple.

In today’s global world, money is being transferred daily across the globe. Knowing the right payment for those transfers can help save you time and money, as well as prevent any headaches. Understanding the details of each of these payment methods can seem daunting, but our OFXperts will keep it simple. Interested in learning more about our seamless, secure payment methods? Contact your OFXpert today!

Quick, secure, seamless transfers

We help clients move money quickly, safely, and accurately. Whether your business is just getting started or well-established, OFXperts have the experience to help you save time and money on foreign exchange.

Move your money with Finder’s top International Money Transfer service today! Our OFXperts can help you get your money where you need it quickly, safely, and seamlessly. Contact us.

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. UKForex Limited (trading as “OFX”) and its affiliates make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.