As businesses branch out globally, they need financial platforms that deliver cost-efficient, transparent, and robust international transaction tools. Wise and Revolut both provide multi currency accounts designed to elevate cross-border business operations, but with distinct approaches.

This article unpacks Revolut Business and Wise Business, compares their strengths, and helps you determine which may best serve your company’s needs.

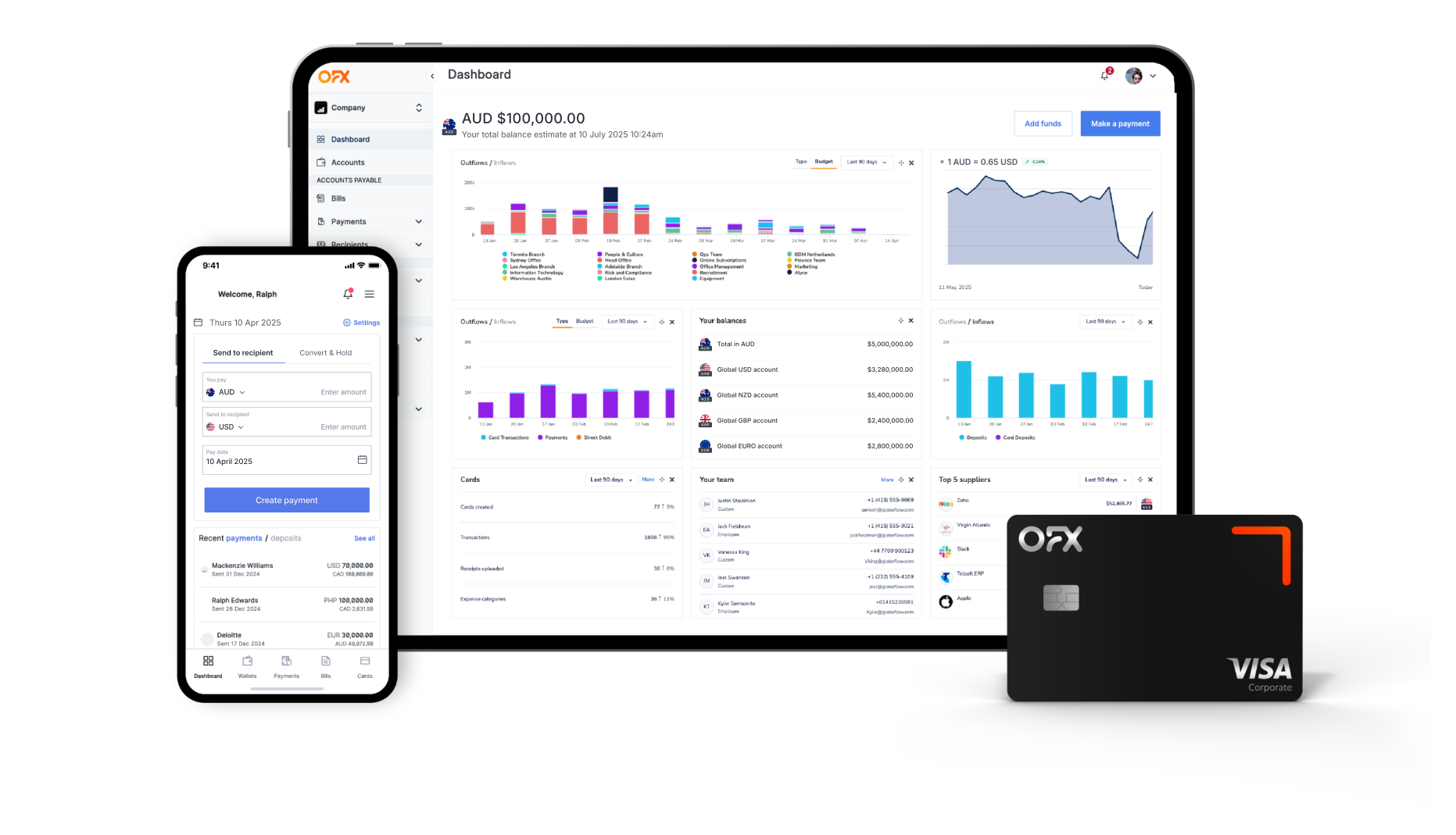

We’ll also have a look at the features of OFX’s Global Business Account and why OFX could be a great alternative for you and your business.

