Managing international payments is an important part of doing business across borders. Platforms like PayPal offer a widely used option for sending and receiving funds globally. With PayPal Australia, businesses can accept payments in multiple currencies from customers around the world, and send money internationally when needed.

While there are no setup or monthly charges for business accounts, international transactions typically come with additional costs. These may include a cross-border fee, applied when a payment is received from or sent to another country, and a currency conversion fee if the transaction involves exchanging currencies. The structure of these fees can vary depending on the payment type, the country involved, and the currencies used.

Understanding these charges in advance can help businesses manage their international transactions more effectively and avoid unexpected costs.

We’ll also show you how OFX’s Global Business Account could help you save on international payments and why OFX could be a great alternative for you and your business.

Summary:

• Types of PayPal accounts

• Does PayPal charge international fees?

• How do PayPal fees work?

• Understanding PayPal fees for personal and business accounts

• PayPal currency conversions

• Receiving international payments with PayPal Business

• Other PayPal fees to be aware of

• PayPal V OFX

• Tips to keep costs down

• Alternatives to PayPal for international business payments

• PayPal International Fees FAQs

Types of PayPal accounts2

PayPal Australia offers two main account types to meet the needs of individuals and businesses alike:

| Account type | What is it? | Best for | Key features |

| Personal | This option allows you to make and receive payments securely, with easy access to your funds via the PayPal app or website. | Shoppers, casual sellers, and sending money to friends or family | Secure shopping, easy fund management, no setup fees |

| Business | This account provides professional tools and greater flexibility. You can accept a variety of payment methods, operate under your business name, provide account access to staff (up to 200 users), and connect with eCommerce platforms and accounting systems. | Sellers, merchants, or anyone operating under a business identity | Accept card and PayPal payments, branded business profile, multi-user access, integration with business tools |

Does PayPal charge international fees?

Yes, PayPal does charge international fees for sending and receiving money, including currency conversion fees that add a markup to the exchange rate, as well as cross-border fees that can vary depending on the location of the sender and recipient and how the payment is funded.

How do PayPal fees work?

Personal account3

For personal users, PayPal typically does not charge fees for:

- Sending money to friends or family using your PayPal balance or linked bank account.

- Receiving payments for goods and services from Australian buyers.

However, fees may apply in certain situations, such as:- Sending money using a credit or debit card.

- Receiving international payments.

- Currency conversions.

- Withdrawing funds to a bank account (depending on the method).

Business account4

Business users can expect fees for:

- Receiving payments for goods and services.

- Currency conversions.

- Withdrawing funds to a bank account (depending on the method).

Fees may vary based on factors like transaction volume, currency, and payment method.

- Receiving payments for goods and services.

- Currency conversions.

- Withdrawing funds to a bank account (depending on the method).

Fees may vary based on factors like transaction volume, currency, and payment method.

Understanding PayPal fees for personal and business accounts in Australia5

When using PayPal in Australia, both personal and business accounts can incur different types of fees depending on the transaction.

For personal accounts, sending money to friends or family within Australia using your PayPal balance or linked bank account is usually free. Fees may apply when:

- using a credit or debit card to send money

- when dealing with international payments

- currency conversion fees apply when funds are sent or received in foreign currencies, with PayPal adding a margin to the exchange rate

For business accounts, fees are generally charged on payments received for goods or services. This typically includes a percentage of the transaction amount plus a fixed fee, which can vary based on factors such as:

- payment method

- transaction volume

- currency

Currency conversion fees also apply for international transactions, adding an extra cost when payments are made in or converted from foreign currencies. Withdrawals to linked bank accounts can also involve fees, depending on the withdrawal method chosen.

PayPal may apply additional charges in specific cases, such as cross-border transaction fees when payments involve multiple countries, or service fees like chargebacks and refund processing.

