A closer look at TorFX.

For Australian businesses and individuals needing reliable, cost-effective foreign exchange services, you may come across TorFX.

With low fees, transparent rates, and dedicated account managers, TorFX streamlines international money transfers whether you’re sending for personal reasons or commercial needs.

Although TorFX is a solid choice for businesses making smaller or more frequent international payments, we will also compare it to OFX, a provider that might deliver better value and more flexibility for businesses dealing with large transactions or requiring specialised foreign exchange advice and assistance.

On this page:

• What is TorFX?

• TorFX key features

• TorFX fees

• How to open a TorFX account

• TorFX pros and cons

• TorFX vs. OFX Global Business Account: A comparison

• Summary: TorFX

• Why businesses choose OFX

• FAQ

Looking for a better way to handle global business payments?

What is TorFX?

TorFX is a specialist currency exchange broker offering ultra competitive foreign exchange rates, free transfers, and a personalised service through Account Managers. It serves both personal and business clients in Australia and beyond.1

TorFX key features.

TorFX offers a range of services designed to support international money transfers for individuals and businesses.

The table below outlines the key features available through the platform.

| Feature | Details | Benefit |

|---|---|---|

| Free account setup | Opening an account is simple, fast, free, and comes with no obligation to trade2 | Quick access without commitments. |

| No transfer fees | TorFX charges no transfer fees or commissions3 | Makes transfers more economical. |

| Competitive exchange rates | Offers highly competitive rates, beating banks by 3%+4 | Maximises value on every transfer. |

| Customer service | Holds Canstar’s 5 Star Rating for outstanding value (2018–2024)5 | Trusted and recognised performance. |

| Dedicated account manager and support | You receive personal service and fast guidance from a real expert6 | Personalised support for peace of mind. |

| Modern online platform | Transfer online 24/7, monitor rates, set alerts, and upload recipients7 | Convenient and flexible access anytime. |

| Transfer options and risk tools | Includes Limit Orders, Forward Contracts, Stop Loss options to manage currency risk8 | Helps protect against market volatility. |

| Regular overseas payments | Automate recurring transfers (e.g. wages, school fees) with no fees and great rates9 | Saves time and avoids bank charges. |

TorFx fees.

TorFX earns its revenue from a margin on the exchange rate (the spread between the wholesale rate and the customer’s rate) rather than transfer fees.10 Transfers are commission-free, transparent, and can be cheaper than banks.11

How to open a TorFX account.

Setting up your account is quick, simple, and free to open with no obligation to trade.12

Once registered, you’re assigned a dedicated Account Manager, and you can trade either online or over the phone. You’ll receive a contract note after confirming your rate, followed by payment instructions.13

Speed and efficiency.

TorFX aims to deliver transfers as quickly as possible, often completing currency transfers in 1‑2 working days depending on the currency and destination.14 Their online platform allows users to register, get quotes, trade, and send funds with streamlined processes.15 Reviews often mention that transfers are completed “within 48 hours” or “the next day” when all checks and banking steps align.16

Global supplier management.

While TorFX is focused on foreign exchange and international money transfers (rather than full supplier‑management systems), several features make it suitable for businesses working with global suppliers:

- Dedicated account managers who help tailor solutions for larger or recurring international payments.17

- The ability to manage transactions in many currencies (e.g. AUD, USD, EUR etc.), which allows better flexibility when dealing with suppliers in different countries.18

- Transparent exchange rates and clear communication of fees, which helps businesses plan costs of supplier payments more accurately.19

Security and compliance

TorFX is regulated by financial authorities and takes care to protect client funds and data:

- In Australia, TorFX holds an Australian Financial Services Licence (AFSL) and is regulated by the Australian Securities and Investments Commission (ASIC).20

- Client monies are held in segregated accounts, meaning customers’ funds are kept separate from TorFX’s corporate funds, and protected in the event of the company’s insolvency.21

TorFX also emphasises “safe and secure” transfers, with compliance procedures in place for verification and regulatory checks.22

Support and user experience.

TorFX gets frequent positive feedback on its customer service and ease of use:

- Being assigned a personal account manager, which helps with communication, guidance, and handling complex or large transfers.23

- The process of opening an account is generally described as straightforward. Registration is possible online or by phone.24

- The website and app are noted to be user‑friendly, and customers often praise clear guidance and responsiveness from support staff.25

What customers are saying about TorFX.