Jump to:

• Who is Wise?

• Wise Business Account: Key features and benefits

• Wise Business fees explained

• Who is Revolut?

• Revolut Business Account: Key features and benefits explained

• Revolut Business fees explained

• Revolut v Wise: Side by side comparison

• Which platform is the best fit?

• Why more businesses are turning to OFX

• OFX key benefits at a glance

Looking for a better way to handle global business payments?

Who is Wise?

Wise (formerly TransferWise) is a fintech provider offering international money transfer and multi-currency business accounts. It helps businesses to send, receive, hold, and convert funds in dozens of currencies, all with transparent, mid-market exchange rates.1

Wise Business Account: Key features and benefits.

The Wise Business Account provides a comprehensive toolkit tailored for businesses operating internationally. Whether you’re looking for multi‑currency flexibility, corporate card access, or batch payment functionality, you’ll find what you need, all seamlessly built into the Wise Business platform.2

Below is a detailed breakdown of the features and benefits available through the Wise Business Account in Australia:

| Feature | What is does | Benefit |

|---|---|---|

| Multi-currency account | Hold 40+ currencies and send to 140+ countries3 | Centralise finances, reduce currency waste |

| Local account details | Unlock local bank details (e.g., IBANs, sort codes, routing numbers) in 23+ currencies via a one‑time setup fee.4 | Get paid like a local, avoiding international transfer fees. |

| No monthly subscription | One-off account setup; no recurring fees.5 | Ideal for businesses of any size—only pay when you use features. |

| Batch payments and invoicing | Create bulk payments and generate invoices or payment links directly from your account.6 | Streamline payroll and billing with powerful automation. |

| Business debit cards | Issue physical and digital cards to yourself and your team, with full control over spending.7 | Simplify controlled, flexible team-based spending. |

| Accounting integrations | Sync your account transactions with tools like Xero, QuickBooks, Sage, and more.8 | Saves time, reduces errors, and improves reconciliation. |

| Interest on balances | Earn returns on unused AUD and USD balances via an opt-in, interest-earning fund, subject to capital risk.9 | Let your idle funds grow, though returns are not guaranteed. |

| Security and support | Offers built‑in 24/7 fraud protection, two‑factor authentication (2FA), and digital card controls for safe, flexible access.10 | Confidence your money is protected |

Wise Business fees explained.

In addition to the account setup, some Wise Business features come with transaction-based fees. Here’s what to expect for Australian businesses:

- Account Setup: One-time fee of 65 AUD to unlock local payment details in 23+ currencies.11

- Currency Conversion & Transfers: Transparent variable fees, starting from ~0.63% and often lower for larger volumes.12

- Debit Card Spending & ATM Fees:

- Up to 350 AUD/month, 2 free ATM withdrawals.

- After that, a fee of 1.75% plus 1.50 AUD per withdrawal applies.

- Team member cards cost 6 AUD each.13

- Receiving Funds:

- Domestic (AUD) and some international non-SWIFT payments are free.

- Fees for SWIFT or wire payments vary by currency (e.g., USD: 6.11 USD; GBP: 2.16 GBP; EUR: 2.39 EUR).14

OFX Global Business Account

Receive, hold, convert and send funds across a wide range of currencies, reduce costs and gain greater control over your international payments.

Who is Revolut?

Revolut Business is a digital financial platform offering business accounts with support for multi-currency accounts, transfers, cards, expense tools, integrations, and different plan tiers tailored to business size and needs.

Revolut Business Account: Key features and benefits explained.

