How businesses are #betterfasterstronger

National study highlights how US businesses thrived during the COVID-19 pandemic

The COVID-19 pandemic and ensuing shutdowns turned the business world upside down, and some things will never go back to the way they were before. For many businesses, the repercussions of the pandemic were insurmountable, forcing them to shutter permanently. Others struggled but survived. And an even luckier segment of the business world is actually thriving in these unlikely conditions.

According to Better Faster Stronger, a survey of 600 small business owners, 97% of small business owners believe their business is stronger now than it was before the pandemic. When asked to define what “stronger” meant to them, 55% of SMB owners pointed to increased sales, 46% said overall revenue growth, and 40% cited streamlined operations.

Read the full report: Download the Better Faster Stronger Findings

Get in touch to learn how OFX can help you with your money transfer needs.

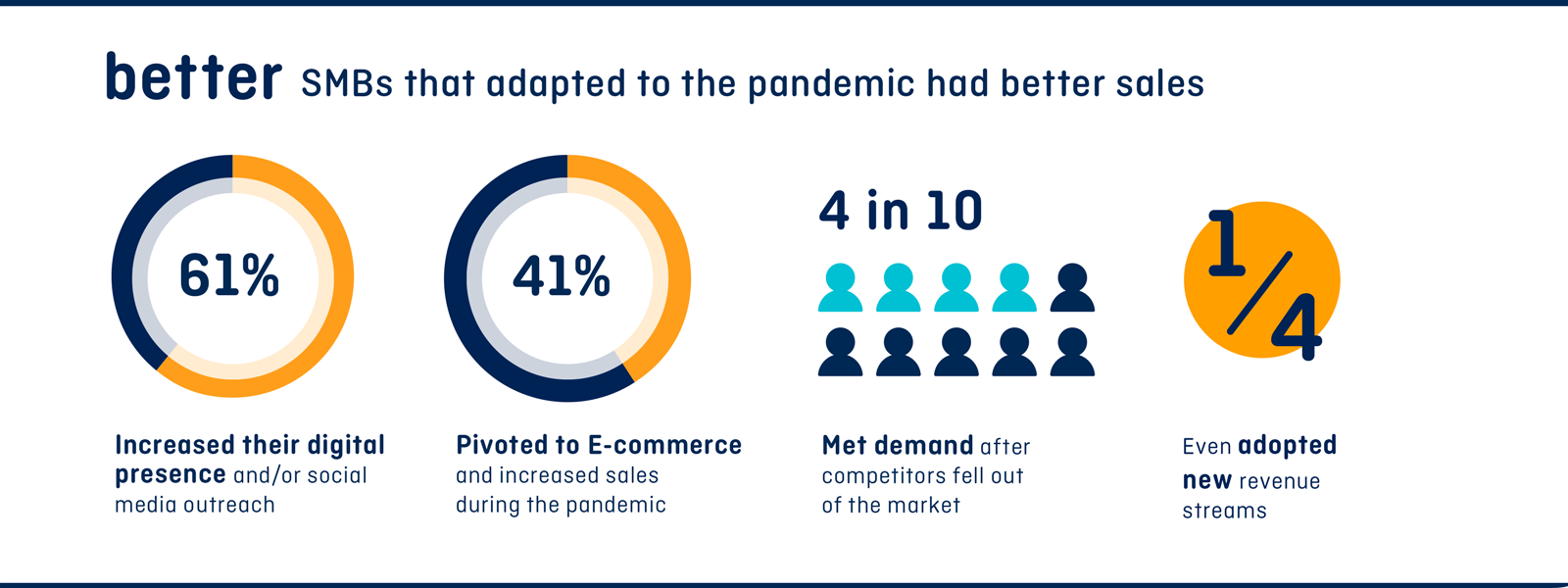

Better

How did these companies achieve success? In short, they adapted. 41% reported a pivot to e-commerce, 40% said that they met increased demand after competitors fell out of the market, and 61% reported increasing their digital presence and/or social media outreach. One quarter of respondents adopted new revenue streams (such as converting production to manufacture high-demand pandemic supplies like hand sanitizer and face masks). Nearly all the respondents, 92% of them, worked to actively expand their customer base, and 40% of respondents expanded to new overseas markets.

