With two in three Australian businesses eyeing global growth, access to smart international banking solutions is no longer a luxury. It’s a necessity. If you’re importing goods, paying global suppliers, or receiving overseas revenue, the right international business bank account can simplify foreign exchange, reduce costs, and bring efficiency to your operations.

While traditional banks still play an important role in international transactions, many Australian businesses are switching to modern fintech alternatives. These platforms often offer multi-currency accounts with lower transaction fees, better foreign exchange (FX) rates, 24/7 human support, and more business specific features to help save time on managing payments. This makes them ideal for modern businesses operating beyond borders.

In this guide, we’ll explain what makes a bank account truly “international,” compare top providers, and show why an OFX multi-currency account is a leading choice for Australian businesses with global ambitions.

Summary:

• What Makes a Business Bank Account Truly “International”?

• Traditional International Bank Accounts vs. Fintech Global Accounts

• Key Features to Look for in an International Business Bank Account

• Top International Business Bank Accounts in Australia

• Benefits of an International Business Bank Account

• Choosing the Right Account for Your Business

• Try the OFX Global Business Account for free

• Best International Bank Account FAQs

What Makes a Business Bank Account Truly “International”?

A true international business account goes beyond basic banking. Unlike standard domestic accounts built for local transactions, international accounts are purpose-built for global trade. They let businesses operating in Australia send, receive, and hold multiple currencies without excessive FX fees. This makes cross-border payments smoother, faster, and often cheaper.

Essential Features of an International Business Bank Account

- Multi-Currency Capabilities

Hold, manage, and transfer multiple currencies in one place. Avoid forced conversions and manage exchange rate exposure more strategically. - Low or Zero Foreign Transaction Fees

The best accounts minimise costs when sending or receiving overseas payments, protecting profit margins. - Simple Cross-Border Transfers

Send and receive international payments quickly with competitive FX rates and low transfer fees. - Global Accessibility & Mobile Banking

Manage your account from anywhere with easy-to-use mobile apps and online platforms. - No Residency Requirements

Many accounts allow you to open and operate them regardless of your residency, which is great for remote or global teams. - Worldwide ATM Access

Withdraw local currency while travelling or operating overseas, often with reduced fees. - Security & Compliance

Top providers ensure strong data protection, fraud monitoring, and compliance with global financial regulations.

If you’re aiming to manage multiple currencies, cut foreign fees, or access funds while abroad, an international account helps you stay in control and move money with ease, something domestic accounts simply weren’t built to do.

Traditional International Bank Accounts vs. Fintech Global Accounts

Big banks like NAB, ANZ, Westpac, and Commonwealth Bank have long led international banking in Australia. They offer foreign currency accounts, international transfers, and FX services. However, they often do so with higher FX margins, international transaction fees and limited integration with other financial tools.

Fintechs such as OFX offer a more competitive, flexible alternative. While they operate under Australian Financial Services Licences (AFSLs) in Australia, they often provide more transparent pricing and agile multi-currency solutions.

Modern businesses want speed, control, and lower costs, without the friction of legacy systems.

