Keep up to date with currency movements with Daily and Weekly Commentary

Track currency trends, access the latest on market movements and today’s expected ranges of the major currency pairs, or sign up to receive daily, weekly and monthly market analyses direct to your inbox.

Never miss a market update. OFXpert commentary straight to your inbox

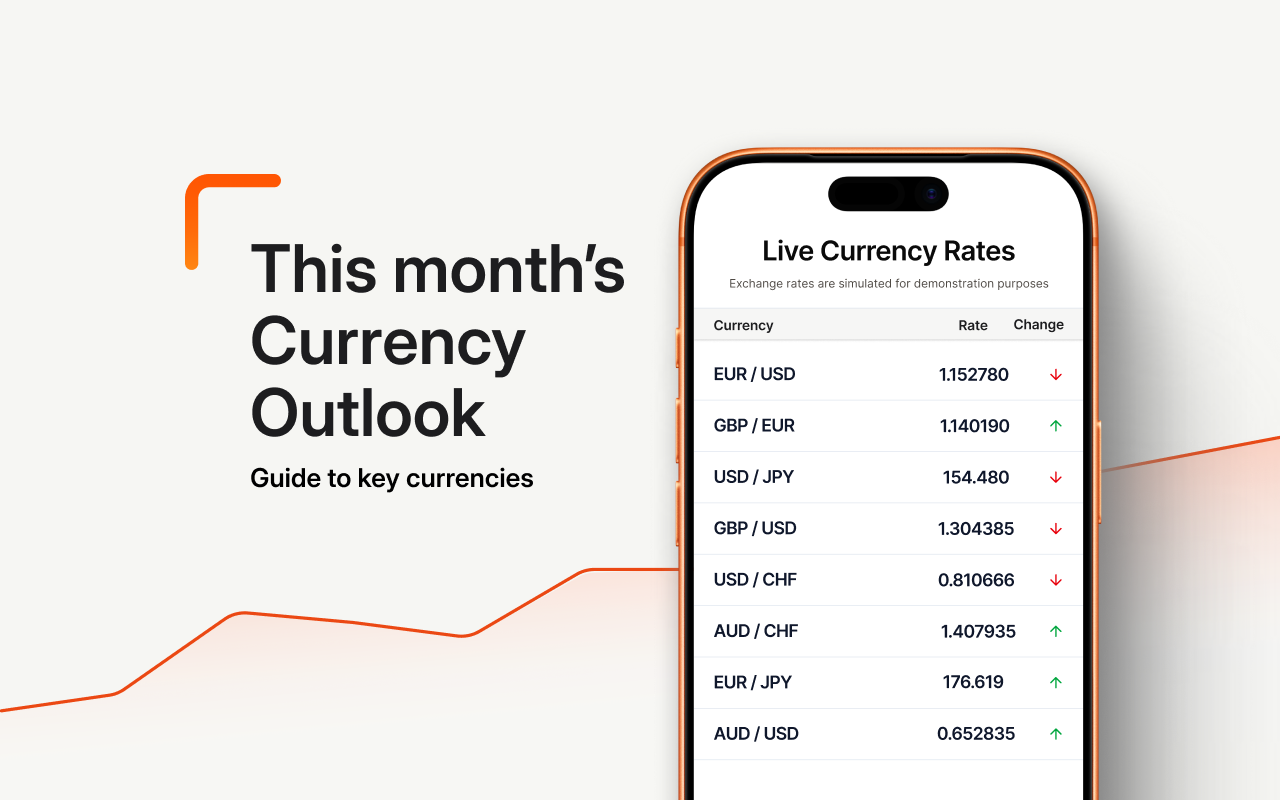

Read this month’s Currency Outlook

Find out what could impact exchange rates for key currencies in the month ahead in our cheat sheet.

2026 FX strengths: what analysts expect.

Read the monthly currency news from the OFX currency specialists and keep informed on the macroeconomics of future currency movements in the coming month.

Currency chart

AUD/USDcurrency chart: 1.00 AUD = 0.7068 USD

With offices around the world, we’re on-hand to answer questions 24/7

Want to stay ahead of market moves?

Subscribe to email currency updates from our OFXperts. We monitor global events and FX markets day and night, so you don’t have to.

* Required information

"*" indicates required fields