On this page

Types of currency risk

Factors influencing currency risk

Can you avoid foreign exchange risk?

Foreign currency risk isn’t always a bad thing

Managing currency risk

Real-world examples of currency risk

Know your FX needs

Protect yourself with tailored support

Currency risk, also known as foreign exchange (FX) risk or forex risk, refers to the losses you could incur when making an international financial transaction, due to currency fluctuations.

Anyone who transfers between two different currencies is susceptible to currency risk but international businesses and investors are particularly at risk.

As professionals navigating the fluctuations of the global market, understanding and managing currency risk is critical for sustaining success.

It pays to understand the common risk management strategies and the potential impacts of your international trade, purchase and investment decisions.

Types of currency risk

- Transaction risk

arises from the fluctuation in exchange rates between the time a transaction is agreed upon and its actual settlement. - Economic risk

is the overall impact of currency fluctuations on a company’s cash flows and market value. - Translation risk

emerges when the financial statements of a company are converted from one currency to another, impacting reported profits and balance sheets.

Learn more about the types of currency risk and how they can impact your business’s bottom line. Read now.

Factors influencing currency risk

Currency risk is a complex interplay of multiple factors, each capable of sending ripples through the global financial waters.

The main driving forces behind the fluctuation (or volatility) of currency values are:

- Interest rates

- Inflation

- Political stability

- Market sentiment

Changes in interest rates can influence investment flows, while inflation differentials impact a currency’s purchasing power.

Political stability plays a crucial role, as uncertainty can lead to heightened currency volatility.

Additionally, market sentiment, often driven by economic indicators and geopolitical events, can swiftly sway currency values.

Learn more about the driving factors of exchange rates and how they interconnect to impact the value of currencies. Read the article.

Can you avoid foreign exchange risk?

Buying international goods or services creates an inherent foreign exchange risk, based on the price of the currency you are buying or selling when you make the transaction.

You may feel this risk is out of your control, but it doesn’t have to be.

You can help create more certainty by knowing what your foreign currency risk is and when it is likely to work for or against you.

Foreign currency risk isn’t always bad for your business

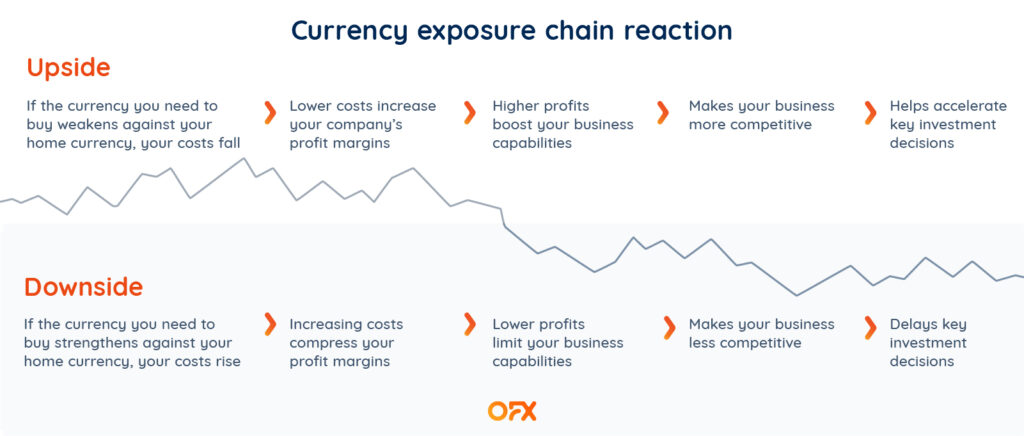

As with any type of risk, there is an upside and a downside to consider.

For businesses, an upside of currency risk could be saving money on a contract, payment or invoice by making a well-timed currency transfer, at a time when the exchange rates are in your favour.

For example, if you want to pay an invoice in US dollars when the USD is strong, that US$20,000 invoice could cost you AU$22,000 because of the difference between the exchange rates. On the other hand, if you make a transfer when the USD is weaker, that US$20,000 invoice could cost you just AU$18,000.

This is why timing is everything.

For investors or property buyers, choosing a transfer option like a Forward Contract means you could lock in a great rate now, so you won’t be surprised with a higher cost of exchange on your shares, or by the time you settle.

The bottom line is, if you leave your foreign exchange to chance, you have no control over whether you will be facing an upside or a downside.

Managing currency risk

The most common and simplest way to get more certainty over foreign exchange costs is by using a simple hedging approach.

Hedging is the primary tool in the risk manager’s toolkit.

Forward Contracts are a way to hedge. It enables you to lock in exchange rates for future transactions, shielding them from adverse movements.

Something to bear in mind with a Forward Contract is that once booked, they can’t be cancelled. You are locked into that transfer.

If you book a Forward Contract, it may mean losing out if the market rate improves because you’re contracted to settle at the agreed rate. Read more. Forward Contracts are not available for personal clients in Hong Kong

Being ‘locked-in’ might give you pause, but that’s how you gain control over your costs – they’re fixed.

Diversification, which means spreading exposure across different currencies and assets, is another effective strategy to manage risk in a well-rounded manner.

By planning for market uncertainty, your cash flows can be more predictable and profitable.

We have a range of risk management tools to help you identify your potential risk, hedge your risk and stay ahead of volatility. View tools.

Real-world examples

To illustrate the real-world impact of currency risk, consider the case of a multinational corporation that conducts business across various countries.

Fluctuations in exchange rates can significantly affect the company’s profitability when converting overseas earnings back into the reporting currency.

In 2019, the sudden strengthening of the US dollar created headwinds for many multinational companies, impacting their financial performance.

By examining such cases, professionals can glean valuable insights into the tangible consequences of currency risk.

Know your FX needs

Whether you use foreign exchange services for your business as a one-off or regularly, you should consider how to make these transactions work better for you.

Knowing what your minimum profit margin is can help you understand, and then plan for, the worst exchange rate you can afford to accept for any transaction. Then you can aim for an exchange rate for your transaction above this.

Protect yourself with tailored support

Businesses don’t need to leave their currency risk to chance. Foreign exchange specialists, like OFX, have products designed to help businesses use currency risk to their advantage and help create more certainty.

You wouldn’t trust a GP with heart surgery, so rather than dealing with a bank, speak to our currency specialists. We have dedicated OFXperts to talk you through the options and find a solution that works for you.

As well as offering typically lower fees and great rates, our OFXperts can also help you develop a strategy to help protect your profit margins and create more cash flow certainty, allowing you to focus on growing your business.

In the dynamic world of global finance, the ability to navigate the ups and downs of currency risk is not just a skill; it’s a strategic imperative for sustained success.

Create your FREE account

There are better uses for those savings

More than just a preventative measure, having a foreign exchange risk strategy in place means all that saved money can be reinvested into your business or passed on to your customers.

If your business is customer-centric, it’s a great way to build lasting working relationships and generate business through word-of-mouth referrals.

Not to mention how saving your business money makes you look great at bonus time.

Interested in how to manage forex risk in your business?

Try our free tools or speak to an OFXpert.

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. OzForex Limited (trading as OFX) and its affiliated entities make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.