Why did they expand into new markets? 93% said international markets were ripe for penetration in their respective area of offerings. 88% said it presented the opportunity to gain access to a new customer base for their product/service offerings. 91% said operating in multiple markets created more of a security cushion in the event that one market slowed again due to COVID-19 lockdowns/restrictions. Business owners were challenged. They lacked understanding of customs, taxes, currency exchange, and the ability to accept currencies in local markets.

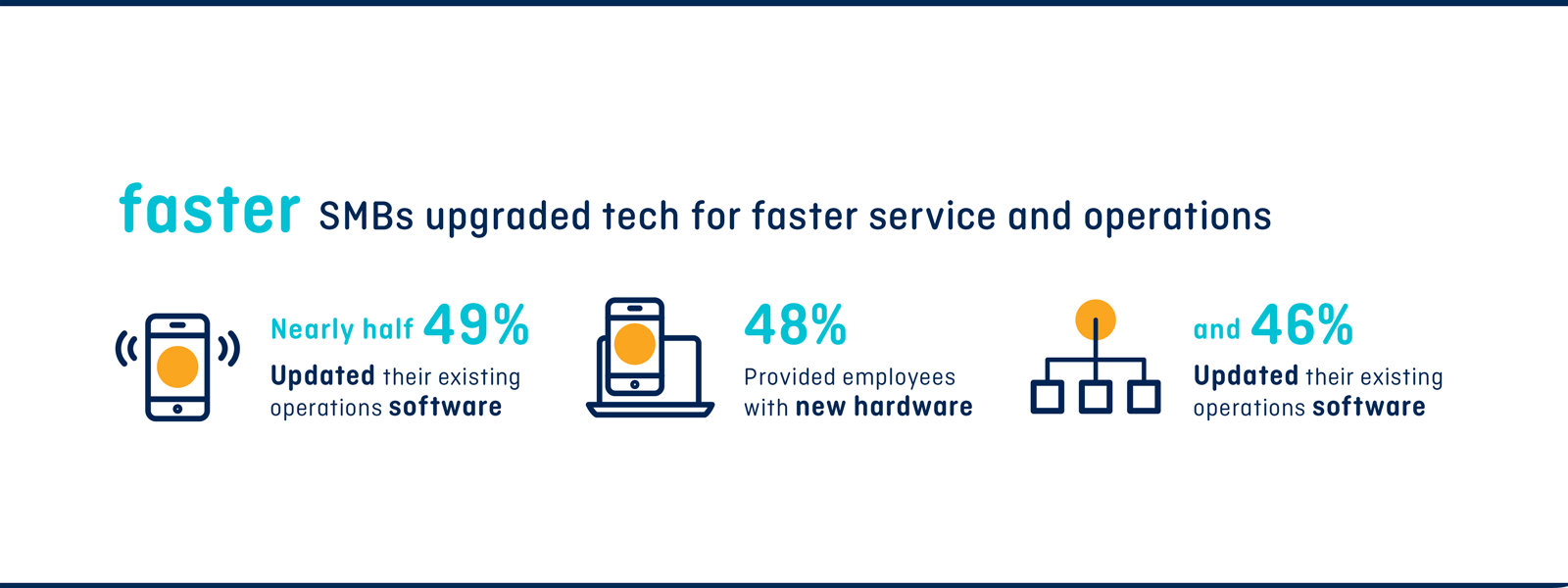

Faster

Companies that moved to adopt processes and operations came out of the pandemic faster then their competitors. To keep employees safe, 92% of SMB owners had to make significant changes to their work environment in response to the COVID-19 pandemic. 62% of business owners who were unable to go fully remote said that they invested in enhanced cleaning and safety measures, such as installing Plexiglass, and 78% of those agree that it helped with customer and employee retention. 32% of SMB owners reported that their business went fully remote. Nearly all respondents, 94%, reported that the change necessitated the adoption of new work processes. Despite some initial concerns, 83% of business owners saw an increase in employee productivity after moving to a remote environment.

Many found they needed a tech investment to keep up in a new remote world. 48% reported investments in new hardware, 49% updated both their financial and communications software, and 46% reported that they updated their operations software.

