TERMS AND CONDITIONS MASTER AGREEMENT

These OFX Terms and Conditions v1.22 govern the relationship between OFX and its customers.

Dated: 15 November 2022

Version 1.22

You should read these Terms and Conditions carefully and ensure you understand them. Please obtain independent advice or contact us if you have any questions.

Section 1: About this Agreement

Please read this Agreement carefully before you begin to use our Services. If you proceed to use our Services, you acknowledge that you understand this Agreement and have had the opportunity to obtain your own independent legal advice in relation to this Agreement.

1. What is the purpose of this Agreement?

A. This Agreement (the “Agreement”) is a legal agreement between you and us and governs your access to and use of our Services.

B. Nothing in this agreement is intended to, or shall operate to create a partnership between the you and us, or authorise either party to act as agent for the other, and neither party shall have the authority to act in the name or on behalf of, or to otherwise bind the other, in any way including, but not limited to, the making of any representation or warranty, the assumption of any obligation or liability and the exercise of any right or power.

2. Who does this Agreement apply to?

A. This Agreement is between you and ©UKForex Limited (trading as “OFX”). We are registered in England and Wales (Company No. 04631395). Our registered office is at 4th Floor, The White Chapel Building, 10 Whitechapel High Street, London, E1 8QS. We are a wholly owned subsidiary of OzForex Limited (ABN 65 092 375 703). We are authorised by the Financial Conduct Authority as an Electronic Money Institution (Firm Ref. No. 902028). http://www.fca.org.uk/.

B. This Agreement applies to all Customers who use our Services through our Website, telephone, mobile applications, software, APIs or any other access channels.

C. In this Agreement, “we”, “us” or “our” means the relevant OFX company. “Customers” and “you” includes individual and business Customers.

D. We enter into Transactions directly with you or with you via your Authorised User. We have no responsibility to any third party. The agreement is personal to you and you cannot transfer any rights or obligations under it to anyone else.

E. If you access the Services using a mobile application developed for Apple iOS, Android or Microsoft Windows, you agree that Apple Inc., Google Inc. and Microsoft Corporation are not parties to this Agreement and are not responsible for the provision or support of the Services. Your access to the Services using a mobile application is subject to such applicable third-party provider’s terms of service.

3. When does this Agreement apply?

A. Each use of our Services will be treated as a separate Transaction.

B. The specific details of each Transaction, including the currencies, the amounts and the Recipient Account, will be agreed separately each time you request a Transaction in the confirmation by email you receive. This is called a Deal Confirmation.

C. Whilst each Transaction will be a separate Agreement in its own right, it will still incorporate the terms and conditions contained in this Agreement.

4. Do any additional terms apply to me?

A. There may be supplemental terms specific to the services you use such as the additional Service terms listed on the Legal and Policy page of our Website, including the Global Currency Account Terms of Service. If these are relevant to any particular Transaction, you agree that these will become part of this Agreement.

B. Some of the documents we have listed below

contain legal obligations for you and for us, so you should read them carefully to make sure you understand them.

Please click on the hyperlinks below to read our:

5. How do I agree to this Agreement?

A. By accessing and using our Services, you agree to be bound by this Agreement.

6. How is this Agreement to be interpreted?

A. We use some words which start with capital letters in this Agreement. These are called Defined Terms and you can see what each of these words means in the Glossary.

B. In the event of any conflict or inconsistency between any of the documents we refer to, the following order shall prevail:

- Deal Confirmation

- Country-specific terms and conditions

- Supplemental terms specific to the Services you use

- This Agreement

- Privacy Policy/Website Terms of Use/Cookie Policy

C. The headings used to identify this Agreement’s provisions, do not have any substantive meaning or interpretative value.

D. Except where expressly stated otherwise, this Agreement will prevail over any conflicting policy or agreement and supersedes all prior agreements or understandings you may have with us.

E. If any term under this Agreement, whether in full or in part, is found to be illegal, invalid or unenforceable, under any law or enactment, it will no longer form part of this Agreement. That will not affect the legality, validity or enforceability of the rest of this Agreement which will otherwise remain in full force and effect.

GLOSSARY

In this Agreement:

Advance Payment means a payment of all or part of any sum that is due us on the Maturity Date.

Authorised Signatory Form means a form that we will give you to enable you to appoint somebody else to perform a Transaction on your behalf. This person will then become an “Authorised User”.

Automatic Conversion is when you instruct us to convert funds from one currency to another and enter into a Transaction immediately upon us receiving funds into our account.

Business Day means a day other than a Saturday, Sunday or public holiday on which banks are open for business in the jurisdiction of the company in the global OFX group with whom you have contracted.

Close-out Amounts means the losses we would incur or gains we would realise on the Termination Date in replacing the material terms and option rights of the parties under a Transaction. We may consider any of the following in determining the Close-Out Amount:

1. Quotations for replacement Transactions from third parties;

2. Third party market data; or

3. Internal quotes or market data.

We may determine Close-out Amounts for groups of Transactions if they are all accounted for. Unpaid Amounts and Expenses in respect of Terminated Transactions are excluded from the Close-out Amount calculation.

Customer/s means as defined in section 1 clause 2 “Who does this Agreement apply to?”.

Data Protection and Privacy Laws means all laws and regulations relating to the processing of your Personal Data under this Agreement.

Deal Confirmation means the notification we send you confirming the details of the Instruction you have given us.

Delivery Date means the date on which we have requested that you deliver your funds to our account for transmission.

Expenses means any amounts incurred by you or us in enforcing and protecting the rights under

this Agreement.

Forward Contract means a foreign exchange contract under which we exchange money at an agreed exchange rate and at an agreed time which is between 48 hours and 12 months from the time of the contract commencing.

FX Service means the Service where we buy and sell currency from you for personal or commercial purposes. Being Spot Contracts, and Forward Contracts.

Instruction means a request made by you or any of your Authorised Users to enter into a Transaction. It shall be taken to include any information, communications or documents incidental to or relating to a Transaction whether we process the Transaction or not.

Illegal Activities means any actual or alleged unlawful or criminal acts including but not limited to money laundering, terrorism financing or any similar activities.

Limit Order means an Instruction to enter into a Spot or Forward Contract at a rate you have nominated (“Target Rate”).

Margin means the difference between the retail exchange rate we quote to you and the wholesale exchange rate we obtain from our provider.

Market Disruption means a situation wherein markets cease to function in a regular manner, typically characterised by rapid and large market declines. Market disruptions can result from both physical threats to the stock exchange or unusual trading (as in a crash).

Maturity Date means, in relation to a Forward Contract, the date on which the currency exchange is to be made by the Company and includes any agreed variation to the original date, being either an earlier or a

later date.

“OFX” means as defined in section 1 clause 2 “Who does this Agreement apply to?”.

Payment Services means the Service where we send your money to someone else, rather than to an account owned by you. It also covers the Service where we send your money to an account owned by you where there is no FX.

Rate means the foreign currency exchange rate that we quote you for a Transaction.

Recipient Account means the account to which you are sending your funds.

Secure Details means the log in details for your account, or other passwords we may require you to provide to us any time you wish to access any of our Services.

Secure Website means the private login area for our Customers on www.ofx.com and the OFX app.

Services means FX Services and Payment Services, provided by us through our Secure Website, mobile applications, software, APIs or other access channels.

Spot Contract means a foreign exchange contract under which we agree to exchange money at an agreed rate within 48 hours of the contract commencing.