While these fees might seem small individually, they can add up, especially for businesses handling numerous transactions or operating internationally. It’s always wise to review PayPal Australia’s current fee schedule to understand the costs involved fully.6

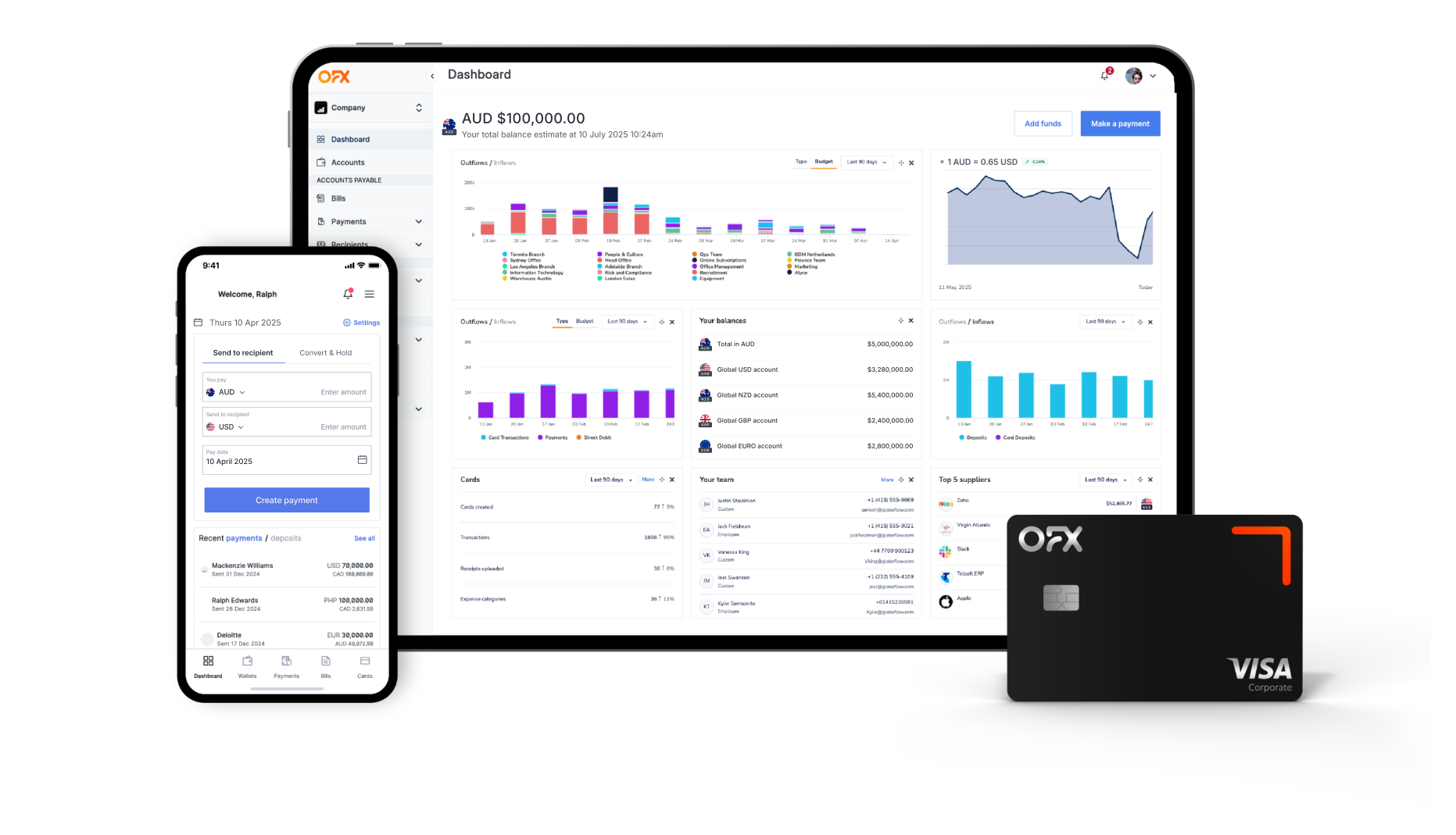

OFX Global Business Account

Receive, hold, convert and send funds across a wide range of currencies, reduce costs and gain greater control over your international payments.

PayPal currency conversions7

When using PayPal for transactions involving different currencies, it’s important to understand how currency conversion fees work. PayPal applies a conversion rate that includes a margin on top of the base exchange rate, which affects the total cost of sending, receiving, or withdrawing funds in foreign currencies.

