Managing business expenses, locally and across borders, can become complex as your company grows. Corporate cards help simplify that, giving you more control, clearer visibility, and fewer surprises. They can be used to cover expenses like subscriptions, travel & entertainment and business materials, and give you more clarity on where the money’s going.

With a range of options on the market, you may wonder what corporate cards are best for your business. This guide covers the essentials: what corporate cards are, how they work, the different types available, and what to look for when it comes to fees, compliance and spend control.

We’ll also show you how the OFX Global Business Account and Corporate Card is a smart alternative to a corporate card from your bank.

Jump to:

• What are corporate cards?

• How do corporate cards work?

• Types of corporate cards, and what’s the difference?

• Corporate cards vs. business credit cards

• Features and benefits of corporate cards for business

• What to consider when choosing a corporate card program

• Benefits of using corporate cards for expense management

• Corporate cards and global business: What to know

• OFX Corporate Cards

• FAQs

What are corporate cards?

A corporate card is a payment card issued to employees on behalf of their company. It can be used to pay for approved business expenses such as travel, accommodation, software, subscriptions, office supplies and other operational costs.

Instead of asking employees to pay upfront and file their expense claims, corporate cards simplify the process. It means faster payments, less paper and guesswork, and better expense tracking across your teams, departments, and offices around the world.

How do corporate cards work?

Corporate cards give your team the ability to pay for what they need, without asking them to cover the cost upfront. For flights, fuel, accommodation, client dinners, business materials and other work-related expenses, your staff can pay with a card that’s issued by your business, so there’s no need for out-of-pocket spending or waiting weeks for reimbursement.

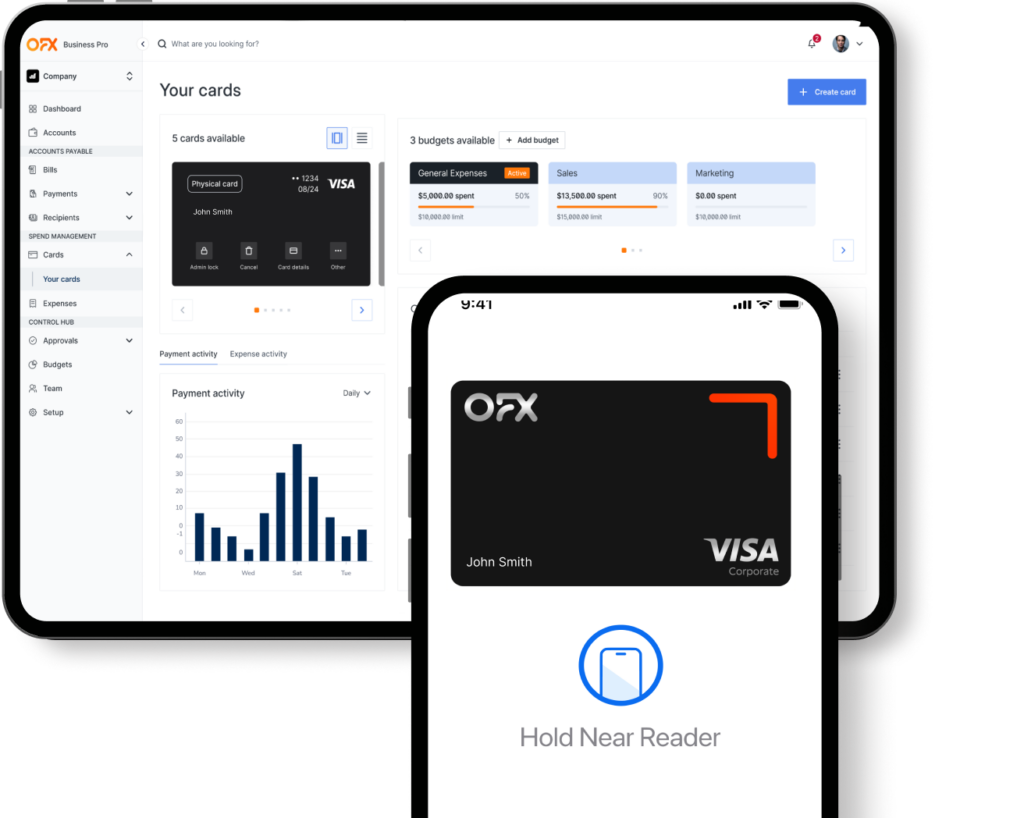

Your finance or admin team can manage the cards through an online dashboard, where they set spending limits, control where cards can be used, and keep an eye on the transactions as they happen. If a card’s lost or no longer needed, you can freeze or cancel it instantly.

