Currency exchange rates are constantly fluctuating, and current events can play a significant role in market fluctuations. By understanding the factors that influence currency exchange, you can make more informed financial decisions.

Current events and FX

Whether you are a business owner, investor, or someone who wants to understand more about currency exchange, knowing how current events can impact exchange rates could help you make the most of market volatility. In our third instalment of the Factors that influence currency exchange blog series, we will dive into the ways that current events can have an impact on foreign exchange (FX).

We connected with OFXpert and Treasury Dealer, Isaac Figueroa to explore the ways that current events may impact FX rates. “Unexpected current events often have the most significant impact on the markets and therefore on currency exchange,” Figueroa said.

Unlike other factors that markets can sometimes anticipate, such as monetary policy decisions, current events are one of the factors that are often unpredictable to markets. Let’s dive into what current events have the power to impact economies.

Ready to start transferring with OFX? Register now

Understanding a black swan event

While current events are happening every day that are both newsworthy and impact our daily lives, identifying events that will impact the economy and exchange rates is slightly different. “These unexpected current events have to be large enough that they can influence the weight of a currency. We call these black swan events,” Figueroa said.

A black swan event is something that happens that is unpredictable and goes beyond what is normally expected of a situation. This means that it could lead to severe consequences. One example that many analysts use to explain the black swan event theory is the 2008 financial crisis in the US. The effect of the crash was catastrophic and influenced markets and currencies globally. Let’s take a look at some more examples of black swan events.

Not all current events have an impact on FX, but black swan events almost always lead to market and economic volatility.” – Treasury OFXpert, Isaac Figueroa

Examples of black swan events

- Terrorist Attacks

- 9/11

- When America was attacked by terrorists on September 11th, 2001, the world was shocked and markets were rocked. Stock markets immediately dipped and almost every economic sector was impacted which rippled across the globe.

- 9/11

- International Health Pandemic

- COVID-19 Outbreak

- Health events that impact any of the major markets will undoubtedly affect currency exchange. One of the most notable events in this category was the Coronavirus outbreak in 2020, which resulted in business shutdowns, travel bans, and an economic nosedive in the spring of 2020; most major currencies plummeted.

- COVID-19 Outbreak

- Natural Disasters

- Earthquake and Tsunami in Japan

- The 2011 earthquake and subsequent tsunami that hit Japan is a significant natural disaster in modern history. Not only did the tsunami hit the nuclear plant in Fukushima, causing a nuclear disaster, but the “Triple Disaster” caused extreme volatility in the yen currency and prolonged economic loss for the nation. The JPY moved up and down significantly after Japan experienced record trade deficits following the disasters.

- Earthquake and Tsunami in Japan

Current events sometimes lead to one currency coming out on top. During the beginning to the middle of COVID-19 it was the US dollar and the Japanese yen. The USD became, as it had many times in the past, a safe haven asset for many investors when the future of the pandemic was unknown. Towards the end of the pandemic, both the USD and the JPY were among the worst-performing currencies, demonstrating real volatility during global pandemics. While we cannot anticipate events like these, our OFXperts can always help to prepare you and your business for black swan events and the effects they could have on your money.

Understanding how current events can impact FX movements may make a difference in your business. Let our OFXperts help you prepare.

Preparing for rate changes

So you’re probably wondering how you can be ready for an event that no one can anticipate? That’s where our OFXperts can help. We work with you to develop risk management plans for your business that help keep your money protected so that current events don’t rock your bottom line when they hit the market. Let’s take a look at some of our solutions to help keep your money safeguarded:

- Forward Contracts – Forward Contracts are a ‘buy now, pay later’ option for businesses trying to take advantage of a positive rate today on a payment that needs to be paid in the future.

- Risk Calculator – Have you ever experienced exchange rates shifting between the time you receive an invoice and its due date? Use our risk calculator to determine the impact shifting market exchange rates could have on an example invoice. This is not a quote, it’s designed to help you understand the impact of currency fluctuations.

- Rate Alerts – Stay on top of moving markets with OFX rate alerts. The Rate Alert tool allows you to set an alert for your desired rate and our currency experts will monitor the market for you. If your target rate is reached, we will notify you via email or SMS. If your target rate is never reached you will not be notified. There’s no limit on the number of market rate alerts you can set.

Taking advantage of these OFX tools and the expertise of our OFXperts can help you prepare for whatever unexpected black swan events are in the future. Interested in learning more about protecting your bottom line? Contact an OFXpert today!

Quick, secure, seamless transfers

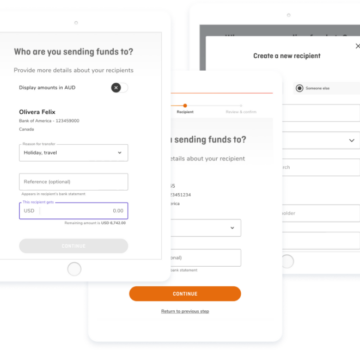

We help clients move money quickly, safely, and accurately. Whether your business is just getting started or well-established, OFXperts have the experience to help you save time and money on foreign exchange.

Navigate rate swings in turbulent times. Our OFXperts can help you make more informed decisions about hedging and risk management. Contact us.

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. UKForex Limited (trading as “OFX”) and its affiliates make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.