The table below outlines the key details to help you navigate these fees with confidence.

| When currency conversion applies | When you send, receive, or withdraw money in a currency different from your primary PayPal currency. |

| Conversion rate | PayPal applies an exchange rate that includes a margin on top of the base rate. |

| Typical margin | Usually between 3% to 4% added to the wholesale exchange rate.8 |

| Impact on transactions | Conversion fees apply whether you’re paying, receiving funds, or withdrawing money in another currency. |

| Example situations | – Paying a seller in a foreign currency – Receiving international payments – Withdrawing funds in a different currency |

| How its calculated | PayPal adds a percentage fee to the currency exchange rate, which varies depending on the currencies involved. |

| Transparency | The exact exchange rate and fees are shown during the transaction before you confirm payment. |

| Advice for users | Consider the conversion costs when transacting internationally or using multiple currencies. |

Receiving international payments with PayPal Business

If you run a business in Australia and use a PayPal Business account, receiving payments from overseas customers is straightforward but involves certain fees and considerations.

When you receive international payments, PayPal charges a transaction fee that typically includes a percentage of the payment amount plus a fixed fee, which varies depending on the currency received. This fee structure helps cover the costs associated with processing cross-border transactions securely and efficiently.

If the payment is in a foreign currency, a currency conversion fee applies, which means PayPal will convert the funds to your primary currency at a rate that includes a small margin above the wholesale exchange rate. This margin generally ranges between 3% to 4% and is an important factor to keep in mind when budgeting for international sales.9

Beyond fees, PayPal offers a reliable and convenient way to accept multiple payment types from global customers, such as credit cards, debit cards, and PayPal balances, all under your business name. You can also access tools to manage international transactions and track payments easily through your PayPal Business dashboard.

For Australian businesses, this makes PayPal a popular choice for expanding reach and streamlining payments across borders. It’s advisable to regularly review PayPal’s fee schedule and terms on their official website to stay informed about any updates or changes).10

At a glance

Looking for a quick breakdown? See the below table:

| Transaction type | Cross-border fee applies? | Currency conversion fee |

| Sending personal payments (business account) | Yes | 3-4%11 |

| Receiving personal payments (business account) | Yes | 3-4%12 |

| Receiving payments for goods/services | Yes (plus merchant fee) | 3-4%13 |

| Sender or recipient choice applies | Yes (sender chooses payer) | – |

Other PayPal fees to be aware of

While PayPal is known for its convenience and ease of use, there are some lesser-known fees that can catch users off guard, particularly when dealing with international transactions or currency conversions. These fees don’t always appear upfront but can affect the total cost of using the platform, especially for businesses.

Account & transaction basics

Opening a PayPal account is free, there are no setup or monthly charges. Fees are typically incurred when you:

- Receive payments for purchases (goods or services)

- Receive money from outside your country or region

- Send personal payments using a credit or debit card

- Convert currency

- Withdraw funds using an eligible debit card (transfers to a linked bank account are free)14

Cross‑border & currency conversion fees

International personal or purchase payments often attract cross-border fees, paid by either the sender or recipient, depending on how the transaction is arranged. If currency conversion is required, PayPal applies a margin on the exchange rate15

Specialised business‑related charges16

For sellers using Business or Merchant accounts, additional fees may apply, including:

- Micropayments, which carry higher percentage fees plus a small fixed amount

- Chargebacks, where a settlement fee applies if a buyer disputes a transaction

- eCheque processing fees, including potential maximum fee caps

- Withdrawal fees, especially when transferring to cards or across currencies

PayPal V OFX

When it comes to sending or receiving international payments, both OFX and PayPal are popular options, each with distinct features, benefits, and fee structures.

The table below offers a side-by-side comparison to help you understand how they differ and decide which might best suit your needs.

| Features | Paypal | OFX |

| Account set up fee | No monthly or setup fees. You only pay when you receive money.17 | No monthly platform fee for Standard Plan (up to 2 users) or Full Suite (per user fee applies). |

| Cross border/International fee | Yes. Sending or receiving funds internationally incurs cross-border fees. Includes flat and percentage-based components depending on transaction type.18 | For all business users, $0 local transaction fee |

| SWIFT/Wire fees | Not separately specified—cross-border fees apply for international transactions, including purchase and personal payments.19 | AU$10 per payment when sending via SWIFT on OFX Standard and Full Suite plans. |

| Currency conversion/FX margin | Currency conversion involves a fee (margin included in PayPal’s exchange rate).20 | Margin is included in the quoted exchange rate (competitive rates). OFX premiums are lower, particularly for business users. |

| Recipient bank (intermediary) fees | Potential bank fees may apply depending on recipient’s financial institution; not disclosed by PayPal.21 | Intermediate banks may deduct a fee; OFX does not receive any portion of it. |

| Multi-currency/holding | PayPal allows sending/receiving payments, but multi-currency holding capabilities are limited. No specific mention on business multi-currency management. | Offers multi-currency holding accounts, batch and payroll payments, and a corporate multi‑currency card minimizing FX fees. |