Spot Rate means the rate that we receive from our bank service provider at the time that the conversion is initiated plus our Margin.

Sustainable and Purchasable: means, in regard to foreign exchange market rates, the rate at which a Limit Order will be executed. The rate must be traded in the market with volume sufficient to sustain that rate level for a commercially reasonable timeframe.

Target Rate means the rate (calculated after we apply our margin) at which the customer has instructed us to carry out the Transaction if and when the stipulated rate is Sustainable and Purchasable.

Termination Amount means the sum of:

- The Close-Out Amounts; plus

- Any Expenses; plus

- Any Unpaid Amounts due from you to us; minus

- Any Unpaid Amounts due from us to you.

Termination Date means the date on which a Transaction is cancelled.

Transaction means a contract to use a Service and shall be taken to refer to a series of Transactions pursuant to standing Instructions given by you or any Authorised User.

Unpaid Amounts means all amounts (excluding the Termination Amount) that have become payable by one party to the other under this Agreement and which remain unpaid as at the Termination Date.

7. When and how can this Agreement be changed? What happens if the Agreement changes?

A. We may make changes to this Agreement for a number of reasons including, but not limited to,

changes in:

- the Services we offer or introducing a new Service,

- technology, the banking system or industry,

- expected changes, to laws or regulations,

- our costs, or,

- how we need to operate to manage our business sustainably over the long term.

B. To make changes to this Agreement, we may be required to give you notice. We will notify you of any changes by email and by posting an updated version of this Agreement on our Website. The amount of notice we are to give you will depend on the type of changes we are making. If the changes affect the Payment Services we offer, we will give you two months’ notice. Otherwise, we can make any changes by telling you before we make them.

C. This will not affect any rights or obligations you may already have, but you will be bound by the changes to this Agreement when you enter into subsequent Transactions.

D. This will not affect any rights or obligations you may already have, but you will be bound by the changes to this Agreement when you enter into subsequent Transactions.

E. If you do not tell us you want to terminate this Agreement before the change happens, then we’ll treat you as having accepted the change. If you wish to terminate this Agreement, you can do so without charge but you will need to complete any Transactions or Payment Services that have been requested.

8. When and how can additional terms be changed? What happens if these terms change?

A. We may amend our Privacy Policy, Website Terms of Use or Cookie Policy from time to time.

B. Such amendments will become effective as indicated in the updated document, when we post the revised policy or document on our Website or as per our communication of the changes to you. We will endeavour to provide notice as is required.

C. If you continue to use our Services after our Privacy Policy, Website Terms of Use or Cookie Policy the documents have been amended, you will be deemed as having accepted those changes. If you do not agree with any of the amendments, you may terminate your account with us. See section 1 clause 7 “When and how can this Agreement be changed? What happens if the Agreement changes?” for full details.

9. When and how can this Agreement be terminated?

A. This Agreement will remain in effect until it is terminated by you or us.

By You

You may terminate this Agreement at any time without charge by notifying us in writing or telling us (we may ask you to confirm this in writing), providing all monies owed to us have been paid. If you wish to terminate this Agreement, you can do so without charge but you will need to complete any Transactions or Payment Services that have been requested.

By Us

We may terminate this Agreement and close your Account with us at any time by giving you two calendar months’ notice in writing. We may also suspend or limit your access to our Services or we may terminate this Agreement on shorter notice, or immediately, if we reasonably believe that:

- You have seriously or repeatedly broken the terms of this Agreement,

- You have given us false or misleading, incomplete, incorrect or inaccurate information,

- You are no longer eligible for a Service,

- A Service you have requested is, we believe, connected to or allegedly connected to fraud, money laundering, terrorist financing, tax evasion, or any other Illegal Activity,

- Not doing so would mean we may break any law, regulation, code, or other duty that applies to us,

- Not doing so may expose us to claims by third parties,

- You have been threatening or abusive towards any of our people,

- Your account is dormant (i.e. you have not used any of our Services for more than 24 months),

- Not doing so could otherwise expose us (or any of the OFX companies) to legal or regulatory action,

- In the event of your death or loss of mental capacity; or

- You become bankrupt, or we reasonably believe that you are insolvent or at risk of insolvency.

10. What happens if this Agreement is terminated?

A. When this Agreement is terminated, for any reason, you must pay us the Termination Amount. We will calculate the Termination Amount on the date of such cancellation/termination.

B. Where the Termination Amount is an amount owing to us, it will be immediately due and payable to us. You agree to pay the Termination Amount within 7 days of being notified by us of the total amount due.

C. Upon termination of this Agreement for any reason, the following sections of this Agreement, in addition to any payment obligations and any other provision that in order to give proper effect to its intent, shall remain in effect: section 5 (“Warranties, Indemnities and Limitation of Liability clauses”); section 8 clause 4 (“How to Make a Complaint clause”); section 1 clause 6 subclause D (“Entire Agreement clause”); section 1 clause 10 subclause C (“Survival clause”); section 8 clause 1 subclause A (“Governing Law clause”).

11. Can I transfer my obligations under this Agreement?

A. Unless you have our express written consent (not to be unreasonably withheld), the rights and obligations under this Agreement may not be transferred by you. This Agreement is with you, the Customer, and we have no obligations to any other party. We may transfer this Agreement to any third party, providing we tell you in advance.

12. How can I obtain a copy of this Agreement?

A. You can obtain a copy of this Agreement, or any other document referred to in this Agreement, at any time, from our Website at www.ofx.com, by calling the telephone numbers in the Contact Us section below, or by emailing us at customer.service@ofx.com.

Section 2: About the Services

1. What Services does OFX provide?

A. We are an online payments company. We provide “FX Services”, that is buying and selling currency from you, for personal or commercial purposes. There are two main types: Spot Contracts and Forward Contracts (Options are available in Australia and New Zealand only). We also offer “Payment Services”, which can either be a same-currency Transaction or a cross-currency Transaction.

2. What Services does OFX not provide?

A. We do not offer any form of investment or speculative trading facilities.

B. We do not provide you with personal financial advice. We do not take into account your specific financial circumstances or needs when we enter into a Transaction with you. Any advice we do provide will relate only to information that is already publicly available and/or to the mechanics of your Transaction. You must obtain your own financial advice and make your own assessment as to whether our Services are appropriate for your requirements and financial circumstances. Selection of the type and timing of each Transaction you enter into is for you to decide.

C. We do not enter into any kind of set-off arrangements that would allow you to receive or pay only the amount of any gain or loss you may have made as the result of exchange rate movements when a Transaction completes.

3. What exchange rate will apply to my Transaction?

A. When you give us an Instruction, we will provide you with a quote for an indicative exchange rate that may apply to your Transaction. The exchange rate we quote is not the same as the market exchange rate, and is not guaranteed until the Transaction is confirmed as rates can, and do change frequently. The exchange rate that applies to your Transaction will be listed on the Deal Confirmation email you receive.

4. What Fees apply to the Services?

A. We do not charge any fees on a Transaction if the Transaction involves a currency conversion. Please be advised that your own bank or your Recipient’s bank may independently charge fees on the Transaction. You should consult directly with the bank for information regarding any fees they may charge. In our sole discretion, from time to time we may permit same currency transfers that do not involve a conversion of currency. The fee for a same-pair currency transfer will be quoted to you at the time of booking and will be expressed either as a flat fee or a percentage of the transfer amount. Any fees charged by us in relation to a particular Transaction will always be shown on the Deal Confirmation email as well as the receipt we provide to you.