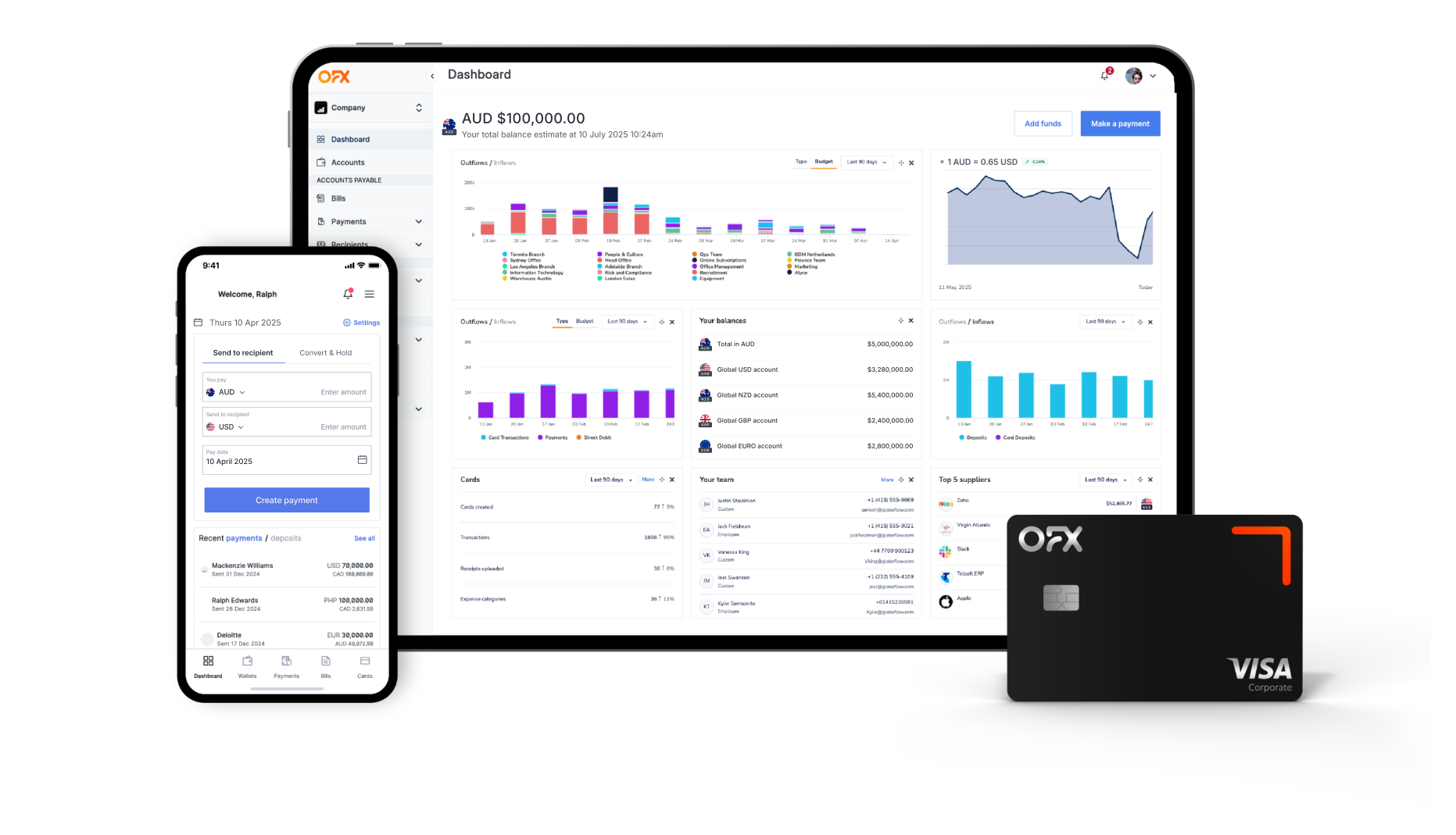

OFX Global Business Account

Receive, hold, convert and send funds across a wide range of currencies, reduce costs and gain greater control over your international payments.

Key Features to Look for in an International Business Bank Account

Multi-Currency Capabilities

A cornerstone of any international business account is the ability to hold and manage multiple currencies simultaneously. This feature allows businesses to:

- Avoid unnecessary conversions by transacting directly in the currencies of key markets, helping protect margins and reduce exchange rate volatility.

- Optimise foreign exchange through access to live market rates and tools to lock in favourable rates or schedule automated conversions.

- Spend more flexibly, particularly with multi-currency debit cards that let teams pay overseas expenses in the local currency, without the usual card fees.

- Handle large payments efficiently, with the infrastructure to support high-value international transactions securely and without manual workarounds.

These capabilities provide much-needed control and predictability in cross-border transactions, especially for businesses with recurring international payments or diverse revenue streams.

Transparent Transaction Fees

One of the biggest challenges in international banking is understanding the true cost of cross-border activity. Look for providers that offer:

- Clear international transfer fees, so you know exactly what you’ll be paying before initiating a transaction.

- Upfront ATM withdrawal costs, both domestically and abroad, to avoid surprises while travelling or operating in overseas markets.

