USDemand: the end of the dollar’s dip?

February 2021

The US dollar has been declining relative to other major currencies, particularly since the pandemic, thanks to the US Federal Reserve keeping interest rates low. In this article our OFXperts look at three key factors that could change the trajectory of world’s reserve currency including:

- Why a strong US stock market is generally supportive of a lower dollar, and what the new Democratic government means for equity investors.

- Fears of a bubble in stock valuations and how a sell-off would impact the USD

- The fundamental issues still affecting the US economy and therefore the value of the USD, including COVID-19 variants and vaccination rollout

January is a time for renewal and optimism, and for most of the month it was renewed optimism that drove US equities, in the process keeping investors away from the US dollar and into stock markets.

The US dollar is kind of the Yin to the stock market’s Yang. In good times people want to chase returns (risk-on) by buying up stocks. In bad times, investors tend to dump stocks (risk-off) and buy the US dollar, as well as commodities like gold, as a safe-haven.

So how the US stock market is performing is a usually great guide to what the US dollar will do. Stocks rise, dollar stays weak: stocks wobble, dollar starts to climb. This relationship can change under certain market conditions but it’s considered a rule of thumb.

Currently, the US Federal Reserve’s ongoing dovish (nb. dovish: inclined to keep rates low. Hawkish: raise rates) stance and the promise of more economic stimulus has been fuelling a rally that pushed the S&P500 up nearly 15% to new record highs in the last few months. Retail investors have been piling in, drawn by heady returns and the prospect of a rapid economic rebound once a vaccine comes through.

The US stock market is “priced to perfection” says OFX’s Global Treasury Manager Sebastian Schinkel, meaning everything has to go right in terms of how successful the vaccine rollout is, and how finely tuned the balance will be between fiscal stimulus (spending policies of governments) and monetary policy (the actions of central banks).

All this optimism has been driving ‘risk-on’ investing in financial markets, but little fluctuations in January are causing some observers to worry that asset prices can’t go much higher without popping. If it does, that will have a significant effect on the US dollar, and is something to keep an eye on.

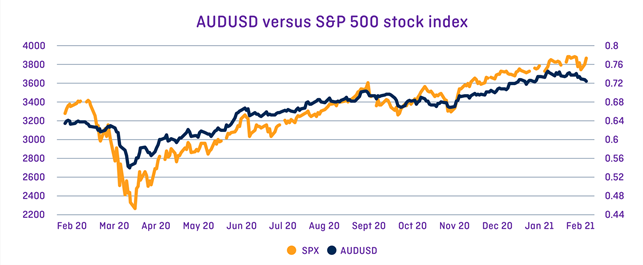

How the US market performs has a highly correlated effect on the US dollar and other currencies relative to it. As the below chart shows the Australian dollar/USD is almost perfectly matching the rise in US stocks. Any selloff in US equities will most likely see the USD rise as a safe-haven asset and many other currencies to fall against it.

Stocks keep surging on big blue Democratic wave

Joe Biden entering the Oval Office was not always expected to be a positive for stocks. The markets factored that the Democratic government would be more stimulus friendly than a Republican one, with direct transfers to citizens of US$1400 under Biden, compared to $US600 under the Trump administration1. There already has been a significant surge in retail trading as young, underemployed Americans cashed previous stimulus checks into stocks via brokerage free trading apps like Robinhood.2

The Goldilocks scenario for investors was a divided congress, in which they’d expect stimulus from the White House but there would be a check on high-taxes and tighter regulation thanks to a Republican-controlled Senate. A clean sweep of the Georgia senate race on January 5 has given Democrats control of both the House and the Senate, but investors have not gone cold on markets as expected.

Schinkel says investors are still trying to work out how market friendly the Biden administration will be. They are watching for how the Senate will play out in terms of which Republicans might side with the Democrats and how many Democrats themselves will reject any anti-corporate agenda.

Another factor cheering markets has been the appointment of former Obama-era Fed Chair, Janet Yellen, to the role of Treasury Secretary.3 Her intimate knowledge of the relationship between Fed Policy and government fiscal policy has given the markets confidence that the administration and the Fed Reserve will work in tandem.

“Janet Yellen will help keep the game going,” Schinkel says. “She understands markets well and is a really good communicator. That keeps things smooth for everyone.”

All this positive sentiment has been supporting the stock market and keeping the dollar low, but what might tip asset values in the other direction?

