After pouring years of her time into creating a successful wine business, the founder of Wine Alliance, Marina Beck, recognised the need for a reliable foreign exchange (FX) partner. After she began working with OFX and experienced the difference an OFXpert makes, Beck helped her family find success with OFX too.

The challenges of managing foreign exchange for a family business

Small businesses are often the source of the most unique and well-made products, but they can face challenges when it comes to FX. This is especially true for businesses that operate in multiple countries, or that import or export goods and services.

Marina Beck, proprietor of Wine Alliance, is one small business owner who has created a product based on her familial roots. Beck entered the world of wine through a family heritage trip to Italy. It was there that she explored her family’s winery, met one of her cousins, and fell in love with the idea of selling that wine near her home in Calgary, Canada. “I knew my family had a winery in Italy but I had never seen it. At the time my cousin, Ciro, and I were really both searching for something new in our professional lives and we connected so well. We ended up starting the business in 2007 and growth was very organic from there,” said Beck.

Owning a business means juggling many roles. Between connecting with clients, ensuring prompt deliveries, and maintaining relationships with vendors, there is little time left to focus on something like FX. While FX is important to any organisation that conducts business across borders, it is often pushed to the side of a desk already filled with a never-ending to-do list. This is how Beck felt 8-years into her business journey in 2015, “About 8 years after I started the business I was still making wire transfers through the bank. I remember looking through my books and couldn’t believe I was paying CAD$45 for every transfer. That’s when I looked for other options to find a secure way to make payments and keep my business moving forward, I am so happy I found OFX.”

Ready to start transferring with OFX? Register now

Why OFX is more than just an FX company

In 2016, after a search online, Beck reached out to OFX to find out more about how we could help with her business’s FX needs. “It was my OFXpert, Jeff that I was first talking to when I found OFX and he just made it so easy. Finance is not my background and I didn’t necessarily understand the market but Jeff just made everything make sense,” Beck said.

In the beginning, Wine Alliance was using OFX spot transfers as a quick, easy, and affordable way to transfer money to vendors or pay bills. Spot transfers are a single purchase of a foreign currency with the currency you currently own at today’s rate of exchange between the currencies. For example, Beck would trade her Canadian dollars for euros when she needed to pay European vendors. Soon enough, Beck’s OFXpert Jeff began to understand the volatility associated with grape harvesting to make wine. Beck’s product was so dependent on a good harvest each season and could vary drastically in the amount of currency she needed to exchange based on the outcome of that harvest. Jeff therefore identified an opportunity to help protect Wine Alliance’s bottom line using Forward Contracts*.

*If you book a Forward Contract, it may mean losing out if the market rate improves because you’re contracted to settle at the agreed rate. Read more.

Forward Contracts, a ‘buy now, pay later’ option for businesses trying to take advantage of a positive rate today on a payment that needs to be paid in the future, made sense for Wine Alliance because of the nature of the wine industry. “When I learned about Forward Contracts it was such an interesting shift in thinking. Jeff flagged to me that it might be a good time to take advantage of the market and book a forward. They are useful for me because of purchasing seasons for wine and when those bills need to be paid. For me, it’s about looking forward at what needs to be paid and then I will talk to Jeff and he will say this is how much you will save based on what we know today versus if we wait,” Beck said.

For Beck, it was more than just the tools that OFX could offer to save her business money and make her life easier, it was about the service and the trust. “We are not just a number, we have a partnership and we are a client that matters,” Beck said. Working with an OFXpert like Jeff can make a major difference in growing small businesses. Beyond the tools and expertise that OFX can offer is a culture focused on service, building relationships, and caring about the people behind the business. “It’s more than just a service, there is interest in who we are and what we are doing,” Beck said.

Beyond service, Beck noted that working with a reputable organisation was very important to her. When she sends transfers through she wants to feel confident they will arrive on the other end without a hitch. “Everyone wants to work with suppliers who trust you. That was one of the biggest differences I saw when I began working with OFX. When people see a copy of a transfer that I sent and see that it’s through OFX they know it is a reputable company and they trust that it will come through,” Beck said.

Working with OFX is like having an extended team member.” – Wine Alliance Proprietor, Marina Beck

Referring family to OFX

Beck’s cousin, Ciro was interested in how Beck was paying bills internationally and managing her Canadian-based business. Ciro sought out Beck for advice on this when he began developing his own wine business. “He was setting up invoices in the US and trying to figure out how to do what I was doing but from Italy. He wanted to know more and I just showed him how easy it was,” Beck said.

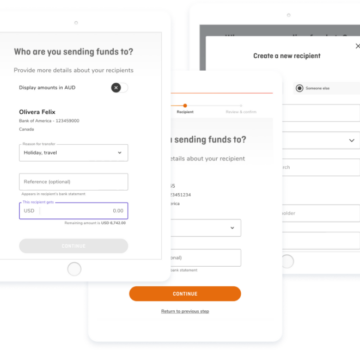

After this quick tutorial, Ciro began working with OFX as well. As an owner of a winery in Italy who is always on the go, OFX’s online portal meant Ciro could easily transfer whenever and wherever he is, whilst having customer service available 24/7 if he needs assistance. This flexibility and the seamless transfers made this a no-brainer for Ciro’s business. “ For Ciro having the freedom and flexibility to log onto his laptop and transfer money wherever he is is great. It is very challenging to do that in Italy with banks so it simplified his life drastically,” Beck said.

Both Beck and Ciro have found great success with their small businesses and continue to use OFX for their foreign exchange needs. “Knowing that OFX has my back is money in the bank, literally,” Beck said.

Interested in partnering with OFX? Register today.

Fix your rate to protect against market moves

Create currency confidence and stay ahead of market fluctuations with OFX’s risk mitigation hedging tools.

Navigate rate swings in turbulent times. Our OFXperts can help you make more informed decisions about hedging and risk management. Contact us.

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. UKForex Limited (trading as “OFX”) and its affiliates make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.