Survey finds global concerns aren’t deterring business expansion abroad

For the third year in a row, global money transfer specialists OFX conducted a confidence survey of UK SMEs to pulse-check how these businesses are feeling about the latest international news, and the results are surprising. Despite the ongoing uncertainty of Brexit, the fatigue is setting in and many have ranked other global concerns in front of no-deal situation. Here’s what key decision makers in these businesses had to say:

Global economic slowdown top of mind for businesses today

OFX’s survey of 500 senior SME decision-makers found that almost 1 in 5 (18%) consider a global economic slowdown to be the biggest threat to their business over the next year. For 19%, this synchronised slowing of the global economy has actively decreased their appetite for international trade. Despite the looming possibility of a no-deal Brexit, the majority of small and medium-sized UK businesses (53%) are simply preoccupied with other global concerns as the effects of the global slowdown are certainly keenly felt.

This demonstrates how no economy works in isolation, and a country’s currency is also intrinsically linked not only with its own economic performance, but also the performance of the currency you are paired with.

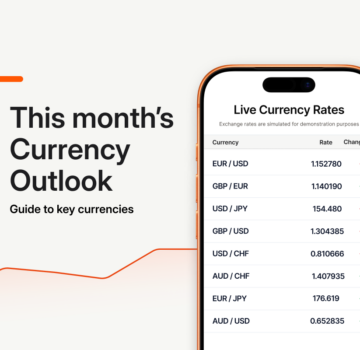

The traditional safe haven currencies – the US dollar, the yen and the Swiss franc – will usually benefit from uncertainty as companies and individuals look to reduce their exposure to currencies that are more likely to be affected by specific changes.

Overall decrease in interest towards trading with the US

Though the ongoing Brexit negotiations expected to impact global ambitions of British SMEs are waning, other geopolitical issues continue to make their mark – and Trump’s ‘America first’ trade policies, in particular, are having a sizeable impact.

Small and medium-sized UK businesses have been put off the US by the threat of new barriers to the market. Interest in trading with the US fell again this year, with 1 in 5 businesses (21%) reporting a decreased appetite for UK-US trade in light of President Trump’s protectionist trade policies, which include the threat of new tariffs on billions of dollars’ worth of European goods.

This year’s findings represent a sustained depression in America’s popularity amongst UK exporters, as the US underperformed for the second year in a row. This stands in dramatic contrast to 2017, when respondents to OFX’s annual survey ranked the US as by far the most attractive market for international sales (62%).

Not to mention that, as outlined in the latest OFX Currency Review, consumer spending figures released by the US in May suggest that they’re being more cautious with their money, with figures falling by 0.2% from the previous month. As retail spending boosts an economy, this does not spell good news. Another critical measure was the Empire State Manufacturing Index survey, which came out as -8.6 – the worst reading since May 2016. It showed that growth is reversing, employment is shrinking and future optimism is declining in the face of growing trade tensions.

Between 2017 and 2018, as Trump’s tough trade policies began to spook SMEs, the US dropped 53% in popularity and was overtaken by Western Europe as businesses’ favoured export market. In the last year, the number of UK SMEs trading with the US dropped by 26%.

This might all sound very bleak, but it’s not all bad news. There’s opportunity for businesses who can harness this volatility and turn it into an advantage when trading with the US in the future. To learn more about how you can manage you US dollar exposure and discuss your options for seizing opportunities as they arise, chat to a currency specialist at OFX.

OFX can help protect your business against exposure and turn volatility into opportunity.

Sales to Europe look promising in the next year

The survey found that, with the threat of a global economic slowdown front of mind, British businesses are less willing to trade with non-neighbouring countries than they were last year. In the next twelve months, 24% fewer businesses intend to start trading with markets outside Europe than in 2018.

What’s more, 47% of respondents expect to start or increase sales to Western Europe in the next year, despite the fast-approaching Brexit deadline and uncertain future trading relationship.

For these businesses, the risk of a no-deal Brexit seems to be outweighed by the proximity and familiarity of Europe.

Sarah Webb, President, UK and Europe at OFX, said: “While UK businesses are right to prepare themselves for the risks of a no-deal Brexit, this should not be the only issue that takes their attention right now. The knock-on effects of a global economic slowdown could end up posing a bigger challenge to global trade and the currency markets, so it’s comforting to see small to medium-sized businesses taking action to protect themselves so they can continue to trade with confidence.”

Similarly, businesses in the UK are not as worried about doing business in Northern Ireland. Despite uncertainty around the future of the border, 47% of Northern Irish SMEs named the Republic of Ireland as the most attractive market for international sales in the next year.

Meanwhile, after Greater London, businesses named Scotland and Northern Ireland as the best places in the UK to set up an internationally-trading business.

For 30%, Scotland’s main attraction is its access to major transport links, while respondents highlighted local employment costs and the availability of talent as the major draws in Northern Ireland.

Jake Trask, FX research director at OFX, said: “As we approach the Brexit deadline, it’s encouraging to see such a show of confidence from small and medium-sized businesses right across the UK. That’s particularly true for Northern Ireland, where businesses have embraced cross-border trade despite ongoing uncertainty around the terms of Brexit.

“Despite escalating rhetoric amongst politicians, businesses are simply knuckling down and taking appropriate measures so they can continue to trade like it’s business as usual.”

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. OzForex Limited (trading as OFX) and its affiliated entities make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.