Managing multiple business entities — whether local branches, regional offices, or international subsidiaries — presents unique challenges for finance teams. You have varying tax regulations, currency exchange considerations, compliance requirements, and financial workflows to juggle.

Without the right system in place, you quickly run into financial inefficiencies, blow through budgets, and face serious security risks.

You ultimately need real-time visibility, financial control, and operational efficiency across all entities. And ideally without costing you time, effort, and resources.

Traditional financial tools, spreadsheets and disconnected accounting systems just aren’t fit for this purpose. They lack the agility required to provide a single, consolidated view of company-wide financial activities. This in turn leads to budget overruns, unauthorised transactions, compliance issues, and difficulty in forecasting financial performance across multiple locations.

In this article, we share the smarter way to manage multiple entities as a single finance team. You’ll get the simple steps to keep everything in check.

What is multi-entity management?

Multi-entity management involves supervising and coordinating the financial records and performance of various branches, divisions, or subsidiaries within a single organisation. These entities could be local offices, distinct arms of the business, or entirely different companies falling under an umbrella group.

Finance leaders must ensure cohesive operations, unify financial reporting, and maintain oversight across separate legal entities – all while empowering each unit to be independently effective.

Core elements of effective multi-entity management include:

- Unified financial consolidation

- Central oversight, with local autonomy

- Efficient inter-entity transactions

- Optimised use of international currencies

- Consistent operational procedures across entities

- Integrated risk and compliance governance

Whether you’re growing your business across borders or handling several local branches, developing strong multi-entity management practices is essential. You want smooth financial workflows, strict adherence to legal requirements, and consistent reporting across the entire organisation.

Common challenges with managing multiple entities

It’s always going to be easier to manage one business than a handful. And while commercially connected, a handful of entities isn’t too different from a handful of companies. For finance teams, the most common issues include:

- Fragmented financial data: Without a centralised system, finance teams have to switch between platforms, creating data silos and increasing the risk of errors.

- Lack of spend visibility: Without real-time tracking, finance leaders struggle to monitor expenses across departments, suppliers, and subsidiaries. And trying to do this in real time is virtually impossible.

- Manual approval bottlenecks: Processing expenses through manual workflows leads to delays and increases administrative burdens for finance teams.

- Budget overspending: Without set spending limits per entity or department, businesses risk uncontrolled expenses, impacting cash flow.

- Security & compliance risks: With multiple employees managing spending, the risk of unauthorized transactions, fraud, and non-compliance increases.

These challenges bedevil finance teams worldwide. But with the right spend management tools in place, you can ensure financial transparency, compliance, and efficiency.

Most importantly, your finance team can focus on strategic growth rather than day-to-day administrative work.

How a spend management platform solves these challenges

A spend management platform is a centralised solution that lets businesses track expenses, set role-based permissions, automate approvals, enforce spending policies, and monitor budgets across multiple business entities – all in real time.

This is more than just a financial tracking tool. It’s a strategic enabler that helps you operate efficiently while maintaining financial control.

As a result, you get:

- Seamless multi-entity control: Instead of managing different financial systems, you control all entities, locations, and departments from one login and one dashboard.

- Stronger financial oversight: Gain complete visibility into how every entity, team, or location spends money in real time. Identify inefficiencies, optimize budgets, and find opportunities to improve profitability.

- Time-saving automation: Automate payment approvals, expense tracking, and reconciliations. Free up valuable finance team time to focus on growing the business.

- Improved security & compliance: With role-based access control, real-time fraud detection, and audit-ready financial tracking, you can protect against unauthorized transactions while ensuring compliance with local and international regulations.

- Better budgeting for growth: By setting spend limits, automating reporting, and tracking expenses in real-time, businesses can confidently scale without financial uncertainty.

Key features for managing multi-entity business operations

Spend management is truly a no-brainer for any finance team tasked with controlling spend across entities. So when you’re looking at your potential options, these are the features and capabilities to prioritise.

1. Centralised financial oversight across all entities

First step: stop switching between entity bank accounts, payment systems, and financial records. A spend management platform consolidates all entities under one dashboard, letting finance teams:

- View spending activity across all locations in real-time

- Track departmental budgets, vendor payments, and team expenses without logging into multiple systems

- Ensure consistency in financial reporting across different branches or regions

Example: A retail company with locations in five different countries can monitor expenses for each store, while maintaining a single source of truth for financial data.`

2. Real-time budget controls to prevent overspending

Setting team budgets is crucial to maintain financial discipline, especially across multiple locations. A spend management platform provides:

- Pre-set budgets per entity, team, or department to avoid excessive spending

- Automated alerts when teams or locations approach spending limits

- Customisable budget rules that align with business objectives

Example: A manufacturing company can allocate specific budgets to each factory. Receive real-time alerts when one location exceeds its spending threshold.

