Looking to protect your business from future volatility? Discover how hedging can give you protection and certainty for your bottom line. In this blog we will cover what hedging is, how to hedge, and some common hedging strategies in the foreign exchange industry.

What is FX hedging

At OFX we know the value of peace of mind, that’s why we offer risk management tools for our clients. Many use the terms hedging and risk management interchangeably. Hedging is a form of risk management and in the world of OFX, it’s currency risk management. When you hedge, you are providing yourself protection against fluctuating exchange rates. For example, if you know you need to purchase inventory for your business in 6 months, and that inventory is priced in a foreign currency, you can help reduce the risk of currency fluctuation by locking in the rate as it stands today. Providing no surprises on what you need to pay 6 months down the line.

Why hedge

Hedging can help provide your business with protection against changes in currency rates, limit the impact of FX movements on your profits, and reduce currency risks. Utilizing hedging contracts in your business can also help you protect your gross margin, improve your business’s forecasting capabilities, lower cash flow volatility, and focus more attention on your core business. It’s a win, win! Hedging contracts are also customized for your business, meaning that you can hedge all, or even a portion of your known FX exposure for the year ahead. When you work with an OFXpert we learn your business inside and out to help provide the best hedging solutions to fit your needs.

How to hedge

Learning how to hedge always starts with visibility into your own financials. Our OFXperts we can help you identify and quantify your business’s FX exposure. We work alongside your finance team to help understand your currency transfer risks. This means letting our OFXpert help you with financial forecasts against exposures. The next step is setting goals around hedging. Goal setting with hedging could mean reducing risk in your business, lowering your cash flow volatility, moving forward with more rate certainty, or achieving more accurate forecasting. At the end of the day, you will need to set risk management goals and develop a hedging strategy that works for your business.

Ready to start transferring with OFX? Register now

Risk management strategy development

No two businesses are alike, which means no two risk management strategies should be either. Our OFXperts help develop a personalized risk management strategy tailored to your business. Our FX risk strategies are created by uniting three key elements to serve as your guide for future decision making. These elements combined help identify the percentage of hedging that makes sense for your business, the length of contract that works best for your organization, and the type of product you want to use. Using these three elements together creates a hedging strategy.

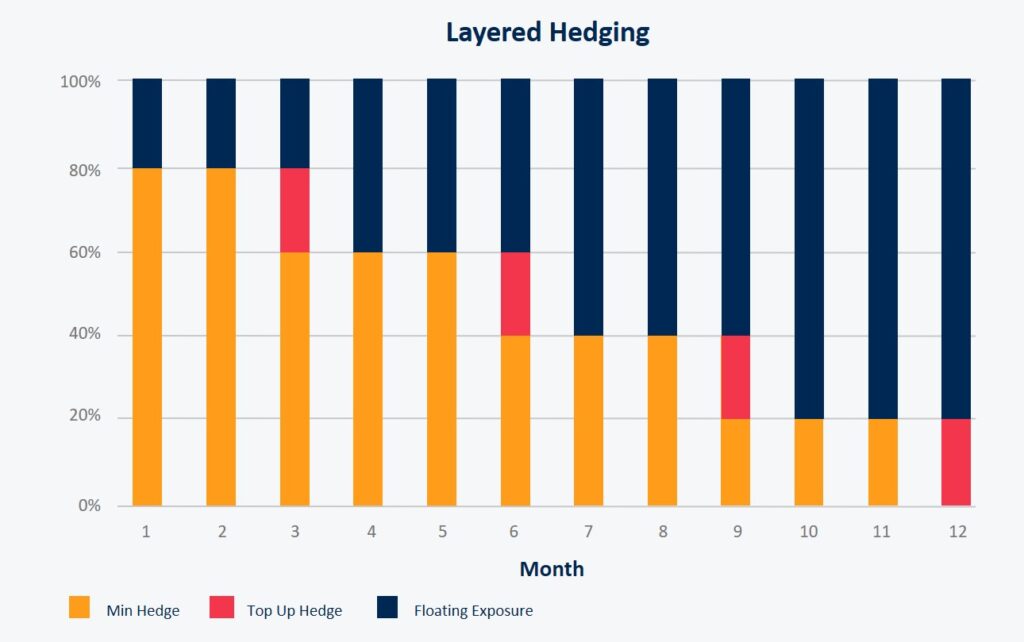

Risk management strategies can come in all shapes and sizes. One common strategy for businesses is “Layered Hedging.” The “layered” element refers to the multiple number of hedges deployed for different notionals and over different periods of time. For example, a layered hedging program might see 6, 12, and 18 month hedges executed in layered proportions such as 80%, 50%, and 20% respectively. Layered hedging set up in this way helps organizations reduce volatility over time because the layered strategy achieves a more averaged forward rate. This, as with any other hedging programs, helps businesses budget, execute true financial forecasting, and anticipate overall cash flow. The graph below helps you visualize how a business would achieve this.

The FX market is always fluctuating, but that doesn’t mean that your business’s profits need to oscillate along with it. Work with an OFXpert who can help you put together a hedging strategy that fits your business. Or reach out to our North American Director of FX Risk Management, Jean-Francois Giguere today to discuss how hedging may work for your business needs.

Fix your rate to protect against market moves

Create currency confidence and stay ahead of market moves with OFX’s risk mitigation hedging tools.

Navigate rate swings in turbulent times. Our OFXperts can help you make more informed decisions about hedging and risk mitigation. Contact us.

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. UKForex Limited (trading as “OFX”) and its affiliates make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.