B. In certain circumstances, certain intermediary fees might be levied upon a Transaction. Where possible, we will estimate the amount of such fees in the Deal Confirmation, but the Recipient Account may receive less than originally estimated. You acknowledge and agree that third party intermediary fees may apply to your Transaction. We have no control over those, receive no part of them and they are you or your Recipient’s responsibility to pay (depending upon what may have been agreed between you).

5. Are there any additional costs I should be aware of?

A. Please be advised that if you book a Transaction through a mobile device, your wireless carrier’s standard charges, data rates and fees may apply.

Section 3: Opening and Operating an Account

1. What type of account should I open with OFX?

A. Personal accounts are intended only to be used for Transactions related to personal, family or household purposes. Personal accounts may not be used for business, commercial or merchant transactions.

Some features of our Services may not be available to personal account holders.

B. Business accounts should be used when you are conducting Transactions for commercial purposes such as the sale of goods and services. When registering for a business account, we may collect personal information about the beneficial owners, principals or any employee of your business that will be permitted access to the account. You must be authorised to bind the business and submit information

on its behalf. Business accounts should not be used for personal, family or household purposes otherwise there is a risk of the Transaction being cancelled and/or your account being closed.

2. What do I need to provide OFX with to open an account?

A. To provide you with our Services, we must collect certain information about you and any Authorised User you may appoint to provide an Instruction on your behalf. This is so that we can verify your identity and also meet any regulatory or legal obligations we may have. The information may include, but is not limited to, details such as name, contact details, date of birth, proof of identity and/or financial affairs.

If you are a business, it may also include information about the way you are set up, your directors or management body, the laws you may be subject to, and the ownership of your company or business. Without this information, or if we are not satisfied with it, we may not be able to provide you with

our Services.

B. We may also carry out electronic database searches and credit reference agency searches to verify your identity and, if necessary, the identity and credit standing of the owners, principals, employees or directors of your business or any Authorised User of your business account. This may create a credit “footprint” on the relevant individual’s file with any such credit reference agency. When opening an account, you agree that we are permitted to leave a footprint on credit files as part of the performance

of our Services. For more information see section 6 clause 1 “What information will OFX collect on me?”.

3. How do I access my account?

A. We will issue, or you can choose, a username for your account with us. We will also ask that you provide personalised security details (such as a password or fingerprint) and answers to security questions. Together these are known as your Secure Details and they allow us to verify your identity so that you can give us an Instruction. We may accept any Instruction received, using the Secure Details, without performing any further checks on the identity of the user.

B. You must take all reasonable steps to keep your Secure Details secret and safe, and you must take all reasonable steps to prevent loss, theft or fraudulent misuse of them. We recommend that you do not write them down in a format that is recognisable, save them electronically, choose simple passwords, or let someone else know them unless they are an Authorised User.

4. What should I do if I suspect my account has been subject to a security breach?

If you know or suspect that your Secure Details have been lost, stolen or misappropriated, or that there has been unauthorised use of our Services or any other security breach, you must notify us immediately by calling us on the numbers in section 7 clause 7 “How can I contact OFX?” or by emailing us at customer.service@ofx.com. In such circumstances we may suspend your account to protect you and refer the matter to our fraud department.

5. In what circumstances can OFX prevent me from accessing my account?

A. We will prevent the use of your Secure Details if we reasonably believe that:

- It is appropriate to protect their security or access,

- Their use is or may be unauthorised or fraudulent,

- It may otherwise compromise our security measures, or

- We have to do so under an applicable law or regulation or order of a court or other regulatory body.

B. Unless we have terminated the Agreement due to a security breach or a suspected security breach, we will allow you to use your Secure Details again once the reasons for suspending the use of your Secure Details no longer applies.

C. In certain circumstances, we may freeze or block an account where we believe or are told that it is being, or has been used, in connection with actual or suspected Illegal Activities. Freezing or blocking can arise as a result of the account monitoring that is required by AML/CFT laws and or at the direction of a court, regulator or government authority.

6. Will OFX notify me if I am prevented from accessing my account?

A. We will tell you if we need to stop or suspend the use of your Secure Details, using the contact details you have provided to us, unless that would break the law.

B. We will also take reasonable steps to tell you (provided we are legally permitted to do so) if we become aware of a security breach that could impact you and let you know of any steps you may take to reduce any risk to you.

7. When can OFX close my account?

We have the right to close your account, at our sole discretion, if we reasonably believe the information you have provided to us is false or misleading or that a proposed Transaction may be connected in some way with Illegal Activities or may result in reputational harm or any other unacceptable business risk to us. If we do this, any monies we may owe to you will be returned to you in accordance with applicable laws. Likewise, any monies you owe to us must be paid.

8. Can I enter into Transactions on another party’s behalf?

A. For each Transaction, unless we agree otherwise, you, or the business you represent, must be the beneficial owner of the money you intend to transfer or you are acting in your capacity as a trustee of trust money. We may request documentary evidence showing ownership of the funds.

B. You may not enter into Transactions on behalf of third parties, unless you are expressly authorised to do so in accordance with this Agreement and can prove that to us if we ask you to.

C. We recognise that there may be situations where a third party is legitimately involved, while you are still the beneficial owner of the funds, including but not limited to: salary payment; from solicitor e.g. property sale, estate, trust; sale of shares where payment is from the investment firm; joint accounts; family member (to first party); pension payments; refund of a deposit on rental/holiday accommodation; inheritance payment, etc. In such circumstances we may ask you to provide us with additional documentary evidence so that we can meet our legal requirements.

9. I’m a Personal Customer. Can someone else act on my behalf?

A. If you are transacting with us as a Personal Customer, you may choose to appoint one or more Authorised Users if you would like us to take an Instruction from someone else acting on your behalf.

B. You can do this by signing an Authorised Signatory Form. An Authorised User may have unlimited authority to give us an Instruction on your behalf, or you may specify the stages of a Transaction you authorise them to undertake. We may contact you to confirm the details on any Authorised Signatory Form we receive from you.

C. We will rely on an Instruction received from any individual(s) authorised by you in accordance with this Agreement until such time as you withdraw or change that authority by giving us 48 hours’ notice in writing. If you wish to change or remove an Authorised User, you may do so by completing a Change of Authorised Signatory Form or otherwise by notifying us in writing.

D. This Agreement also applies to Authorised Users, but you remain responsible for their actions. We accept no liability for carrying out a Transaction that has been instructed by your Authorised User if you did not want the Transaction to proceed.

E. You, or an Authorised User, can give us an Instruction, consent to a payment or confirm the payment to the Recipient Account via our Secure Website, verbally by telephone, or by email (where we agree in advance to email Instructions).

10. I’m a Business Customer. Do I need to appoint someone else to act on my behalf?

A. If you are transacting with us as a Business Customer, you must appoint one or more Authorised Users (even if you have a sole director who has created the business account).

B. You can do this by signing an Authorised Signatory Form. An Authorised User may have unlimited authority to give us an Instruction on your behalf, or you may specify the stages of a Transaction you authorise them to undertake. We may contact you to confirm the details on any Authorised Signatory Form we receive from you.

C. We will rely on an Instruction received from any individual(s) authorised by you in accordance with this Agreement until such time as you withdraw or change that authority by giving us 48 hours’ notice in writing. If you wish to change or remove an Authorised User, you may do so by completing a Change of Authorised Signatory Form or otherwise by notifying us in writing.