See below for a summary of key features and benefits:

| Feature | What is does | Benefit |

|---|---|---|

| Tiered business plans | Offers multiple subscription tiers: Basic (~AUD 15/month), Grow (~AUD 60), Scale (~AUD 210), and Enterprise (custom plans).15 | Choose a plan that aligns with your business size, budget, and feature requirements |

| Global and local transfers | Provides free local and international transfers up to plan-specific monthly limits (e.g., Basic: AUD 1,400; Grow: AUD 28,000; Scale: AUD 112,000).16 | Save on cross-border payments by staying within your monthly transfer allowances |

| Cards and spend controls | Issue physical and virtual business cards; set spending limits and controls; premium cards available on higher tiers.17 | Empower controlled spending for teams and minimize fraud or misuse |

| Expense management | Track, approve, and categorize employee expenses; advanced approval workflows in Grow and Scale plans.18 | Maintain full oversight of team expenditures in real time, improving budget control |

| Integrations and API | Connect with accounting and HR platforms like Xero and QuickBooks; API access available from Grow plan upwards.19 | Automate financial workflows and reduce manual errors for smoother operations |

| Security | Offers 24/7 customer support, advanced fraud monitoring, biometric login options, and strong data protection.20 | Protect your business finances with enterprise-grade security protocols |

Revolut Business fees explained.

In addition to monthly subscription fees, certain features within the Revolut Business account may incur additional charges. Below is an overview of the potential fees for Australian users:

Subscription plans.

Revolut Business offers four subscription plans:

- Basic: AUD 15/month

- Grow: AUD 60/month

- Scale: AUD 210/month

- Enterprise: Custom pricing based on business needs

These plans provide varying levels of features and allowances.21

Currency exchange fees.

Revolut applies a variable exchange rate for currency conversions. For the Basic plan:

- Exchange Allowance: Up to AUD 1,000 per monthly billing cycle at no additional fee.22

Above Allowance: A fee of 0.6% applies to any amount exceeding the allowance. For example, exchanging AUD 1,500 would incur a fee of AUD 3.00.23

Active team member fees.

For plans that include the Expenses feature:

- Expenses App: A fee of £5 per active user per month applies. A team member becomes active when they first submit an expense.24

*Please note that all fees are subject to change, and it’s advisable to consult the Revolut Australia website for the most current information.

Revolut v Wise: Side by side comparison.

As two leading financial platforms offering foreign exchange and expense management solutions in Australia, you may be considering which business account, Revolut or Wise, is better suited for your company’s needs.

Both platforms provide multi-currency support and business debit cards, but they differ in several important areas such as subscription models, access to local account details, batch payment capabilities, and fee structures. Understanding these differences can help you select the platform that aligns best with your business priorities, whether you prefer pay-as-you-go flexibility or a tiered service offering with advanced controls.

| Feature | Wise Business | Revolut Business |

|---|---|---|

| Subscription model | Pay-as-you-go with no monthly fee; a one-off fee applies to unlock local account details like USD or EUR accounts25 | Tiered monthly subscription plans starting at AUD 15/month for Basic, AUD 60/month for Grow, and AUD 210/month for Scale plans26 |

| Currencies supported | Hold over 40 currencies and send money to more than 140 countries27 | Supports transfers and exchanges in 25+ currencies28 |

| Local account details | Available after a one-time upgrade fee for local account numbers like USD (ABA), EUR (IBAN), GBP (sort code/account number)29 | Local account details included based on subscription tier; higher tiers provide access to more currencies and account types30 |

| Card and spend controls | Business debit cards issued with spend limits and team member controls31 | Physical and virtual cards with detailed spend controls, including premium cards at higher subscription levels32 |

| Batch payments/Invoicing | Batch payments and invoicing included with no additional fees, ideal for payroll and client billing33 | Bulk payments available starting from the Grow plan and above34 |

| APIs/Integrations | APIs and integrations available to all users; supports platforms like Xero, QuickBooks, Stripe, etc.35 | API access and third-party integrations available from Grow plan upwards36 |

| Interest on balances | Interest earned on USD balances via Wise Assets for Business (opt-in feature)37 | No interest paid on account balances38 |

| Fee transparency | Transparent fees with mid-market exchange rates and fee disclosure before transactions39 | Transparent pricing, but FX and transfer allowances vary by subscription tier with fees applying if allowances are exceeded40 |

| Best for | Pay‑as‑you‑go, low-cost international transfers, multi-currency account management | Businesses needing integrated tools, prepaid cards, spend controls, and tier-based allowances |

Customer support.

