SWIFT codes (sometimes known as a SWIFT Number) are 8 to 11 characters long and made of both letters and numbers. You can typically find them on a bank statement or on your bank’s website. The SWIFT code is a format of your BIC (Bank Identification Code), and the two terms are used interchangeably. SWIFTs or BICs are unique identification codes for the particular bank that holds your account.

These codes are used to transfer money between banks, in particular for wire transfers or SEPA payments.

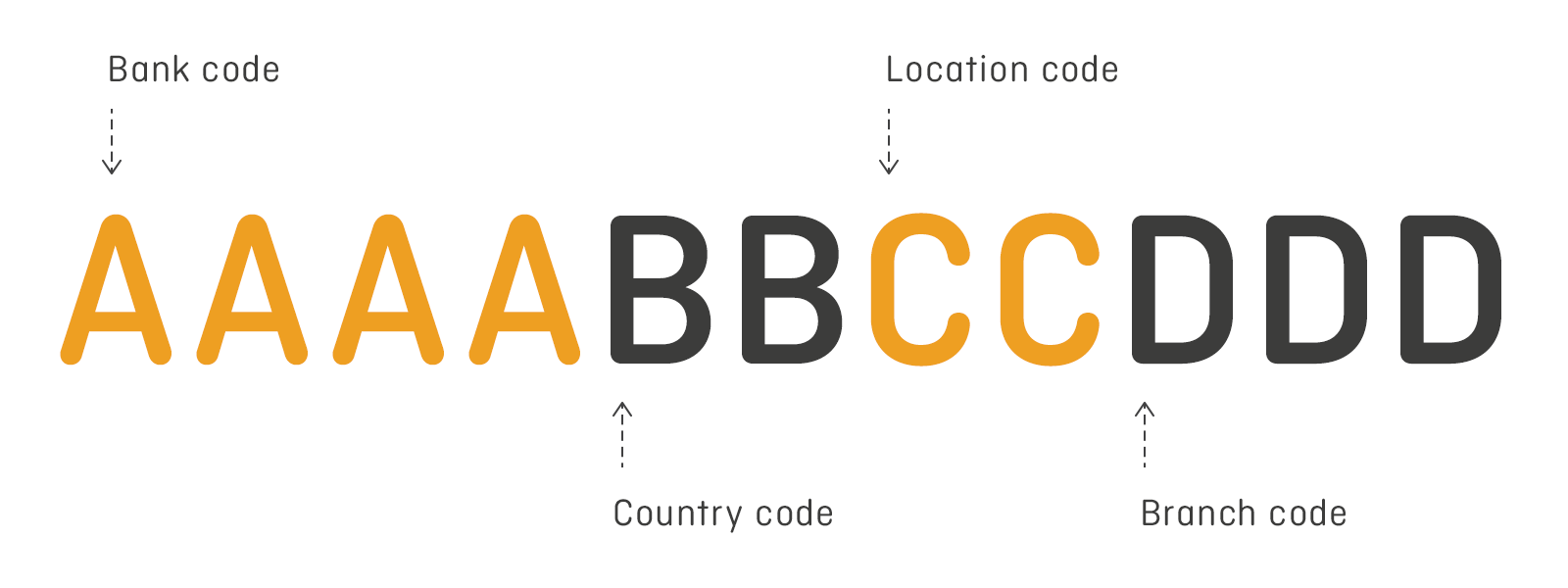

There are four components to a standard SWIFT/BIC code, these include:

- Bank code

- Country code

- Location code

- Occasionally the branch code may be included but this is optional

The SWIFT (Society for Worldwide Interbank Financial Telecommunications) system allows banks and financial institutions to send and receive secure messages regarding payment instructions.

What about the IBAN?

Many banks, especially European banks, also use IBANs (International Bank Account Numbers). These are unique codes that identify a given bank account and provide a standardised way of recognising and locating bank accounts throughout the world.

