Corporate Cards

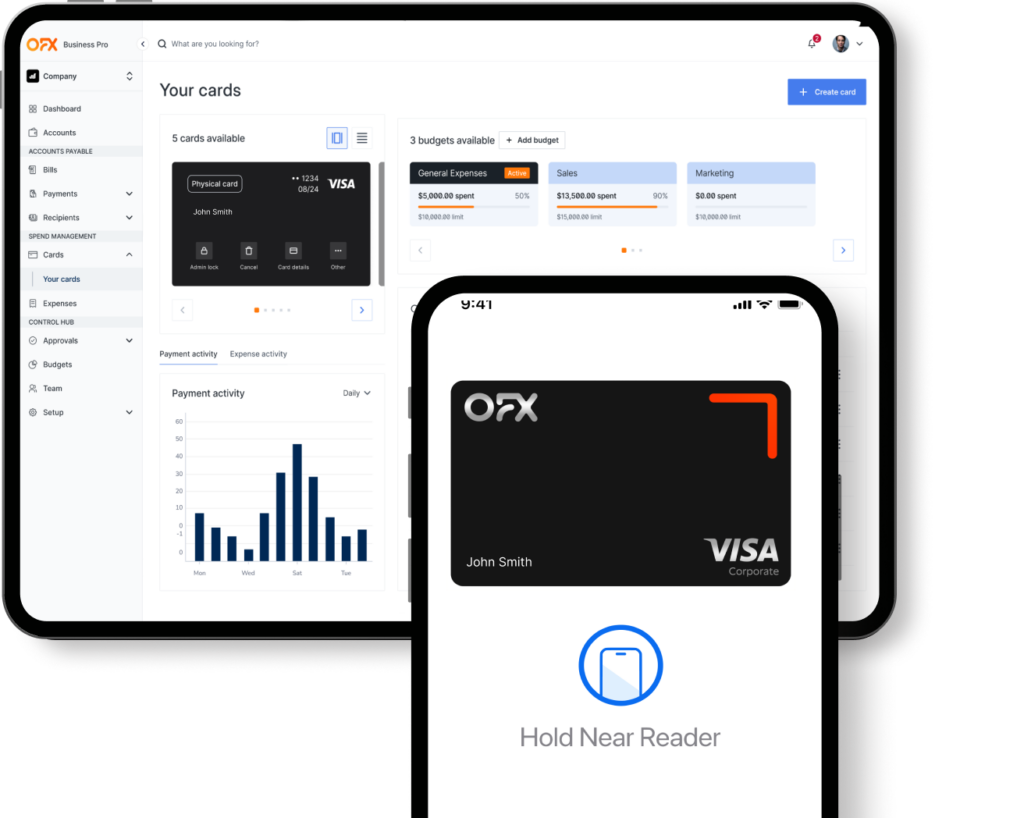

Meet the corporate card giving businesses more control.

No more shared company cards or out of policy spend. Monitor and approve spend before it happens with smart corporate cards issued in minutes. Pay in 30+ currencies and know you’re in control at every tap and swipe.

Take more control and empower your team. Not just a regular corporate card.

Classic company cards create confusion, overspending and painful admin. But OFX Corporate Cards are your tool for more spend control. Set custom limits for each employee, with built-in rules to ensure all spending is permissible, or create a unique card for every subscription and pay in the currencies you do business in. Welcome complete visibility over company transactions, AI receipt capture and automated approvals.

Global access, zero FX fees

Make zero FX fee transactions with your card in 30+ currencies, using your account balances.

Business travel made easy

Issue virtual cards in minutes, ensuring team members are ready for tasks or travel without lengthy wait times or delays.

Ensure expense control

Set budgets and automate approval policies card-by-card. Easily manage spending and empower all teams to spend responsibly.

Automated receipt collection

Submit receipts instantly, with automatic merchant identification. So you can focus on your work, not chasing down receipts.

Enable mobile payment

OFX Corporate Cards can be added to Apple Wallet or Google Pay for the ultimate in contactless convenience.

Open an account today

Join 37,000+ businesses globally regaining control with OFX today

Simplify your business financial operations in one platform and save time and money.

