In today’s global economy, having more than just a local bank account is a must for businesses. Whether you’re paying suppliers overseas, juggling multiple currencies, or looking to expand into new markets, choosing the right financial platform can make all the difference.

Cross-border payments reached AU$156 trillion in 2024, with projected growth of 8% annually through 2025. Yet 73% of businesses still struggle with traditional banking inefficiencies, losing valuable time and money on international transactions.1

Two popular digital alternatives to traditional banks that many businesses turn to are Airwallex and Wise.

Both are designed to simplify international money management, but each have their own unique strengths and features.

In the following sections, we’ll break down how Airwallex, Wise and OFX compare in key areas like pricing, features, currency support, and ease of use, helping you decide which might suit your business needs best.

Jump to:

• Who is Wise?

• Wise Business Account: Key features and benefits

• How much does Wise cost?

• Who is Airwallex?

• Airwallex Business Account: Key features and benefits

• How much does Airwallex cost?

• Airwallex V Wise: A side by side look

• Which platform is the best fit?

• Why more businesses are turning to OFX

• OFX key benefits at a glance

Looking for a better way to handle global business payments?

Who is Wise?

Wise (formerly TransferWise) is a fintech company specialising in international money transfers and multi-currency business accounts. It enables businesses to send, receive, hold, and convert funds in multiple currencies with transparent, mid-market exchange rates.

Wise Business Account: Key features & benefits.

Whether you’re paying overseas suppliers, receiving payments from global clients, or managing multi-currency accounts, Wise offers a fast, transparent, and cost-effective solution.

The table below outlines the key features and benefits to help you decide if Wise is a smart choice for your business.

| Feature | What is does2 | Benefit |

|---|---|---|

| Multi-currency account | Hold, send, and receive over 40 currencies | Manage international payments from one platform without juggling multiple bank accounts |

| Local account details | Get bank details in USD, GBP, EUR, AUD, and more | Receive payments like a local business, avoiding delays and high SWIFT transfer fees |

| Batch payments | Pay multiple suppliers or employees at once | Save time and reduce admin effort when |

| Business debit card | Spend online or in-store with real exchange rates | Control business expenses globally while avoiding hidden currency conversion costs |

| Quick setup | Fully online sign-up process | Get started quickly, with no need to visit a bank branch or deal with traditional paperwork |

| Basic expense tracking | Track card transactions within the app | Simple spend monitoring for freelancers or small teams |

| Accounting integrations | Connect with tools like Xero and QuickBooks | Automate bookkeeping and save time reconciling international transactions |

How much does Wise cost?

Here’s a quick rundown of what you can expect:

- Opening an account: Generally free for most users. Some countries might require a small verification fee, but overall it’s straightforward to get started without any upfront costs.3 However, there is a one‑time fee of AUD $65 to unlock local account details in multiple (23) foreign currencies.4

- Currency conversion: Wise charges from around 0.63% depending on currency pair, amount, etc. Mid‑market rate, you pay only a small fee when converting between currencies.5

- Receiving payments: Receiving money in major currencies usually won’t cost you a thing, making it easier to accept international payments without extra charges.6 SWIFT payments and some cross-border payments incur fees.7

- Sending money: There’s a small fee involved that depends on the currencies and where the money is going.8

- Card usage: There is a one‑time fee to order a Wise debit card.9 Regarding ATM withdrawals: you get 2 free ATM withdrawals per month up to a total of AUD 350. After that, withdrawals incur AUD 1.50 per withdrawal plus 1.75% on amounts over AUD 350 per month.10

OFX Global Business Account

Receive, hold, convert and send funds across a wide range of currencies, reduce costs and gain greater control over your international payments.

Who is Airwallex?

Airwallex is a global payments company that offers multi-currency accounts, international transfers, corporate cards, and expense management tools. It’s designed to help businesses scale globally with ease.

What they offer:

Airwallex Business Account: Key features & benefits.

