Prices on the rise

Is inflation just a phase or here to stay?

June 2021

As the great reopening of global economies gathers steam, inflation is continuing to become a key concern for markets, with currencies directly in the firing line.

A year of pent-up demand, boosted by enormous amounts of financial stimulus by major governments, is leading to steep rises in the cost of key commodities like iron ore, lumber and copper.

One of the most widely watched commodity indexes – the S&P GSCI is already up 26% for the year to date and up 120% since the depths of the pandemic to be higher than at any time in the last 5 years.1

The reasons for the rise are twofold. On the one hand, all that stimulus is causing enormous demand. Across the world consumers are taking up incentives to pour money into new housing, factories are gearing up to supply both consumer goods and steel-hungry government infrastructure projects, and planes, trucks and cars are back burning fuel. Even the cost of shipping has soared.

On the other hand, the pandemic massively curtailed supply. Social distancing meant factories and workers were kept idle and major investments in new supply were put on hold as finance dried up.This perfect storm of high commodity prices has markets on tenterhooks wondering whether what we are seeing is just a temporary spike that will even out as things return to normal, or whether we are now in a highly inflationary world that will require central banks to raise interest rates much faster than they would have liked.

Currency markets are being moved by any signs that it is one or the other.

Commodity currencies are in the box seat

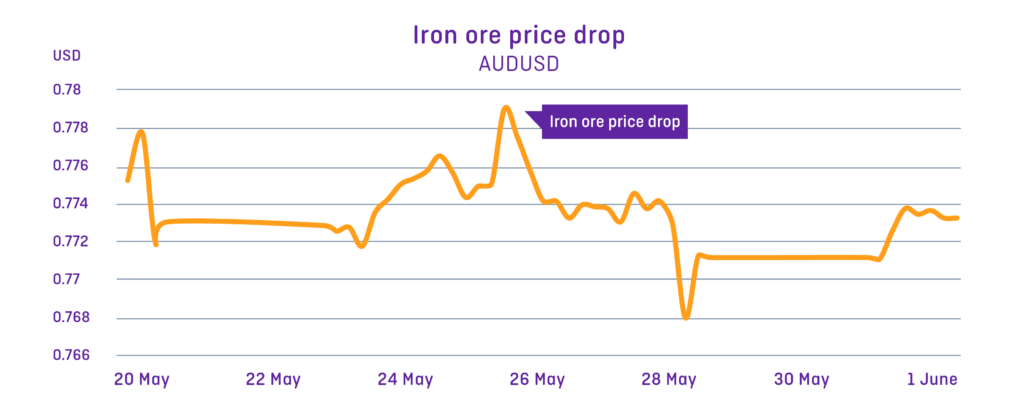

The soaring prices for key products is great news for exporters of commodity products. Iron ore is a perfect example. The price of iron ore has shot up to over $USD200 per tonne from $USD80 a tonne in just a year as Chinese steel mills crank up to meet government stimulus going toward infrastructure. That is higher than the previous record in 2011, when the last round of stimulus was put in place to get through the Global Financial Crisis.This has kept upward pressure on the Australian dollar — but has also made the dollar hostage to any signs that China is trying to get the iron ore price down. In the last weeks of May, the Chinese government declared that the iron price was too high, warning that companies “should not collude with each other to manipulate market prices… hoard goods and drive up prices.”2 That sent the iron ore price tumbling 3.6% in a day and the Australian dollar with it.

But overall demand for commodities hasn’t gone away. In May, the Canadian dollar hit its highest level against the USD since 2015 as both copper and oil prices soared.3;

Stimulus everywhere

To get a sense of why we are seeing such high demand, look to the scale of government stimulus.

According to research by Capital Economics, Germany’s fiscal stimulus has been equivalent to nearly 10% of GDP.4 That’s five times the size of Germany’s stimulus in the wake of the global financial crisis. By comparison, US fiscal stimulus has reached 25% of GDP. As the researchers noted, “Germany’s support may have been enormous, but US support has been off the scale.”

While governments are engaged in fiscal stimulus, central banks are engaged in monetary stimulus, artificially depressing interest rates to keep companies and consumers borrowing and spending.

This unprecedented amount of support being thrown at the economy is also being compounded by the great opening of consumers’ wallets. Months of lockdown with little to spend it on, bolstered by stimulus checks, has meant consumers are cashed up and looking to spend.

Effectively, triple afterburners are being applied to a vehicle that was brought to a screeching halt.

Supply bottlenecks are everywhere. In the US, housing developers can’t find enough workers or timber to meet demand for new homes. The housing market is so hot that there are now more real estate agents than homes listed for sale.5

Across the USA and EU, companies are working flat out with key surveys showing record high output in US services and manufacturing firms6, and record high manufacturing output in Europe.7 All that activity is pushing demand for commodities higher and higher as companies try to buy up scarce goods to meet that growth. Ultimately those higher input costs will feed through to consumer prices.

All eyes on inflation

Market watchers are asking how long prices can keep rising before central banks are forced to slow their economies with higher interest rates. For currency markets, any data that gives hints to which way banks will move is being watched closely, as currencies tend to appreciate when interest rates go up relative to peers as investors chase higher yields.

“Both the Bank of Canada and Bank of New Zealand have been leading the way in acknowledging inflation pressures and what that means for their respective interest rates and asset purchases, and their currencies have reacted accordingly,” said Sebastian Schinkel, Global Treasury Manager at OFX.

The most significant central bank is the US Federal Reserve and everyone is keenly looking at US economic data for a guide to what the Fed will do. In early May, when US employment figures came in drastically lower than expected, it looked like there was still plenty of slack in their economy. But just when the narrative suggested the US economy looked like it was easing nicely out of the recession, markets got a big shock when US inflation (CPI) figures released mid-May showed the largest rise in more than a decade.

For its part, the US Federal Reserve is saying that it is too early to act on these volatile numbers that are more reflective of economic distortions unwinding than an overarching trend. “This is a highly uncertain environment that we’re in,” Neil Kashkari, a member of the Federal Reserve Board told Bloomberg. “We have a long way to go, and let’s not prematurely declare victory.8

But markets, by their nature, look a long way down the road and if the signposts keep pointing to inflation, they could move quickly.

“After aggressive fiscal and monetary intervention across the globe, currency markets are currently very sensitive to any headline that has potential to feed the inflation narrative,” says Schinkel.

“A combination of higher commodity prices, stressed supply chains and tight labour dynamics are starting to show up in the data but it is the central banks’ interpretation of these factors which is generating the biggest moves in the currency market.”

1https://www.spglobal.com/spdji/en/indices/commodities/sp-gsci/#overview

2https://www.abc.net.au/news/2021-05-25/markets-wall-street-dow-jones-asx/100162696

3https://financialpost.com/news/economy/the-loonie-is-soaring-and-it-isnt-just-an-oil-story

4https://www.capitaleconomics.com/blog/global-inflation-outlook-more-complicated-than-polarised-debate-suggests

5https://apnews.com/article/prices-home-prices-lifestyle-health-coronavirus-pandemic-f072fbf01de5af9e4c27792810c69e7b

6https://www.afr.com/markets/currencies/fed-may-blink-first-on-policy-20210524-p57uhh

7https://www.markiteconomics.com/Public/Home/PressRelease/42031fb929244ec0a64df832d27a5a31

8https://www.nytimes.com/2021/05/07/business/jobs-report-fed-interest-rates.html

Download the OFX Currency Outlook

Learn more in the latest edition of the OFX Currency Outlook. It’s been produced to help you navigate market movements today, and to understand what to watch out for in the coming months.