TorFX has garnered a strong reputation among its customers, reflected in its Trustpilot rating of 4.8 out of 5, based on over 8,700 reviews.26

- Personalised service: Many users commend the dedicated account managers who provide assistance throughout the transfer process. For instance, one customer noted, “I was pleased with the combination of personal service and efficient systems”.27

- Competitive exchange rates: Clients frequently highlight the favorable rates offered by TorFX.

- User-friendly platform: The simplicity of the online platform and mobile app makes initiating and tracking transfers straightforward, even for first-time users.

- Efficient transfers: Many reviews mention that funds are transferred promptly, with some transactions completed within 48 hours.28

TorFX account pros and cons.

In this section, we’ll break down the key advantages and potential drawbacks of using a TorFX account:

| Pros | Cons |

|---|---|

| Free to open, no transfer fees | Not a full-service offering , no deposit/cheque facilities |

| Competitive exchange rates | Smaller scale compared to global banking giants |

| Personalised service with dedicated Account Manager | Requires trust in third-party broker rather than in-house banking |

| Flexible risk management tools | |

| 24/7 online trading and regular transaction automation |

Summary: TorFX.

TorFX is a smart choice for anyone, individuals, expats, businesses, making international transfers from Australia. With excellent rates, zero fees, and a personable service model, they offer an efficient, transparent, and supportive alternative to traditional banks.

Key features:

- Outstanding value with award-winning rates

- Seamless, user-friendly platform and app available torfx.com.au

- Secure: AFSL-licensed, AFCA member, backed by strong financial credentials33

- Ideal for both one-off and recurring transfers, flexible up to high volume

Ideal use cases.

The TorFX service is particularly well-suited for:

Businesses funding imports or one-off purchases overseas — Whether you’re covering the cost of imported goods, settling business-related purchases abroad, or handling property settlement payments, TorFX offers competitive, transparent solutions to simplify your foreign exchange needs.29

Companies with recurring international payments — If your business makes regular transfers—such as paying supplier invoices, royalties, or overseas staff, TorFX’s Regular Overseas Payments service allows automated monthly transfers (from A$5,000 to A$500,000 over a minimum of six months) fee-free.30

Businesses exposed to FX volatility or requiring FX risk management — For organisations worried about market fluctuations, TorFX offers robust tools like Forward Contracts (fix exchange rates up to two years in advance), Limit Orders (execute when a target rate hits), along with Spot Contracts and Stop-Loss Orders to protect margins and forecast costs with confidence.31

Businesses that value proactive guidance and personalised support — Every client is assigned a dedicated Account Manager, providing tailored market insights, rate alerts, and expert currency analysis to help time transfers effectively and maximise savings.32

TorFX vs. OFX Global Business Account: A comparison.

This comparison table provides a side-by-side overview of the TorFX and OFX Global Business Account services, highlighting key features, pricing structures, and support options to assist businesses in selecting the most suitable international payment solution.

| Feature | TorFX | OFX Global Business Account |

|---|---|---|

| Monthly fees | No setup, transfer or account fees; account opening is free.34 | Standard plan – Free for up to 2 users; Full Suite is AU$25/user/month for advanced features. |

| Multi-currency holding | Primarily an FX broker, not an account; offers competitive rate transfers. No multi-currency holding functionality.35 | Supports holding, sending and receiving in 30+ currencies with local bank details for AUD, USD, EUR, GBP, and CAD. |

| Payments and payouts | Supports regular overseas payments automatically (from $5K–$500K monthly) with no transfer fees.36 | Enables batch & payroll payments in 30+ currencies, with automated reconciliation. |

| Capital tools | Offers FX risk tools such as spot and forward contracts to manage currency risks.37 | FX tools include competitive rates, but advanced tools available via Business Plus; further hedging tools implied in broader offering. |

| AP integrations | Does not offer accounting integrations | Integrates with Xero and other accounting platforms; supports automation and spend tools within the platform. |

| Security and support | Regulated via AFSL and AUSTRAC; personalised service with dedicated Account Manager.38 | ISO/IEC 27001 certification, regulated by ASIC/AUSTRAC, secure platform with 24/7 support. |

TorFX has a personalised, no-fee FX transfer service and powerful hedging tools, ideal for those focused on cost-efficient regular or large-value transfers. However, it does not function as a multi-currency account platform or offer automation/integrations.