3. Automated approval workflows for faster decision making

Traditional approval processes can be slow, often relying on manual spreadsheets, email chains, or paper-based requests. A spend management platform:

- Automates approval workflows to ensure expenses are reviewed and authorized before payment

- Lets finance teams set custom approval levels based on transaction amount, department, or region

- Reduces administrative workload by eliminating manual processing of expense requests.

Example: A software company with multiple offices can automate approvals for business travel expenses, ensuring that all employee travel costs align with company policies before payments are made.

4. Role-based permissions & unlimited user access

Security is a top concern when managing multiple business entities. A spend management platform lets you:

- Assign different roles and permissions to employees, finance teams, and department managers

- Ensure only authorised personnel can approve or process transactions

- Provide unlimited user access without compromising financial security

Example: A global marketing agency can grant regional finance managers access to local transactions, while restricting senior executives to high-level budget oversight across all regions.

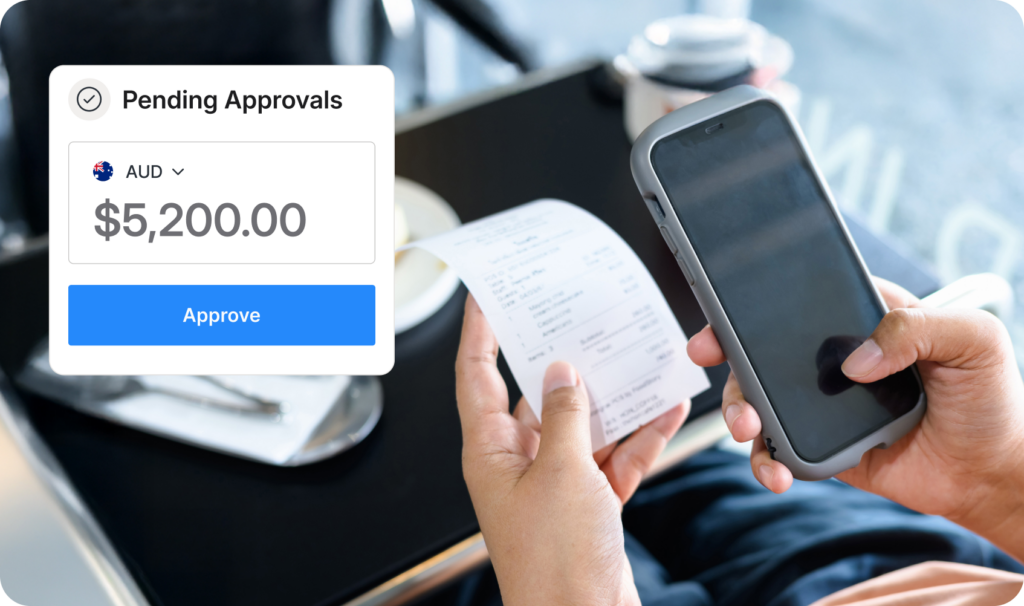

5. Multi-currency & international payment support

For global businesses, making payments across multiple currencies can increase costs and create FX exposure risks. A spend management platform that supports multi-currency transactions helps businesses:

- Make payments in local currencies without unnecessary conversion fees.

- Reduce FX risk with competitive exchange rates and hedging options.

- Simplify international vendor payments while ensuring compliance with local regulations.

Example: A logistics company operating in Australia, Europe, Asia, and North America can make supplier payments in AUD, USD, GBP, EUR from one platform, reducing FX conversion fees.

Scale business operations with a spend management platform

Whether you’re dealing with local offices or global branches, managing entities can quickly become complex without the right systems in place. Without visibility and control, it’s easy for budgets to slip, approvals to get delayed, and compliance to become a challenge.

Traditional tools often don’t cut it. Manually tracking expenses across entities, juggling disconnected systems, and relying on outdated reports only add friction and increase risk.

A spend management platform gives you a centralised, real-time view of spending across all locations. You can automate approvals, set clear budget limits, and keep every transaction secure and audit-ready – without the back-and-forth.

Whether you’re growing into new markets or managing teams across regions, this kind of platform simplifies operations, reduces admin work, and helps you scale with confidence. It’s not just about saving time – it’s about gaining control where it matters most.

Take control of your financial operations. Book a free demo to see the OFX Global Business Account in action.

This article is purely for informational purposes only and should not be treated as advice. OFX will not be held liable for any losses incurred as a result of individuals or businesses relying on the information contained in this article

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. UKForex Limited (trading as “OFX”) and its affiliates make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.