Paying overseas staff

How to optimise your payments to overseas staff

If your business needs to pay overseas staff, the good news is: you have a number of options. The bad news is: not all international payment providers are created equal, so it’s wise to do your homework before you choose one.

What to look for in an overseas payments provider

- Rates. When paying overseas staff, your bottom line can be affected by exchange rate margins and transaction fees. Look for a provider with good rates and low fees keeping in mind that a better rate may make the fee negligible.

- Consistent service. If you’re going to be making regular transfers, you need a company that can provide superior customer service tailored to your unique business needs. Find a provider that won’t treat you like just another number by calling up to enquire.

- Speed. Money transfers should move quickly and major currency conversions can often be processed within one day. A speedy service means you can worry less about when you’re money is going to arrive. While there are some affordable peer-to-peer foreign payment options out there, but be aware that your staff could be waiting days, or even weeks, to get paid when using a peer-to-peer service. Within that time, exchange rates may move dramatically costing you or your employees substantially.

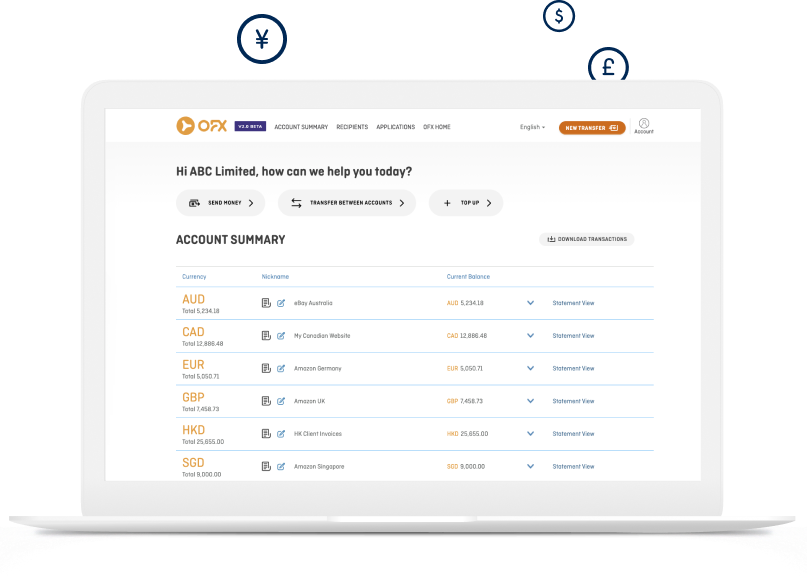

- Options. The best way to insulate your business from currency volatility is to find a foreign payments provider who offers risk management tools that can support your business objectives. If you pay a large number of overseas employees, make sure your provider offers a platform like OFX’s Multipay, so you can pay up to 500 people with one click. Get the flexibility your business needs, so you can gain a competitive edge.

- Reliability. Peer-to-peer transfer models are often unstable during high-demand trading events such as Brexit and major elections. You want a provider with a proven track record of stability–like OFX. To read more about the risks of peer-to-peer transfers, check out this article.

The benefits of paying overseas staff with OFX

- A great rate. No hidden fees. No surprises.

- You get 24/7 customer support. When your bank is closed, we’re open. You’ll have access to our team when and where you need it, because you need a foreign payments provider who can keep up with your expanding business.

- Your transfers often arrive faster. We use our global network of 115 local bank accounts to transfer your money from our local accounts whenever possible. Local processing means we can often provide same-day payments. And all those confusing international bank codes? Not a problem.

- You get a choice. We have a number of product options to help you protect your business from adverse currency fluctuations. You choose the risk management strategy that’s best for your business, and if you need help, we’re here to discuss your options.

*Average savings based on a sample of OFX Customer deals between 5 July and 9 August 2016 on an AUD$10,000 to USD single transfer against published rates of ANZ, Westpac, NAB and CBA for the same period. Fees and transaction costs excluded. Quoted savings are not indicative of future savings. Please consider OFX’s PDS and your circumstances before making a decision about any financial product.