- Low or no monthly account fees, and beware of minimum balance requirements or hidden charges that can eat into profitability.

Transparency isn’t just about fairness, it’s about being able to forecast costs accurately and manage cash flow with confidence.

Global Accessibility

Your international account should be as mobile as your business. The best accounts today offer:

- Remote account opening with digital onboarding, and no need to visit a branch or send paperwork by post.

- Access to local payment rails such as ACH (US), SEPA (EU), or BACS (UK), enabling faster, lower-cost transactions with global partners.

- Seamless platform access via mobile apps and desktop dashboards, letting you manage funds, track transactions, and view real-time balances from anywhere.

For remote teams, distributed operations, or businesses with offshore clients and suppliers, global accessibility is no longer a luxury, it’s essential.

Business-Critical Considerations

Beyond basic banking, your international account should actively support your business operations. Key considerations include:

- Reliable customer support, ideally 24/7 human phone support and responsive across time zones, so help is available when and where you need it.

- Strong security protocols, including two-factor authentication, encryption, and fraud detection, to protect your funds and data.

- Software integration with accounting platforms like Xero, QuickBooks and Employment Hero to automate reconciliation and reduce admin.

- Built-in expense management tools, including approval workflows, transaction categorisation, and budget insights to streamline financial control.

A good international account should be an extension of your finance team, not just a place to store money.

Top International Business Bank Accounts in Australia

Below is a high-level comparison of Australia’s leading international business bank accounts, helping you evaluate their key features, fees, and suitability for your international business needs.

Commonwealth Bank Foreign Currency Account

Commonwealth Bank (CommBank) offers foreign currency accounts that are designed to meet the needs of businesses engaged in international business.

Key Features1:

- Hold funds in over 14 major currencies, including USD, EUR, GBP, and JPY.

- No monthly account fees, reducing ongoing costs.

- Interest may be earned on certain currency balances, subject to eligibility.

- Integrated with NetBank and the CommBank app for online management.

Limitations:

- Each account holds a single currency; multiple accounts are needed for multiple currencies.

- International transfer fees apply.

Fees Snapshot2:

- Outgoing international transfers: Up to AUD $30.

- Incoming foreign transfers: Up to AUD $11.

Best For: Businesses already banking with CommBank seeking basic international transaction capabilities.

Westpac Foreign Currency Account

Westpac Group serves over 12.7 million customers through a portfolio of brands including St. George Bank, Bank of Melbourne, BankSA, BT, and RAMS. Its Business Foreign Currency Account enables businesses to make and receive payments in foreign currencies while choosing the optimal time to convert funds into Australian dollars.

Key Features3:

- Hold and transact in 12 major currencies online, including USD, EUR, GBP, JPY, and SGD.

- Open and manage your foreign currency account alongside other accounts via Westpac Online Banking.

- Choose when to convert foreign currency into AUD to better manage exchange rate risk.

- $0 monthly account fees help reduce overhead costs.

Limitations:

- Additional application steps may be required to access currencies beyond the 12 offered online.

- Very low or no interest is paid on positive account balances.

- A deposit maintenance fee may apply depending on the currency and balance.

Fees Snapshot2:

- Outgoing telegraphic transfers (via Westpac Online Banking): AUD or foreign currency: $20

- Outgoing telegraphic transfers (via branch/over the counter): $32

- Outgoing telegraphic transfers (via Corporate Online): $20

- Incoming telegraphic transfers (AUD or foreign currency): $12

- Monthly account fees: $0

Best For: Westpac customers needing a convenient way to manage foreign currency transactions alongside domestic accounts, with flexible conversion timing and online access.

NAB Foreign Currency Account

NAB serves approximately 8.5 million retail and business customers across Australia and New Zealand, with affiliated services offered through UBank and the Bank of New Zealand. Its Foreign Currency Account is designed for businesses that frequently send or receive payments in foreign currencies.

Key Features5:

- Hold and transact in 16 major global currencies, including USD, EUR, GBP, and JPY.

- Flexibility to convert funds when it suits your business needs.

- No monthly account fees, helping you minimise ongoing costs.

