As more and more businesses look to expand globally, there’s become an increasing need for affordable ways to transfer money across borders. Not only that, but global growth also requires businesses to find efficient, transparent, and dependable financial management solutions that don’t break the bank.

Looking for multi-currency, financial management tools that do just that? OFX and Wise are two leaders in the space, both deliver a variety of services that can make international payments and spend management that much easier. But how do these two platforms compare and which may be better suited for your business? Read on to find out.

On this page

• Who is Wise?

• Wise Business Account: Key features and benefits

• How much does Wise Business cost?

• Wise fees explained

• Who is OFX?

• OFX Business Account: Key features and benefits

• How much does OFX cost?

• OFX fees explained

• OFX vs. Wise

• Why more businesses are turning to OFX

Who is Wise?

Wise is a financial technology company formerly known as TransferWise that offers international money transfer services as well as multi-currency accounts and corporate cards for businesses. First launched in the United Kingdom in 2011, Wise now offers its services in Australia and is regulated under the Australian Securities and Investments Commission (ASIC). Wise also holds an Australian Financial Services Licence (AFSL) for operation in Australia.

Wise Business Account: Key features and benefits.

The Wise Business Account hosts a wide range of features and tools that could be useful for your business. From multi-currency support to corporate cards to batch payments, you can pick from many products all available on the Wise Business Account.

For a more in-depth look at the Wise Business Account features and benefits, check out the below:

| Feature | What is does | Benefit |

|---|---|---|

| Multi-currency account | Holds balances in over 40 currencies, with access to local account details in 10 currencies1 | Uses your local bank details so you can make payments while avoiding the usual SWIFT fees1 |

| Exchange rates | Lets you send money at the mid-market rate1 | – Transparent fees1 – Wise may apply a discount for larger transfers over 40,000 AUD (or equivalent)1 |

| Batch payments | Sends multiple payments in one go2 | Especially helpful for payroll, where you can make up to 1,000 payments at once with a batch payment template file2 |

| Corporate cards | Wise Business Card is an international business debit card you can use to spend in multiple currencies, online and in-store3 | – Businesses can purchase additional virtual and physical cards at a low cost – Cards can be used to control spend with spend limits and access restrictions3 |

| Accounting software integration | Connects with accounting software such as Xero, Quickbooks, and more4 Integrates with other platforms like Amazon, Spotify, Stripe, and more | Automatically reconcile transactions and track payments in real-time |

| Team management | Customises access for corporate cards and automates approval workflows5 | Enjoy real-time transparency and control employee expenditure with spend limits5 |

| Interest earnings | Earn potential returns by investing in an interest-earning fund, holding government guaranteed assets via a Wise Business Account6 | Capital growth is not guaranteed, however may be an avenue to make money |

| Invoicing and payment links | Generates invoices directly from the Wise dashboard2 | Keep all your invoices in one place, and add payment links to make it easy for your clients to pay in their local currency |

How much does Wise Business cost?

The Wise Business Account costs $65 for the initial set-up, with ongoing fees depending on the features you use. However, you can trust Wise to keep exchange rates at the mid-market rate, and apply volume discounts when you spend over $40,0007.

Wise fees explained.

Aside from the plan pricing, you may also be required to pay a fee when using features of the Wise Business Account, such as sending money internationally, transferring between currencies, and using the Wise Business Card.

Here’s a breakdown of the fees you can expect to pay when using the Wise Business Account.

| Account feature | Fee |

|---|---|

| Currency conversion | 0.63% min. depending on the currency pair and the amount you’re transferring7 |

| International payments | SWIFT fees may vary (e.g. for USD, GBP, EUR)7 |

| ATM cash withdrawals | 2 free withdrawals (up to $350 per month). 1.75% on cash withdrawals over $3507 |

| Business debit cards | One-time fee of $22 for a Wise Business Card7 |

Bear in mind, you don’t need to pay a fee when opening an account. Only a one-time fee applies when accessing local account details.

Who is OFX?

OFX is a publicly-listed financial technology organisation specialising in giving businesses real-time control over their finances. With over 25 years of experience in the foreign exchange space, OFX leverages their expertise to deliver multi-currency and spend management support for businesses in 30+ currencies, and backs their services with 24/7 specialist human support.