Tips to keep costs down

For Australian businesses using PayPal to send or receive international payments, managing fees effectively can help reduce overall costs. Given that PayPal charges fees on currency conversions, cross-border transactions, and certain payment types, understanding how these fees apply is key.

To minimise fees, businesses should consider:

- Choosing the right payment method: Funding transactions using a linked bank account or PayPal balance typically incurs lower fees than credit or debit cards.

- Currency options: Where possible, request payments in your primary currency to avoid PayPal’s currency conversion fees.

- Utilising multi-currency accounts: PayPal allows users to hold balances in multiple currencies, which can help avoid frequent conversions.

- Consolidating transfers: Grouping multiple payments before withdrawing funds can reduce withdrawal fees and currency conversions.

- Stay informed: Regularly review PayPal’s fee schedules and any changes posted on their official site to adjust your processes accordingly.

- Be transparent upfront: Check who will cover the cross‑border fees, sender or recipient? Communicate clearly to avoid surprises.

- Use business tools wisely: For bulk international payouts, consider alternatives but always check the total cost including conversion rates.

While PayPal fees are part of the service, these practical steps can help businesses keep costs manageable while benefiting from PayPal’s global reach and convenience

Alternatives to PayPal for international business payments

When it comes to managing international business payments, options extend beyond PayPal. Australia’s major banks, Commonwealth Bank (CommBank), ANZ, Westpac, and NAB, offer traditional banking services, while fintech providers such as Wise and OFX deliver specialised cross-border payment solutions. Below is a comparative snapshot highlighting key features and costs.

| Provider | Key features | Fees and pricing |

| CommBank | International Money Transfers to over 200 countries via NetBank, app, or branch | Branch: $30 per transfer; Via App/NetBank: Typically fee-waived for foreign currency transfers; third-party and amendment/cancellation may incur $25 plus overseas charges22 |

| ANZ | International transfers and FX with tailored business trade services | Sending: Internet banking $18, phone $32, branch $32; Receiving: Up to $15 per inbound payment unless covered by sender23 |

| Westpac | Telegraphic transfer services for fast global payments | Online App: Foreign currency transfers free, AUD transfers $20; Branch: $32; plus possible correspondent bank deductions (e.g. US intermediary $5)24 |

| NAB | Online international transfer capability with foreign currency accounts | Via App/Internet: Foreign currency transfers fee-free; other channels or AUD transfers may incur charges or correspondent bank fees25 |

| Wise | International business account, mid‑market exchange rates, and multi‑currency balances | No hidden markups, interbank exchange rates, charges fees; supports multiple currencies, batch payments, and ecommerce/marketplace payouts26 |

| OFX | Multi‑currency accounts, FX tools, corporate cards, and accounting software integrations | No monthly fee for up to 2 users, 30+ currencies. Sending: Standard cross-border $0, $10 via SWIFT, receiving fee via SWIFT $5; competitive currency margins apply, ideal for large amounts. |

Why more businesses are choosing OFX

OFX is purpose-built to simplify international payments. With support for over 30 currencies, you can send, receive, and hold funds globally. You also get access to local receiving accounts in five key currencies AUD, USD, EUR, GBP, and CAD making it a powerful solution for ecommerce businesses, import/export operations, international payroll, or invoicing global clients.

When it comes to managing foreign exchange risk, OFX offers valuable tools and expertise:

- Forward contracts to lock in rates for future transfers

- Limit orders that trigger transfers when your desired rate is reached

- Personalised FX help from dedicated specialists

This level of support is especially useful for businesses with ongoing international transactions, helping them minimise exposure to currency fluctuations.