See below for a summary of key features and benefits:

| Feature | What is does11 | Benefit |

|---|---|---|

| Multi-currency wallet | Hold and convert funds in over 60 currencies | Avoid unnecessary conversion fees and manage multiple currencies from one wallet |

| Global account details | Get local bank details in USD, EUR, GBP, AUD, and more | Accept international payments faster and more affordably with local receiving accounts |

| Corporate cards | Issue employee cards with spending limits and controls | Empower staff while keeping tighter control on business expenses |

| Batch payments | Pay multiple recipients in one go | Simplify payroll or supplier payments and reduce time spent on admin |

| Advanced expense management | Track, approve, and categorise expenses in real time | Improve visibility, control, and compliance around team spending |

| API & integrations | Connect to platforms like Xero, Netsuite, and Shopify | Automate finance workflows and streamline operations at scale |

| Quick online onboarding | Sign up without going to a branch | Launch fast with a digital-first process that scales with your business |

How much does Airwallex cost?

Airwallex offers flexible pricing that adjusts depending on your business size and the plan you choose, making it a good fit for companies at different stages.

- Monthly plans: Plans start from around $29 AUD per month, with features and limits increasing as you move up the tiers. This way, you only pay for what suits your current needs, whether you’re just starting out or scaling globally.12

- Currency conversion: Rates typically range from 0.5% to 1%. This means the more you use the platform, the better the rates you can access.13

- Receiving international payments: Receiving funds in supported currencies is often free, which helps keep costs down when dealing with overseas clients or suppliers.14

- Card issuance: Issuing cards through Airwallex usually comes at no extra cost, though fees may apply depending on how the card is used and which currencies are involved.15

Airwallex vs Wise: A side by side look.

The table below offers a side-by-side comparison of Airwallex and Wise, highlighting their key offerings and differences to help you make an informed decision.

| Feature | Wise16 | Airwallex17 |

|---|---|---|

| Currencies supported | 40+6 | 20+18 |

| Local receiving accounts | Yes (e.g. GBP, USD, EUR) | Yes (e.g. USD, EUR, GBP, AUD, more) |

| Debit or expense cards | Wise Business Card | Airwallex Borderless Cards |

| Expense management | Basic | More advanced tools |

| Integrations and API’s | Limited | Extensive (ideal for scaling businesses) |

| API & integrations | Connect to platforms like Xero, Netsuite, and Shopify | Automate finance workflows and streamline operations at scale |

| Batch payments | Yes | Yes |

Customer support.

Airwallex offers customer support primarily through in-app chat and email. Their website highlights dedicated support for businesses, including access to account managers for larger customers, helping with onboarding and ongoing assistance. Support availability aligns with Australian business hours, ensuring timely responses to local clients.19

Wise provides 24/7 customer support via live chat and email, as noted on their Australian site. This round-the-clock availability means businesses can get help whenever needed, including outside standard business hours. Wise emphasises fast, responsive assistance especially for international money transfers and account queries.20

Security.

Airwallex employs bank-level encryption and is regulated by the Australian Securities and Investments Commission (ASIC), holding an Australian Financial Services Licence (AFSL). This compliance with strict regulatory standards ensures robust protection of user data and fraud prevention.21

Wise similarly uses bank-level encryption and is regulated by ASIC with an AFSL, ensuring adherence to Australian financial regulations. Wise also implements advanced security features such as biometric authentication, two-factor authentication (2FA), and real-time fraud monitoring to help protect user accounts and transactions.22

Transfer speeds and processing times.

For businesses operating internationally, fast and reliable transfers are crucial. Both Airwallex and Wise offer efficient transfer services, each with its own strengths.

Airwallex provides fast and reliable international transfers, with many transactions processed within one to two business days.23 This speed is particularly beneficial for businesses needing to manage cash flow and supplier relationships effectively.

Wise is known for its quick transfer processing, with many transfers completing within one to two business days, and often faster for popular currency routes.24 This efficiency helps businesses maintain timely access to funds and manage international transactions with ease.

Business account accessibility.

Wise provides an intuitive online platform accessible via web and mobile apps, enabling businesses to manage multi-currency accounts, perform batch payments, and oversee their finances anytime, anywhere. Their user-friendly interface supports seamless international business operations on desktop or mobile devices.25

Airwallex also offers a cloud-based platform accessible through web browsers and mobile apps, allowing businesses to hold and manage multiple currencies, initiate batch payments26, and integrate with accounting software27 for streamlined workflows. Airwallex supports physical and virtual cards for multi-currency spending, giving businesses flexibility and control over their expenses.28

Geographic reach & accessibility.