D. This Agreement also applies to Authorised Users, but you remain responsible for their actions. We accept no liability for carrying out a Transaction that has been instructed by your Authorised User if you did not want the Transaction to proceed.

E. You, or an Authorised User, can give us an Instruction, consent to a payment or confirm the payment to the Recipient Account via our Secure Website, verbally by telephone, or by email (where we agree in advance to email Instructions).

Section 4: Transactions

1. How do I instruct OFX to enter into a particular Transaction?

A. To give us an Instruction, we require that you provide us with the value of the transaction, the currencies you want to exchange and the Recipient Account you want to pay, as applicable.

SPOT CONTRACTS

A. If you wish to enter into a Spot Contract, you may do so by giving us an Instruction online, by telephone, or by email, if we agree this with you in advance.

LIMIT ORDERS

A. You may give us an Instruction for a Limit Order on a Spot Contract by telephone, or, if we agree this with you, through our Secure Website or by email.

FORWARD CONTRACTS

A. The Forward Contract must be to facilitate payment for identifiable goods, services or direct investment. We may ask you for evidence to support this. For this reason, Forward Contracts can only be booked on the phone. In giving us an Instruction for a Forward Contract, you must also specify the date you want the exchange to occur.

2. Is there a limit on the number of Transactions I can make or amount of money I can transfer each day?

We may apply limits to the number of Transactions that you can make each day. We may also apply limits to the amount of money that you can transfer each day. Where this is the case, we will notify you separately and let you know if there is another way you can give us an Instruction.

3. How will I know when my Instruction has been received?

A. When we receive an Instruction from you, we shall provide you, as applicable, with the exchange rate, information on the maximum time it will take for the Recipient Account to receive the money, any charges payable by you and a breakdown of such charges.

4. What must I do if OFX has quoted a rate that is clearly a mistake?

If we quote you a rate that is clearly a mistake on our part, as the result of a technical or human error, it is not binding on us and we reserve our right not to process the Instruction. You must notify us by telephone or email as soon as the mistake comes to your attention and we will send a revised quote as soon as possible.

5. How will I know when my Instruction is accepted?

A. Transactions become legally binding once the booking process has been completed online or when your email, giving an Instruction, has been processed or when the telephone call, in which you place an Instruction, has concluded. We will then send you an email headed “Deal Confirmation” which is our written record of the Instruction you have given us. If you do not contact us within 24 hours of receipt of the Deal Confirmation, the Transaction details will be deemed to be correct. Even if no Deal Confirmation is received, the Transaction is still legally binding, unless we have made a mistake, and this can be evidenced by the emails we have exchanged with you, the data available on our Secure Website or the transcript of the telephone conversation during which it was booked.

B. In the Deal Confirmation email, we will specify the Transaction details including:

- The amount of the “Sale Currency” required, that is, the currency you are selling to us,

- The amount of the “Purchase Currency”, that is, the currency you are buying from us,

- The exchange rate offered,

- Any applicable fees,

- Who the funds are to be sent to (the “Recipient Account”),

- The “Booking Date”, that is, the date your Instruction is treated as finalised,

- The “Maturity Date” or “Delivery Date”, that is, the date on which the currency exchange is to be made by us and by which you must have provided cleared funds to cover the Transaction costs and any applicable fees. These should be in the same currency as your Sale Currency and into the bank account we specify, and

- Any terms and conditions for paying an Advance Payment or deposit (if applicable).

6. Can I change or cancel an Instruction?

A. An Instruction from you cannot be cancelled, withdrawn or changed once you have given it unless we have made a mistake and you inform us as such, after receiving your Deal Confirmation. In exceptional circumstances, we may agree to cancel or change an Instruction after it has been received. If you think that such circumstances exist you should contact us immediately by telephone.

LIMIT ORDERS

A. You may cancel a Limit Order at any time before the Target Rate is reached by contacting us by telephone only, the Limit Order will remain in place until you receive written confirmation from us of such cancellation. You may not cancel a Limit Order after the Target Rate has been reached, whether or not we have notified you that the Target Rate has been reached. When the Target Rate is reached, you are legally bound by the Transaction.

FORWARD CONTRACTS

A. You may ask us to bring forward (pre-deliver) or to extend (roll over) the Maturity Date in relation to the whole or only part of your Forward Contract. Agreeing to such a request is entirely at our discretion. If we agree, the rate may be adjusted to account for the timing of the new Maturity Date and no profit on the adjusted Transaction will be payable by us.

7. What happens if a Transaction is cancelled?

A. When a Transaction is cancelled for any reason, you must pay us the Termination Amount. We will calculate the Termination Amount on the date of such cancellation/termination.

B. Where the Termination Amount is an amount owing to us, it will be immediately due and payable to us. You agree to pay the Termination Amount within 7 days of being notified by us of the total amount due.

8. What must I do so that my Transaction can be processed?

A. By entering into this Agreement, you acknowledge that exchange rates can fluctuate rapidly, so being able to access the rate we quote you depends on you promptly performing your agreed actions. We reserve the right to cancel or suspend a Transaction if you do not provide us with any requested information or funds promptly.

B. It is your responsibility to ensure that accurate and complete payment information (including details of the Recipient Account) are provided to us on or before the Maturity Date or Delivery Date. You must provide us with full details of the Recipient Account, including the account number, the full name and address of the recipient, the full name and address of the recipient’s bank and any other reasonably requested details. If you fail to do so, we will not be able to process the Transaction.

We rely solely on the Recipient Account bank account number you give us. We do not, as a matter of course, carry out any further checks to verify that the account details are correct so it is important that you give us the right details. You should check Deal Confirmation emails, receipts and other information when you receive it from us and contact us immediately if there is anything which is incorrect or which you need us to clarify or confirm. If you do not do so, we will not be liable to you for any associated loss.

FORWARD CONTRACTS

A. You must transfer the full amount of funds due for the Forward Contract Transaction (which is the total amount due, less any Advance Payment you have already paid) together with any applicable fees payable, on or before the Maturity Date. If we have not received funds by the Maturity Date, you will be in breach of your obligations under the Forward Contract and we may cancel the Transaction. You should use your client reference number as the reference for all payments to us.

B. We may ask you to pay a deposit in full or part payment of a Forward Contract, at any point from the time you give us an Instruction until the Maturity Date. We will tell you whether a deposit is payable before you confirm the Forward Contract. We will state the amount of any deposit/s that must be paid and tell you the date by which they must be paid. If you do not pay the deposit by the date required, we may cancel the Forward Contract.

SPOT CONTRACTS

A. You must pay us the full amount into our nominated account as soon as possible and within two Business Days of when the Transaction becomes legally binding. If we have not received the funds by that date, we will not be able to process the Transaction and reserve the right to cancel the Transaction. You should use your client reference number as the reference for all payments to us.

LIMIT ORDERS

A. We will notify you by telephone or email as soon as possible after the Target Rate has been reached. The Target Rate will be deemed to have been reached only when the exchange rate nominated in your Limit Order has been filled with our provider. This will occur when the rate you have nominated has been exceeded by an amount that includes our Margin.

B. It is important that you know that exchange rates can change very quickly and the Target Rate may not remain for long. As such, you may need to act quickly when you receive a notification from us. As soon as you receive our notification that the Target Rate has been reached, you must take action to ensure that the funds reach our nominated account by the Delivery Date. If we do not receive the funds in time, we reserve our right to cancel the Limit Order.

