Transfer money online now or save time and money on future transfers

Global money transfers made easy

- Send money from A to B fast in 50+ currencies

- Save money with OFX’s great rates

- Transfer online, in-app or over the phone

- Products to plan ahead for future transfers

Need help creating your account?

Want to ask a question?

You can call or email us, anytime. With offices in 9 countries, there’s always an OFXpert to help you, 24/7.

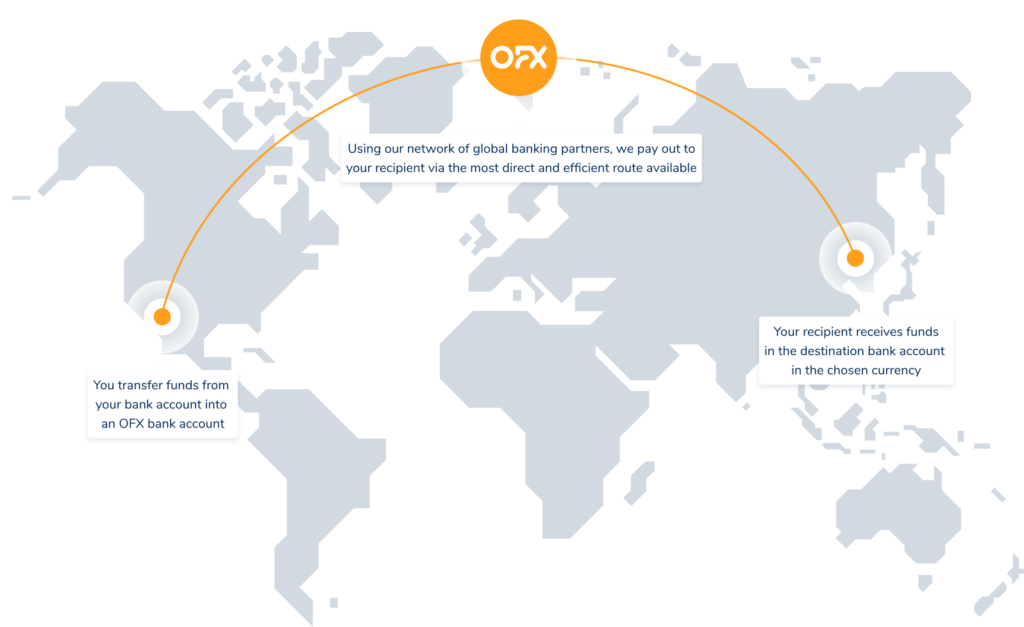

Send money to over 170 countries

Quick, secure, global payments to more than 50 currencies

Ready to move money? Do it simply, securely, and at a great rate.

How it works

Other topics you might be interested in

General FAQs

A Forward Contract is an arrangement that allows you to transfer money at some time (up to 12 months) in the future at an exchange rate that you agree to now, so that you know what the exchange rate will be at the time the transaction takes place. This allows you to avoid the risks and uncertainties associated with adverse exchange rate movements.

Forward Contract pros and cons

A Forward Contract may be beneficial for business and individuals if exchange rates are particularly attractive now, and you want to lock in that rate to hedge against uncertainty in the future. This can be especially helpful for small businesses who want to keep their cash flows predictable when buying or selling overseas.

However, a Forward Contract precludes you from taking advantage of further beneficial movements, if your currency pair continues to move in a profitable way. To avoid missing out on further profitable movements, some people use a Forward Contract for a smaller portion of their total payment (say 50%) as a way to hedge against volatility.

A Better Way to Manage Risk: OFX

OFX offers a number of alternatives that help you manage your business and personal foreign exchange risk.

- Our Forward Exchange Contract lets you buy now but transfer later. This lets you lock in a great rate even if you aren’t ready to transfer your money immediately. Whether you need to book your transfer two days from now or a year from now, you’ll be protected against exchange rate fluctuations.

- With our Limit Orders option, you won’t have to miss your target rate if it happens overnight or while you’re busy. Instead, you can set your rate and, once triggered, we’ll get in touch to let you know you can complete your transfer.

- With an FX Option, you retain the right but not the obligation to transfer funds at an agreed rate at a later date. You pay a small premium on the option to gain protection against exchange rate shifts while being able to profit if the exchange rate shifts in your favor.

Talk to one of our dedicated dealers today to develop a currency strategy that’s right for you.

Note: Forward Contracts are currently available in Hong Kong for specific business purposes (See Hong Kong’s T&Cs for Forward Contracts.), while still being open to our customers in Australia, United States, Canada, New Zealand, United Kingdom and Singapore.