Airwallex

- Airwallex supports international transfers to more than 120 countries and regions.29

- Through its Global Accounts product, Airwallex allows businesses to open local-currency accounts in many regions. For example, businesses can receive local bank transfers in Australia (AUD), Canada (CAD), Singapore, New Zealand, the UK, the US, and others.30

- Airwallex supports transacting in nearly 1,000 currency pairs across 64 currencies via Transactional FX.31

- For issued cards, Airwallex provides issuance capabilities in 50+ countries including Australia, Canada, UK, the European Economic Area, Hong Kong, Israel, New Zealand, Singapore, and the United States.32

Wise

- Wise allows sending money services to over 160 countries, per their Australian site.33

- Wise accounts support holding 40+ currencies.34

- You can receive payments in some local account details/currencies; for instance, Australian customers can get “own Australian dollar bank details … Receive money in AUD … as well as other major currencies.” 35

- Wise offers local bank details (account numbers) in 21+ currencies for people in Australia.36

- The Wise debit (or “Wise Card”) can be used globally in many countries i.e. as a way to spend or withdraw in local currencies when travelling.37

Customer reviews.

Airwallex: Airwallex holds a Trustpilot rating of 3.7 out of 5 stars, based on over 2,000 reviews.38

Users appreciate the platform’s user-friendliness and the ability to create global accounts in multiple currencies, which simplifies international payments. For instance, one reviewer mentioned, “Been using their service for about a year and so far it is so good. The credit card payment link is very useful for me.” 39

Wise: Wise boasts a higher Trustpilot rating of 4.3 out of 5 stars, with over 269,000 reviews.40

Customers consistently praise the service for its user-friendly interface and seamless experience, particularly highlighting the app’s design and ease of navigation. One reviewer noted, “I have been using Wise for years, and I have never had any kind of trouble. The cost of the transaction is cheaper than other banks and they are really punctual.”41

Which platform is the best fit?

Choose Wise Business if:

- You prefer a pay-as-you-go model with no monthly fees

- You need to hold and manage funds in multiple currencies

- You require batch payments and invoicing features

- You value transparency in fees and exchange rates

Choose Airwallex Business if:

- You seek a comprehensive global payments platform

- You need corporate cards and expense management tools

- You require high-speed international transfers

- You want to earn competitive returns on idle funds

Both platforms are solid choices, but they serve slightly different business needs.

- Choose Wise if you’re a smaller business, freelancer, or startup wanting to save on international fees without needing too many extras.

- Choose Airwallex if you’re growing fast, hiring internationally, or need smart financial tools like team cards, custom workflows, and API integrations.

Why more businesses are turning to OFX.

More businesses are choosing OFX when it comes to handling international payments, especially if they regularly work with clients or suppliers overseas. One of the main reasons is how much simpler it makes sending money across borders compared to traditional banks. OFX offers faster transfer times, which means businesses don’t have to wait around for funds to clear, helping keep cash flow moving smoothly.

Another big drawcard is the personal touch.

OFX provides access to real people who are ready to help with any questions or issues, which can be a welcome change from the often impersonal experience with larger banks. This support can make a real difference when dealing with the complexities of currency exchange and international payments.

OFX offers competitive exchange rates and lower fees, which can add up to significant savings for businesses sending money overseas regularly.

This makes OFX an attractive choice for companies wanting a more straightforward, cost-effective way to manage their international transactions.

OFX key benefits at a glance.

| Benefit | What it means for your business |

|---|---|

| Better value on currency transfers | OFX provides competitive exchange rates with no hidden transfer fees, which means your business gets to keep more of its money when sending funds overseas. |

| Around-the-clock expert support | You won’t be stuck chatting to bots or distant call centres. OFX offers 24/7 access to knowledgeable, local currency experts who are ready to help whenever you need. |

| Tools to manage currency risk | Planning ahead is easier with features like forward contracts, letting you lock in favourable exchange rates for upcoming payments and protect your business from market fluctuations. |

| Send money to over 170 countries | Whether you’re paying suppliers, staff, or receiving international revenue, OFX supports over 50 different currencies, giving you the flexibility to do business almost anywhere in the world. |