Bubble, bubble causing trouble?

Up until late January it had been looking like the good times for the stock market would just keep on rolling. While talk of a bubble has been getting louder, by and large investors have been happy to keep dancing while the music has been playing. But the big question, Schinkel says is what happens when the music stops.

A couple of wild swings have given a preview of what might happen.

On January 6, the US 10-year bond yield, which is an indicator of investor sentiment about the economy, crossed 1 per cent for the first time since March 2020, as investors started to bet inflation may begin creeping back into the economy with the Democratic win and strong jobs figures. Suggestions that the Federal Reserve could begin tapering its asset purchases added to the bond selloff, pushing up the 10-year and other parts of the yield curve, causing the US dollar to reverse its mostly downward trajectory against other currencies.

But that bond selloff was short-lived and the risk-on sentiment for investors continued for the rest of January until those Millennial retail investors started to challenge the might of financial professionals. Via US stock tipping bulletin board WallStreetBets, retail investors took on short sellers who were betting against a number of beaten down companies (including a video game retailer and cinema chain), driving the value of one in particular, GameStop, up 900% in a week and 147% in day.4 Hedge funds had to scramble to cover their short holdings, prompting a broad-based selloff and sending shivers through the market on January 27th. The Dow dropped 2% and the NASDAQ shed 2.6% on investor concerns that this might be a trigger for the party to end, driving the US dollar up as a safe-haven asset and pushing other currencies like the Aussie dollar down.

Regulators are stepping in to curb the potential for more retail-driven shenanigans, but it does highlight how vulnerable the market is to bad news. Speaking of the bulletin board-driven frenzy, seasoned investor Jeffrey Sherman told CNBC, “This is the euphoria of market tops. I’m not saying we’re going to have an imminent crash, but it definitely reeks of bubblish-type corrections.”5

Amid the froth, what’s really cooking?

Markets always return to fundamentals, and there are still fundamental issues that need to be addressed.

COVID continues to wreak havoc around the world, particularly the US, and the vaccine rollout is slower than many had hoped. Concerns are increasing that the new variants of COVID-19 may not be as easily defeated by the vaccine, or that the highly transmissible strain may cause a new surge in cases before the vaccine arrives.6

The Biden administration has a bold agenda it wants to enact in the first 100 days and is winding back many of Trump’s policies. If that leads to greater regulation and to higher taxes for corporations, then that may halt the bull market (or the rise) in equities that has been running since March 2009. That’s the bad news take.

The good news take is if the vaccine rollout is successful, the US economy takes off and wages and consumption — of both goods and energy — starts to rise. In that situation inflation, which has been so dormant for so long, is likely to raise its head and the US Fed will need to start tapering its quantitative easing policy, pushing bond yields back up again and causing risk-off sentiment.

In both the good news, and the bad news take, the US dollar has reasons to rise as either a growth or safe-haven asset. Not too much of either good news or bad news is likely to keep the equities market melting up and, as a result, the US dollar low.

Schinkel says that there is a “massive risk” to equities when the narrative around inflation changes, but as long as it doesn’t appear, things should keep going.

Strategies for an uncertain world

Despite the trends, currency markets can be hard to predict. With volatility never out of the question, it makes sense to consider your global money transfer needs and goals, and to be prepared. That way, when currency swings present opportunity, or you need to act quickly to defend against rates moving against you, you will feel confident and in control.

Whether you’re waiting for the right exchange rate, or just need a little support with the transfer process, our OFXpert team is here to help 24/7. Contact us today.

______

1https://www.nytimes.com/2021/01/28/business/coronavirus-aid-democrats.html

2https://www.cnbc.com/2020/05/21/many-americans-used-part-of-their-coronavirus-stimulus-check-to-trade-stocks.html

3https://www.nytimes.com/2021/01/25/us/politics/senate-yellen-treasury-secretary.html

4https://au.finance.yahoo.com/news/gamestop-memestocks-revenge-retail-trader-142719034.html

5https://www.cnbc.com/2021/01/27/these-wild-stock-moves-will-end-badly-for-investors-doublelines-sherman-says.html?recirc=taboolainternal

6https://www.nytimes.com/interactive/2021/01/24/us/covid-vaccine-rollout.html

Download the OFX Currency Outlook

Learn more in the latest edition of the OFX Currency Outlook. It’s been produced to help you navigate market movements today, and to understand what to watch out for in the coming months.