Both Revolut and Wise provide customer support to assist businesses whenever needed. Wise offers 24/7 support via live chat and email, ensuring quick access to help when transferring money or managing accounts. Revolut also provides around-the-clock support through in-app chat and email, with priority support available on higher-tier business plans. While Wise emphasises direct support with responsive service, Revolut offers tailored assistance levels depending on your subscription, including dedicated account managers for enterprise clients.

Security.

Security is a top priority for both Wise and Revolut. Wise employs bank-level encryption and is regulated by the Australian Securities and Investments Commission (ASIC), with an Australian Financial Services Licence (AFSL), ensuring compliance with strict regulatory standards41. Revolut is regulated by ASIC as well and uses advanced security measures such as biometric authentication, two-factor authentication (2FA), and real-time fraud monitoring to protect your business finances42. Both platforms are committed to safeguarding user data and promoting fraud prevention.

Transfer speeds and processing times.

For businesses operating internationally, fast and reliable transfers are crucial. Wise is known for its quick transfer processing, with many transfers completing within one to two business days, and often faster for popular currency routes. Revolut also offers speedy transfers, with many international payments processed almost instantly or within a few hours, especially between Revolut accounts. Both platforms strive to ensure timely access to funds, helping businesses maintain cash flow without delays.

Business account accessibility.

Wise and Revolut both provide convenient access to their business accounts via web browsers and mobile apps, allowing you to manage your finances anytime, anywhere. Wise offers an intuitive interface with features like multi-currency account management and batch payments, all accessible on desktop or mobile43. Revolut’s business platform supports multi-user access with customisable roles and permissions, and includes integrated expense management tools44. Both platforms also issue physical and virtual cards, enabling businesses to spend in multiple currencies online or in-store.

Customer reviews.

Both Wise and Revolut have earned strong customer satisfaction ratings in Australia.

Wise consistently receives positive feedback for its transparent fees and reliable international transfers, boasting a global Trustpilot rating of approximately 4.3 stars from over 260,000 reviews as of mid-202545.

Revolut is praised for its innovative features and user-friendly app, holding a Trustpilot rating close to 4.2 stars from more than 160,000 reviews worldwide around the same time46.

These high ratings reflect the confidence businesses place in both platforms to handle their financial operations effectively, further supported by their dedicated Australian services detailed on their respective websites.

Which platform is the best fit?

Choose Wise Business if:

- You favour no‑monthly‑fee flexibility and pay only for services you use.

- You manage many currencies with minimal FX expense.

- You want invoicing, batch payments and, interest opportunities.

Choose Revolut Business if:

- You prefer a bundled service model (plan‑based) with built‑in cards, analytics, and expense tools.

- You need advanced team-spend controls or HR, accounting integrations.

- Your business benefits from tiered allowances, curated features, and dedicated support at higher levels.

Both Wise and Revolut serve international business needs, but with different philosophies:

- Wise excels in cost effective, transparent multi-currency operations without monthly commitments.

- Revolut offers packaged plan-based features for businesses seeking streamlined tools, oversight, and integrations.

Why more businesses are turning to OFX.

For many Australian businesses managing payments across borders, OFX has become a go-to solution, offering more flexibility and better value than traditional banks. Whether it’s paying global suppliers or receiving income from international clients, OFX helps simplify the process with faster transfers and lower costs.

One of the big reasons businesses make the switch is ease of use. With the OFX Global Business Account, companies can collect and hold funds in multiple currencies, send money to over 170 countries, and get local account details in key currencies like USD, EUR, GBP, and AUD, all through one streamlined platform.