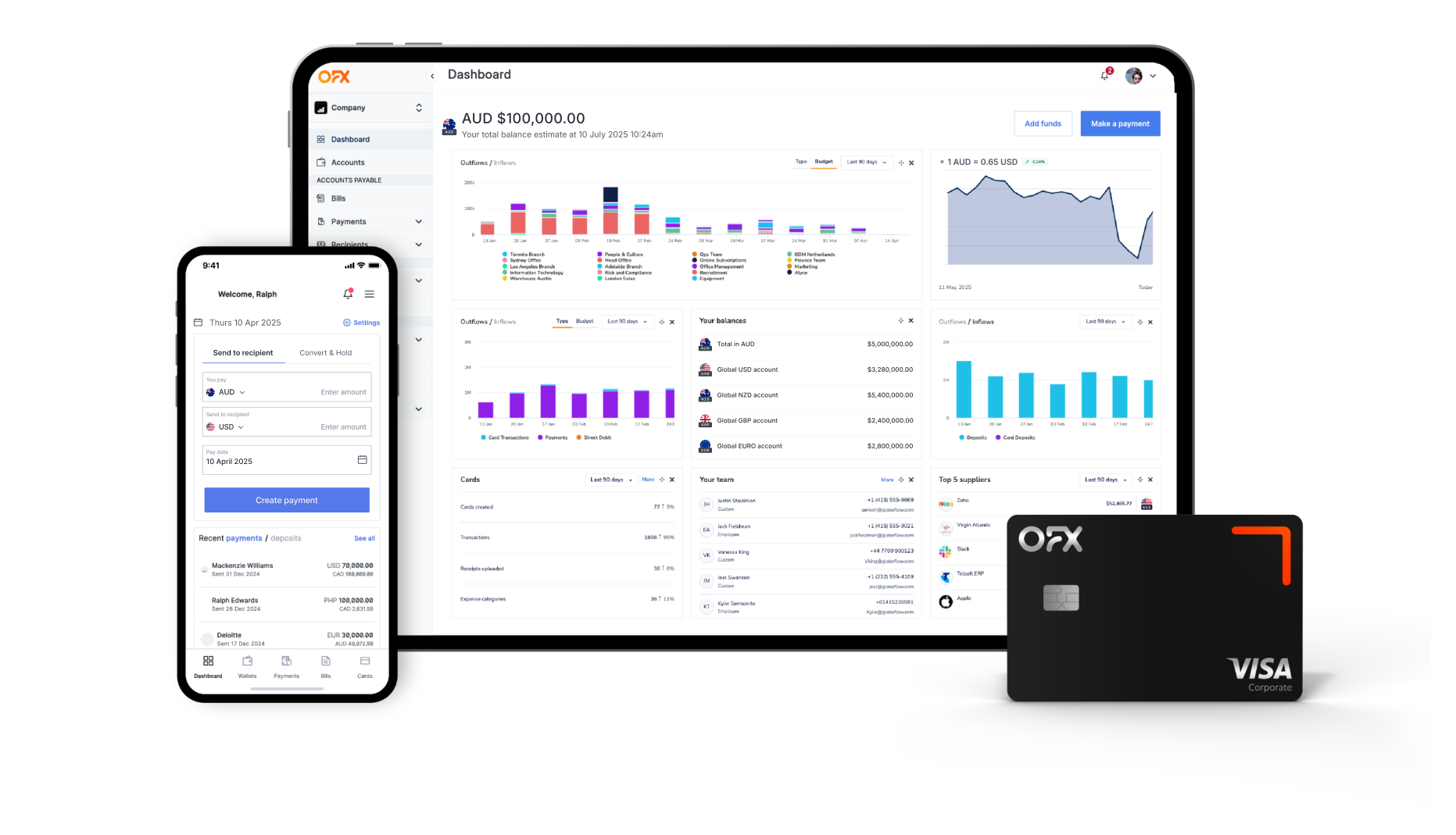

| Simple online platform | The OFX dashboard is user-friendly and provides clear visibility over your transfers, helping you keep a close eye on your cash flow without any fuss. |

| API integration available | For businesses handling a high volume of payments or wanting to automate processes, OFX offers API access so developers can connect directly to their system and streamline payment management. |

| AI Automation | Automate spend control with spend management software and avoid overspending, Capture receipts & invoices with AI technology and match to expenses removing tedious manual tasks at month end, gain visibility of cashflow with 2-way sync automatic reconciliation to accounting software like Xero and QuickBooks. |

| Free monthly plan available | Get started for free with access to multi-currency accounts, corporate cards and more on the OFX Standard Plan. |

Finding the right fit for your business.