- Integrated with NAB Connect for streamlined international transfers and FX management.

Limitations:

- Interest is only paid on balances exceeding USD $5,000.

- Each currency requires a separate bank account.

Fees Snapshot6:

- International transfers sent (with currency conversion via NAB Connect): $0

- International transfers sent (in AUD or from a foreign currency account in the same currency via NAB Connect): $20

- International money transfers received: $0 to $35 per transaction

- Monthly account fees: $0

Best For: Businesses managing regular foreign currency transactions looking for a traditional banking partner with no monthly fees and flexible conversion timing.

ANZ FX Online

ANZ’s FX Online platform is tailored for businesses with significant foreign exchange needs, offering advanced tools for managing international transactions.

Key Features7:

- Access to over 270 currency pairs for trading.

- Real-time FX trading with online confirmation and deal history tracking.

- Role-based access controls for enhanced security and workflow management.

Limitations:

- A minimum annual FX volume of AUD $250,000 is required.

- Pricing is quote-based, with fees varying per transaction.

Fees Snapshot8:

- No setup or maintenance fees

- Transaction fees apply based on usage.

Best For: Mid-to-large businesses with high foreign exchange volumes requiring comprehensive FX management tools.

OFX Global Business Account (Non-Bank Alternative)

The OFX Global Business Account offers a fintech solution tailored for businesses requiring international payment capabilities without the constraints of traditional banking.

Key Features7:

- Multi-Currency Account: Hold and manage funds in over 30 currencies, including local bank details in AUD, USD, GBP, EUR, and CAD, facilitating seamless international transactions.

- Multi-Currency Corporate Card: Issue virtual and physical corporate cards linked directly to your OFX account, enabling your team to spend and withdraw money in held currencies without additional FX fees.

- Batch Bulk Payments: Pay thousands of vendors, suppliers and employees in multiple currencies with automatic reconciliation in your Xero or QuickBooks accounting software.

- Large Payments Support: With no enforced maximum transfer limits you can send as much currency as you need, fast. Custom pricing available for clients with large and ongoing FX transfers.

- Spend and Expense Management: Utilise built-in tools for expense tracking, approval workflows, budget setting, and accounts payable automation, simplifying spend management.

- Accounting Integration: Seamlessly integrate with accounting platforms like Xero, allowing for efficient reconciliation and financial reporting.

- 24/7 Customer Support: Access dedicated phone support from real people around the clock, ensuring assistance is available whenever needed.

Limitations:

- Non-Bank Status: OFX is not a bank, so funds are not covered by government guarantee schemes. In Australia, OFX is registered as a financial service provider and regulated by ASIC (AFS Licence number 226 484). Learn more about how OFX keeps your money and information secure here.

Fees Snapshot8:

- Account Fees: No setup or monthly fees for the standard Business Plan (up to 3 users). The Business Plus Plan offers additional features for AUD $15 per user per month.

- Transaction Fees: International payments via SWIFT cost AUD $10, but this can be avoided by using OFX’s local payment networks. Receiving funds via SWIFT costs AUD $5, which is also waived if local account details are used.

Best For: Businesses seeking a flexible, cost-effective international payment solution with robust support, advanced expense management tools, and strong integration capabilities.

Benefits of an International Business Bank Account

The right international business account can unlock efficiency, cost savings, and flexibility for companies trading across borders. Key benefits include:

- Simplified global transactions

Send and receive payments in foreign currencies without constant conversions or manual workarounds. - Reduced FX exposure and risk

Hold funds in multiple currencies and choose when to convert, helping you manage rates more strategically. - Faster international payments

Cut down on delays with faster settlement times—ideal for meeting supplier terms and strengthening client trust. - Improved cash flow control

Greater visibility over incoming and outgoing international transactions makes it easier to plan ahead. - Stronger global relationships

Paying suppliers or receiving funds in their local currency helps reduce friction and build long-term partnerships. - More professional presence overseas

Having local account details in key markets can boost credibility with clients and partners abroad.