9. How must I pay OFX?

A. To reduce the risk that our Services could be used for money laundering purposes, we will not accept payment in cash, by cheque or by debit or credit card. All money is received and remitted by us by means of electronic bank transfer only. Funds from Business Customers must come from a business bank account.

B. When you transfer your funds to us via a bank transfer, you need to include your client reference number so we can tell who the money has come from. This number is unique to you for all your transfers and every currency and should be used by you every time you send money to us. This number will be included in the Deal Confirmation we send to you after you give us your Instruction. You can also find your client reference number by accessing your online account and going to the “Our Account Details” tab and selecting an available currency. Your unique client reference number will be next to “Reference” on the last line of every bank account. You acknowledge that if you do not include your client reference number we may not be able to link the payment to you and may have to cancel the Transaction and attempt to return the funds to the account from which we received them.

10. Can I pay OFX from another person’s account?

A. If you want to make the payment from someone else’s bank account, we may require evidence that you are entitled to do this and you must bring it to our attention as early as possible to avoid delays to your Transaction. You must be the beneficial owner of the applicable funds (see 5.3 Owner of the Money you Are Transferring).

11. What if I fail to make payment when due?

A. The full amount being transferred, plus any Transaction fees that may be payable and any other fees that have been requested or may be deducted by us or a third party, must be received by us in cleared funds before we credit your Recipient Account.

B. The exception to this is where certain Business Customers have access to intra-day credit and the Transaction is carried out before funds have cleared, following proof being provided to us that the funds have been sent to us. Access to this feature is at our discretion and is not available to all Business Customers.

C. If you fail to make full payment for any Transaction when due; or when a payment is returned unpaid or is otherwise dishonoured and no alternative form of payment is received by us, we will not be able to process your Transaction and may take other action such as cancelling a Transaction (see section 1 clause 9 “When and how can this Agreement be terminated?”), closing your account or pursuing you for any losses we may have suffered as a result. Should we receive less than the agreed amount of funds from you (for example, as a result of your bank deducting a fee prior to transfer), we reserve the right to proceed with the Transaction using that lesser amount which will result in a lesser amount being transferred to your Recipient Account.

D. Your failure to pay any amount owed to us is considered a material breach of this Agreement. In addition to the amount owed, you will be liable for any costs we may incur during collection of such amounts. Collection costs may include lawyers’ fees and expenses, the cost of arbitration or court proceedings, collection agency fees, applicable interest and any other related costs.

E. You agree that we may charge you interest on any sum that remains payable to us after it fell due.

F. Interest will be charged at a rate of 2% per annum over the base rate of the Bank of England (or of such monetary authority as may replace it). Interest will accrue and will be calculated daily and be compounded monthly from the date payment was due until the date full payment is made by you.

12. How does OFX keep my funds secure?

A. Once any FX Service has been concluded, we will segregate and safeguard the funds for onward payment (‘relevant funds’) in a separate bank account in accordance with the UK Payment Services Regulations 2017. This means in the event of our insolvency, you have priority over relevant funds and no creditor should be able to claim relevant funds held in this account.

B. Funds held prior to the FX Service being concluded are not considered relevant funds and will not be segregated or safeguarded.

13. What if I fail to provide OFX with an Instruction after sending OFX funds?

A. If you send funds to us prior to giving us an Instruction and want us to hold your funds, pending completion of the Transaction, you must provide us with your Instruction as soon as possible. If you do not do so, we will attempt to return the funds to you.

B. You acknowledge and agree that we do not hold your funds in trust and will not transfer your funds into a separate bank account or pay you any interest on any funds held by us.

14. When will my Purchased Currency be available?

A. We will not pay out funds until all payments to us have cleared, including the full amount being transferred and any fees that may be due.

B. Once we have completed any FX Service you require, then provided this has occurred before our cut-off time we will carry out any related Payment Service on the same day. The exception to this is where you have asked us to make a payment on a future date, in which case we will process your Instruction on that date as long as it is a Business Day, or the next Business Day if it isn’t. The cut-off time that applies depends on where you have asked us to send the money to. You can find our cut-off times on our website or you can ask us for them.

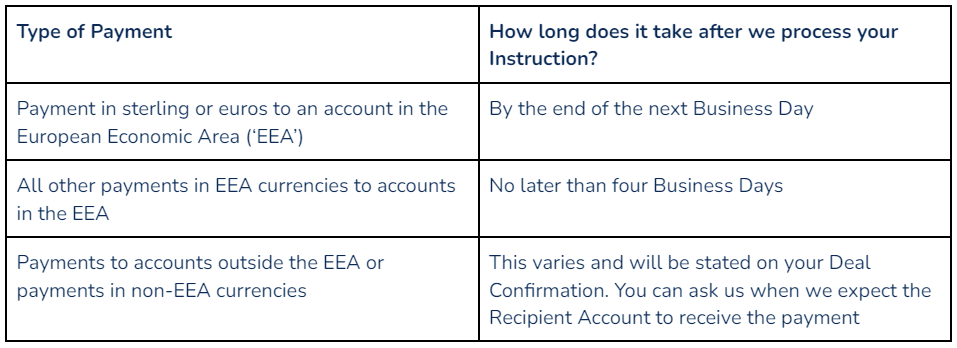

C. How long will my transfer take?

15. How will OFX pay my funds?

A. We will pay your funds by electronic means only.

16. Will I be notified when OFX has paid my funds? How?

Once we have carried out a Service for you, we will send you a notification including a reference, amount of the payment in currency used, any charges and the date the order was received. This information is also available on our Secure Website. If you decide to turn off e-mail notifications, it is your responsibility to check these regularly and print or save a copy of this information for your records.

17. What is Automatic Conversion and how does it work?

A. If you elect to use Automatic Conversion, we will convert your funds immediately upon receipt by us and transfer such funds to your designated Recipient Account. If you instruct us to undertake Automatic Conversion, either for a single Transaction or as a standing instruction, you acknowledge and

agree that:

- We will convert funds from one currency to another and transfer such funds to your designated Recipient Account at our then current Spot Rate;

- The Transaction will be legally binding on you when we receive the relevant funds; and

- We will provide you with confirmation of the Transaction details via a Deal Confirmation.

B. It is your responsibility to ensure that you give us accurate and complete details. We rely solely on the account number you give us and will not check that the name you provide matches the account number you have given us.

C. You may cancel an Automatic Conversion instruction at any time by giving us at least 24 hours’ notice, which will apply to any funds received by us after this time. Otherwise, a Transaction or Instruction cannot generally be withdrawn or changed once it has been received.

18. What should I do if I suspect an unauthorised payment has been made from my account?

A. If you believe that you did not authorise a Transaction relating to a Payment Service, please notify us without undue delay. If we determine that you did not authorise a Transaction in accordance with the process in Section 6, we will refund you the value of the transaction as soon as practicable unless:

- We reasonably believe you have acted fraudulently, or

- You have failed to take care of your Secure Details or failed to notify us without undue delay after becoming aware of the loss, theft or unauthorised use of your Secure Details. In both cases, you will be liable for any associated loss.

B. If we investigate further and find that you authorised the payment(s), you must return any refund(s) we provided to you as soon as possible.

