Feeling like a pawn in the foreign exchange (FX) game? Understanding how to manage currency fluctuations can help your business gain currency control and work towards achieving stability and growth. In this blog, we will cover how exchange rate movements could impact your business and OFX tools that can help you develop risk management strategies to keep your business more secure.

Currency fluctuations and business impact

The only sure thing about exchange rates is that they are constantly fluctuating. This is due to a variety of factors like current events and economic policy.

As currencies fluctuate it reminds us that exchange rates are more than just numbers on a screen. They can significantly impact businesses, influencing both costs and revenue.

A weakening currency, for example, can make imports more expensive for businesses that rely on them, squeezing their profit margins. Conversely, exporters can benefit from a weaker currency, as their products become cheaper in foreign markets and potentially boost sales.

The key for businesses is to understand how exchange rates fluctuate and adapt their strategies accordingly. This may involve adjusting pricing models, diversifying import sources, or using OFX’s risk management tools like forward contracts to hedge against unexpected currency swings.

“By being proactive and staying informed about global economic trends that impact exchange rates, businesses can turn these fluctuations from potential threats into opportunities for growth,” OFXpert Harry Narenthira said.

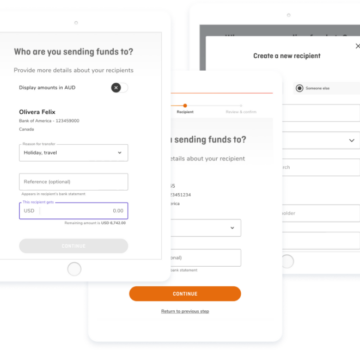

Ready to start transferring with OFX? Register now

How to hedge against exchange rate volatility

When exchange rates fluctuate, your businesses should focus on keeping balance and planning for the future. Fortunately, OFX’s tools like forward contracts, risk calculators, a risk management strategy, and 24/7 OFXpert service can help mitigate the risks of unexpected tumbles and leaps.

- Forward Contracts– Allow you to hedge a percentage of your annual exposure at the start of the year to protect your business from volatility and book your remaining if the rate moves in your favour.

A partial hedge can help minimise exposure to currency fluctuations but each strategy has its downsides. For example, you may not be able to take advantage of favourable market movements after booking the forward contract. - Risk Management Strategy- A risk management strategy helps your business hedge against market movements. Our OFXperts help develop a bespoke risk management strategy tailored to your business.

- 24/7 OFXpert Service- Our experienced OFXperts are available anywhere, anytime to help your business make transfers when exchange rates are advantageous for you.

Choosing the right hedging tool for your business depends on your risk tolerance. For short-term fluctuations, riding it out might be cost-effective. For significant transactions or long-term exposure, hedging can be a valuable safety net. “Remember, predicting precise currency movements is a near-impossible feat,” Narenthira said.

Beyond hedging tools, diversification may also prove useful. Sourcing from multiple countries or expanding your customer base internationally reduces your dependence on any single currency’s whims. Think of it as spreading your bets to mitigate risk.

In short, as exchange rates swing, equip yourself with appropriate tools, diversify your risk, and stay informed. “With these strategies, you can transform volatility from a potential threat into a manageable challenge, navigating towards smooth sailing for your business,” Narenthira said.

Exchange rate fluctuations can have a big impact on your business. Let skilled OFXperts help you put together a risk management strategy today.

A real-life example of FX impacting business

By now we know that FX can have a big impact on your business, let’s talk about OFX’s tools that can also help your business hedge against market fluctuations. One Canadian-based wine seller found success in the volatile grape industry with Forward Contracts.

Marina Beck, Wine Alliance proprietor, would trade her Canadian dollars for euros when she needed to pay European vendors. After working with OFX, Beck’s OFXpert Jeff began to understand the volatility associated with grape harvesting to make wine. Because Beck’s product was so dependent on a good harvest each season and could vary drastically in the amount of currency she needed to exchange based on the outcome of that harvest, Jeff identified an opportunity to help protect Wine Alliance’s bottom line with Forward Contracts.

Forward contracts made sense for Wine Alliance because of the volatile nature of the wine industry. “When I learned about Forward Contracts it was such an interesting shift in thinking. Jeff flagged to me that it might be a good time to take advantage of the market and book a forward. They are useful for me because of purchasing seasons for wine and when those bills need to be paid. For me, it’s about looking forward to what needs to be paid and then I will talk to Jeff and he will say this is how much you will save based on what we know today versus if we wait,” Beck said.

For Beck, it was more than just the tools that OFX could offer to save her business money and make her life easier, it was about the service and the trust. “We are not just a number, we have a partnership and we are a client that matters,” Beck said. Working with an OFXpert like Jeff can make a major difference in growing small businesses.

By being proactive and staying informed, businesses can turn these fluctuations from potential threats into opportunities for growth.” -OFXpert Harry Narenthira

If you are doing business internationally and looking for an FX partner that can help you understand FX volatility and build a risk management strategy catered specifically to your business, contact your OFXpert today!

Quick, secure, seamless transfers

We help clients move money quickly, safely, and accurately. Whether your business is just getting started or well-established, OFXperts have the experience to help you save time and money on foreign exchange.

Navigate rate swings in turbulent times. Our OFXperts can help you make more informed decisions about hedging and risk management. Contact us.

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. UKForex Limited (trading as “OFX”) and its affiliates make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.