Currency exchange rate fluctuations have you puzzled? Let our OFXperts explain what factors influence foreign exchange (FX), specifically data reports. The release of data from central banks or reputable agencies can have a strong impact on FX exchange rates.

Data reports and FX

Regardless of why you trade currencies, understanding the factors that influence ever-changing exchange rates is important to make the most of your money. One of those factors is data reports.

You may be asking, what is a data report? Data reports are information released on a regular basis from multiple sources such as Hong Kong Economy who reports Gross Domestic Product (GDP) quarterly. Each report highlights a specific data set. Here we will explore the many data reports that influence FX rates as well as insight from OFXpert and Treasury Dealer, Isaac Figueroa into how data releases can spark volatility. “Data releases are powerful and important to markets because if they are not in line with expectations they can shift the market sentiment and the currency’s exchange rate,” Figueroa said.

Data reports are often released by a nation’s central bank, a government agency or a reputable organisation, such as a university, and consist of economic information relating to trade balances, payroll numbers, job standing, production, sales, inflation, and more. While we can’t cover all of the key data reports to keep an eye out for, we will discuss the top monthly reports that have some of the biggest impacts on currency exchange.

Ready to start transferring with OFX? Register now

Key data releases

Key data reports that provide insights into the economic health of a country can influence investor sentiment and central bank policy decisions, both of which can affect the value of a currency. Here are some of the most important data reports that impact currency exchange rates:

- Inflation Reports: Inflation is a key economic indicator that measures the rate at which prices are rising. When inflation is high, it erodes the purchasing power of a currency, making it less attractive to foreign buyers. This can lead to a depreciation of the currency. Inflation reports, such as the Consumer Price Index (CPI) and the Producer Price Index (PPI), are closely watched by traders and analysts for signs of inflation pressures or easing. Most inflation reports including CPI and PPI are released on a monthly basis.

- Trade Balance Reports: Trade balance measures the difference between a country’s exports and imports. A trade surplus is when a country exports more than it imports, while a trade deficit is the opposite. Trade balance reports, such as the such as Census and Statistics Department’s External Merchandise Trade report, provide insight into the strength of a country’s economy and its ability to compete in the global market. A trade surplus can lead to the appreciation of a currency, while a deficit can put downward pressure on the currency. Most trade balance reports like international trade deficits are released monthly, however some are published on a quarterly basis.

- Economic Growth Reports: Economic growth is another key indicator that measures the rate at which an economy is expanding. When an economy is growing and producing more goods and services, it can lead to increased demand for the currency from foreign investors. Economic growth reports, such as the Gross Domestic Product (GDP) report, are closely watched by traders for signs of economic strength or weakness. Strong economic growth can lead to an appreciation of a currency, while weak economic growth can push the currency downward. Growth reports, like GDP, are most often released on both a quarterly and monthly basis.

- Employment Reports: Employment reports track the current state of the labour market in a country. Employment reports, such as the General Household Survey released by the Census and Statistics Department Hong Kong, provide information on unemployment rates, payroll employment numbers, average hourly earnings, workforce participation rates, jobless claims, and much more. Employment reports are an important indicator of the health of a country’s economy and allow investors to assess the risk associated with investing in certain industries or sectors. Positive employment data can help push a currency upward while negative data can depreciate a currency. These reports are typically released every month and quarter by government agencies.

While the names of data reports can differ between countries, the data discussed is relatively universal. Another universal component of data reports is the market sentiment that follows these releases. While market sentiment cannot be classified as a data release, it is an important byproduct of these releases that influences currency exchange.

Data is a powerful tool that can shift the direction of a currency. That is why data releases are so important.” – Treasury OFXpert, Isaac Figueroa

Data’s effect on market sentiment

Data plays a significant role in shaping market sentiment. Market sentiment is the overall mood of investors and their perceptions of risk and opportunity. Market sentiment reports are often released by private agencies. Both the market sentiment itself and the market’s expectations of what the data will report, can cause FX rates to rise or fall beyond a point that would be warranted by the data, causing volatility. In the FX market, the sources of market sentiment are very diverse, and these reports can provide:

- Insights into the health of a country’s economy

- The performance of companies

- The direction of various markets

With this wealth of knowledge, investors and traders rely heavily on this information to help make informed decisions about their investments and trading strategies.