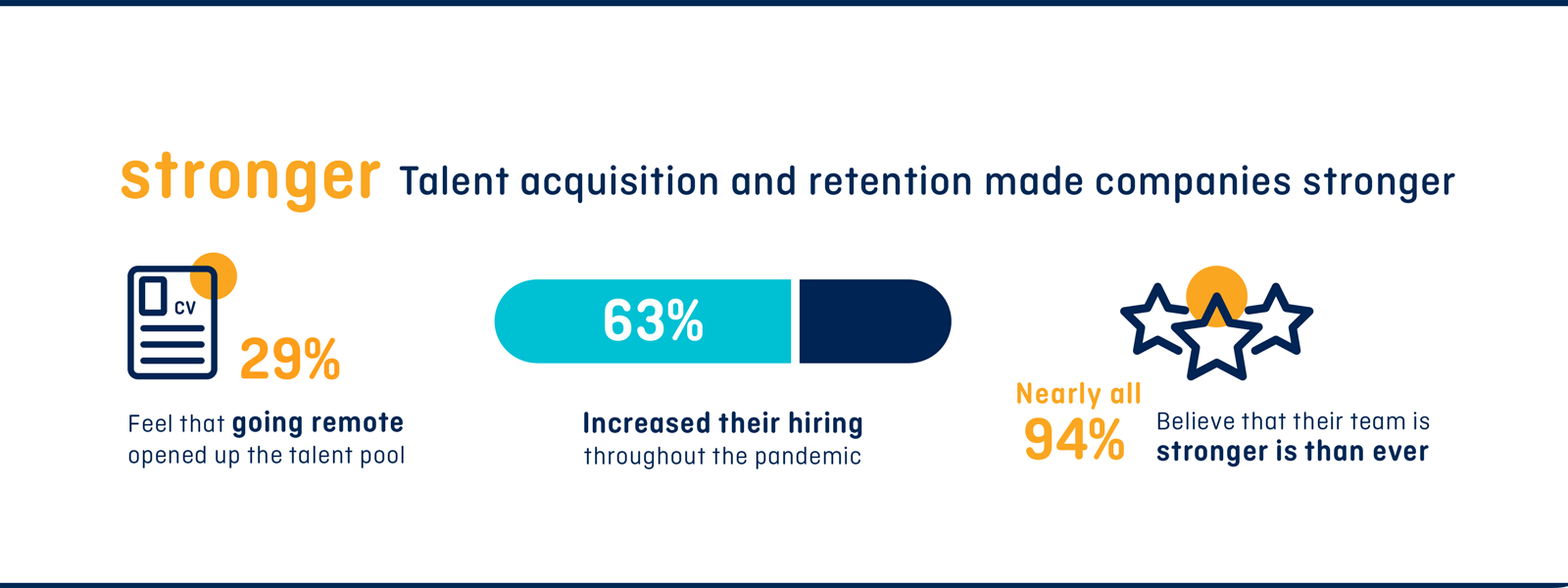

Stronger

Many businesses also came out stronger because of talent they employed, with 63% saying they increased their hiring during the pandemic. 29% of business owners reported that moving to remote work gave them access to a wider talent pool, and 94% felt that making it through the tumultuous year together made their team stronger than ever.

Flexibility was key to a stronger team. 54% of SMB owners agree that increased flexibility for their employees was an important area of focus during the pandemic, with 88% reporting a resultant increase in employee morale. 60% provided child care stipends or assistance to their employees. 68% say they introduced new wellness benefits to employees, 75% organized virtual team building activities, and 78% created opportunities for socially distant in-person activities. Due to these initiatives, 54% feel that their company culture has seen an overall improvement since the pandemic began.

SMBs are also seeing overall improvement when it comes to business. 88% stated their companies have economically recovered from the pandemic and another 70% said that they are now more conservative when it comes to invest in their business than they were previously. 88% feel more confident in their ability to manage a business now than they did prior to the pandemic, and 89% say that their business is better prepared now for any future crisis.

When you’re ready for international markets

Exchanging one currency for another as part of your business is far simpler than most small businesses realize. For example, one in five small businesses say that information on ways to structure payments would help them. Using a currency expert like OFX to help navigate currency markets can remove some of the complication. Businesses might be worried about the volatility of the markets but with the right strategy in place, there is an opportunity to improve exchange rates, manage cash flow and save.

The OFX Better Faster Stronger Survey was conducted online between March 1 and March 12. It reflects the opinions of 600 owners and executives of small and medium sized businesses in the US and has a margin of error of +/- 4 percentage points.

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. OzForex Limited (trading as OFX) and its affiliated entities make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.