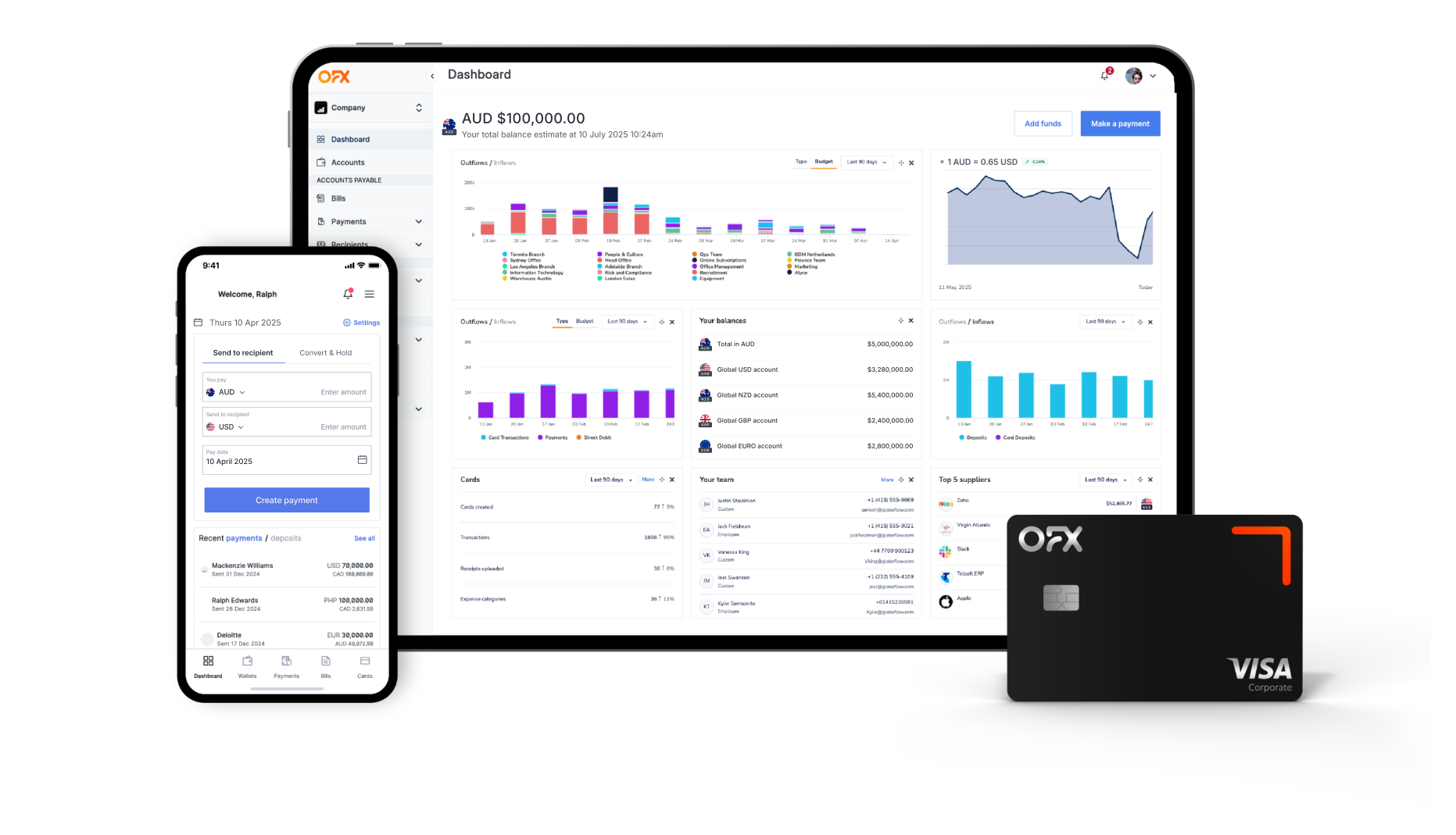

OFX Business Account: Key features and benefits.

Below are the key features and benefits to note of the OFX platform.

| Key feature | What it does | Benefit(s) |

|---|---|---|

| Global Business Account | An all-in-one platform for better financial control, including multi-currency accounts, FX solutions, and spend management8 | – Help businesses manage expenses and payments in one platform – Seamless for your customers to pay in their preferred currency |

| International payments | Pay suppliers in 30+ currencies and 170+ countries at competitive FX rates9 | Save on fees while making and receiving payments your preferred currencies |

| Corporate cards | Issue corporate cards instantly, with the ability to pay in 30+ currencies10 | – Monitor and approve spend with corporate cards on the OFX platform for more transparency – Includes convenient automated receipt collection and can be used with Apple Wallet and Google Pay |

