Fedspeak

Why US central bank commentary moves currency markets

July 2021

Currency markets have been on high alert since the start of the year for any signs of a change of policy by the US Federal Reserve. As the 800-pound gorilla in the room, whatever the Fed does, cumarrencies will react.

So far, it’s been a whole lot of not much in terms of commentary by the Fed — that is until June 16, when the narrative shifted, surprising financial markets.

The US economy has been in overdrive thanks to a huge stimulus package from the Biden administration, the easing of restrictions (and opening of wallets) as vaccination rates climb, and ultra-accommodative monetary policy, where the Fed keeps interest rates at record lows via by buying $US120 billion in bonds every month (known as Quantitative Easing). With the largest balance sheet, and most aggressive monetary policy, how the Fed moves is of global significance.

But coming out of their two-day meeting, the Federal Reserve Chairman, Jerome Powell, acknowledged what everyone had been worrying about — that the hot US economy could be at risk of a sustained breakout in inflation. Keeping inflation in a range of between 2-3% has been a core mandate of the Fed, and many other central banks, as it is seen as the sweet spot where economic growth can continue without distorting the economy. Interest rates are the key tool to manage inflation but getting the balance right is essential. Raise interest rates too high and you might cause a recession; leave rates too low for too long and assets like property and shares can overheat. When those bubbles pop, like in the dot com crash of the 2000s and the housing crash that caused the Global Financial Crisis, deep recessions can follow.

While Powell poured cold water on inflation being a significant problem, he did telegraph that the era of ultra-low interest rates was likely coming to an end. The Federal Reserve’s “dot plot”, a pictographic representation of interest rate expectations, had shifted to suggest there could be two rate rises in 2023.1

Powell also talked about the Fed’s massive bond-buying program (Quantitative Easing, or QE), and for the first time since the pandemic revealed that QE had come up for review at the meeting. Not that he was particularly forthcoming.

“You can think of this meeting… as the ‘talking about talking about’ meeting, if you’d like,” he said.

But ‘talking about talking about’ ending bond buying is a big deal for investors and along with the dot plot, markets had the first strong inkling that the punchbowl that had been fuelling the party in investments — and therefore its impact on currencies and equities — might be removed.

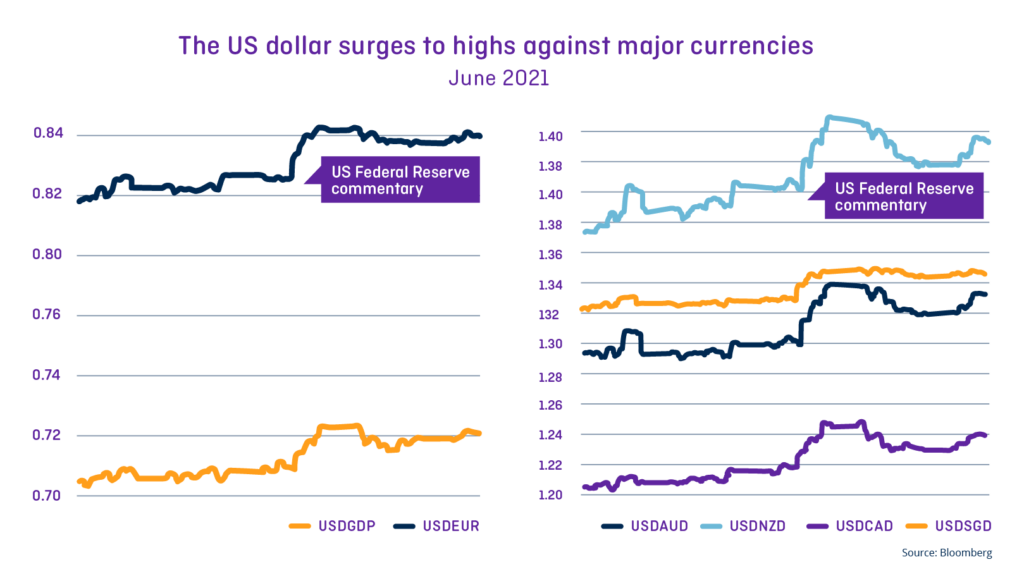

“The Fed took markets by surprise. The upbeat assessment of the economy was expected but officially starting ‘taper talks’ and bringing the dot plot to 2023 gave the USD good momentum. Three months ago officials were not expecting any rate hikes until at least 2024, now some officials are seeing hikes as early as 2022,” said Sebastian Schinkel, Global Treasury Manager at OFX.

