Great expectations

How treasury bonds and interest rate changes impact currencies

February 2022

After months of speculation, financial markets got the headline they’ve been waiting for at the end of January as the two-plus year party for investors came to a resounding halt.

The chief caterer — The US Federal Reserve — gave the strongest indications yet that it was time to ‘remove the punchbowl’ and tighten monetary policy. On January 11, Fed chairman Jerome Powell declared the economy was strong enough to end quantitative easing and for interest rates to “normalize”1 (read increase), sending markets into a tailspin. The Dow and the S&P 500 had their worst months since March 2020, while at the time of writing the Nasdaq was closing in on its worst month since October 2008, as equity traders absorbed the reality that the supportive environment of the last few years would be ending.

This also triggered currency market volatility, with the US dollar well and truly hitting an ascendancy. The DXY, an index of USD value against other major currencies, jumped sharply by almost 3% in two weeks on the back of the Fed’s announcement. Risk-based currencies, such as NZD and AUD, suffered losses.

After years of low interest rates and bond-buying to help economies recover from the pandemic, central banks are now moving in the opposite direction to try to prevent inflation running out of control. But how does this work, and what does the bond market, specifically government-issued bonds, tell us about currencies?

The short answer? As one of the largest globally traded financial assets, Treasury bonds and how they are priced for yield are a leading indicator of price movements in currencies. The long answer? It’s complicated.

What are bonds?

Effectively an IOU, a bond is an issuance of debt by an entity looking to borrow from investors. A bondholder will be paid a fixed amount of interest on the debt (the coupon payment) and the initial principal (the bond’s face value) is paid at the maturation date of the bond.

Bonds are issued by corporations, municipalities and governments and interest rates offered by each entity differ on the creditworthiness of the issuer. Junk bonds, for example, are bonds issued by corporations who have riskier business profiles – who will pay a higher rate of interest to reflect the risk of default.

On the other hand, Treasury bonds are issued by governments, so are seen as an extremely safe investment, particularly in times of volatility. The most creditworthy issuer is the US government, whose deep, broad and diverse economy provides plenty of tax revenue to meet its repayments.

How US Treasuries are traded and their role in influencing interest rates is critical to understanding the currency market.

How bonds are priced

US Treasuries are sold at auction open to everyone from private investors to global financial institutions like banks and pension funds.

On the auction date the face value of the bond is fixed, e.g. $1,000, and the auction determines the yield, or the interest rate, of the coupon payment. The duration of the debt can range from two weeks to 30 years.

After the Treasury auction, bonds can be actively traded in the secondary market until their maturity date and it’s here you get variations in the bond price.

Bond prices and bond yields are inversely related so as bond yields rise, bond prices will fall, and vice versa.

–

Example

Say you bought a $1,000 bond with a 4% coupon to give you a return of $1,040. Maybe a few years later you decide to sell the bond to pay for a holiday, except now, interest rates are at 6%, rising in accordance with the interest rate set by the central bank and the overall economic outlook.

Your bond is now less attractive on the secondary market because it earns 4% interest rather than the current market rate of 6%, which would give a return of $1,060 on a $1,000 bond. You would now be looking at selling your bond for less than the $1,000 you originally paid to match the returns of new bonds that are earning more interest.

On the other hand, in an environment of decreasing interest rates, buyers would be willing to pay more than the bond’s face value to achieve the overall higher return.

Central bank policy and bond yields

For the last hundred years, the US Federal reserve has been able to control interest rates and manage the economy by manipulating the Federal Funds Rate (the ‘overnight’ lending rate) and by buying and selling US Treasuries and other government bonds from financial institutions to influence prices through supply and demand.

But during the global financial crisis and through the pandemic, the US Federal Reserve, like many other central banks, used excessive bond buying, also known as quantitative easing (QE), to further stimulate the economy. Rather than just buying Treasuries to influence the overnight rate, the US Fed started purchasing large quantities of longer-dated Treasuries, like three and 10 year durations. The effect was three-fold.

- First, it pumped money back into the economy – as it purchased those assets from private investors, they then reinvested the returns back into the economy. The great rally in equities was supported by QE, as investors rotated their bond returns into buying stocks, driving up their prices and making consumers feel much more confident about their retirement portfolios, which in turn gave them more confidence in the economy.

- Secondly, QE allowed the US government to issue far more debt to pay for economy boosting infrastructure projects and issue stimulus payments to citizens. By taking the debt onto its own balance sheet, the Fed allowed the US government to raise funds without spooking the market that it could run the risk of default.

- Finally, QE kept bond yields, and the yield curve, low. Rather than investors buying long-dated bonds and waiting out the recession only to earn a small return, QE kept interest rates on those securities so low that it forced them to find other places to put their money, such as equities property, and even non-traditional assets such as vintage cars and cryptocurrency.

