How to set up a foreign exchange account for your business

Setting up a business account with OFX is easy and can be completed in a few steps. In Australia, OFX offer business accounts for companies operating as a Sole Trader, within a Partnership or Trust, or are a Proprietary Limited (Pty Ltd) company.

Get in touch to learn more about OFX can help you get started with a business account.

Why OFX for your business?

OFX is a money transfer service that gets your business. Our OFXperts are on hand 24/7 to help your business. Whether you need to pay international suppliers or overseas staff, set a transfer date or protect against moving currency markets. Your OFXpert can manage all your currency needs in a single place.

Save time and money with an OFXpert working for your business.

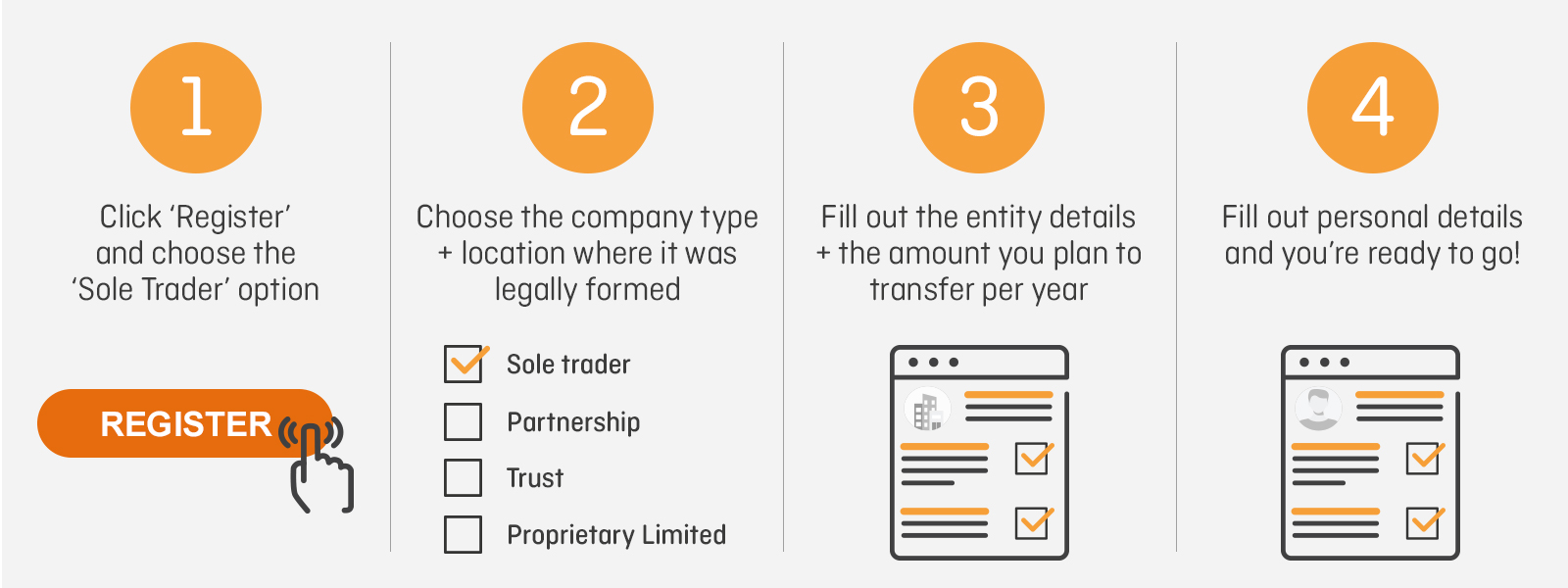

How to sign up for OFX as a Sole Trader

Sole trader – An individual legally responsible for all aspects of the business.

Next steps:

We fast track your account activation with automated ID processing and fully digitised business verification.

From there, one of our OFXperts will call you within an hour of registration. In most cases, accounts are fully verified within 60-90 minutes!

99% of Australian Sole Traders who discuss their transfer requirements when they register are activated to book their first transfer on the same day.

