1. Negotiate currency exchange rates as part of your contract with international suppliers.

2. Sign up with a money transfer provider to save big on the exchange rate margins and fees charged by banks.

3. If you’re business is exposed to currency risk, consider risk management products like Forward Contracts.

If your company does business with organisations that are located in other countries and that use different currencies, you will inevitably find yourself having to pay international invoices. But, unlike your standard invoice, which you receive for goods and services that you purchase from a domestic brand, an international invoice could result in your business having to pay more than you expected, thanks to pesky fees like currency conversion fees, exchange rate margins, and transfer fees.

But paying for an invoice online, especially an international invoice, does not have to be complicated or expensive. With the right strategy, you can ensure that every one of your payments will go through promptly and you will not be hit with high margins and fees in the process. In this way, you can conduct business even on an international scale without having to worry about your bottom line being adversely affected, whether you are buying inventory for your e-commerce shop from China or you are hiring a freelance graphic designer from Spain.

Negotiate currencies and exchange rates

To make paying an international invoice online easier, talk to your supplier to find out if they would be willing to accept payment in your domestic currency. For example, if you are a business in the United States and you need to pay a company in China, you may find that many businesses are happy to be paid in dollars.

If your supplier agrees to let you pay in your domestic currency, it will eliminate the need to send your money in the supplier’s foreign currency. In turn, it will eliminate the need to have your money converted when it is being transferred. As you probably already guessed, doing so could help you save money on currency conversion fees, and you will not have to deal with the headache that comes with exchange rates, so it is worth trying to negotiate this aspect of your payment with your supplier, whether you are investing in goods or services.

The pros and cons of a foreign currency account

If you’re considering using a foreign currency account to pay your international invoices online, you should pay close attention to:

- Up-front and monthly account keeping fees.

- The margin the bank will take on any invoice payments.

- The margin on the exchange rate to convert your funds. (This can be up to 5%.)

- Any fees involved with international transactions.

With foreign currency accounts, your money will still be vulnerable to currency exposure, unless you use risk management tools to lock in an exchange rate.

If you find the bank’s costs/fees on foreign currency accounts are unfavourable, you can sign up for a free account with OFX, to access bank-beating exchange rates 24/7.

Options for paying an international invoice online

1. Banks: When it comes to paying an international invoice, many business owners think of using their bank to submit an electronic money transfer. Unfortunately, your bank is banking on that. Because research shows that 80% of people would use their bank to transfer money, banks charge an absolute premium on international invoice payments (up to $500 on a transfer of $10,000.)^

According to The Telegraph, a study estimated that small businesses in the U.K. were paying a staggering £4bn annually because of the costs associated with paying international invoices via their banks.1 That is a lot of zeros, and whole lot of money that could have been put to better use to grow those businesses!

So even though you might find that using your bank to pay domestic invoices works out just fine for you, keep in mind that you could get stung harshly if you use the same payment method for your international invoices.

2. Online payment services

Online payment services like PayPal might be convenient, but they can take a chunk out of your bottom line too. When PayPal converts your currency to pay an international invoice, they will use a wholesale exchange rate that is adjusted periodically, based upon market conditions. As of August 2017, you can expect that they will tack on a 3% fee on the transaction amount, in addition to the wholesale exchange rate in the U.S.2

Also, if you are planning on using a credit card or debit card via PayPal, keep in mind that your credit card or debit card issuer might also charge their own fee for any international transaction. And if you are purchasing with PayPal Business Payments, you might also be charged a fee.3

3. Credit Cards: In addition to using your bank or an online payment service like PayPal, you also have the option of using your credit card to pay an international invoice.

Business owners who would prefer not using a wire transfer option might consider this payment method instead. But it also comes with its own set of drawbacks that you need to consider before deciding if this is the right choice for your company.

First off, you will need to confirm with your supplier if they will accept a credit card, such as Visa, Discover, MasterCard, or American Express. You will need to receive confirmation that these types of payments will be accepted and that they will be secure. Therefore, depending upon where you do business, paying by credit card might not even be a possibility.

Like the payment options described above, paying with a credit card will also result in having to pay extra fees. A lot of credit card companies will add an additional charge that typically ranges from 1.95% to 3.5% for international payments.4 This service fee is tacked onto the total amount for the transaction, so things can add up quickly.

4. OFX: By now, you are probably thinking, “There has to be a better way!” Thankfully, there is. As an alternative to expensive banks, credit cards, and online payment services, an online money transfer provider like OFX could help you pay your international invoices without taking a big bite out of your pocket.

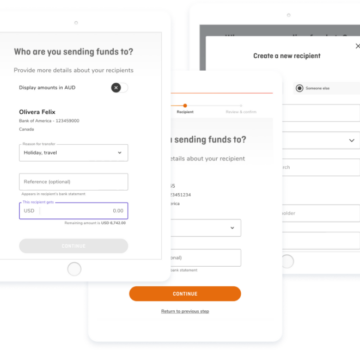

With OFX, you will have market access and telephone customer support 24/7, in case you run into any questions or concerns. Our simple transfer form will guide you through all of the information that you need to provide to ensure your money will be sent securely and swiftly. You also have several transfer options so you can pay all of your international invoices in a way that will benefit your business.

With OFX, you can send your money to more than 190 countries and convert your funds into 55 different currencies. Most transfers will only take 1-2 business days to complete, though some could take up to 5 business days, depending upon where you are sending your money.

In terms of fees, OFX does not charge any fees to create or maintain your account, and our margins on the exchange rate are substantially lower than the banks.

Another distinguishing advantage that comes with using OFX to pay your international invoices is the option of using a Forward Contract. This will let you lock in a great exchange rate for up to 12 months, so even if you are not ready to pay right away, you can still take advantage of the savings. Whilst a Forward Contract can be an excellent tool in your risk management strategy, there are certain risks associated with this product. You can find more information here. Or you can set up a Limit Order instead. This will let you set your target exchange rate, and then OFX will notify you once that rate has been triggered so that you can make your payment at the right time to save the most money.

Paying international invoices while growing your business

Doing business with companies that are located abroad may be a smart way to grow your business. You may even realise that you can make purchases for products and services that are priced much more competitively than they are at home. But if you are hit with an international invoice and you do not use the right payment method, all of those savings could go out the window when you have to factor in the cost of margins on the exchange rate, along with currency conversion fees and transfer fees. That is why using an online transfer service like OFX—as opposed to your bank, credit card, or a service like PayPal—is so important, and such a wise move for the financial success of your organisation.

^Survey conducted by Galaxy Research on behalf of OFX (August 2016). Sample size: 1000 Australians. Question: if you wanted to send money overseas, would you use a bank? Answer: 81% of people responded that they would use a bank to send money overseas.

Reading Time: 2 mins

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. OzForex Limited (trading as OFX) and its affiliated entities make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.