| FX solutions | Solutions such as Spot Transfers, Forward Contracts and Limit Orders11 Custom pricing available for clients with large and ongoing FX transfers11 | – Ability to choose what FX payment method works best for your business, while securing optimal exchange rates – Real-time visibility over exchange rates and currency changes – Save with custom pricing options |

| Batch and payroll payments | – Pay multiple recipients in one transaction, including payroll12 – Can be used for both domestic and international payments12 | – Easy payment approval workflow set up so nominated employees can approve bulk payments in one click – Helps reduce manual bank transfers and Australian Banking Association (ABA) files – Flexibility to set up partial payments |

| Control Hub | A feature of the OFX platform that allows businesses to create approval workflows, monitor payments, and track budgets13 | – A secure place to manage and collaborate -Helps prevent common issues like budget overruns, complex approval flows and limited user access |

| Spend management | Manage expenses, budgets, and reimbursements in one place14 | – Increases efficiency with less manual work while encouraging transparency – Enjoy real-time controls on one unified platform |

| Accounts Payable (AP) automation | Automated invoice and payment approvals with multilayered workflow options15 | The ability to easily action your bills and payments |

| Accounting software integration | Sync your accounting software with the OFX platform, including Xero and Quickbooks16 | – Keep your existing data while reducing the chance of human errors with manual data entry – Enjoy real-time insights with accurate bookkeeping and data transparency |

| Rewards on credit card payments | Lets you pay suppliers with your rewards credit card and earn points17 | A convenient way to collect and redeem points with your existing Amex, Visa, or Mastercard |

OFX Global Business Account

Receive, hold, convert and send funds across a wide range of currencies, reduce costs and gain greater control over your international payments.

How much does OFX cost?

OFX offers a variety of business plans at different price points to suit your business. There are currently three available plans for your business to choose from.

| Plan | Standard | Full Suite | Custom |

|---|---|---|---|

| Price | Free (two users included) | $25/month (per user) | Custom pricing |

| Inclusions | – Global Business Account – Corporate cards – FX solutions – Accounting integrations | – All Business plan inclusions – Control Hub – Spend management tools – Accounts Payable & Bill automation – Advanced accounting integrations – Account management features | – All Business Plus plan inclusions – A dedicated account manager and onboarding support – Volume-based, tailored FX pricing – Multi-entity support with a single login |

As seen above, you can enjoy a wide range of helpful payment features on the free OFX Standard plan, while the Full Suite plan includes advanced expense management tools if that’s more of what you’re looking for. Before committing to $25/month, you can try the Full Suite Plan for free for 30 days.

OFX fees explained.

Similar to Wise, businesses will naturally incur certain fees when using the OFX platform and Global Business Account, especially when making international payments. Below are the fees in detail.

| Account feature | Fee |

|---|---|

| Cross border fees if sending via ACH Wire or SWIFT | $10 per transaction |

| Cross border fees if receiving via ACH Wire or SWIFT | $5 to receive international funds into the Global Business Account |

| FX margins on international card payments | 1.5% (custom with Configure plan) |

| Physical corporate card | $10 per card (one-off fee) |

| Fund your Global Business Account by card (Visa, Mastercard) | – 1.27% of the amount added per transaction – 3.40% of the amount added per transaction for international cards |

Worth noting there are $0 foreign transaction fees on payments or OFX Corporate Card purchases when spending from held currency balances in the Global Business Account and account holders can receive domestic funds into their Global Business Account (EFT, Direct Debit) at no additional cost.

Comparing OFX vs Wise.

As financial platforms both offering FX-centric and expense management tools for businesses, you may be wondering which business account between OFX and Wise is best suited for you and your business. Despite their similarities, OFX and Wise also have their differences, particularly around business plan options, bill automation, and card rewards.

| OFX | Wise | |

|---|---|---|

| Publicly listed on the Australian Securities Exchange (ASX) | Yes | No |

| Free plan with no minimum requirements | Yes | No |

| Corporate cards | Yes | Yes |

| FX solutions for 30+ currencies at competitive exchange rates | Yes | Yes |

| Accounting software integrations | Yes – Xero and Quickbooks | Yes – Xero and Quickbooks |

| 24/7 service | Yes | Yes |

| Spend management tools | Yes – with Full Suite | Limited |

| AP and bill automation | Yes – with Full Suite | No |

| Batch payments | Yes | Yes |

| Budgeting and approval policies | Yes | Limited |

| Ability to earn interest | No | Yes |

| Rewards on credit card payments | Yes | No |

| Multiple plan options | Yes | No |

The key difference between Wise Business and the OFX Business Account is the spend management tools available on each platform. While both companies offer great FX transfer services, OFX offers more expense management tools for businesses, including AP and bill automation, customisable approval workflows, and budgeting.