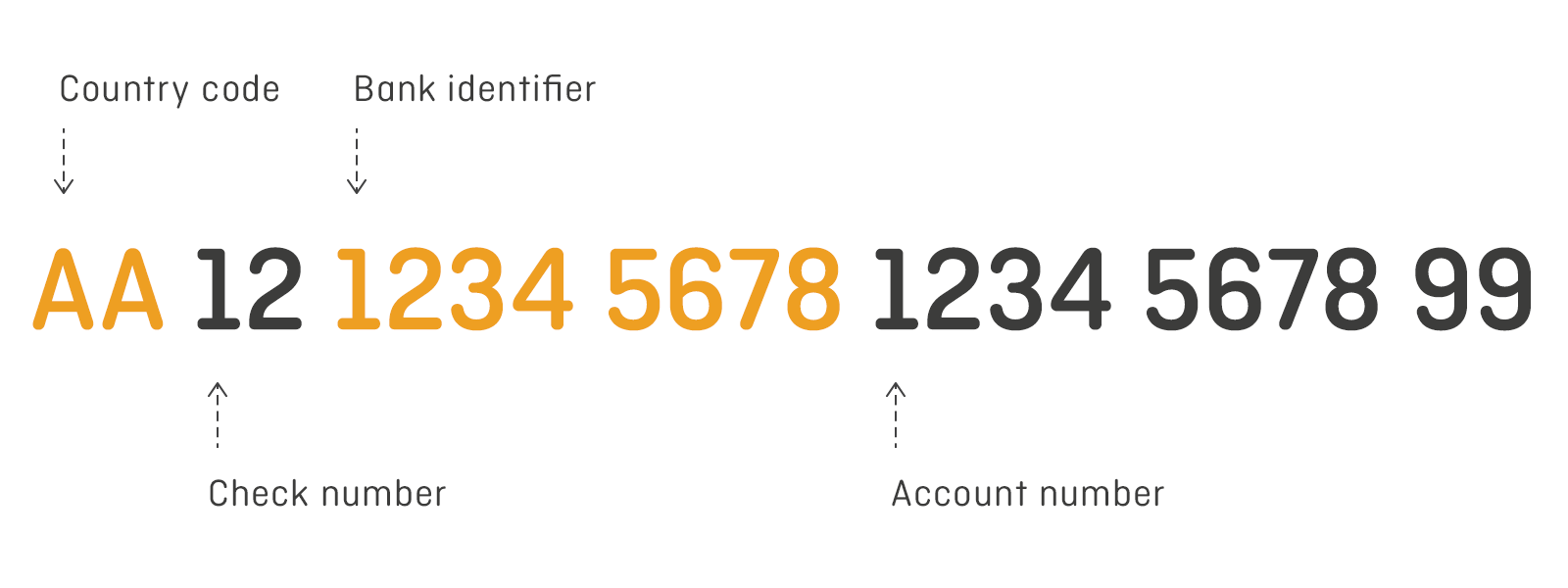

Typically an IBAN will include:

- Alphabetical country code (i.e ‘NL’ for the Netherlands, or ‘PT’ for Portugal)

- Followed by two digits

- Then up to 35 characters for the bank account number

Started in Europe during the 1990s, this method of bank account identification for international transfers has been adopted by more than 60 countries worldwide.

Do I always need to use an IBAN?

Not all countries will require an IBAN as it may be optional for transfers to other countries like Australia or Canada. At OFX, we use our Global By Local (GBL) system to process your transfers locally whenever possible, so you may be able to avoid using complicated bank codes.

Instead, you can often make your transfers using simplified domestic codes like the routing and account number for the US, BSB for Australia, and the sort code and account number for the UK.

How does OFX deliver funds so quickly?

At OFX, we use our network of 115 global bank accounts to tap into the power of local payment processing networks. Our GBL network typically takes 24 business hours for major currencies* and is very cost-effective compared to the banks and other FX providers. That’s part of why our rates are so competitive and why our transfers often arrive faster.

The local network extends to our customer service as well, so you can chat to someone in our friendly customer support teams in our global offices online or over the phone 24/7. So wherever you are in the world, OFX can help you with your transfer needs.

Better yet, when you send money with us, you may not even need to ask the recipient to search high and low for a SWIFT or IBAN. You just request their regular account details, and our local bank account in the destination country will do the rest.

Still not sure?

There’s no doubt that international payments can be tricky, confusing and sometimes, time consuming. When you register with OFX, we make the initial sign-up as painless as possible, and you’ll get the peace of mind of knowing that you can transfer at our great low rates—no matter which currency you choose or when.

*Delivery times are indicative and measured in business days from the time your funds are received by OFX.

Register in less than 5 minutes

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. OzForex Limited (trading as OFX) and its affiliated entities make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.