Our Spend Management and AP Automation tools are purpose-built to give small businesses greater control, visibility, and efficiency over their finances. With features like real-time expense tracking, automated invoice capture, multi-currency employee cards, and custom approval workflows, businesses can manage budgets, streamline approvals, and prevent overspending with ease. AI-driven automation extracts and categorises data from invoices and receipts, significantly reducing manual entry, human error, and processing time. Integrations with accounting platforms like Xero ensure everything stays in sync, from bill entry to final payment.

What sets OFX apart is our focus on helping small businesses solve common financial pain points, improving cash flow visibility, enabling smarter decision-making through spend analysis, and enforcing financial control across teams and projects. By bringing payments, budgets, approvals, and expense data into one intuitive platform, OFX empowers business owners to save time, reduce risk, and stay in control, whether they’re operating locally or globally.

Another standout is our support. OFX offers access to real human help 24/7, not just automated bots or long call queues. Our currency specialists are on hand to guide businesses through everything from one-off payments to long-term foreign exchange planning. This personalised touch can be a game-changer when dealing with complex international transactions. In short, OFX makes it easier and more affordable to manage international payments, giving Aussie businesses the control, clarity, and confidence to grow globally.

OFX key benefits at a glance.

| Benefit | What it means for your business |

|---|---|

| Great value on transfers | Competitive exchange rates and no hidden fees mean you keep more of your money when sending or receiving overseas. |

| Local account details in key markets | Hold and receive funds in major currencies, USD, EUR, GBP, CAD with local banking details, making international payments faster and easier. |

| 24/7 expert support | Access to real currency experts around the clock, not just chatbots, for tailored help whenever you need it. |

| Currency risk management tools | Use forward contracts or set rate alerts to help protect your margins and plan ahead with confidence. |

| Fast, reliable transfers | Most transfers arrive within 1–2 business days, helping you manage cash flow and supplier relationships more effectively. |

| Easy-to-use platform | The OFX dashboard is clean and intuitive, giving you full visibility over your transactions and balances. |

| API and batch payment options | Automate payments or pay up to 500 recipients at once, ideal for businesses with high volumes or global payrolls. |

If you’re a business looking to streamline your global payments while saving time and money, OFX offers a smart, scalable solution backed by local expertise and worldwide reach.

Open an OFX Global Business Account

Make international payments easy

Sources

1, 2, 5, 6, 7, 27, 31, 33, 37, 43 https://wise.com/accounts/

3, https://wise.com/au/blog/business-account-australia

4, 14 https://wise.com/au/pricing/business/receive

8, https://www.thecurrencyshop.com.au/reviews/wise-business-review

9, 10, https://www.thecurrencyshop.com.au/guides/wise-business-account-requirements

11, 12, 15, 16, 17, 18, 19, https://wise.com/au/pricing/business

13, https://wise.com/au/pricing/business/card-fees

15, 16, https://www.revolut.com/au/business/pricing

17, 32 https://www.revolut.com/au/business/cards

18 https://www.revolut.com/au/business/features

19, 36 https://www.revolut.com/au/business/integrations

20 https://www.revolut.com/au/business/security

21, 30, 34, 40 https://www.revolut.com/en-AU/business/business-account-plans

22, 23, https://www.revolut.com/en-AU/legal/business-basic-fees

24 https://help.revolut.com/en-AU/help/managing-my-business/users-and-employees/payroll-expenses-members/how-does-charging-for-app-members-work/business

25, 29,39 https://wise.com/au/pricing

26, https://www.revolut.com/en-AU/business/business-account-plans

28, 44 https://www.revolut.com/en-AU/business

35 https://wise.com/au/business/integrations

38 https://help.revolut.com/en-AU/business/help

41 https://wise.com/au/legal

42 https://www.revolut.com/en-AU/legal/security

45 https://www.trustpilot.com/review/wise.com

46 https://www.trustpilot.com/review/www.revolut.com