19. Can OFX refuse to service me as a Customer or to process a specific Instruction?

A. We are under no obligation to accept an Instruction from you and we do not accept any liability for any loss you may incur as a result

B. We reserve the right to refuse to accept you as a Customer or to refuse to process any Transaction at any stage of our relationship if we reasonably believe the information you have provided to us is false or misleading or that a proposed Transaction may be connected in any way with Illegal Activities or may result in reputational harm or any other unacceptable business risk to us.

LIMIT ORDERS

A. You may find that, in some cases, the exchange rate spikes and falls with the result being that the exchange rate you have nominated in your Limit Order has been reached but it may not get filled due to limited liquidity in the market. For the avoidance of doubt, we will not fill your Limit Order in those circumstances.

If the Target Rate does not become Sustainable and Purchasable during the relevant period, the Instruction will automatically expire.

20. When can OFX cancel my Transaction (“Adverse Events”)?

A. We reserve the right to cancel any Transaction, without prior notice to you, if we believe there is a valid reason for us to do so including, but not limited to, any of the following Adverse Events:

- An Instruction is not complete or you have not provided us with any additional information we may have asked for;

- We do not believe the Instruction came from you (at our sole discretion, acting reasonably) and we have been unable to verify that the Instruction did come from you;

- You have not paid us money you may owe us when it is due;

- You are resident in certain countries where we do not or cannot do business;

- It would mean we may break a law, regulation, code, or other duty that applies to us or may expose us to claims by third parties;

- We reasonably believe an Instruction is connected to fraud, money laundering, terrorist financing, tax evasion, or other criminal activity;

- We believe it could expose us or another member of our group of companies to legal or

regulatory action; - We believe your account has been misused for example, using a Business Account for

personal Transactions; - If you breach any other material term in this Agreement or any terms and conditions relating to any individual Transaction;

- In the event that a dispute arises between us that is unable to be resolved without delaying the Transaction (for the purposes of minimising loss to us).

- If any information or warranty you have given us is or becomes, in our opinion, inaccurate, incorrect or misleading;

- In the event of your death or loss of capacity;

- If bankruptcy proceedings are commenced against you or we reasonably believe that you are insolvent or at risk of insolvency or bankruptcy;

- If our banking partners refuse to process a payment or similar events that are outside of our control; or,

- If you terminate this Agreement.

21. What happens in the case of an actual or suspected Adverse Event?

A. You must notify us immediately if you become aware of any Adverse Eevent happening or being possible or likely to happen.

B. There may be a delay in the Services we provide while we check that none of the above reasons apply. We will notify you if we are or have been unable to process a Transaction and the steps you may need to take to correct any errors in your Instruction.

22. Will I be liable to pay OFX any money if my Transaction is cancelled?

A. If we cancel a Transaction, we will contact you explaining the amount of any sums that are payable to us and the amount of any sums being withheld by us.

B. When we cancel a Transaction, we buy back the currency that we have bought for your Transaction at the prevailing market rate. If the value of the currency you have asked us to exchange has strengthened, a loss will be incurred on the Transaction and you will be liable to pay us the amount of that loss, together with any reasonable expenses or other costs we incur as a result. This is called a “Reversal Loss”.

C. The amount of any Reversal Loss is a debt payable by you and you agree that we may immediately, without notifying you, deduct the total amount of any Reversal Loss (together with any other costs we may have incurred) from any funds we may hold for you, including from any deposit whether related to the cancelled Transaction or not. If the amount we are seeking to recover exceeds the amount of any deposit or other funds held by us, you agree to pay us the balance.

D. You agree that we may charge you interest on any sum that remains payable to us after we cancel any or all Transactions. Interest will be charged at a rate of 2% per annum over the base rate of the Bank of England (or of such monetary authority as may replace it). Interest will accrue and will be calculated daily and be compounded monthly from the date payment was due until the date full payment is made by you.

23. What if OFX profits from the cancellation of a Transaction or otherwise?

We will not pay you any profit arising from us cancelling a Transaction, or for any other reason, under any circumstances.

Section 5: Rights and Responsibilities

1. In entering into this Agreement, what does OFX warrant as true and accurate to me?

A. We represent and warrant that:

- We have the right, power and authority to enter into this Agreement and to perform all of our obligations under it;

- The Services will be provided in accordance with generally accepted industry standards;

- We have used, and will continue to use, reasonable commercial efforts to provide the Services and to protect your account and money.

2. In entering into this Agreement, what warranties does OFX not provide?

A. We will make every effort to process Transactions in a timely manner, but we make no guarantees or warranties regarding the time it takes to complete a particular Transaction because our Services are dependent upon many factors outside of our control. Additionally, we do not have any control of, or liability for, any acts or omissions of the bank where the Recipient Account is held or any goods or services that are paid for using our Services.

B. Whilst we make every effort to provide our Services to you with the utmost care and diligence, we do not warrant or guarantee that the Services will meet your requirements; that the Services will be available at a particular time or location; that the Services will be uninterrupted, error-free, without defect; that any defects or errors will be corrected; or that the services are free of viruses.

3. I’m a Personal Customer. In entering into this Agreement or providing an Instruction, what do I warrant as true and accurate to OFX?

A. You agree that the following statements are true and accurate, and you acknowledge that we may refuse to process, or cancel, any or all Services and Transactions, if we find at any stage that they are

not true and accurate:

- You are over the age of 18,

- You have full authority to enter into this Agreement and to instruct the Services under it;

- You are the owner or beneficial owner of the money being transferred (or otherwise have the right to transfer the money in accordance with this Agreement);

- You have a valid legal reason for entering into each Transaction and will not enter into any transaction for speculative purposes

- You are resident in the country in which you are transacting.;

- You will not use your account for business, commercial or merchant transactions.

- Please read our Money Laundering Statement within the Legal section of our website at ofx.com. You will not knowingly do anything to put us in breach of the Anti-Money Laundering and Counter-Terrorism Financing laws in any jurisdiction in which we operate. You undertake to notify us if you become aware of anything that would put us in breach of any AML/CFT law.

B. If you are acting as a trustee of a trust, this Agreement binds you in your personal capacity and in your capacity as trustee of the trust.

C. By entering into this Agreement, you assume responsibility for carrying out your own due diligence

on the identity of the holder of your intended Recipient Account. While we reserve the right to cancel Transactions where we suspect there may be Illegal Activities or where our compliance requirements are not met, it remains ultimately your responsibility to ensure that the Recipient Account is legitimate. We will not be liable where you fall victim to a scam and where we have met our obligations under

this Agreement.

D. By entering into this Agreement, you acknowledge that there may be delays in the transfer and receipt of payments and whilst we will do everything in our power to ensure the transfer of funds, you accept that we cannot guarantee that transfers of funds will always be made on time.

E. By giving us an Instruction, you confirm that you are not aware and have no reason to suspect that: (i) the money you are transferring comes from or is related to Illegal Activities; or (ii) the money you are transferring will be used to finance, or used in connection with, Illegal Activities.

4. I’m a Business Customer. In entering into this Agreement or providing an Instruction, what do I warrant as true and accurate to OFX?