The release of key economic data can have a significant impact on market sentiment. Generally, the primary driver of market sentiment is positive data, such as lower-than-expected inflation or higher-than-expected job growth, which can boost investor confidence and lead to a more optimistic outlook. This would consequently help raise the trade value of that currency. Conversely, negative data may dampen investor sentiment and lead to a more pessimistic outlook. “Data reports often help to determine market sentiment. If the data released is far below expectations, market participants could view that currency as a risk and rush to trade. This, of course, leads to volatility,” Figueroa said. Either way, strong data reports often result in strong market sentiment, causing volatility.

Data reports can be confusing, don’t let them overwhelm you. Our OFXperts are well-versed in how data can influence currency exchange. Contact an OFXpert today.

FX and the bandwagon effect

Alongside market sentiment and data report releases is the bandwagon effect. Humans often follow the crowd. This tendency, known as the “bandwagon effect,” is especially prevalent in economics and financial markets.

The bandwagon effect manifests itself in two distinct ways within the financial landscape:

- Price Bubbles: These artificial surges in prices happen when a currency experiences a rapid and unsustainable increase in value due to excessive buying pressure driven by herd mentality. As more investors jump on the bandwagon, they increase the value of the currency, perpetuating the illusion of scarcity and value.

- Liquidity Holes: In response to unforeseen events, market participants often freeze trading activity. This can lead to reduced liquidity. Liquidity is how easily a currency pair can be traded without significantly impacting its exchange rate. This decline in trading intensifies the impact of price fluctuations, as there are fewer traders to moderate the movements. This amplifies volatility. These swings can trigger panic among investors, heightening uncertainty and fueling the cycle.

Understanding the bandwagon effect is important to help make informed decisions and navigate financial markets effectively. By recognising the influence of herd mentality on FX markets, you can better evaluate market sentiment and it can help being swept away by irrational actions. “Instead of succumbing to the bandwagon effect, harness the volatility in the market with OFX,” Figueroa said.

Harnessing market volatility

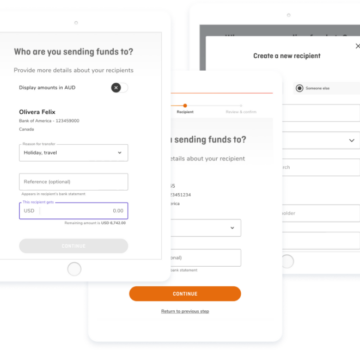

Wondering how to navigate markets that are influenced monthly by countless data reports? It may feel complex, but luckily, our OFXperts are well-versed in the currency exchange markets and are ready to help you and your business harness market movements. Here are some OFX tools to help make the most of volatility:

- Forward Contracts*- Forward Contracts are a ‘buy now, pay later’ option for businesses trying to take advantage of a positive rate today on a payment that needs to be paid in the future.

- Risk Calculator- Have you ever experienced exchange rates shifting between the time you receive an invoice and its due date? Use our risk calculator to determine the impact shifting market exchange rates could have on an example invoice. This is not a quote, it’s designed to help you understand the impact of currency fluctuations.

- Rate Alerts- Stay on top of moving markets with OFX rate alerts. This tool provides you with personalised market rate alerts directly to your inbox. Our currency experts will monitor the ever-changing market for you

*Forward Contracts are not available to personal clients in Hong Kong.

Whether you’re trading currencies personally or overseeing an international business, understanding how data reports influence the FX market is important in supporting you to help make the most of your money. Interested in learning more about how to protect your money from market volatility? Chat with an OFXpert today!

Fix your rate to protect against market moves

Create currency confidence and stay ahead of market moves with OFX’s risk mitigation hedging tools.

Still experiencing currency exchange data overload? Let our OFXpert do what they do best, make FX simple. Contact us.

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. UKForex Limited (trading as “OFX”) and its affiliates make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.