Most corporate card programs, OFX included, come with smart expense management tools. Your team can snap photos of receipts and tag expenses on the go, while you get one clear view of company-wide spend. It all adds up to fewer surprises and better cash flow visibility, making the process of reconciling much quicker and simpler for everyone involved.

The key advantages of corporate cards are visibility and control. Finance teams can see spending as it happens, approve purchases, and set policies to prevent unauthorised transactions.

OFX Corporate Card

Gain greater control and visibility by managing your domestic and international expenses and approvals all in one place.

Types of corporate cards, and what’s the difference?

There are several types of corporate cards, and each has its pros and cons.

- Corporate credit cards: They allow businesses to borrow funds to cover expenses, with repayment typically required monthly. Ideal for well-established companies with good credit, and they may offer perks like cashback, rewards or travel insurance.

- Corporate debit cards: These cards are linked directly to a business account, so employees can only spend the available balance. That makes it easier to control spend and avoid interest or late fees. Debit cards are ideal for SMEs or fast-growing businesses that want more control.

- Prepaid corporate cards: These are preloaded with a specific amount of money and not linked to a bank account. They’re useful for managing discretionary spending or setting fixed budgets for contractors or events.

- Charge cards (purchasing cards or P-cards): Similar to credit cards, but the balance must be paid off in full each month. They are best suited to large organisations with strong cash flow.

- Virtual cards: These digital cards can be generated instantly and used online or via mobile wallets. No plastic needed. They’re especially useful for one-off purchases, remote teams, or assigning to specific subscriptions or departments.

Corporate credit cards vs. business credit cards

You’ll often hear the terms corporate (credit) card and business credit card used interchangeably, but they serve different needs. Choosing the right one depends on the size and structure of your business.

- Business credit cards:

A business credit card works much like a personal credit card, giving small businesses access to credit with a set spending limit and APR terms. But unlike corporate credit cards, business credit cards may require an individual, often the business owner, to be personally responsible if payments aren’t made. They typically come with perks like cashback or rewards, however they don’t offer much in the way of spend controls or integration features. They’re a good starting point for a one-person operation or if you’re just beginning to manage business expenses separately from your personal finances. - Corporate credit cards:

A corporate credit card is designed for growing or established businesses that need to manage spending across multiple employees, departments or locations. They allow employees to make business purchases while offering spend control features such as expense management and benefits like cashback, rewards and higher credit limits. Liability typically sits with the business, not the individual, which simplifies compliance and accounting.

OFX Corporate Card

At OFX, our Corporate Card is a corporate debit card that draws from available funds in your OFX Global Business Account which helps you stay on budget while avoiding debt.

It’s ideal for managing team expenses, setting clear limits, and tracking spend in real time. With features like virtual cards, built-in approvals and accounting integrations, it gives finance teams better visibility and oversight on spend.

If your growing business needs a smarter way to manage company spend, OFX Corporate Cards offer a level of structure, security, and efficiency that standard business credit cards can’t match.

Why not just use personal cards?

While some small businesses rely on employee or founder credit cards, this creates unnecessary risk:

- Lack of visibility: You may not see spend until weeks later.

- Out-of-pocket costs: Staff may hesitate to make essential purchases.

- Compliance issues: It’s harder to enforce policies or track spend.

- Missed savings: You may miss out on volume discounts, FX tools, or better reporting.

Corporate cards solve these problems by making it easier to separate business and personal expenses while streamlining approvals, reporting and reimbursement.

