Save with OFX bank-beating rates

OFX grew from the idea that there had to be a better, fairer way to move money around the world. That was 20 years ago, and we’re still driven by the same mission today.

So, what do we mean by “bank-beating rates”?

We take a fair approach to prices and work with an independent third party to review bank rates across multiple countries, and in multiple currencies. To make sure our prices are bank-beating, they conduct a monthly price comparison of OFX and 15 banking institutions across the globe.

Which banks are OFX rates compared with?

| AU | US | CA | UK |

| ANZ | Bank of America | CIBC | Barclays Bank |

| CBA | Citi Bank | RBC | Lloyds Bank |

| NAB | JPMorgan Chase | TD | HSBC |

| Westpac | Wells Fargo | Natwest |

The price comparison looks at how much it costs to send money internationally using OFX and each of the banks listed, between specified currencies on the same day.

What costs are being compared?

To make sure we’re comparing apples to apples, the price comparison takes into consideration the exchange rate, margin and fees. The cost is calculated on a single transfer in the following currencies on a specified date each month. It also shows the amount the recipient gets.

$20,000 AUD to USD

$20,000 USD to EUR

£25,000 GBP to USD

$20,000 CAD to USD

Savings are then calculated by looking at the average amount a customer would receive using the banks within each country and comparing this to the amount a customer would receive making the same transfer using OFX.

The comparison savings provided is true only for the example given and may not include all fees and charges. Different currency exchange amounts, currency types, dates, times and other individual factors will result in different comparison savings. These results therefore may not be indicative of actual savings and should be used only as a guide.

Who conducts the price comparison?

We use an independent third party, FXC Intelligence Ltd.

What could you save using OFX vs. Bank?

Transfer AU$20k to USD and you could get up to US$462 more

| Company | $20k AUD to USD = | $ difference |

|---|---|---|

| $12,972 | $462 extra | |

| CBA | $12,510 | $462 less |

| Westpac | $12,536 | $436 less |

| ANZ | $12,598 | $374 less |

| NAB | $12,699 | $273 less |

Price comparison of OFX and 4 banks in Australia

The comparison savings are based on a single transfer of AUD$20,000 to USD. Savings are calculated by comparing the exchange rate including margins and fees provided by each bank and OFX on the same day (1 Apr 2024). Pricing data is provided by an independent third party, FXC Intelligence Ltd. The comparison savings provided is true only for the example given and may not include all fees and charges. Different currency exchange amounts, currency types, dates, times and other individual factors will result in different comparison savings. These results therefore may not be indicative of actual savings and should be used only as a guide. The rate comparison chart is updated monthly.

What could you save using OFX vs. Bank?

Transfer US$20k to EUR and you could get up to EUR€556 more

| Company | $20k USD to EUR = | € difference |

|---|---|---|

| €18,382 | €556 extra | |

| Wells Fargo | €17,826 | €556 less |

| Citibank | €17,914 | €468 less |

| JPMorgan Chase | €17,982 | €400 less |

| Bank of America | €18,042 | €342 less |

Price comparison of OFX and 4 banks in United States

The comparison savings are based on a single transfer of USD$20,000 to EUR. Savings are calculated by comparing the exchange rate including margins and fees provided by each bank and OFX on the same day (1 Apr 2024). Pricing data is provided by an independent third party, FXC Intelligence Ltd. The comparison savings provided is true only for the example given and may not include all fees and charges. Different currency exchange amounts, currency types, dates, times and other individual factors will result in different comparison savings. These results therefore may not be indicative of actual savings and should be used only as a guide. The rate comparison chart is updated monthly.

What could you save using OFX vs. Bank?

Transfer GBP£25k to USD and you could get up to US$874 more

| Company | £25k GBP to USD= | $ difference |

|---|---|---|

| $31,340 | $874 extra | |

| Lloyds Bank | $30,466 | $874 less |

| HSBC | $30,548 | $792 less |

| Natwest | $30,755 | $585 less |

| Barclays Bank | $30,765 | $575 less |

Price comparison of OFX and 4 banks in United Kingdom

The comparison savings are based on a single transfer of GBP£25,000 to USD. Savings are calculated by comparing the exchange rate including margins and fees provided by each bank and OFX on the same day (1 Apr 2024). Pricing data is provided by an independent third party, FXC Intelligence Ltd. The comparison savings provided is true only for the example given and may not include all fees and charges. Different currency exchange amounts, currency types, dates, times and other individual factors will result in different comparison savings. These results therefore may not be indicative of actual savings and should be used only as a guide. The rate comparison chart is updated monthly.

What could you save using OFX vs. Bank?

Transfer CA$20k to USD and you could get up to US$370 more

| Company | $20k CAD to USD = | $ difference |

|---|---|---|

| $14,698 | $370 extra | |

| CIBC | $14,328 | $370 less |

| TD | $14,354 | $344 less |

| RBC | $14,414 | $284 less |

Price comparison of OFX and 3 banks in Canada

The comparison savings are based on a single transfer of CAD$20,000 to USD. Savings are calculated by comparing the exchange rate including margins and fees provided by each bank and OFX on the same day (1 Apr 2024). Pricing data is provided by an independent third party, FXC Intelligence Ltd. The comparison savings provided is true only for the example given and may not include all fees and charges. Different currency exchange amounts, currency types, dates, times and other individual factors will result in different comparison savings. These results therefore may not be indicative of actual savings and should be used only as a guide. The rate comparison chart is updated monthly.

Why choose OFX

- Bank-beating rates: Keep more of your money as it travels around the world

- 50+ currencies: Make transfers to over 170 countries

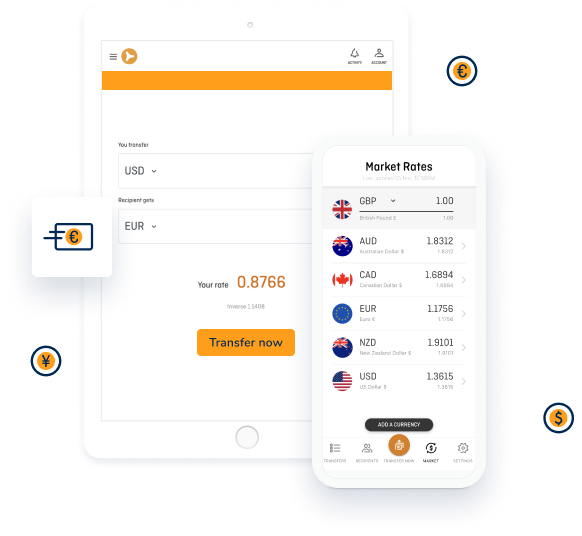

- Easy to use: Check rates, make payments or track transfers online or via our app

- Peace of mind: OFX is ASX-listed and monitored by over 50 regulators globally

- We know FX: Markets can move, we can help you plan for ups or downs

- 24/7 support: Talk to a real person at any time, day or night