Receive international payments without paying hefty fees

Who would have thought that getting paid could be so costly for your business? Whether you’re working for international clients or selling overseas, OFX can help you bring your money home at a substantial savings.

The insider secret that will help you master your profit margins

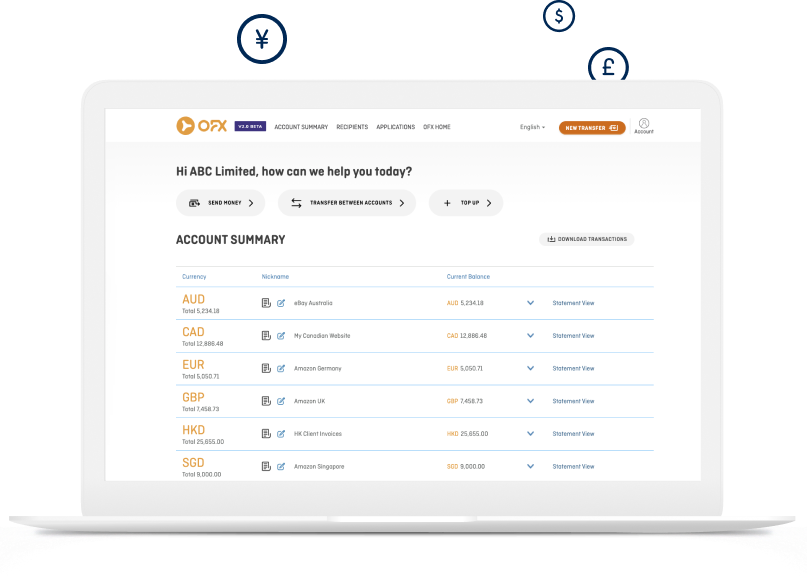

At OFX, we know you worked hard for your money, and we think you should keep it. When you sign up with us you’ll receive foreign exchange payments quickly and securely while saving on fees and margins. We also offer online seller accounts specifically for people selling on marketplaces like Amazon, so you can simplify your international enterprise.

What to look for in an overseas payments provider

- Rates. When paying overseas staff, your bottom line can be affected by exchange rate margins and transaction fees. Look for a provider with good rates and low fees keeping in mind that a better rate may make the fee negligible.

- Consistent service. If you’re going to be making regular transfers, you need a company that can provide superior customer service tailored to your unique business needs. Find a provider that won’t treat you like just another number by calling up to enquire.

- Speed. Money transfers should move quickly and major currency conversions can often be processed within one day. A speedy service means you can worry less about when you’re money is going to arrive. While there are some affordable peer-to-peer foreign payment options out there, but be aware that your staff could be waiting days, or even weeks, to get paid when using a peer-to-peer service. Within that time, exchange rates may move dramatically costing you or your employees substantially.

- Options. The best way to insulate your business from currency volatility is to find a foreign payments provider who offers risk management tools that can support your business objectives. If you pay a large number of overseas employees, make sure your provider offers a platform like OFX’s Multipay, so you can pay up to 500 people with one click. Get the flexibility your business needs, so you can gain a competitive edge.

- Reliability. Peer-to-peer transfer models are often unstable during high-demand trading events such as Brexit and major elections. You want a provider with a proven track record of stability-like OFX. To read more about the risks of peer-to-peer transfers, check out this article.

One of the best ways to receive international payments is OFX

We offer a number of bespoke foreign currency strategies to help you receive foreign exchange payments at a great exchange rate.

- Spot Transfers. Anytime you need to make an international transfer, we can help you save. Nights, weekends, holidays? No problem. Your business moves fast, choose an international payments partner who can keep up.

- Forward Contracts. Keep more control over your money with a Forward Contract. Secure an exchange rate for up to 12 months, so you can keep your cash flow predictable.

- Automated Regular Payments. Simplify your accounting with predictable regular payments. You can choose from fixed or non-fixed rates of exchange.

- Limit Orders: With a Limit Order, we watch the forex markets, so you can concentrate on what you do best. When the rate is right, we transfer your funds automatically.