Grow your business with our flexible, secure global payment integrations

Our robust infrastructure means no heavy lifting

- With 9 global offices our customer service teams are available 24/7

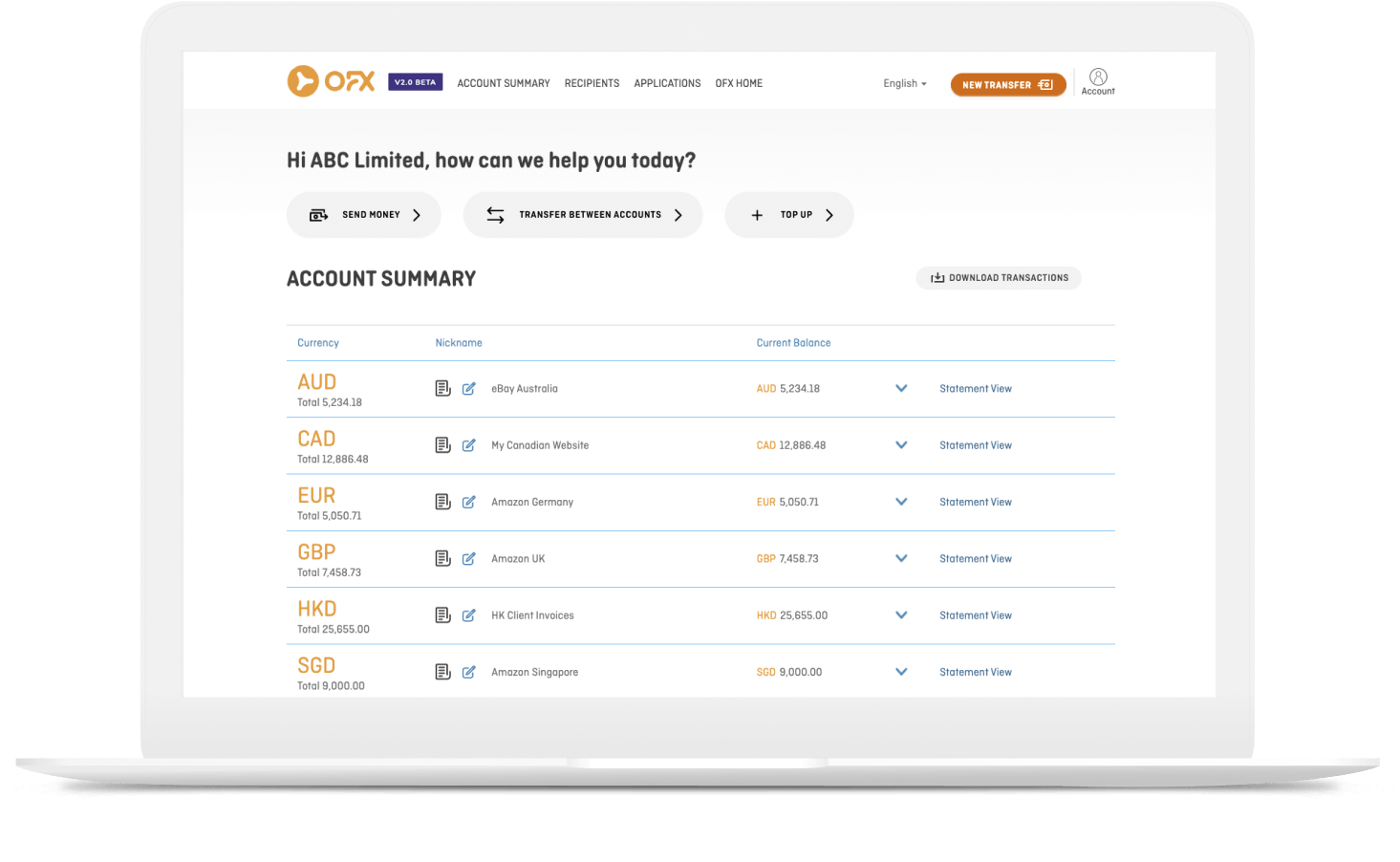

- An intuitive digital platform allows self-service transfers, day or night

- Our global banking network enables secure transfers via some of the fastest payment schemes available

- A rigorous operating model enables us to meet the strict legislation and regulation of our industry

How we bring FX expertise to our partners

Your payments, powered by OFX

Comprehensive suite of APIs

Every business is different, so our APIs and Global Currency Accounts can be configured to suit yours.

Payments optimised for speed and reliability

Payments and receivables occur via some of the fastest payment schemes available globally. Interwallet transfers in the Global Currency Account are made in real time.

Security for you and your clients

Whether payments occur on your platform or ours, our APIs are protected by multi-level authentication and authorisation.

Expert support

Our partnerships are supported by a dedicated Enterprise team, and backed by our global experts across technology, operations and delivery.

Secure and regulated

We’re registered as an e-money institution with the Financial Conduct Authority (FCA).

We monitor transactions for fraud utilising leading technology, our specialist Fraud and Compliance team as well as our fraud-trained staff.

With offices around the world, we’re on-hand to answer questions 24/7

Partner with us and pass on the OFX advantage

We do FX, and we do it well. If your customers, employees or members could benefit from bank-beating rates, easy transfers and 24/7 support, we’re here to help.

"*" indicates required fields