OFX Global Business Account is a rich, multi-currency platform with robust automation (batch payments, AP workflows), deep integrations, spend control tools, and strong security support, suited to businesses needing scalable and integrated financial operations.

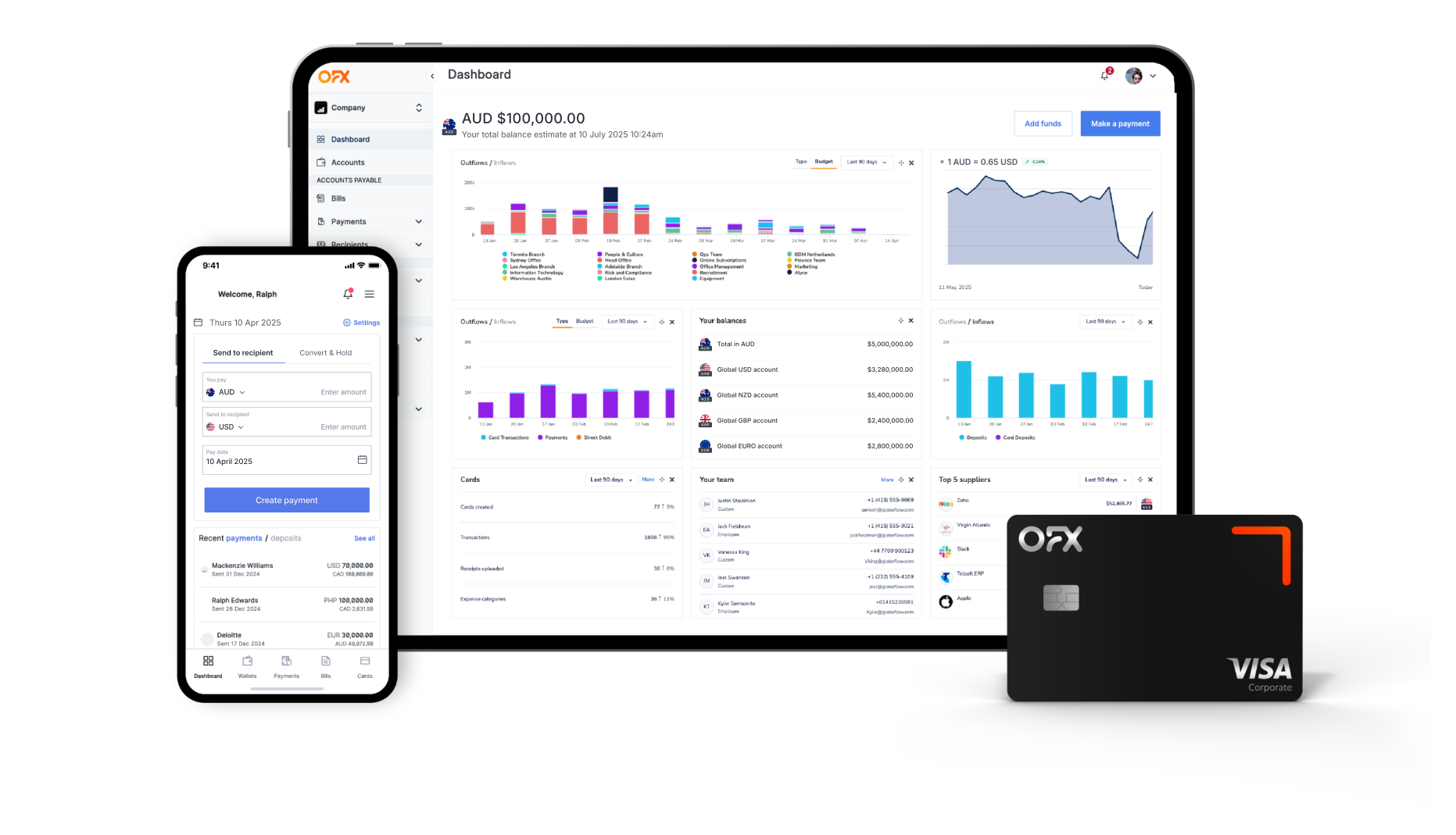

Why more businesses are choosing OFX.