A simplified way to manage business spend with company and employee corporate cards

Stay on top of business cash flow

Centralise all your card spend in one place, in real time. Get insight into your expenses as it happens.

Save by preventing out-of-policy spend

Eliminate offside card spending. Set card spend limits by vendors and employees, so everything is locked down before spending starts.

Streamline reconciliation

Employees can easily submit expenses, so you can spend less time chasing down receipts or dealing with reconciliation bottlenecks, and more time focusing on your business.

Total recurring expense oversight

Avoid duplicate payments with unlimited unique virtual cards for each recurring business expenses, such as Google and Meta ads.

Capture receipts anywhere

Whether you’re at work, on the road or with a client, capture expenses on the spot – no delays, just seamless tracking when it matters most.

Added layer of security against fraud

Instantly pause or cancel cards as needed. This also helps prevent any further funds from being withdrawn from your global business account.

Apple Pay is a service provided by certain Apple affiliates, as designated by the Apple Pay privacy notice. Neither Apple Inc. nor its affiliates are a bank. Any card

used in Apple Pay is offered by the card issuer. Visa is a trademark owned by Visa International Service Association and used under license. Cards are issued by OzForex Limited trading as “OFX”

Clients love us. Here’s why.

Your security is our priority

Store your corporate cards in an Apple or Google Wallet for fast, secure contactless payments.

2-step verification

We keep your account secure with 2-step verification to ensure only you have access to your card and funds.

Fraud controls

We use a multi-layered approach to help detect and prevent fraud on your account such as malware, phishing and fraudulent apps.

Instantly lock, unlock or cancel your card

Think your card has been compromised? Lock or cancel it anytime via the online platform or OFX Business App.

Less work. Total control. Let’s automate!

Ready for a personalised walk through?

See how you can use OFX for your business with a personalised demo with one of our helpful specialists.

Corporate Card FAQs

Is the OFX Corporate Card a debit card, credit card or prepaid card?

Our corporate card is a Visa business debit card. In order to spend on the card, all you need to ensure is that there are sufficient funds in your OFX Global Business Account to fully cover the transaction.

How does the card work with the OFX Global Business Account?

Our corporate card is directly linked to the funds in your OFX Global Business Account. Save money by pre-converting your local currency to foreign currency when the exchange rates suit you. With our card, you get access to AUD and 30+ international currencies.

When making a payment in any of those 30+ currencies, our card automatically draws funds from that currency account, allowing you to spend like a local with no international transaction fees. This applies if there are sufficient funds in those accounts.

If you do not hold funds in the currency you are spending in, or have insufficient foreign currency balances, we’ll automatically convert from your local currency (AUD) at competitive exchange rates.

Can I create company cards linked to my OFX Global Business Account?

Yes. You can set up a card for each subscription and manage your expenses per card, with built-in control limits. If your subscription ends, you can cancel the card anytime to ensure you’re not charged on that fee. If there is a security breach on a particular card, you only need to delete that card. This means easier reconciliation, oversight, and added security.

Unlike the employee card (1 card per user), there are no limits to creating company cards in our platform. You can set up multiple company cards all linked to your OFX Global Business Account.

What’s the difference between an employee card and a company card?

At OFX, you can choose to create employee and company cards. The employee card (physical or virtual) is allocated to individual users. Each user gains access to a mobile app where they can privately view and manage their own spending on the cards. You can set specific spending limits on your employee cards to control expenses and ensure compliance with company policies.

The company card (physical or virtual) allows you to control spending limits to prevent overspending, such as setting a limit on Google Ads expenses. It’s ideal for specific subscriptions or recurring expenses, e.g. Google Ads or SaaS services. You can also create a company card for a specific event.

Do you offer a physical card?

Yes. You can choose a virtual or physical card when creating an employee card inside the platform.

Can I link my card payments to my Xero account?

Yes, you can. Reduce reconciliation bottlenecks by syncing your card expenses with your Xero account. Our in-app receipt capture also allows you to document receipts in real-time to help you track employees’ and other business spend.