A. You agree that the following statements are true and accurate, and you acknowledge that we may refuse to process, or cancel, any or all Services and Transactions, if we find at any stage that they are

not true and accurate:

- You are over the age of 18,

- You have full authority to enter into this Agreement and to instruct the Services under it;

- You are the owner or beneficial owner of the money being transferred (or otherwise have the right to transfer the money in accordance with this Agreement);

- You have a valid legal reason for entering into each Transaction and will not enter into any transaction for speculative purposes

- You are incorporated, or registered, in the country in which you are transacting and have full authority to enter into this Agreement and any Transactions;

- You will inform us if you are acting as: (a) a sole proprietor of a business; (b) a trustee of a trust; or (c) a partner of a partnership;

- If you are acting as a trustee of a trust, you are properly authorised to enter into this Agreement and any Transactions in accordance with the terms of the relevant trust deed;

- You will not use the account for personal, family or household purposes;

- Any Authorised User linked to your account is validly appointed by you, is authorised to act on your behalf and all information provided by the Authorised User is accurate, true and not misleading;

- In making your decision to enter into a Transaction, you will not rely on any market-related information that may be provided from time to time by us on our Secure Website or by our employees or consultants;

- You are authorised to bind the business and submit information on its behalf and you acknowledge that you may be held personally liable by us for any breach of any term of this Agreement; and

- Please read our Money Laundering Statement within the Legal section of our website at ofx.com. You will not knowingly do anything to put us in breach of the Anti-Money Laundering and Counter-Terrorism Financing laws in any jurisdiction in which we operate. You undertake to notify us if you become aware of anything that would put us in breach of any AML/CFT law.

B. If you are acting as a trustee of a trust, this Agreement binds you in your personal capacity and in your capacity as trustee of the trust.

C. By entering into this Agreement, you assume responsibility for carrying out your own due diligence on the identity of the holder of your intended Recipient Account. While we reserve the right to cancel Transactions where we suspect there may be Illegal Activities or where our compliance requirements are not met, it remains ultimately your responsibility to ensure that the Recipient Account is legitimate. We will not be liable where you fall victim to a scam and where we have met our obligations under

this Agreement.

D. By entering into this Agreement, you acknowledge that there may be delays in the transfer and receipt of payments and whilst we will do everything in our power to ensure the transfer of funds, you accept that we cannot guarantee that transfers of funds will always be made on time.

E. By giving us an Instruction, you confirm that you are not aware and have no reason to suspect that: (i) the money you are transferring comes from or is related to Illegal Activities; or (ii) the money you are transferring will be used to finance, or used in connection with, Illegal Activities.

5. When is OFX relieved of its responsibilities?

A. Where we are prevented from providing the Services because of telecommunications or utility failures, equipment failures, labour strife, riots, war, terrorist act, pandemics, unforeseen government-imposed restrictions, fire or other acts of nature or any other circumstances outside of our reasonable control (a “Force Majeure Event”), we will be relieved of our obligations under this Agreement.

B. If, in our reasonable opinion, a Market Disruption occurs after we have provided you with a quote, we may revise any quote, or any rate or margin component of any of our Services, with immediate effect, until we reasonably determine the period of Market Disruption has ended.

6. When are the parties not relieved of their responsibilities?

A. Any failure by you or us to exercise any right or provision under this Agreement will not affect the right to enforce the same right or provision on a future date and will not affect any other rights under this Agreement, nor will it affect any right or remedy either of us may have under any applicable law or regulation, unless expressly stated otherwise.

7. If OFX incurs loss under this Agreement because of me, what is my liability to OFX?

A. You agree to indemnify us for any losses, costs, expenses or fees we may incur as a result of your failure to perform any of your obligations under this Agreement. This includes any legal costs that we may incur in enforcing any of our rights or recovering any amounts due to us. You also agree to indemnify us for any fees, costs, duties and taxes charged by any third parties in relation to the Transactions you enter into, including fees or charges which may be charged by your Recipient Account’s bank, whether or not those fees or charges were notified to you in advance.

B. You agree to indemnify us (and our respective affiliates, subsidiaries, officers, directors, employees, contractors, agents, licensors and suppliers) from and against any and all claims, fines, civil penalties (including but not limited to regulatory fines for data breaches), losses, judgments, damages, liabilities, interest and expenses including, but not limited to, legal fees arising out of or in relation to any claim, action, or other proceedings brought by any third party that may arise out of or relate to: (i) any actual or alleged breach of your obligations, representations or warranties, as set out in this Agreement; (ii) your fraudulent, negligent, wrongful or improper use of the Services; (iii) your violation of any law, rule, or regulation of any country; (iv) any other party’s access and/or use of the Services using your Secure Details.

C. You agree to indemnify us for all losses, costs, expenses, claims and damages that we may suffer or be found liable for, in connection with the freezing or blocking of your account.

Business Customers only:

A. It is important to note that if you are a Business Customer, these indemnities apply to any individual assigned a User Account and to the business entity which is registered as a Customer with us, jointly and severally. We may decide to take action against any individual in a personal capacity, or against the business entity, or both, at our discretion, should you breach this Agreement leading to a loss, cost, damage or liability for us.

8. If OFX incurs loss under this Agreement because of me, how can this affect my other Transactions?

A. In addition to other remedies available to us, if you fail to pay any amount when it becomes due under this Agreement, we may set-off such amount against any amount payable by us to you.

B. We are entitled to set-off against any amounts due to us by you, any amounts received by us from

or on behalf of you. We may determine the application of any amounts which are to be set-off at

our discretion.

9. If I incur loss under this Agreement due to OFX’s action or inaction, what will OFX do to remedy the situation?

A. We are liable to you for the correct execution of your Instruction, unless we can show we acted in accordance with your Instruction and the Recipient Account received the requested amount of funds. We are also liable to you for any charges incurred by you where we have incorrectly executed a Transaction. Where we have incorrectly executed a Transaction and we are liable, we shall refund you the amount of the Transaction without undue delay.

B. If we make an error and your funds are sent to the wrong Recipient Account or we complete a Transaction incorrectly or late, unless dealt with elsewhere in this Agreement, we will take urgent action at our own expense to recover the funds. Subject to the exclusion at clause 13.2(b), we will refund the applicable funds to you. We will not be liable to you if the bank where the Recipient Account is held received the funds and they then made the error.

C. Regardless of whether we are liable to refund you, we shall immediately and without charge:

- Make efforts to trace any non-executed or incorrectly executed Transaction; and

- Notify you of the outcome.

10. If I incur loss under this Agreement due to my own error, what recourse do I have?

A. All information you provide to us must be complete, accurate and truthful at all times and you must update this information whenever it changes. We are not responsible for any financial loss arising out of your failure to do so. We may ask you at any time to confirm the accuracy of your information and/or provide additional supporting documents.

B. Should you make an error (for example, you give us the wrong Recipient Account details) and your funds are not sent to the intended Recipient Account as a result, we will not be liable for any loss you incur but we will make reasonable efforts to help you trace the money. Whether the funds can be recovered will depend on a number of factors including which bank the money has been paid to and any local laws that may apply. You can ask us in writing for any relevant information we may have to help you reclaim payment of the funds.

11. What are my responsibilities if OFX transfers funds to a mistaken Recipient Account held by a person or company I have a personal or pre-existing relationship with?

A. Where the mistaken Recipient Account is held by a person or company with whom you have a personal or pre-existing business relationship with, you must immediately take all reasonable steps to assist us to recover any such funds. You agree to take all available steps to recover any such funds if the mistaken Recipient Account is owned or controlled by someone related to you or associated with you in some way. To the extent that your failure to take such reasonable steps impacts our ability to recover the funds from the mistaken Recipient Account or causes you further loss, we will not be liable to you under this clause.