Features and benefits of corporate cards for business

| Feature | Benefit for your business |

| Instant expense tracking | Gain real-time visibility into spending, so you can manage cash flow with clarity and confidence. No more guessing where the money’s going. |

| Reduced admin time | Say goodbye to chasing paper receipts and processing endless reimbursements. Free up your team to focus on the work that matters. |

| Employee empowerment | Staff can make necessary purchases directly, without waiting around for reimbursements or out-of-pocket hassles. |

| Spend control tools | Easily set spending limits, block certain merchant types, and monitor all transactions in real-time to stay in control. |

| Detailed spend reporting | Get clear insights by team, project or individual, so you can make smarter budgeting and financial decisions. |

For a more detailed breakdown of the best bank business accounts and their alternatives, check out our list below.

What to consider when choosing a corporate card program

When selecting a corporate card program, it’s important to look beyond the card type and think about how it fits into your broader financial operations. It’s about choosing a solution that fits your team, your systems, and the way your business runs.

Here are a few things worth weighing up:

- Assess your business’s unique needs

A small business might prioritise ease of use and low fees, while a growing company may need detailed reporting and integration with accounting systems like Xero or QuickBooks. Consider your monthly transaction volumes, average spend per purchase, and which departments will use the cards. Compatibility with your existing tech stack, like your ERP or expense management software, can reduce manual tasks and simplify reconciliation. - Weigh up the selection criteria

Look at card fees and transaction costs, spend controls, reporting features, and available perks like cashback or travel rewards. Every card program comes with its own cost structure, so it pays to dig into the detail. Look out for annual fees, late payment penalties, and foreign transaction charges, especially if your team travels or pays international suppliers. A card that looks cost-effective upfront might cost you more if the fees don’t suit your usage patterns. - Card controls and customization

The more you can tailor the program to your business, the better. Features like individual spending limits, merchant category restrictions, or the ability to pause or cancel cards instantly help you maintain control without micromanaging. It’s especially useful when issuing cards across multiple teams or locations. - Reporting and software integrations

A good corporate card should talk to your finance systems. Look for options that integrate with your accounting software or expense management tools. That means no more chasing receipts, no more manual reconciliations, and far more accurate, timely insights into how your business spends. - Responsive support

Things sometimes go wrong, and having responsive support from your provider can make a huge difference. Whether it’s a 24/7 helpline or a dedicated account manager who knows your business, make sure help is easy to reach when you need it. One of the things that sets OFX apart is that knowledgeable support from a real human is available when and where you need it. - Ease of implementation

Once you’ve chosen your corporate card program, implementation typically involves a few steps. You’ll need to gather documents, define spending policies, and identify your cardholders. After approval, you can configure your account settings, distribute cards securely, and onboard your team on how to use the cards and report expenses. System integration is the final piece. When you connect your cards with your existing expense platform, transactions will flow directly into your reports.

Benefits of using corporate cards for expense management

Corporate cards are about more than just convenience. They offer tangible benefits for finance teams, business owners, and employees alike:

Financial advantages

- Avoid interest and foreign transaction fees (with multi-currency debit cards)

- Gain better FX rates for international spend

- Improve working capital with delayed payments or credit options

Operational efficiency

- Track and reconcile expenses in real time

- Reduce time spent processing reimbursements

- Simplify month-end reporting

Greater control

- Set spending limits by team, cardholder, or project

- Block specific categories of spend

- Instantly cancel or freeze cards

Employee satisfaction

- No more out-of-pocket expenses

- Faster resolution of work expenses

- Less paperwork and fewer delays

Improved insights

- Spot trends and spending anomalies quickly

- Allocate budgets with real-time data

- Ensure policy compliance across teams

Corporate cards and global business: What to know

If your business operates internationally, it’s worth looking at a corporate card program that support multi-currency spend. Where traditional corporate cards often come with steep FX mark‑ups or international transaction fees, fintech providers like OFX stand out by offering better exchange rates and lower fees.

Look for:

- Cards that work across multiple foreign currencies

- Competitive exchange rates

- Cards that link to local currency balances

- No foreign transaction fees

This is especially useful for businesses paying overseas contractors, marketing in multiple markets, or managing international travel.

OFX Corporate Cards

At OFX, we offer smart corporate debit cards designed to make international spending simpler.

- Multi-currency functionality: Hold and spend in 30+ currencies from one account

- Company and employee cards: Issue cards to individuals or set up company-wide spending

- Fast, secure international payments: No converting until you’re ready

- Physical and virtual cards: Create and cancel cards instantly as needed

- Real-time spend tracking: Monitor spending by person, team or category

- Built-in expense management: Reduce admin and gain visibility

The OFX business debit card solution gives you the flexibility and control you need. The set-up is free, and you get local support from a real human when you need it.