For companies dealing with high-value payments, OFX stands out further. There are no maximum transfer limits, and payments are settled efficiently through a wide-reaching global banking network.

Support is available 24/7, with real human assistance, including dedicated account managers and local teams across Australia and other key regions. This hands-on service is particularly valuable during periods of currency volatility or when handling complex transactions.

And to save time as well as money you can automate your business payments.

- Make batch payments to large groups of suppliers or employees

- Streamline accounts payable with AI automation

- Enable multi-user approval workflows and budgeting controls

- Integrate seamlessly with accounting platforms like Xero, QuickBooks, and Saasu

Whether you’re scaling globally or navigating complex financial operations, OFX is a reliable partner for businesses with international reach.

PayPal International Fees FAQs

Does PayPal charge fees for international transfers in business accounts?

Yes. Any payment that crosses borders, whether sending or receiving, will generally incur cross‑border fees, including purchases and personal payments. The sender usually chooses who covers this fee: either themselves or the recipient.27

What exactly are cross‑border fees?

Cross‑border fees are additional charges applied to international personal payments or purchase payments. They’re separate from currency conversion or transaction fees, and are driven by the fact the payment is processed across multiple countries.28

What fees apply when receiving payments from abroad?

Receiving international payments for purchases or services generally incurs:

- A standard commercial transaction fee (a percentage of the transaction), plus

- A fixed fee based on the currency received29

Are currency conversions charged extra?

Absolutely. Whenever PayPal converts currency, a currency conversion fee is added. This is typically a percentage margin on top of the base exchange rate and is distinct from the transaction or fixed fees.30

What is the difference between a business account compared to a personal account?

Business accounts are subject to full commercial transaction rates, which are higher than those for personal or domestic payments. This especially matters for cross‑border transactions.

Is there a way to avoid currency conversion fees?

Yes, they can be avoided if the sender pays in the recipient’s primary currency. In that case, no conversion is triggered, and the corresponding currency conversion fee won’t apply.

How does PayPal let you manage foreign currencies?

You can choose to hold foreign currencies in your business account, converting them manually, automatically, or leaving them as is. This gives you flexibility and control over when conversion, and its associated fees, takes place.

Where can I see the full breakdown of fees?

PayPal provides dedicated fee pages. In Australia, you’ll find all the latest rates, including those for cross‑border fees, transaction rates, and currency conversions under PayPal’s “Fees” or “Business merchant fees” section.

See how the OFX Global Business Account can help you

Sources:

1, 4, 6, 7, 16 https://www.paypal.com/au/business/paypal-business-fees

2 https://history.paypal.com/ad/cshelp/article/what-is-the-difference-between-personal-and-business-accounts

3, 5, 7, 8, 9, 10, 11, 12, 13, 15 https://www.paypal.com/au/digital-wallet/paypal-consumer-fees

14 https://securepayments.paypal.com/au/cshelp/article/what-are-the-cross-border-fees-when-selling-internationally-help

17 https://www.paypal.com/au/business

18 https://securepayments.paypal.com/au/cshelp/article/what-are-the-cross-border-fees-when-selling-internationally-help

19, 20 https://securepayments.paypal.com/au/cshelp/article/what-are-the-fees-for-paypal-accounts-help

21 https://securepayments.paypal.com/au/cshelp/article/what-are-the-cross-border-fees-when-selling-internationally-help

22 https://www.commbank.com.au/international/fees-charges

23 https://www.anz.com/resources/c/e/ce9cc017-492d-49d9-9dab-4a6a098d9921/business-banking-general-service-fees-and-charges.pdf

24 https://www.westpac.com.au/international-travel/international-transfers/send-money

25 https://news.nab.com.au/news/nab-introduces-fee-free-international-transfers

26 https://wise.com/au/send-money/international-business-payments

27 https://www.paypal.com/au/digital-wallet/send-receive-money/send-money-internationally

28, 29 https://qwac.paypal.com/tc/cshelp/article/what-are-the-cross-border-fees-when-selling-internationally-help

29 https://qwac.paypal.com/tc/cshelp/article/what-are-the-cross-border-fees-when-selling-internationally-help

30 https://securepayments.paypal.com/au/cshelp/personal

30 https://www.paypal.com/au/business/paypal-business-fees

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. UKForex Limited (trading as “OFX”) and its affiliates make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.