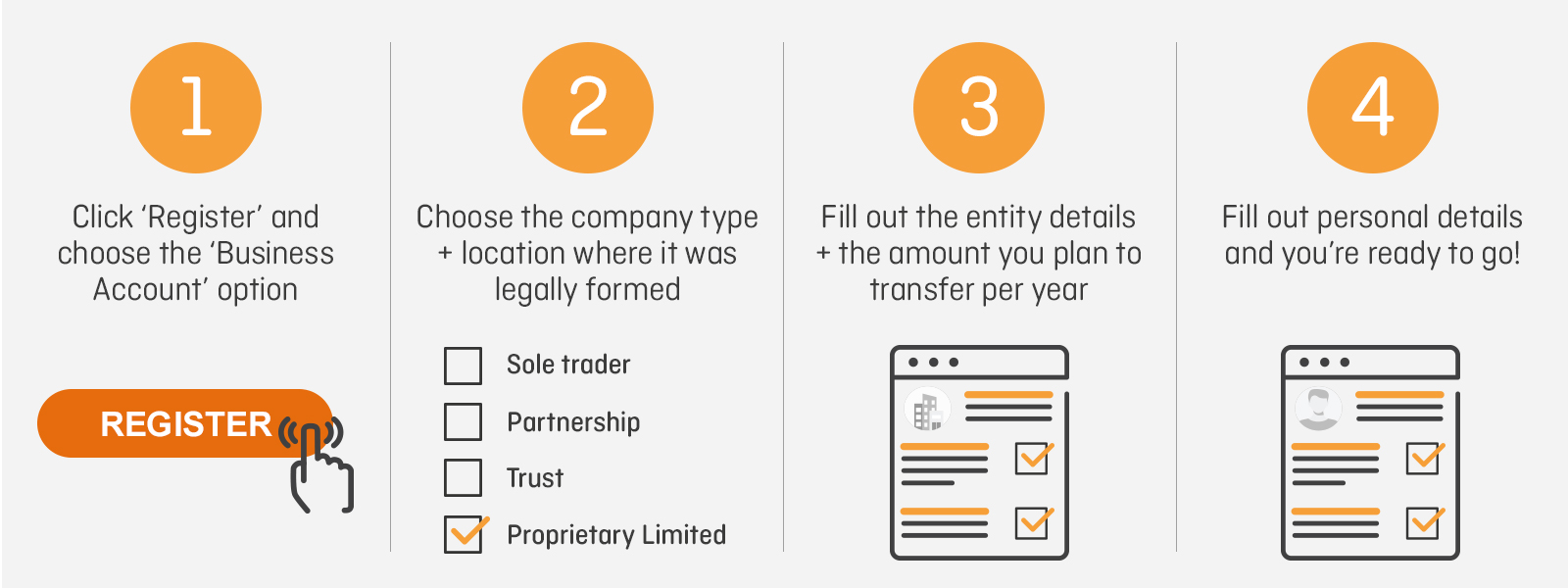

How to sign up for OFX with a Partnership or Trust

Partnerships and Trust – A Partnership is two or more people or entities who do business and receive income jointly. A Trust is the obligation of a trustee to hold property or assets for their beneficiaries, it’s commonly used in investments and businesses.

Next steps:

Complete the registration process with the partnership or trust ABN number.

Provide the partnership agreement or trust deed.

The documents provided will then be assessed and verified by the OFXperts.

In the instance there is missing information, an OFXpert will reach out to you to verify and ensure that your account is activated in less than 48 hours.

More than 50% of trust or partnership accounts are activated and ready to book their first transfer within 12 hours.

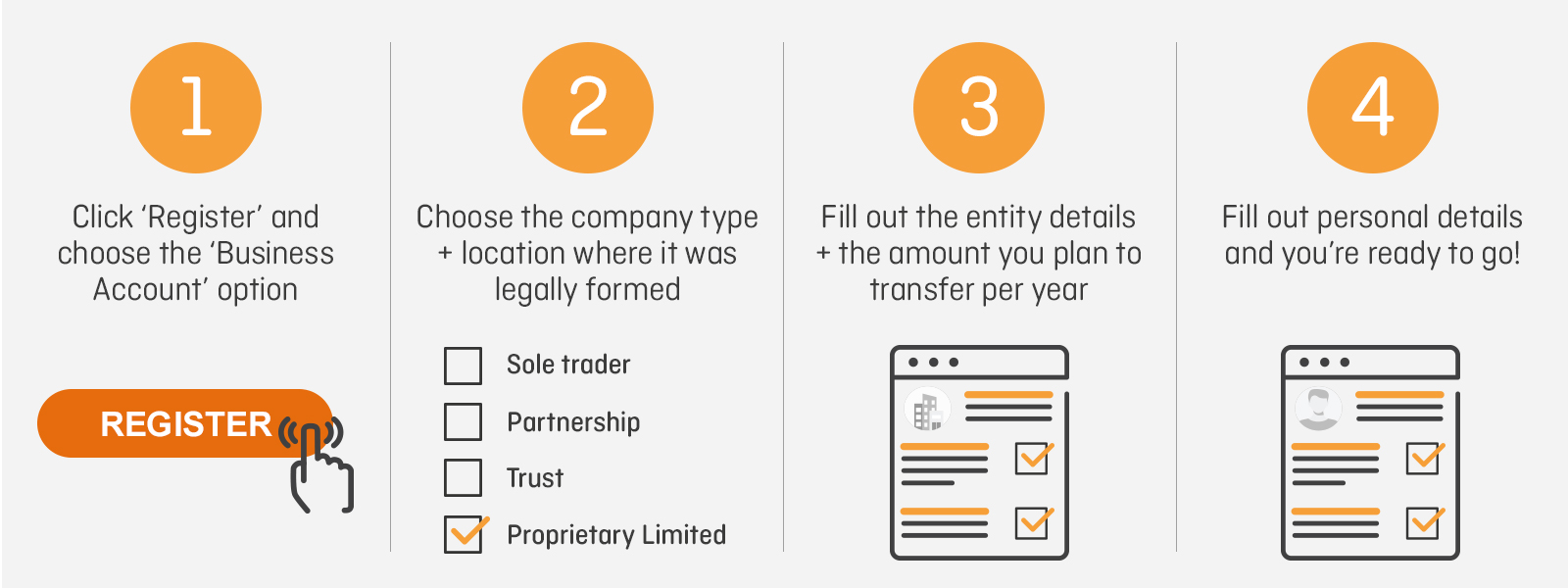

How to sign up for OFX as a Proprietary Limited (Pty Ltd) company

Proprietary Limited (Pty Ltd) – A company that is privately held and the liability of shareholders to pay the debts of the company is limited by the amount of shares. These are the most common company type for small to medium businesses.

Next steps:

Complete the registration with an ABN or ACN number. The OFXperts will then obtain a company report directly from ASIC to identify key individuals within the business and verify them electronically, this typically only takes about an hour and no action is required on your behalf.

All forms are pre-populated with the details provided during registration this way you simply need to digitally sign and return to activate your account.

Your account should then be up and running in less than 48 hours. In fact, more than 50% of new company accounts are activated within 6-12 hours.

Register in less than 5 minutes

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. OzForex Limited (trading as OFX) and its affiliated entities make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.