The OFX platform also has a Pay by Card functionality where businesses can earn reward points for everyday business payments made from linked Amex, Visa and Mastercard credit cards. Below are some other noteworthy differences between OFX and Wise.

Customer support.

When it comes to customer support, both OFX and Wise offer 24/7 support via phone and email. However, OFX guarantees speaking to a human specialist, whereas Wise offers a help and support page where users can find answers to frequently asked questions. Depending on your business account plan, OFX may also offer a dedicated accounts manager as a direct channel of customer support and communication for businesses.

Security.

Both OFX and Wise implement security measures to ensure the safeguarding of your business finances. In Australia, OFX is ASIC and AUSTRAC regulated and ISC 27001:2022 certified. Wise employs bank-level encryption methods to keep your sensitive information secure. Both organisations also remind users of fraud prevention and protect your personal data.

Transfer speeds and processing times.

It’s imperative for global businesses to be able to transfer money quickly. Luckily, both OFX and Wise have generally quick transfer speeds and processing times, with most major currency payments finalised in one or two business days. OFX also offers same-day payments for major currency routes.

Exchange rates.

Wise exchange rates often look more competitive due to being matched with the interbank rate, however Wise make money on their fees so best check the final amount you actually pay, especially if paying by card, which can increase the costs. You may save more, particularly when transferring large amounts of money, with OFX.

Business account accessibility.

You’ll be able to access both OFX and Wise business platforms via web browsers as well as through each respective mobile app. This means you can monitor and manage your business finances 24/7, wherever you have internet. The OFX platform also features multi-user access while letting specific account holders manage roles and permissions, to ensure your business account is accessible to the right people.

Making payments is also simple with OFX business debit cards and Wise corporate cards, as you can pay in multiple currencies both in-store and online.

Customer reviews.

Both OFX and Wise have positive Trustpilot review scores, with OFX averaging a 4.4 star rating out of approximately 10k reviews, and Wise averaging a 4.3 star rating out of approximately 260k reviews (true as of July 2025). The high customer ratings means businesses are generally quite satisfied with services from both organisations, making them both great choices for your own business’ financial management needs.

Why more businesses are choosing OFX.

OFX’s diverse range of service offerings from FX transfers to financial management tools, makes it one of the stand-out options when choosing a business account platform to help grow your business.

OFX offers an all-in-one global business account that’s built to help businesses expand and operate globally without the hassle. With one platform for greater visibility and control, you can track every expense in one place, control your spending before it happens and have 24/7 support without high monthly fees. Manage your business efficiently with technology that helps drive growth.

Achieve more with the OFX Global Business Account:

- Open domestic and multi-currency business accounts within minutes

- Spend like a local with a corporate card that saves on currency conversions

- Track all your expenses in one place & control spend before it happens

- Gain more budget control with employee and company, physical and virtual cards

- Save time with built in accounts payable invoice automation

- Pay invoices and employees in bulk with batch payments

- Get 24/7 support from real people who understand your needs

Don’t let traditional banking slow you down. Open a Global business account with OFX and see how our all-in-one platform can transform your business.

Get started for free with the Standard plan, or invest in the Full Suite plan for $25/month (per user) to gain access to spend management tools, accounts payable automation, and advanced accounting software integrations. For more information, check out our pricing plans.

Open an OFX Global Business Account

Make international payments easy

Sources

- https://wise.com/au/business/receive-money

- https://wise.com/au/business/invoices

- https://wise.com/au/business/card

- https://wise.com/au/business/accounting-software

- https://wise.com/gb/business/manage-team

- https://wise.com/au/business/interest

- https://wise.com/au/pricing/business

- https://www.ofx.com/en-au/business/global-business-account/

- https://www.ofx.com/en-au/business/international-payments/

- https://www.ofx.com/en-au/business/corporate-cards/

- https://www.ofx.com/en-au/business/fx-solutions/

- https://www.ofx.com/en-au/business/batch-and-payroll-payments/

- https://www.ofx.com/en-au/business/control-hub/

- https://www.ofx.com/en-au/business/spend-management/

- https://www.ofx.com/en-au/business/ap-automation/

- https://www.ofx.com/en-au/business/integrations/

- https://www.ofx.com/en-au/business/unlock-card-reward-points/