As the press conference unfolded, investors started aggressively selling off shares, knocking the Dow Jones Industrial Average down by almost 400 points and sending the US dollar sharply higher against peers. The stock market recovered during the conference itself as Powell played down the likelihood of rate rises, but the US dollar continued its upward trajectory.

Investors are now on alert for what this new, more hawkish approach will have on markets. A hawkish stance takes the view that action needs to be taken (i.e., raise interest rates) to prevent an economy overheating. A dovish stance, by contrast, takes the approach that rates need to be reduced, or remain at lows to encourage more economic activity.

With the Fed signaling it is not averse to raising rates, currency markets will be even more attuned to any economic indicators that might contribute to that more hawkish stance.

What currency markets will be looking out for

Speaking to the New York Times, Tara Sinclair, an economist at George Washington University, had this to say about the challenges of predicting what the Fed would do; “During normal times, you can just track a handful of indicators to know how the economy is doing. When big shifts are going on, you’re tracking literally hundreds of indicators.”2

Indicators of Inflation and employment, in their various forms, will be most closely watched, and the stories they tell will impact currencies.

Contender number one will be those all-important inflation figures. As flagged last month, costs of many goods have been rapidly increasing thanks to a combination of rising consumer demand meeting supply bottlenecks.

The Fed’s Powell described those inflationary effects as “transitory” but did warn if inflation continued at its current pace and therefore “materially above what we would see as consistent with our goals, and persistently so, we wouldn’t hesitate to use our tools to address that.”3

The most recent US inflation data, released on June 25, seemed to confirm the Fed’s view. Personal Consumption Expenditure, a key inflation gauge, came in lower than forecast and consumer spending was steady.4

Contender number two is US employment data. Job ads have been growing at a rapid clip, but worker shortages have had many questioning whether wages will need to go up to entice people back into the workforce. The official US unemployment rate is 5.8% (based on May figures), or some 9.3 million workers5 but that leaves some 7 million jobs that existed pre-pandemic to still come back6 and the Fed seems happy to keep policy accommodative until it sees that slack taken up.

If the rate of hiring picks up, or if wages data such as the Employment Cost Index, expected in July, shows a larger than expected gain, then the Fed may need to change its policy sooner, whether that be by tapering its bond buying, or signaling rate rises.

The final indicator is not based on a data point but instead on a reading of what the Fed says next. Everyone is trying to read the tea leaves of Fed commentary, and each remark is pored over and traded on.

“Now markets will be more sensitive to any data confirming this narrative shift,” says Schinkel.

More hawkish commentary (mentions of rate hikes or tapering of bond-buying) from the Fed could see demand spike again and could be a risk for overvalued assets including equities and commodity currencies (AUD, NZD and CAD). Dovish commentary, i.e. maintaining that inflation is transitory and current monetary policy will remain, would suggest USD weakness could continue.

1https://www.cnbc.com/2021/06/16/fed-meeting-live-updates-watch-jerome-powell-speech.html

2https://www.nytimes.com/2021/06/03/business/economy/us-economic-recovery.html?smid=url-share

3https://www.nytimes.com/2021/06/16/business/economy/fed-meeting-inflation.html

4https://www.reuters.com/business/dollar-steady-after-us-inflation-data-misses-estimates-2021-06-25/

5https://www.bls.gov/news.release/pdf/empsit.pdf

6https://www.cnbc.com/2021/06/04/jobs-report-may-2021.html

Download the OFX Currency Outlook

Learn more in the latest edition of the OFX Currency Outlook. It’s been produced to help you navigate market movements today, and to understand what to watch out for in the coming months.