Benefits of a linked corporate card and global business account

The OFX Corporate Card is connected to your Global Business Account, giving you full access to 30+ international currencies. You can convert funds in advance when exchange rates are favourable, helping you manage costs with confidence. It’s the easiest way to manage all your expenses and payments, in one easy platform. It’s simple, flexible, and designed to support your growing global business.

Final words on corporate cards

Corporate cards play a key role in helping growing businesses stay agile, accountable and in control of their finances. With smart spend limits, multi-currency capabilities and seamless integrations, they simplify the day-to-day while supporting long-term goals.

The right corporate card program can help you:

- Save time on manual processes

- Improve budgeting and compliance

- Empower employees while protecting your bottom line

- Stay on top of every spend, local or global

With the right tools and partner, you can streamline spend management and unlock better ways of doing business.

Get started for free today.

The saving lasts forever.

You have nothing to lose, and so much time and money to save. Your all-in-one control platform is ready. Start your free trial today.

Corporate Card FAQs

What is a corporate card?

The best business bank account for startups depends on your specific business needs and the kinds of banking services you’re looking for. For example, some banks only offer digital banking services while others have physical branches and ATMs.

Some bank accounts are also designed for startups, with small business growth programs that offer upskilling and networking opportunities. It’s important to compare the features of the business bank accounts and decide which is best for you.

How do corporate cards work?

Corporate cards are linked to your business account and come with built-in tools to help you manage spending. You can issue cards to employees, set spending limits, control which types of merchants are allowed, and track transactions in real time. At the end of each month (or billing period), your business receives a consolidated statement. Depending on the card type, you either pay it off in full or manage repayments over time.

Are corporate cards secure?

Security is a top priority when managing company spend, and modern corporate cards offer strong protection on multiple fronts. With advanced fraud detection, you can spot unusual activity quickly and act fast to protect your business. Built-in controls let you limit where and how each card is used, reducing the risk of misuse. Plus, clearer liability structures mean you know exactly where responsibility sits, which helps you stay compliant, minimise risk, and give your team the freedom to spend with confidence.

What’s the difference between a corporate card and a business credit card?

Business credit cards are usually designed for sole traders or small businesses and are often linked to the owner’s personal credit. Corporate cards are ideal for larger or growing companies with multiple employees. They offer better controls, more robust reporting, and are usually backed by the business’s credit or account, not the individual’s.

Can I get a corporate card if my business is small?

Yes. Many modern providers now offer flexible corporate card programs that scale with your business. Even if you’re not a large enterprise, you can access corporate debit cards or spend-management tools that give you the same level of control and visibility.

Do corporate cards help with expense management?

Absolutely. Corporate cards make it easier to track spending by team, project, or individual. Transactions sync directly with your expense management system, reducing manual data entry and making month-end reconciliation faster. That means less admin, more accurate reporting, and better financial oversight.

What happens if a corporate card is lost or stolen?

Most corporate card programs allow you to instantly freeze, cancel, or reissue cards through an online dashboard. This minimises downtime and risk. Some providers, including OFX, also offer virtual cards, which can be created or replaced on the spot, making it ideal for remote teams or urgent purchases.

Can I issue virtual corporate cards?

Yes. Virtual cards are increasingly common and can be created instantly for one-time or ongoing use. They’re especially useful for online purchases, project-specific budgets, or remote workers. You can still apply all the same controls, like spend limits and merchant restrictions, while keeping your program agile and secure.

How do I choose the right corporate card for my business?

It depends on your business size, spending habits, and systems. Think about how many employees need cards, what they’ll use them for, and how your team currently manages expenses. Look for a solution with low fees, strong controls, integration with your accounting software, and support when you need it. We’re here to help if you have any questions or concerns. Contact your local OFX specialist anytime.

How long does it take to get set up?

It varies by provider, but many corporate card programs can be up and running within a few days, especially if you already have a business account with them. You’ll typically need to provide business details, define spending rules, and onboard staff. A smooth onboarding experience can save you time and help your team start using the cards with ease.