Choosing between providers comes down to the size, structure, and international needs of your business.

- Wise is a solid choice for smaller operations, freelancers, or start-ups

Great for those who value simplicity, transparent fees, and a no-fuss way to send and receive money across borders. It’s user-friendly and cost-effective, especially if you’re just getting started with international payments.

- Airwallex is well-suited to growing or scaling businesses.

With expense management tools, customisable team cards, and API integrations, it’s good for companies looking for a sophisticated way to manage global finances.

- OFX is best for growing or scaling businesses with global payment needs looking for an all in one financial platform with personalised human support.

Whether you’re paying suppliers, managing payroll overseas, or planning ahead with currency risk tools, OFX offers the flexibility and expertise to help your business thrive globally. With access to real people (not just chatbots), you’ll have peace of mind knowing support is there whenever you need it.

How do I decide?

The best solution is the one that supports your business goals, not just for today, but as you grow into new markets. With the right platform behind you, managing international money doesn’t have to be complicated, it can be a smart, seamless part of how you do business.

Open an OFX Global Business Account

Make international payments easy

Sources

1 https://www.ey.com/en_au/insights/banking-capital-markets/how-new-entrants-are-redefining-cross-border-payments

2, 35, 36, 37 https://wise.com/au/business

3 https://wise.com/au/pricing/business

4, 5, 6, 34 https://wise.com/au/pricing/business/receive

5 https://wise.com/au/pricing/business/hold-fees

8 https://wise.com/au/pricing/send-money

9 https://wise.com/au/multi-currency-account/pricing

10 https://wise.com/au/pricing/business/card-fees

11 https://www.airwallex.com/au/business-account

12 https://assets.ctfassets.net/e6wv1zvbwa49/5dcEt4lUsTHImsNWRd0IyC/17bc9e978e06f0d381743b6e5916243f/2025.04.09_-AU-Fee_Schedule__clean.pdf

13 https://assets.ctfassets.net/e6wv1zvbwa49/5dcEt4lUsTHImsNWRd0IyC/17bc9e978e06f0d381743b6e5916243f/2025.04.09_-AU-Fee_Schedule__clean.pdf

14 https://www.airwallex.com/au/platform-pricing/account-transactions

15 https://www.airwallex.com/au/pricing

16 https://www.wise.com

17 https://www.airwallex.com

18 https://help.airwallex.com/hc/en-gb/articles/900001759623-Which-currencies-can-I-get-a-Global-Account-in-and-what-payments-can-I-receive

19 https://help.airwallex.com/hc/en-gb/requests/new

20, 24, 25 https://wise.com/help/

21 https://help.airwallex.com/hc/en-gb/articles/900001757106-How-is-Airwallex-licensed-and-regulated

22 https://wise.com/help/articles/2932693/how-is-wise-regulated-in-each-country-and-region

23 https://help.airwallex.com/hc/en-gb

26 https://www.airwallex.com/au/solutions/software

27 https://www.airwallex.com/spend-management

28 https://www.airwallex.com/spend-management/cards/virtual-cards

29 https://www.airwallex.com/au/business-account/transfers/send-money-to-us

30 https://help.airwallex.com/hc/en-gb/articles/4411298079129-What-features-and-products-are-available-in-my-registered-business-location

31 https://www.airwallex.com/docs/transactional-fx__supported-regions-and-currencies

32 https://www.airwallex.com/docs/issuing__supported-regions-and-currencies

33 https://wise.com/au/account

38, 39 https://www.trustpilot.com/review/airwallex.com

40, 41 https://au.trustpilot.com/review/wise.com