Understanding the yield curve

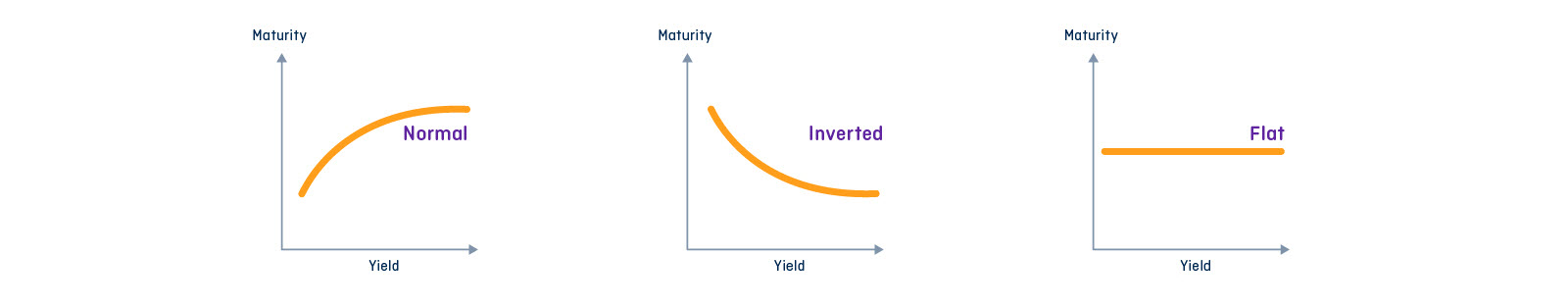

The yield curve is a graph which shows the yields (interest rates) of treasury bonds according to their maturity rates. A normal yield curve has an upward slope. It reflects the notion that the further away an event is, the higher a yield must be to compensate for that risk.

But when market participants start to worry about future economic conditions, they start to look for the safe haven of US Treasuries. Investors don’t want to be holding riskier assets like equities if there is going to be a recession and a likely stock market correction, so they buy longer-dated bonds which are much more stable.

As mentioned, bond prices move in an inverse relation to bond yields (or interest earned), so as demand for longer dated bonds forces their prices up, it pushes down the yield curve. When this happens the yield curve flattens, or even becomes inverted, reflecting the fact that investors are more worried about protecting capital than getting a return.

While we are seeing some countries with flattened yield curves, inverted yield curves are rare. Many economists consider them a foreboding of future conditions. Since 1956, US equities have peaked six times after the start of an inversion, and the US economy has fallen into recession within seven to 24 months.2

What are we seeing now?

As we emerge from the worst of the pandemic, the combination of low rates, QE stimulus and renewed economic optimism from consumers and business is causing economies to overheat.

The combination of low unemployment rates, higher wages, supply chain issues and energy supply crunches are all contributing to inflation concerns, prompting the US Federal Reserve and other central banks to wind back QE and flag hikes in interest rates, with analysts anticipating as many as five rate increases this year in the US.

The bond market has responded quickly, selling off bonds and pushing up short term interest rates in the process. The longer term yield curve actually flattened as rates rose at the short end as investors anticipated imminent interest rate rises, while rates at the lower end remained stable.

This suggests that financial markets believe the US economy is not in as good shape as expected, and that growth is likely to slow in the future. An alternative view is that the curve is expected to return to its normal shape as the Fed reins back its purchases of longer-dated securities, pushing bond prices down as a result and causing interest rates to rise.

Why FX markets are linked to bond yields

The world’s largest global fund managers are mandated to hold a significant portion of ultra-safe assets in their portfolios. That means they are constantly looking for AAA rated securities like US Treasuries or other stable country’s bonds. But they still need to deliver a return to their investors, so they move money around the world in pursuit of the best interest rate relative to risk. Whenever they switch out of one country’s bond market to another, this triggers a currency sale or purchase

The gap, or spread, between yield curves from different countries is a strong indicator of where those currencies will trade. A wide spread between country A and country B, particularly for short-term government bonds, will result in increased demand and currency appreciation for country A against country B. A narrow spread will have the opposite effect. For example, if the 2 treasury yield in Canada is higher than in the 2 year treasury yield in Australia, the CAD would usually outperform the AUD. How quickly the spread between those government bond yields narrows and expands also drives the currency market.

What to watch for currencies

After years of accommodative interest rate policies, the US Federal Reserve is moving faster and harder than many other central banks. Even without official rates rising yet, bond traders are trading based on the expectation of rate rises and pushing up bond yields, causing the US dollar index in January to jump to its highest level in 18 months.

Central banks are eyeing inflation amid tightening job markets and flagging interest rate rises and an end to quantitative easing. Bond traders will be taking action on central bank announcements, particularly the US Federal Reserve, and these shifts in demand will be reflected in the relative value of currencies.

We can expect to see the currencies of central banks with low interest rates and a flattening yield curve, such as Japan, further decline against other major currencies if their monetary policies continues to diverge against peers. Any surprise announcements from these low yield, or ‘hawkish’ countries can change trend directions in the FX market, as we saw from the European Central Bank in early February.

References

2. https://www.investopedia.com/articles/basics/06/invertedyieldcurve.asp

Download the OFX Currency Outlook

Learn more in the latest edition of the OFX Currency Outlook. It’s been produced to help you navigate market movements today, and to understand what to watch out for in the coming months.