Designed for Global Business Needs

The OFX Global Business Account is built for companies with international operations. It lets you send, receive, hold, and manage money in over 30 currencies, all through one user-friendly platform. With local account details in major currencies like AUD, USD, EUR, GBP, and CAD, you can accept payments like a local in key markets.

Whether you’re settling invoices with overseas vendors, paying remote teams, or collecting payments from global customers, OFX supports transfers to more than 180 countries. Handling high volumes is easy too, batch payments allow you to upload hundreds or thousands of transactions at once, complete with approval workflows and real-time tracking for added oversight.

Manage currency risk with confidence

Foreign exchange volatility can be a challenge, but OFX equips you with the right tools to minimise exposure. Lock in today’s rates for up to 12 months using Forward Contracts, or set up Limit Orders that trigger when your ideal rate is met. These features help you better time your transfers and protect your margins.

Need help navigating the FX landscape? OFX’s currency specialists are available to guide you through currency risk strategies no matter the size or frequency of your transfers.

Fast, unrestricted transfers

There are no limits on how much you can send through OFX, ideal for large or repeat payments. Transfers can be processed any time of day, including weekends and public holidays, ensuring your business doesn’t slow down due to banking delays.

Control company spend with smarter tools

OFX gives you greater control over business expenses. With features like custom spending limits, approval workflows, and both physical and virtual corporate cards, your team can manage purchases while staying compliant. Built-in tools like OCR receipt capture and multi-user permissions further reduce admin and manual effort.

Easy integration with your accounting software

OFX connects directly with accounting platforms such as Xero, QuickBooks, and Saasu, helping you automate reconciliation and improve reporting accuracy. Prefer manual handling? CSV exports are also supported.

Personalised, local support around the clock

OFX prioritises real, human support. Forget long hold times or robotic menus, get 24/7 access to experienced local support and dedicated account managers who understand your market and business needs. Whether you’re moving large sums or navigating FX fluctuations, help is always available.

How to get started with OFX

Opening an account is a simple process with immediate access to the platform while you wait for KYC to complete to be approved for full access. Our OFX Global Business Account can usually be verified within a few business days, entirely online.

Once approved, you’ll gain access to multi-currency capabilities, virtual cards and physical corporate cards, and a full suite of batch payment and expense management automations that simplify your day-to-day finances. And you can download the OFX Business App to manage your account from anywhere, 24/7. If you’re ready to find out just how easy and cost-effective international business can be, take our virtual tour and book a free demo with one of our OFX specialists today.

OFX Global Business Account

Receive, hold, convert and send funds across a wide range of currencies, reduce costs and gain greater control over your international payments.

FAQs

Are there transfer fees with TorFX?

No, TorFX charges no upfront fees or commissions; they earn through the FX margin.39

How long will transfers take with TorFX?

Usually same-day or within 1–2 working days; speeds can vary by currency and destination.40

Can I lock in rates with TorFX?

Yes, you can use Forward Contracts to fix rates for up to two years or set Limit Orders for target rates.41

See how the OFX Global Business Account can help you

Sources

1, 3, 5, 6, 11, 14, 15, 22, 39. https://www.torfx.com.au/

2, 12, 13, 40. https://pfxreg.torfx.com.au/register-page/

4. https://www.torfx.com.au/international-money-transfers/transfer-money-australia.php

7, 8, 41. https://www.torfx.com.au/personal/your-transfer-options.php

9, 30, 36. https://www.torfx.com.au/personal/regular-overseas-payments.php

10. https://www.torfx.com.au/assets/docs/TorFX_Financial_services_guide.pdf

16, 26, 27, 28. https://au.trustpilot.com/review/www.torfx.com/

17. https://www.currencyexpert.com/reviews/torfx/

18, 19, 24, 25. https://www.internationalmoneytransfer.com/reviews/torfx

20. https://www.thecurrencyshop.com.au/reviews/torfx

21. https://www.torfx.com/content/security-of-funds.php

23. https://www.currencyexpert.com/reviews/torfx/

29, 32. https://www.torfx.com.au/assets/pdf/TorFX_AU_Business_Brochure.pdf

31. https://www.torfx.com.au/business/risk-management.php

33. https://www.torfx.com.au/content/about-us.php

34, 38. https://www.torfx.com.au/content/faq.php

35. https://www.torfx.com.au/assets/assets/pdf/au/TorFX_AU_Business_Brochure.pdf

37. https://www.torfx.com.au/content/using-torfx.php