Choosing the Right Account for Your Business

Not every international account fits every business. When comparing providers, it’s important to consider:

- Currencies you use regularly

Does the provider let you hold multiple currencies in one place, or do you need separate accounts? - Typical FX volume

High-volume businesses may benefit from tailored FX tools, bulk payments, or automated conversions. - Local collection accounts

If you receive funds from clients in the US, UK, or EU, look for providers that offer local account details to avoid costly SWIFT fees. - Integration with finance tools

Platforms that connect with Xero, QuickBooks or Employment Hero can streamline reconciliation and reporting. - Ease of access and support

Can you manage your account online from anywhere? Is support available 24/7 and across time zones? - Transparency and cost structure

Look for providers with predictable fees and low FX margins, without hidden charges or account maintenance costs.

While traditional banks offer some of these features, they rarely deliver all of them in one place. That’s why more Australian businesses are turning to fintech alternatives that prioritise speed, flexibility, and transparency.

Why more Australian businesses are choosing OFX

OFX offers a modern alternative to traditional international business banking without the high FX fees. Here’s why so many Australian businesses are switching to OFX:

- No monthly fees: Keep operating costs down with a free-to-open, free-to-maintain business account on our free Business Plan.

- Competitive FX rates: Transparent pricing with no hidden markups means more value per transaction.

- Multi-currency accounts: Hold and manage 30+ currencies in one platform.

- Local account details: Receive funds in USD, GBP, EUR, and more as if you were a local with no international transaction fees.

- 24/7 support from real people: Get help when you need it, with human support available around the clock.

- Security and regulation: Regulated in over 50 jurisdictions, with enterprise-grade data protection.

- Smart integrations: Connect with Xero and QuickBooks accounting software.

Ready to simplify your global payments? See our business pricing or request a demo today and start managing international transactions with less admin, lower costs, and full control.

Best International Bank Account FAQs

How do I open an international business account in Australia?

You can apply through your chosen provider’s website. Fintechs like OFX offer intuitive digital onboarding, while traditional banks may require branch visits. You’ll typically need an ABN, identification documents, and basic business information to get started.

How do OFX exchange rates compare to the banks?

OFX offers competitive rates with low, transparent margins, often better than the FX rates provided by major banks. Because OFX doesn’t apply hidden markups, you may save significantly on high-volume or recurring international transfers.

What is the best international business transaction account?

It depends on your business needs. If you want lower fees, better FX rates, and 24/7 support, OFX is worth exploring. Businesses dealing with multiple currencies or requiring local account details often find OFX more flexible and cost-effective than traditional banks.

What are the top international bank & business accounts in Australia in 2025?

Here are some of the top international business accounts in Australia:

- OFX Global Business Account

- Commonwealth Bank Foreign Currency Account

- Westpac Foreign Currency Account

- NAB Foreign Currency Account

- ANZ FX Online

Is the OFX Global Business Account a bank account?

The OFX Global Business Account is not a bank account. It is a virtual global business transaction account and a non-cash payment facility. The account enables you to hold funds, pay and convert in different currencies and manage multi-currency accounts.

Looking for an alternative to your bank?

Sources:

1. https://www.commbank.com.au/business/international/international-payments/foreign-currency-accounts.html

2. https://www.commbank.com.au/content/dam/commbank/personal/apply-online/download-printed-forms/ADB1784.pdf

3. https://www.westpac.com.au/business-banking/international-trade/

4. https://www.westpac.com.au/content/dam/public/wbc/documents/pdf/bb/international-service-fees.pdf

5. https://www.nab.com.au/business/business-bank-accounts/specialised-accounts/nab-foreign-currency-account

6. https://www.nab.com.au/important-information/business/banking-fees-charges#5-international-payments

7. https://www.anz.com.au/business/international-foreign-exchange/foreign-exchange/anz-fx-online/

8. https://www.anz.co.nz/rates-fees-agreements/foreign-exchange-international/

IMPORTANT: This article was written in June 2025. The information is based on our online research at time of publication. The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. OzForex Limited (trading as “OFX”) and its affiliates make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog. If you would like to request updated information, please contact us at business@ofx.com. Please see our pricing pages for the most up to date OFX pricing and fee information.