12. When will OFX not be liable to me for loss incurred by me under this Agreement?

A. We will not be liable to you for loss incurred by you under this Agreement that is:

- Non-financial loss including, but not limited to, loss for emotional pain or suffering;

- Indirect, consequential or special damages or loss including, but not limited to, loss of business, loss of revenue, loss of profit, loss of income, loss of market share, loss of opportunity; loss of goodwill; loss of opportunity to realise a gain as a result of foreign exchange fluctuations; or loss of interest on funds, whether such loss arises in contract, tort (including negligence) or any other legal theory;

- Suffered as a result of or in connection with a change in laws and regulations applicable to us;

- Suffered as a result of or in connection with delay to the provision of the Services and where that delay was caused by circumstances outside of our reasonable control including, but not limited to delays caused by:

I. The action or inaction of third parties to this Agreement including intermediaries on whom we rely on to provide the Services to you;

II. The action or inaction of third parties to this Agreement including intermediaries on whom we rely on to provide the Services to you;

III. Network or equipment failure, including failure, unavailability or defect to our online dealing platform; and

5. Suffered as the result of or in connection to:

I. Your own mistake; or

II. Your own network or equipment failure;

6. Incurred when you have acted or whilst you are acting:

I. Fraudulently, with negligence or gross negligence; or

II. In breach of any of the terms of this Agreement.

7. In connection with the freezing or blocking of your account.

8. Connected to unauthorised access or use of your personal information or Secure Details where you have failed to keep your personal information or Secure Details safe.

B. Our liability to you will be proportionately reduced to the extent that:

1. We could not reasonably have predicted your loss;

2. We have acted in accordance with our obligations under this Agreement; or

3. We have acted in accordance with our obligations under laws and regulation applicable to us in relation to this Agreement.

C. These exceptions will not apply to the extent that we acted fraudulently, with gross negligence or the law does not allow us to exclude or limit liability.

FORWARD CONTRACTS

A. Due to the volatile nature of the foreign currency exchange market, the value of the currency sold by you may be less favourable on the date of settlement than its value upon booking the Forward Contract. You hereby expressly accept and assume such risk and agree that we have no liability to you for any losses you may incur due to fluctuations in the exchange rate.

13. What is OFX’s maximum liability to me for any loss I incur under this Agreement?

A. Our liability to you for each and every Transaction is limited to the amount of money you have actually paid us in relation to any particular Transaction.

B. For the avoidance of doubt and without limiting any other provision of this Agreement:

- If your funds are sent to the wrong account or otherwise fail to reach your Recipient Account as the result of a mistake made by us, we will credit your Recipient Account with the same amount of funds (subject always to your obligations under this Agreement), but that shall be the full extent of our liability to you in these circumstances.

- If we cancel or refuse to process one or more of your Transactions for any reason, we shall refund to you any funds that we hold on your behalf, but that shall be the full extent of our liability to you in these circumstances.

Section 6: Privacy and Data Protection

You acknowledge and agree that we may use, store, retain and otherwise process information, including personal information, or data provided by you in connection with this Agreement.

1. What information will OFX collect on me?

A. You acknowledge that, to provide our Services to you, we may need to obtain personal information about your Authorised Users, your Recipient Account holders and other people involved in your business including but not limited to ultimate beneficial owners (if you are a Business Customer).

B. When you sign up for an OFX account, you will provide certain Biometric Data. OFX uses a third-party service provider to collect and store your Biometric Data for the purposes of identifying you. OFX does not collect, capture, receive or otherwise obtain your Biometric Data without notifying you in writing in advance or without your consent or the consent of your legally authorised representative.

C. You acknowledge and agree that we may access any electronic databases we deem necessary to assist us to identify you and to assess your creditworthiness. You agree that we may obtain, use and retain information about you that we have obtained from any business that provides information about the creditworthiness of individuals, including a consumer credit report from a credit reporting agency. In doing so, we may give information about you to a credit reporting agency for the purpose of obtaining a consumer credit report about you and allowing the credit reporting agency to create or maintain a credit information file containing information about you and you accept and agree that this may create a credit “footprint” on your file with any such credit reference agency.

2. What if I refuse to provide OFX with certain information?

A. You agree to provide us with the information that we request and you agree that, in relation to any information you give us about other people, you have disclosed to the individual/s concerned that we will collect, use and disclose their information in accordance with this Agreement.

B. You acknowledge that, if you refuse or fail to provide any requested information relating to your Authorised Users, Recipients and / or any other relevant third party, we may not be able to process your Transaction.

C. You may decline to provide your Biometric Data. However, if you decline to provide Biometric Data, we may not be able to provide Services to you. Click here for more information.

3. How will OFX handle my (company’s) information?

A. We will handle information collected in connection with this Agreement in line with any Data Protection and Privacy laws that may apply or as may have been disclosed to you during the onboarding process and as set out in these terms. You acknowledge that the terms of the Privacy Policy as disclosed to you (see section 1 clause 4 “Do any additional terms apply to me?”), and as may be amended from time to time, forms part of the basis upon which we provide Services to you.

B. We collect and store all information electronically and take all reasonable steps to protect information

from unauthorised access.

4. How will my information be used?

A. We will be legally obligated to use your information for other purposes, for example, to keep records to meet our regulatory obligations, following termination of this Agreement. If you withdraw any consent provided to us, we may not be able to continue to provide Services to you, but we will be required to retain your Personal Information for as long as may be necessary to meet any regulatory requirements.

5. Will my information be disclosed to third parties? If so, to whom and when?

A. We are subject to various laws relating to AML/CFT. You consent to us disclosing, in connection with any of these laws, any of the personal information we may hold about you, any Authorised User, the owner of a Recipient Account or any other individual linked to your account whose personal information we may hold, such as any of the owners, directors, shareholders or other persons involved in the running of a business who have a Business Customer account with us. All information you provide to us could be made available to regulatory authorities in both the country of origin of the funds and in the country to which the funds are being sent.

B. We are also obligated to report all suspicious activities and Transactions to the relevant authorities. In almost all instances we are not permitted by law to inform you of any such reporting.

5. How must I treat OFX’s intellectual property?

A. All intellectual property, including but not limited to our logo, Secure Website and mobile app are owned by us or third parties, and all right, title and interest relating to them shall remain our property, or that of our subsidiaries, and/or any such other third parties.

B. Our Secure Website, mobile app and Services may be used only for the purposes permitted by this Agreement. Unless you have our express written consent, you are authorised to view and retain a copy of the pages of our Secure Website and mobile app for your own personal, non-commercial use only. Other products, services and company names appearing on our websites or mobile application may be trademarks of their respective owners.

Section 7: How we Communicate

1. What languages can I communicate with OFX in?

A. All communications and notices to be given or sent under this Agreement shall be in English.

2. When will OFX contact me/my company?

A. By entering into this Agreement, together with the consents you gave when registering with us, you consent to receive communications from us, including e-mails and phone calls directed to the e-mail address and/or telephone number you provide when you registered for an account with us. Such communications may include, but are not limited to, Transaction details or Deal Confirmations and receipts, requests for additional documents or information and notifications regarding updates to your account.

B. You may receive marketing or promotional messages where permitted or if you have agreed to this when you created your account with us. You may opt out of receiving promotional e-mail communications at any time by changing your preferences on your account page on our Secure Website, clicking the unsubscribe link included on the email or by contacting Customer Service. To continue using our Services, there are certain communications directly related to your Transactions and your account which you cannot opt out from receiving.

3. How will OFX contact me/my company?

A. When we need to contact you, we will do so by email, text, telephone or mobile application using the most recent details you gave us.